- Bitcoin had a bearish bias due to the relentless selling.

- Accumulation has been strong over the past month and could pave the way for a recovery.

Bitcoin [BTC] the halving had taken place almost three months ago, but the promised bull run was not yet in play. Some investors wonder why BTC is even struggling with ETF demand or cooling inflation.

A deeper dive into the long-term metrics showed that Bitcoin predictions that a bottom is close, or has already been reached, are likely true.

Bitcoin Predictions: Gathering Clues from Price Action

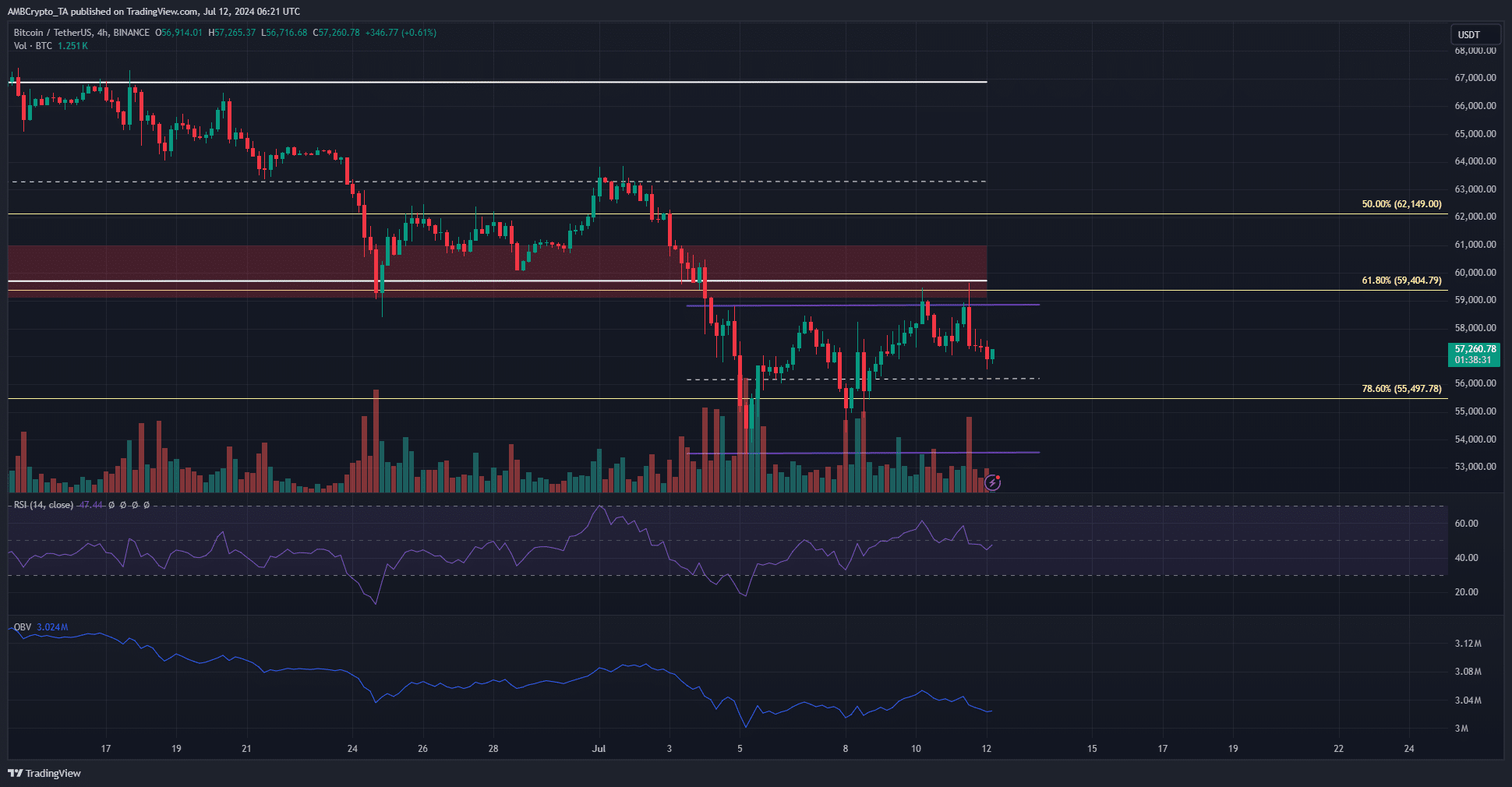

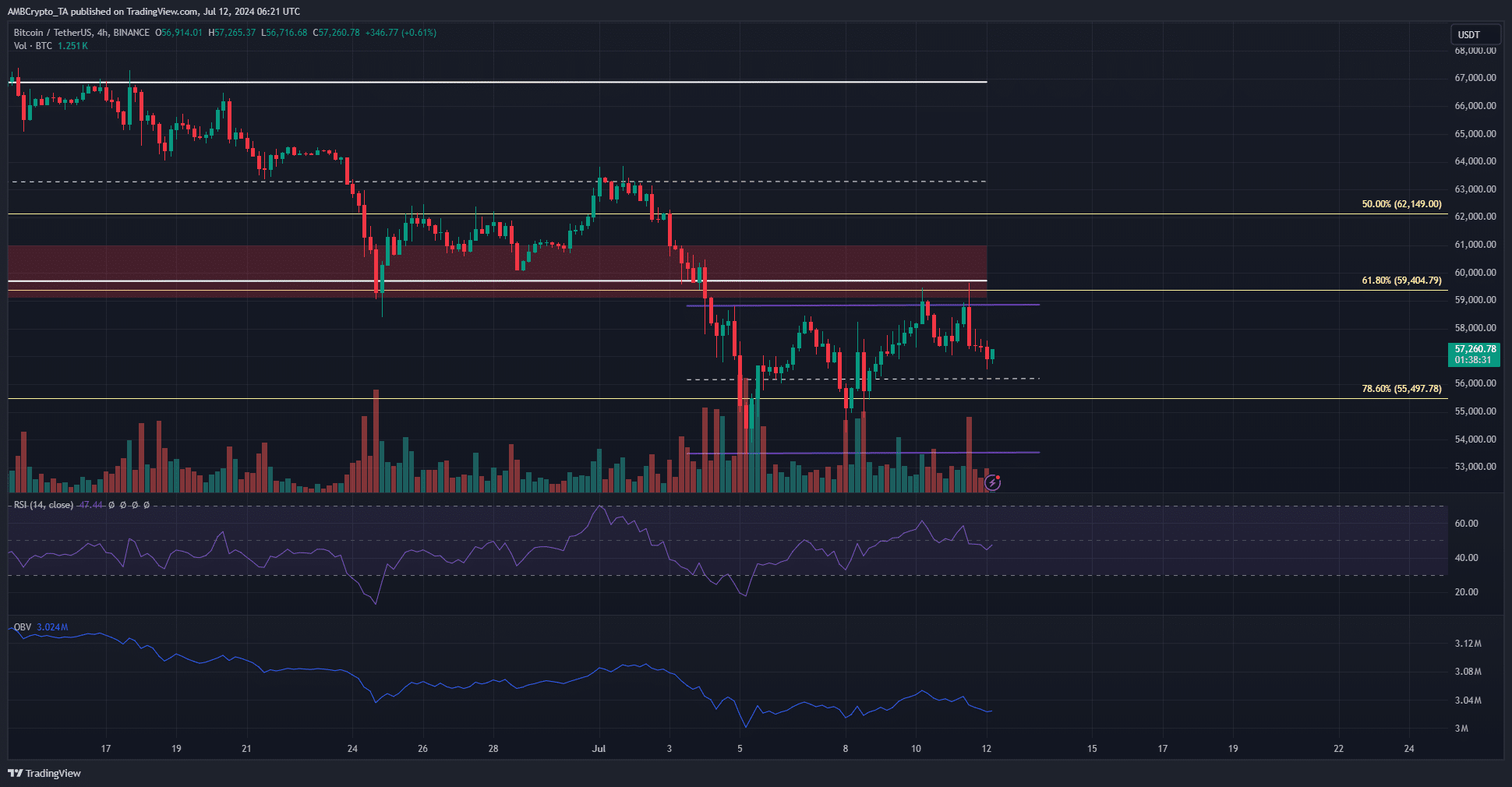

Source: BTC/USDT on TradingView

The 4-hour price chart showed a range formation (purple) between $53.5k and $58.9k. The supply zone (red box) of $59.2k-$61k has been tested twice in the last few days, but without results.

