- The non-Legege portfolios of BTC have reached a low point of 5 months, which reflects the growing concern of retailers in the midst of market volatility.

- Large Bitcoin holders continued to accumulate and signaling potentially bullish sentiment despite smaller investors.

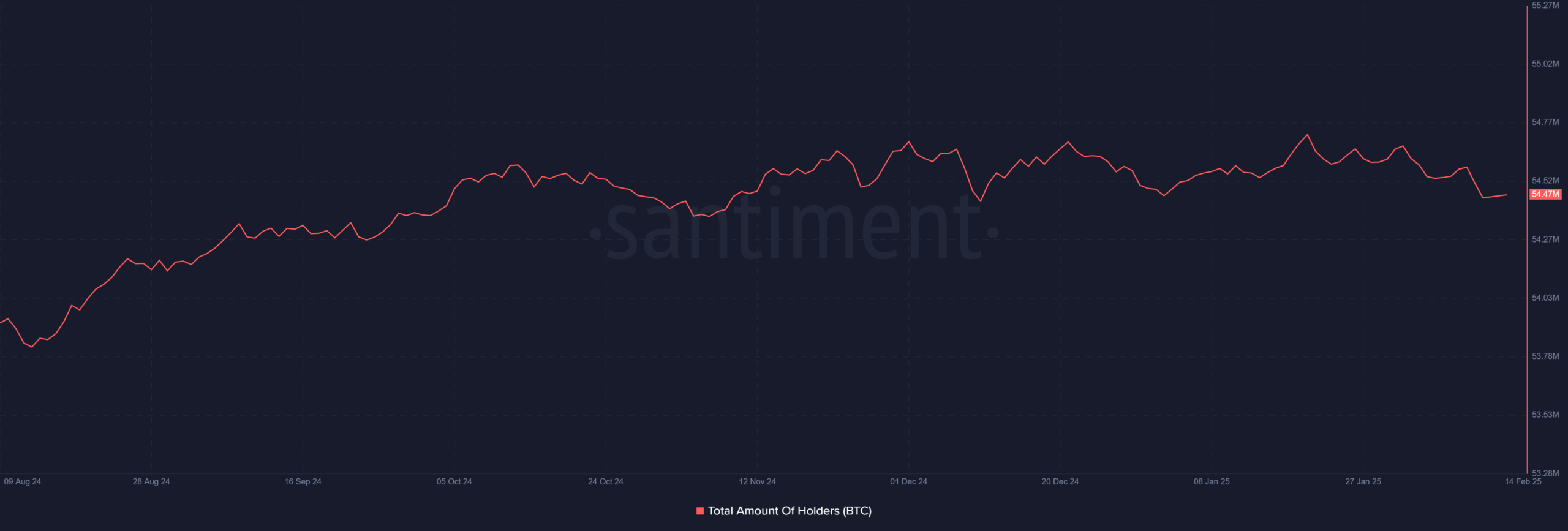

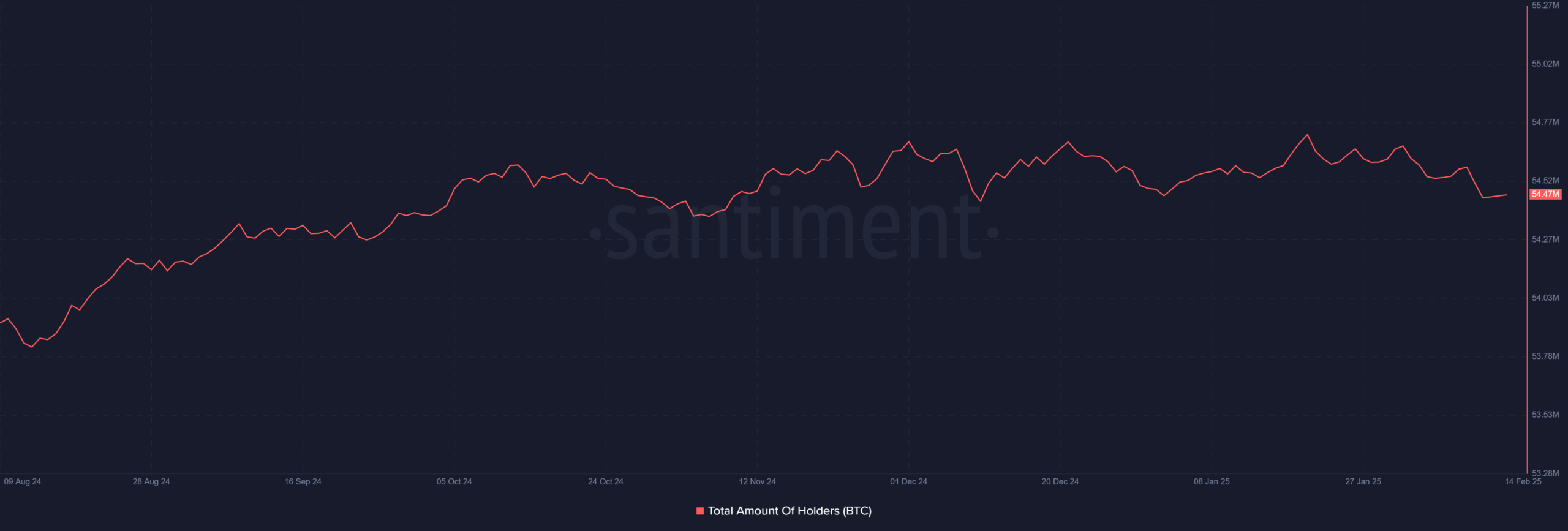

Bitcoin’s[BTC] Netwerk has witnessed a remarkable decrease in the number of active portfolios, which affects a low five-month low of around 54 million non-lodge portfolios.

This drop indicates that retail capitulation increases as smaller traders leave their positions, probably due to recent market uncertainty. The question now is whether whales arrive to absorb the sales pressure.

Retail Exodus and its impact

Analysis of data from Santiment emphasizes that the number of Bitcoin portfolios that holds a balance has steadily decreased.

The decline marked the lowest level since December 10. At the moment it was around 54.7 million.

Source: Santiment

Historically, such trends suggest that smaller investors liquidate their participations, possibly due to the recent volatility.

Selling anxiety drives often coincides with market bases, which increases speculation over an impending price reverse.

Whale accumulation on the rise?

