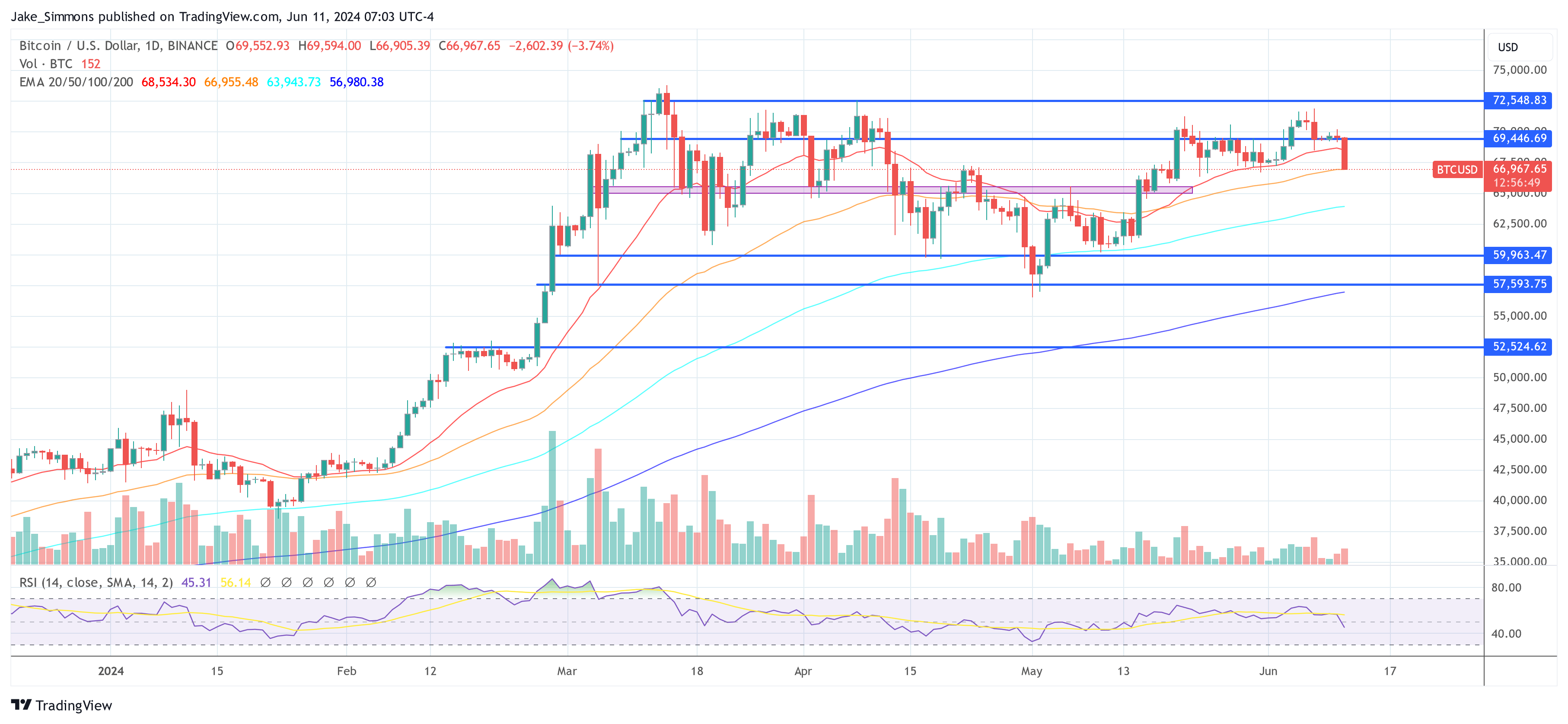

The Bitcoin price has fallen 4.7% since yesterday’s peak of $71,231 and is now hovering around $66,967. This decline marks a notable return of market volatility, driven by several critical factors.

#1 Anticipation of the Federal Reserve’s FOMC meeting

The Bitcoin market appears to be in risk mode ahead of tomorrow’s Federal Open Market Committee (FOMC) meeting on Wednesday, June 12. The market’s sensitivity to macroeconomic indicators is on full display as stakeholders await the US Federal Reserve’s decision on interest rates and its economic projections.

