This article is available in Spanish.

In one analysis shared on Greer’s insights are based on a combination of historical performance data, current market dynamics and broader macroeconomic factors, which she believes are all aligning to create a very favorable environment for Bitcoin.

This is why Bitcoin could soar to $118,000

Greer begins by highlighting Bitcoin’s strong historical fourth quarter (Q4) performance in previous years. She pointed out that Bitcoin’s average return in the fourth quarter to its highest intra-quarter level since 2020 is around 85%. This figure includes a best-case scenario where returns reached as much as 230%, and a worst-case scenario with a drop of 12%.

“BTC average Q4 return (up to max [intra quarter high watermark, full q return]) since 2020 is +85% (worst -12%, best +230%) – push to find a stronger asymmetry,” writes Greer. This statistical asymmetry suggests significant potential upside compared to downside, making the fourth quarter historically a period of robust growth for Bitcoin.

Related reading

A merely average fourth quarter with an 85% price increase could mean a year-end price of $118,000 for Bitcoin. If BTC surpasses its all-time high of 230%, the price could even soar well above $200,000.

Notably, Greer believes that the current market is not fully positioned to take advantage of this potential. She attributes this division to a number of key factors. Firstly, there is concern about the upcoming US presidential election taking place on November 5. Second, other assets such as gold and China A-shares are attracting significant attention and capital, potentially diverting investments away from Bitcoin.

“I still don’t think the market is divided accordingly – 2024 is a unique case where part of the market under-indexes based on the Q4 asymmetry due to a) the November 5 US election risk and/or b) other assets are screaming (gold, China A-shares, etc.),” Greer notes.

Top reasons to be optimistic about BTC

To support her assessment of current market positioning, Greer cites her interactions with risk managers and noted specific market indicators. She mentioned observing “low volatility and limited perp funding,” suggesting traders are not aggressively betting on significant price movements.

In addition to these market dynamics, Greer identifies several macroeconomic and sector-specific factors that she believes create a “generally very positive” backdrop for Bitcoin. An important point is the presence of global stimulus measures in major economies such as the United States and China, with the exception of Japan.

Greer also highlights that BNY Mellon, the world’s largest depository bank, has been granted an SAB 121 exemption. This exemption allows the bank to offer custodial services for Bitcoin without the strict capital requirements that previously made such services less attractive. Greer describes this development as “large-scale and underappreciated,” noting that it will “significantly loosen financing in our sector.”

Related reading

Additionally, Greer points out that ETF flows have become “very constructive.” In recent days, the inflow of BTC has increased enormously. Last Friday, net inflows were $494.8 million, making it the highest net inflow day of the quarter and the highest net inflow day since June 4.

Another positive indicator is that Bitcoin miners are entering into agreements with hyperscalers – large-scale cloud service providers. These partnerships can improve mining efficiency and reduce operating costs.

Greer also mentions that “the offering is outstanding [are] largely done,” suggesting that major sell-offs that could depress prices are unlikely in the near term. Furthermore, she expects that “the demand from FTX cash distributions [is] around the corner,” implying that funds distributed through the FTX exchange could find their way into Bitcoin investments, further increasing demand.

However, Greer also acknowledges potential risks that could impact Bitcoin’s trajectory. This includes signals from the Federal Reserve about monetary policy and the possibility of a stock market pullback. Such events can cause volatility or dampen investor enthusiasm.

However, she believes that overall sentiment remains positive. “There are risks, of course – Fed signals, stock pullbacks, whatever – but the net-net vibes are pretty good and the money flows are just starting to get going,” she notes.

Greer also describes Bitcoin as a “reflexive asset.” She explains: “BTC is the ultimate reflexive asset: price -> flows -> price.” This means that as the price of Bitcoin rises, it attracts more investment flows, which in turn pushes the price even higher – a self-reinforcing cycle.