The OBV showed that purchasing pressure was not great. The RSI was pushed below neutral 50 after the price rejection at the highest levels in the range.

The bulls couldn’t keep up the pressure and traders can prepare for another price drop towards $55k this weekend.

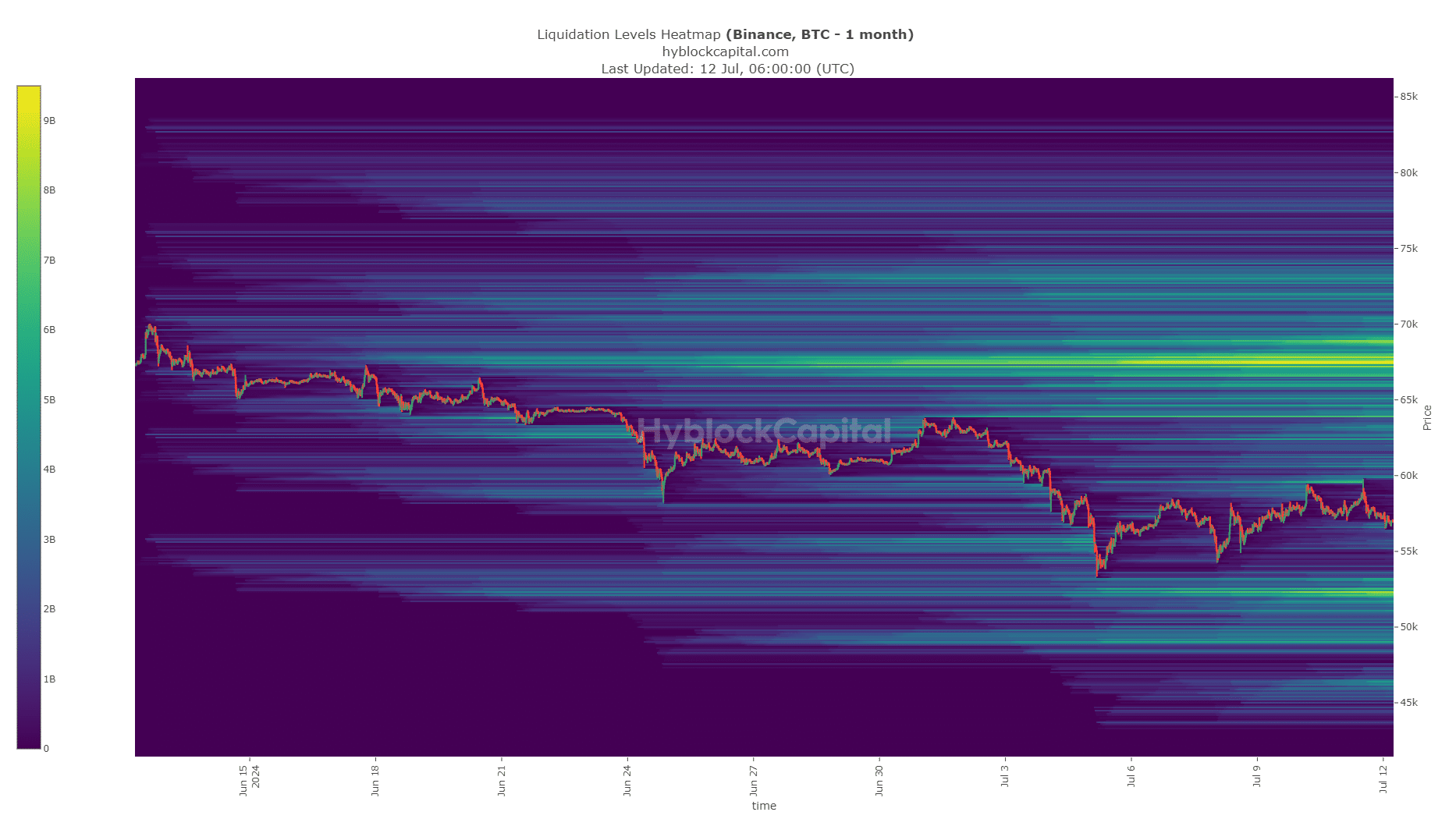

Last month’s liquidation heatmap showed that the $59.5k liquidity position was tested on July 11 and prices recovered immediately. This was a sign that the $52.1k liquidity cluster was the next target.

If the buyers had been dominant, BTC would have broken the $60,000 mark. Since this was not the case, short-term Bitcoin forecasts call for more losses.

Great opportunity for traders

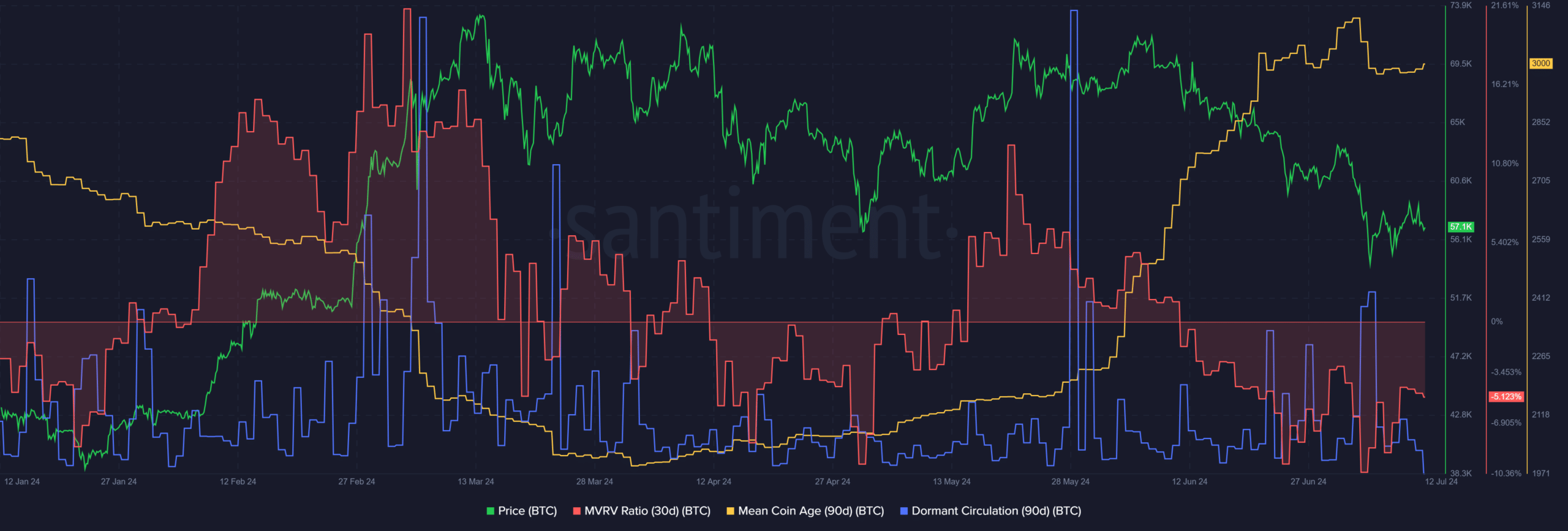

The average coin age has been trending higher since May. Prices have stalled over the past ten days, but overall the measure indicated strong network-wide accumulation during last month’s price decline.

The 30-day MVRV was negative, indicating that short-term holders are making losses. Together, this combination is a strong buy signal.

Read Bitcoin’s [BTC] Price forecast 2024-25

The dormant circulation spiked dramatically on July 5 when Bitcoin prices fell, but it has been quiet since then.

Overall, Bitcoin predictions of more losses remain in place due to the $52.1k liquidity. If sentiment becomes weak enough, the $46,000 region could also become a target. As things stand now, investors may try to buy the dip.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.