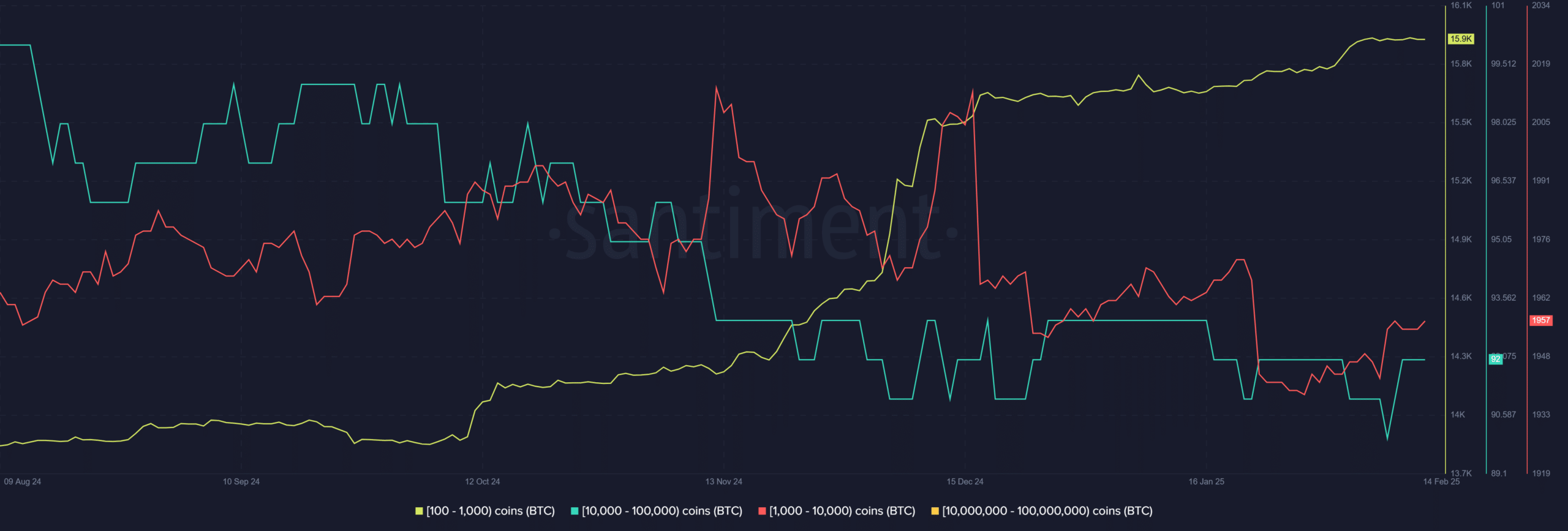

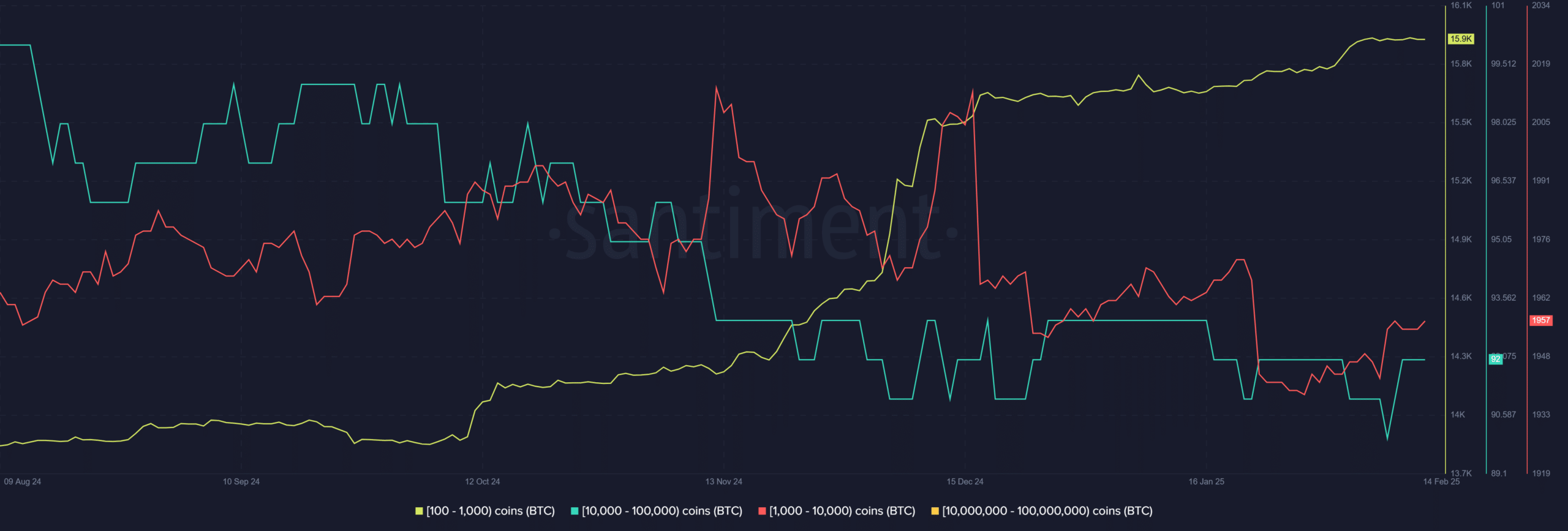

Data on chains from Santiment also showed that although smaller wallet counts are falling, large bitcoin holders-white wise-hun positions maintain or even increase.

In particular, addresses that hold between 10,000 and 100,000 BTC have remained relatively stable, while they have shown a slight increase with 100-1,000 BTC.

Source: Santiment

This divergence suggests that institutional investors or people with a high network value can benefit from the dip to collect BTC at lower prices.

