In a quick turnaround from yesterday’s dip, Bitcoin (BTC) rose to nearly $26,000 during Asian trading hours on Tuesday. This recovery, which saw BTC rise from $25,210 to $25,973 in just 30 minutes (from 3:00 AM to 3:30 AM UTC), was not caused by any specific news event. Instead, the dynamics within the Bitcoin futures market played a crucial role.

Why has the Bitcoin price bounced up?

Renowned analyst Skew as long as a technical perspective on the price movement, and calls this a ‘school-age short squeeze’. Digging deeper into Skew’s analysis, he pointed out a clear difference between the Cumulative Volume Delta (CVD) of perpetual contracts (or “perps”) and the actual price. In trading, a difference between CVD and price can signal a potential reversal. In this context, as sellers tried to push the price below $25,000, the CVD indicated that buying pressure was increasing.

In addition, the futures market had a large number of short positions relative to the open interest rate (OI) and the financing rate was negative. A negative funding rate usually means that shorts are paying long, indicating bearish sentiment. Despite attempts to lower the price, Bitcoin regained its swing-long price level at $25,300 and failed to maintain the bearish trend in the lower time frame (LTF).

The spot market, where assets are bought and sold for immediate delivery, showed signs of a bullish structural change, with prices gradually moving higher. Skew suggested that the culmination of these factors has led to a short squeeze, where those who bet against the market (short sellers) are forced to buy back into the market to cover their positions, further driving the price higher.

Skew’s analysis essentially highlights that while there was bearish sentiment with many traders betting on Bitcoin, the underlying indicators pointed to a possible bullish reversal. For traders, the immediate goal after the squeeze is to recover $26,000.

TheKingfisher offered a more concise version, hint on the short squeeze and its impact on those who bet against Bitcoin: “See you at high-level shorts. BTC deleted them again.”

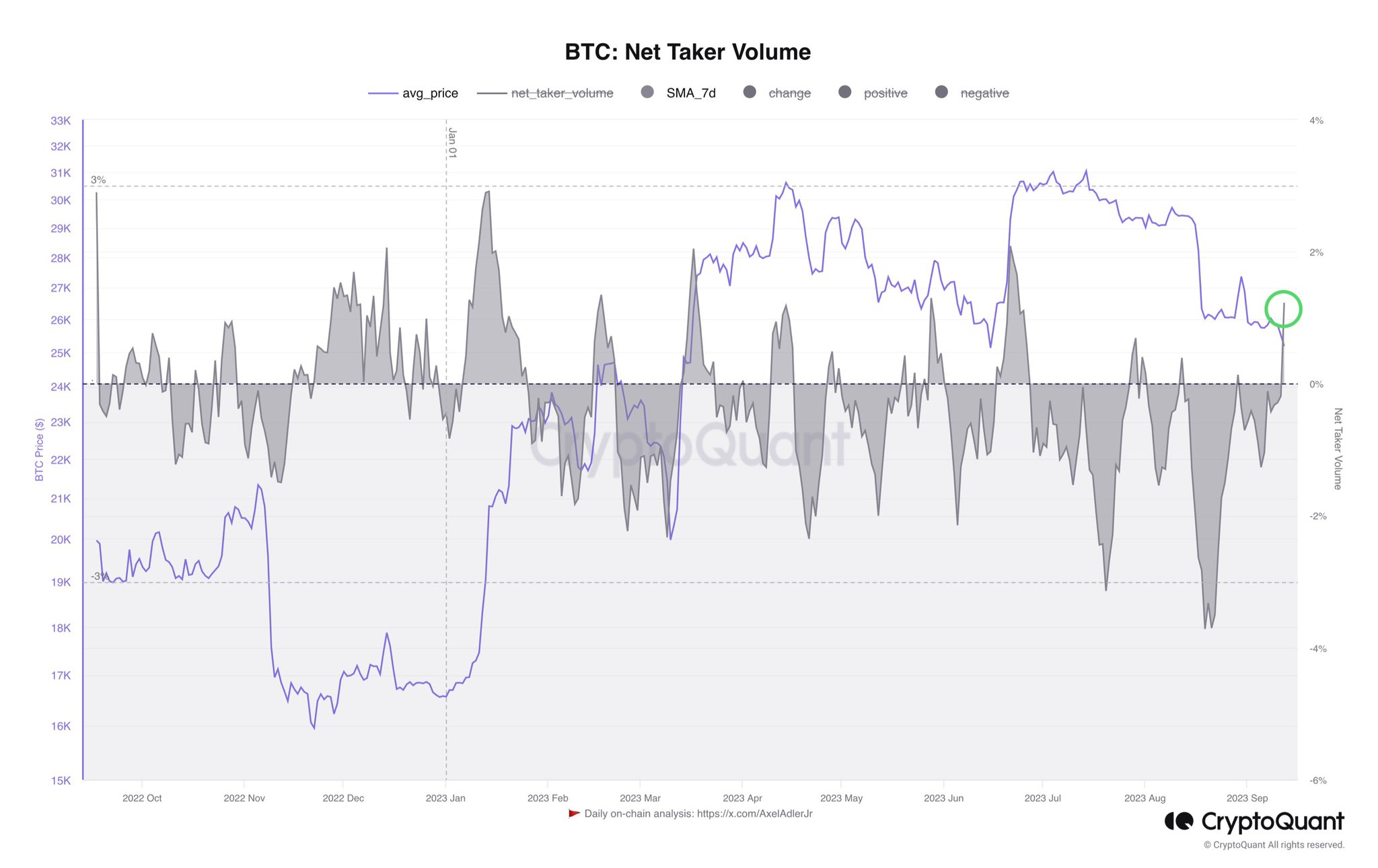

Axel Adler Jr. shed light on broader market sentiment, noticing“Traders have no intention of going any lower. Net taker volume increased by 9.79%. Over the past year, this is a new record for the balance of open Taker orders with long positions.”

Despite the rapid price movement, the size of the short squeeze was relatively modest. Coinglass data shows that approximately $12.32 million worth of BTC shorts were liquidated. For context, the most significant short liquidation event in the past three months occurred on August 17, at $120 million, when BTC briefly fell to $24,700 before quickly recovering above $26,600.

The decline in open interest in futures on the major exchanges was also quite small. Open interest fell from $10.66 billion to $10.65 billion, according to Coinglass. This slight decline indicates that few traders had to close their bets as funding rates turned positive, signaling a shift from bearish to bullish sentiment.

At the time of writing, BTC was at $25,768.

Featured image from Millionero Magazine, chart from TradingView.com