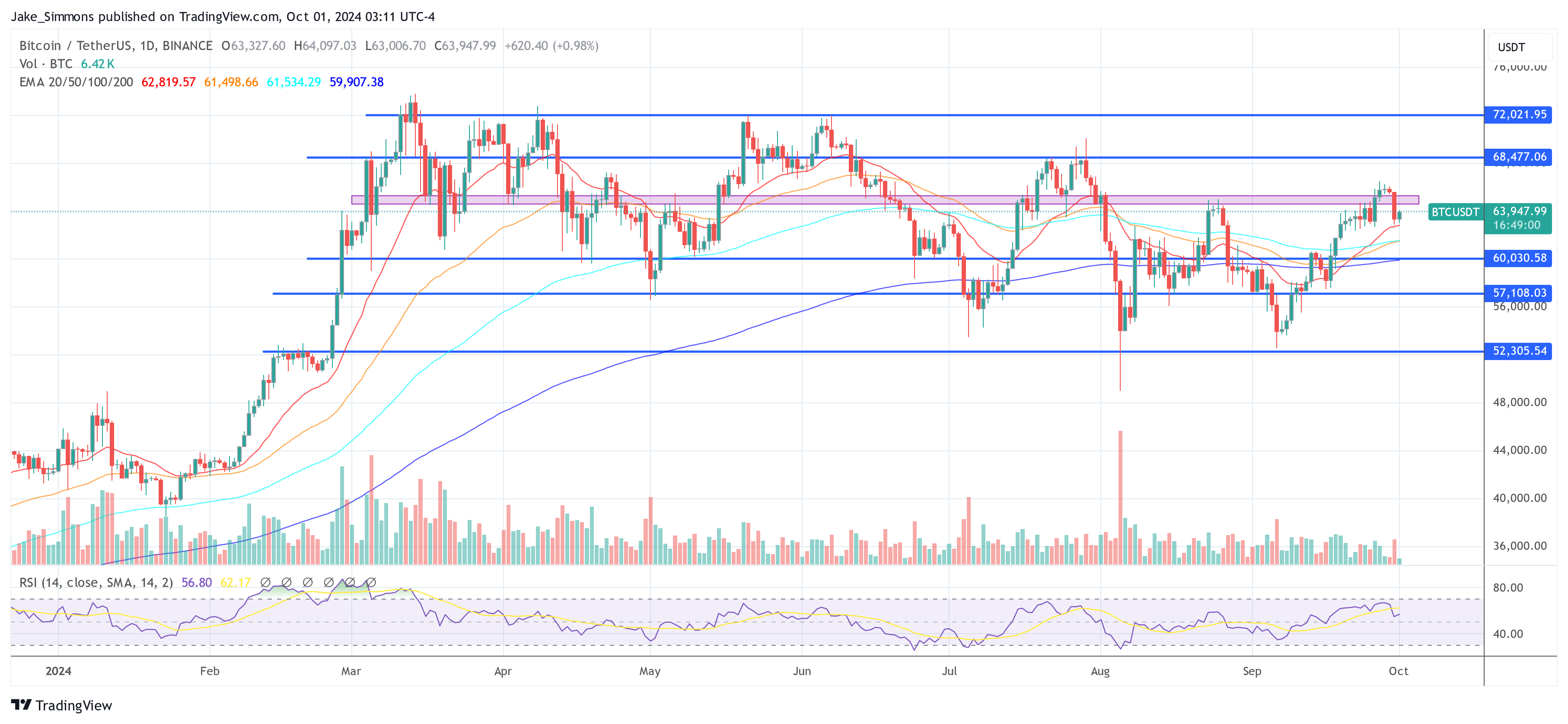

Greer notes that Bitcoin enters the fourth quarter after breaking a key price level at $65,000. If the price were to regain the $70,000 mark, she expects inflows would accelerate as investors respond to the positive momentum and recall the strong fourth-quarter performance of previous years.

At the time of writing, BTC was trading at $63,947.

Featured image created with DALL.E, chart from TradingView.com