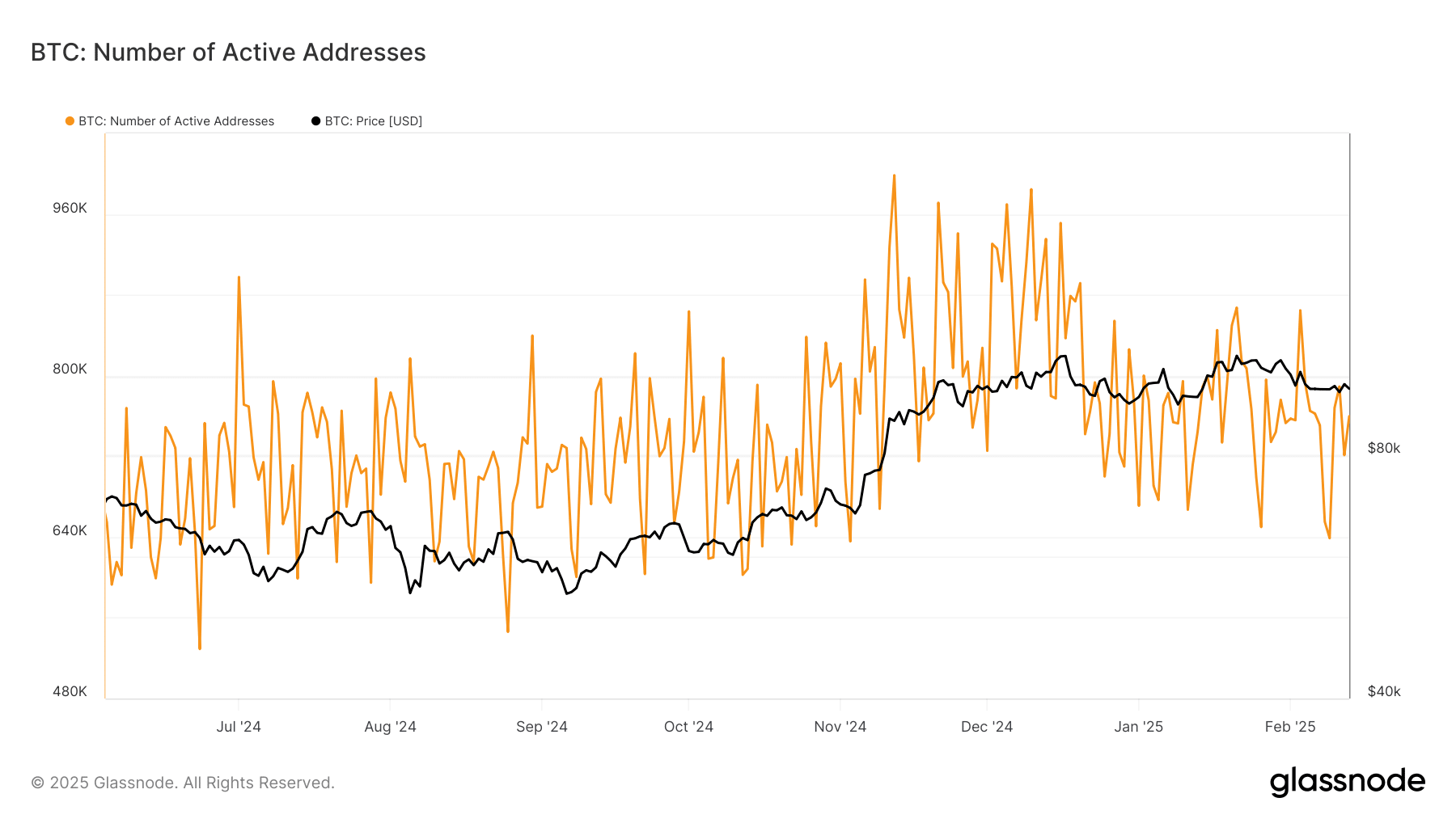

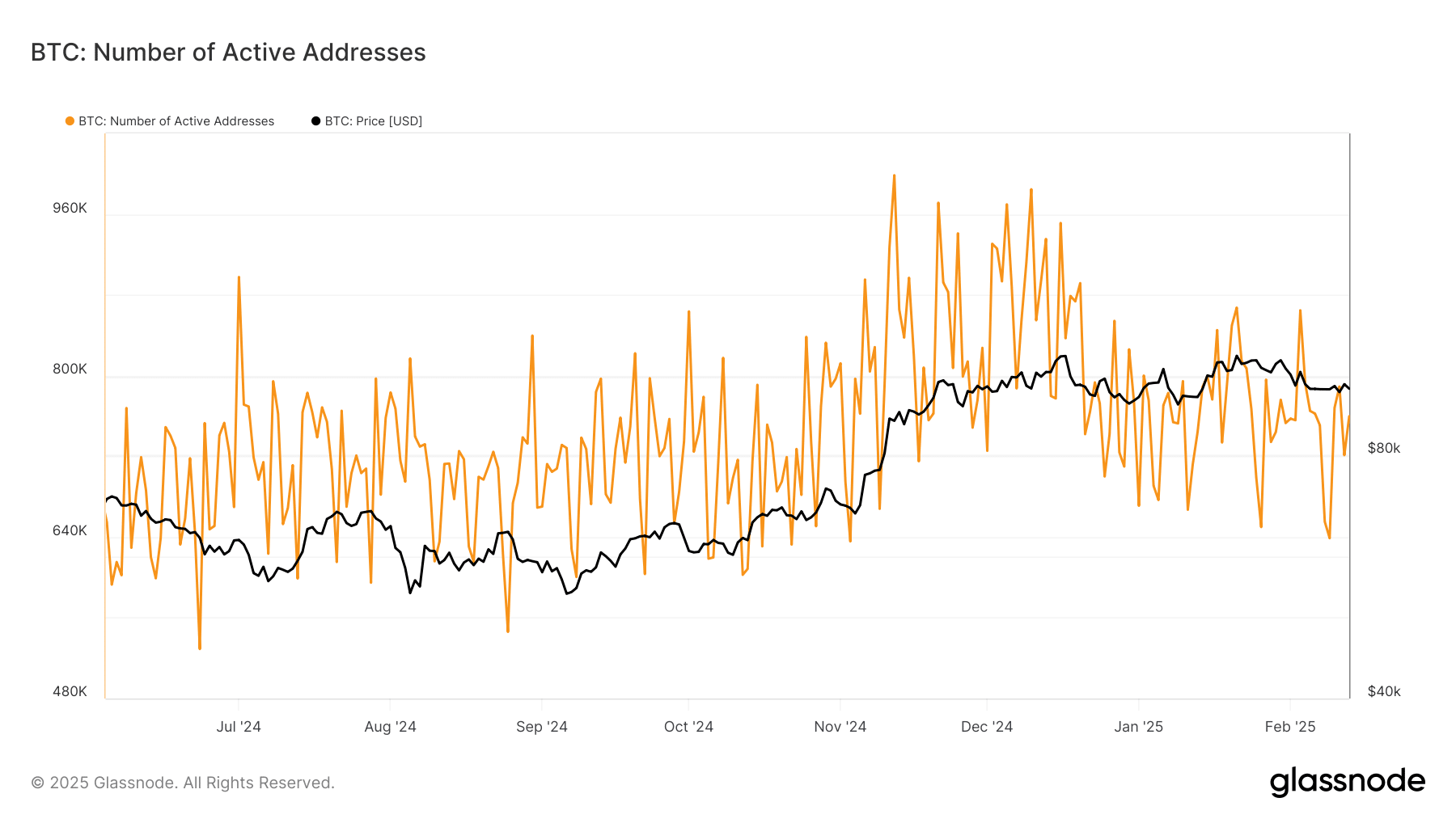

Network activity and market sentiment

The data analysis of Glassnode revealed that the number of active addresses of Bitcoin is also modest. The modest nature of the metric reflects a lower participation of retail traders.

Source: Glassnode

This is in line with the trend of exhaustion of wallets and reduced market enthusiasm among smaller investors.

However, similar patterns have traditionally been preceded by significant recovery, especially when institutional accumulation records.

What is the next step for Bitcoin?

If whales continue to accumulate and delayed by retailing sales, Bitcoin can find a strong support basis and form the scene for a rebound.

Traders must follow signs of increasing whale possession, stabilization in active portfolios and every revival of the activity in chains as important indicators for a potential trend remark.

Although the short -term sentiment remains careful, larger market players can quietly position themselves for the next leg.