Current expectations indicate the Fed will maintain rates at a range of 5.25%-5.50%, but the market is bracing for the updated dot plot, which is expected to take a more hawkish stance. The expected adjustment will see expected rate cuts cut from three to two in 2024, with some speculating about the possibility of just one cut. This hawkish side of monetary policy projections is poised to significantly impact investor behavior as higher interest rates tend to dampen the appeal of non-yielding assets such as cryptocurrencies.

Adding to the uncertainty, the May 2024 US Consumer Price Index (CPI) figures will be released just hours before the FOMC announcement. The market has reacted strongly to US macroeconomic data in recent months, and any deviation from expectations could lead to significant price movements.

Crypto analyst Ted commented on Powell could quickly change this on Wednesday, especially if the CPI is soft. There is a (small) chance of a significant price revision this week, which could set BTC + crypto on the move…”

#2 Intensified sales pressure

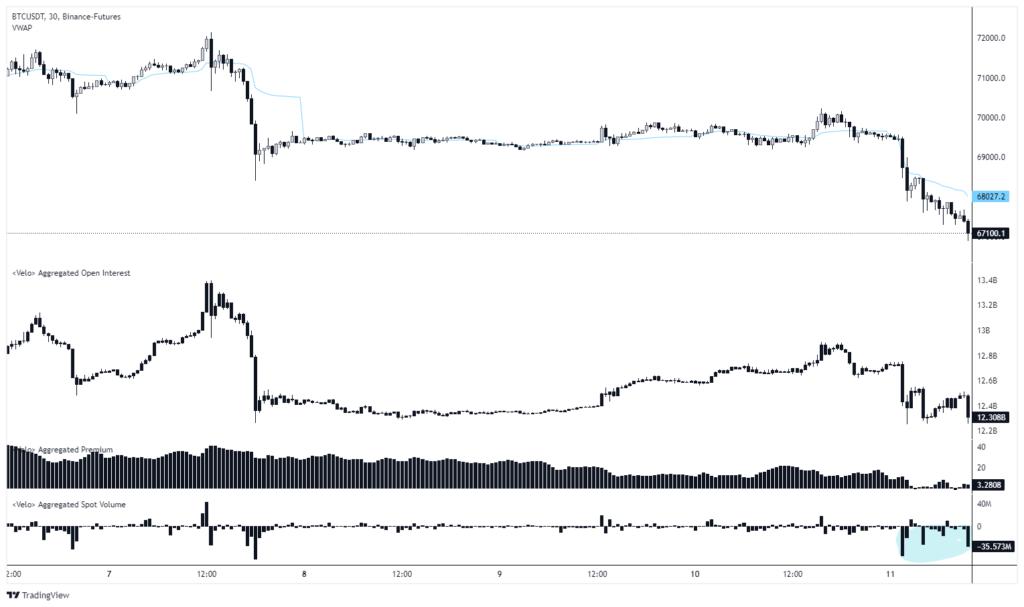

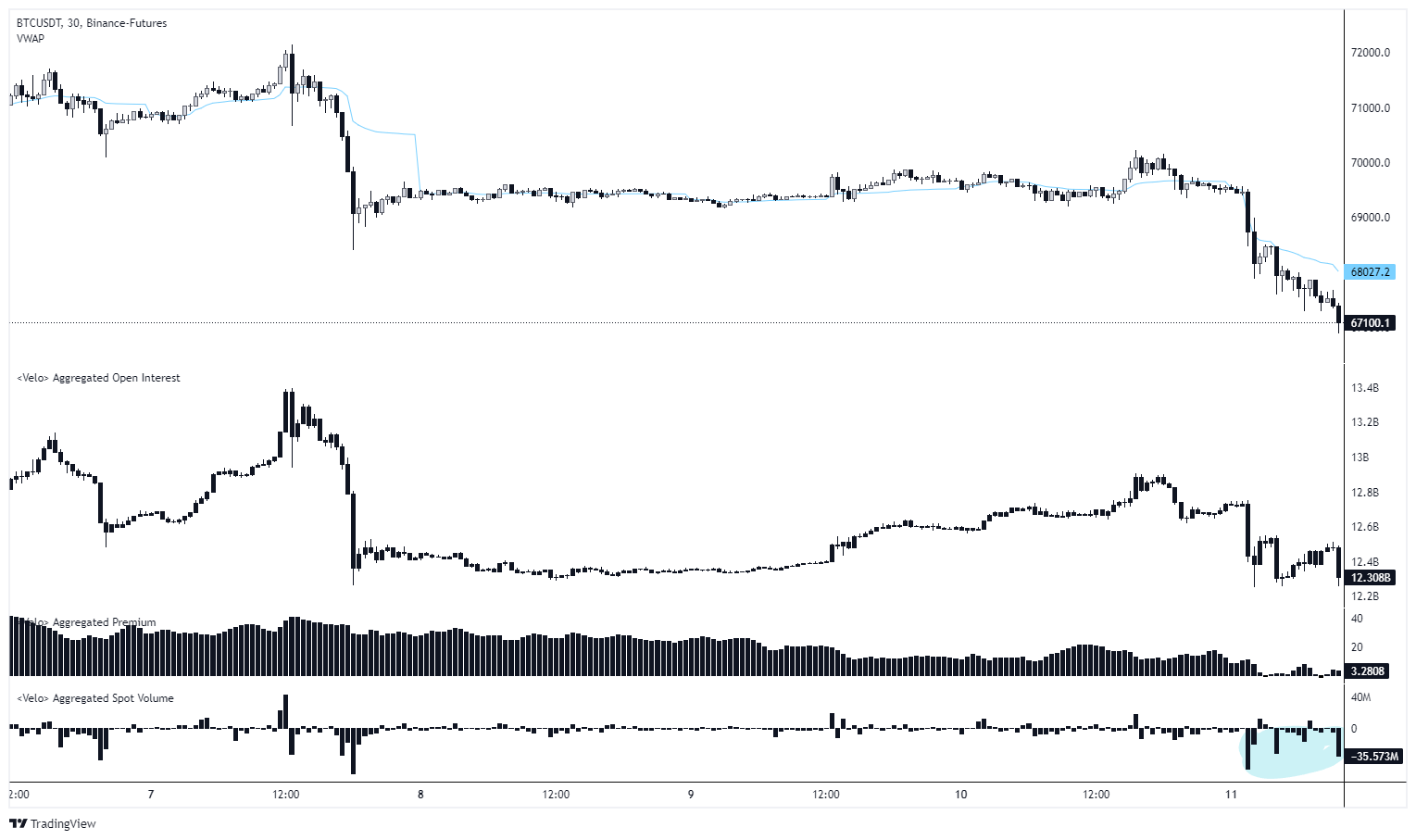

The immediate catalyst for the recent price drop appears to be an increase in spot sales. Analysis of alpha dōjō reveals that heavy selling pressure was largely responsible for the drop to a low of $67,000. The market dynamics observed during this period indicate a clear shift, with a greater number of sell orders not being met by enough buy orders to maintain price levels. This imbalance has led to a break in what was previously considered a robust support zone around $68,000.

The analysts elaborated on the situation: “Volatility has made a comeback, with BTC down as much as 3.5% since yesterday to a low of $67,000. This sell-off was mainly caused by the heavy selling pressure on the spot market, which is quite negative. A major concern is the lack of liquidations while the sell-off is taking place. BTC is currently in a critical area; the daily structure is broken. BTC needs to recover here, otherwise we will most likely fall back to the lower $60k range.”

#3 Spot Bitcoin ETF Inflows Series Ends

The investment dynamics within spot Bitcoin ETFs also reflected the market’s bearish turn. After 19 consecutive days of positive inflows, these funds saw a significant increase outflow yesterday totaled $64.9 million. Notable among these was the Grayscale Bitcoin Trust, which saw an outflow of $39.5 million. BlackRock, on the other hand, recorded a smaller inflow of $6.3 million.

The performance of other ETF providers showed significant differences. Fidelity recorded an outflow of $3 million, while Bitwise registered an inflow of $7.6 million. In contrast, Invesco experienced outflows of $20.5 million, and Valkyrie also reported outflows totaling $15.8 million.

At the time of writing, BTC was trading at $66,967.