- The price movements of Bitcoin in March 2025 have been more stable compared to Altcoins

- Divergence is a sign of the maturity of Bitcoin as a stable active, while altcoins are confronted with greater speculative pressure

In March 2025, altcoins such as Cardano are [ADA]Solana [SOL]And XRP saw a sharp peak in realized volatility, in which Ada hit a record of 150%and surpass Sol and XRP 100%.

Meanwhile Bitcoin [BTC] Also saw a significant volatility, but it remained relatively modest at 50% – well below the historic highlights.

Realized volatility reflects the price variation for a certain period. The walk in ADA, SOL and XRP volatility is a sign of larger price fluctuations, while the volatility of Bitcoin has remained relatively stable.

Altcoins as speculation with a high risk

In comparison with Bitcoin, Altcoins are more sensitive to speculative trade, often powered by news, rumors and community -driven momentum. This can lead to exaggerated price fluctuations.

XRP has been particularly sensitive to legal news, whereby the current sec -right case contributes to irregular price movements.

During Uptrends on the market, investors often move capital from Bitcoin to Altcoins to pursue a higher efficiency, which further strengthens the volatility of Altcoin. Although this volatility offers larger chances of profit, it also increases the risk of considerable losses.

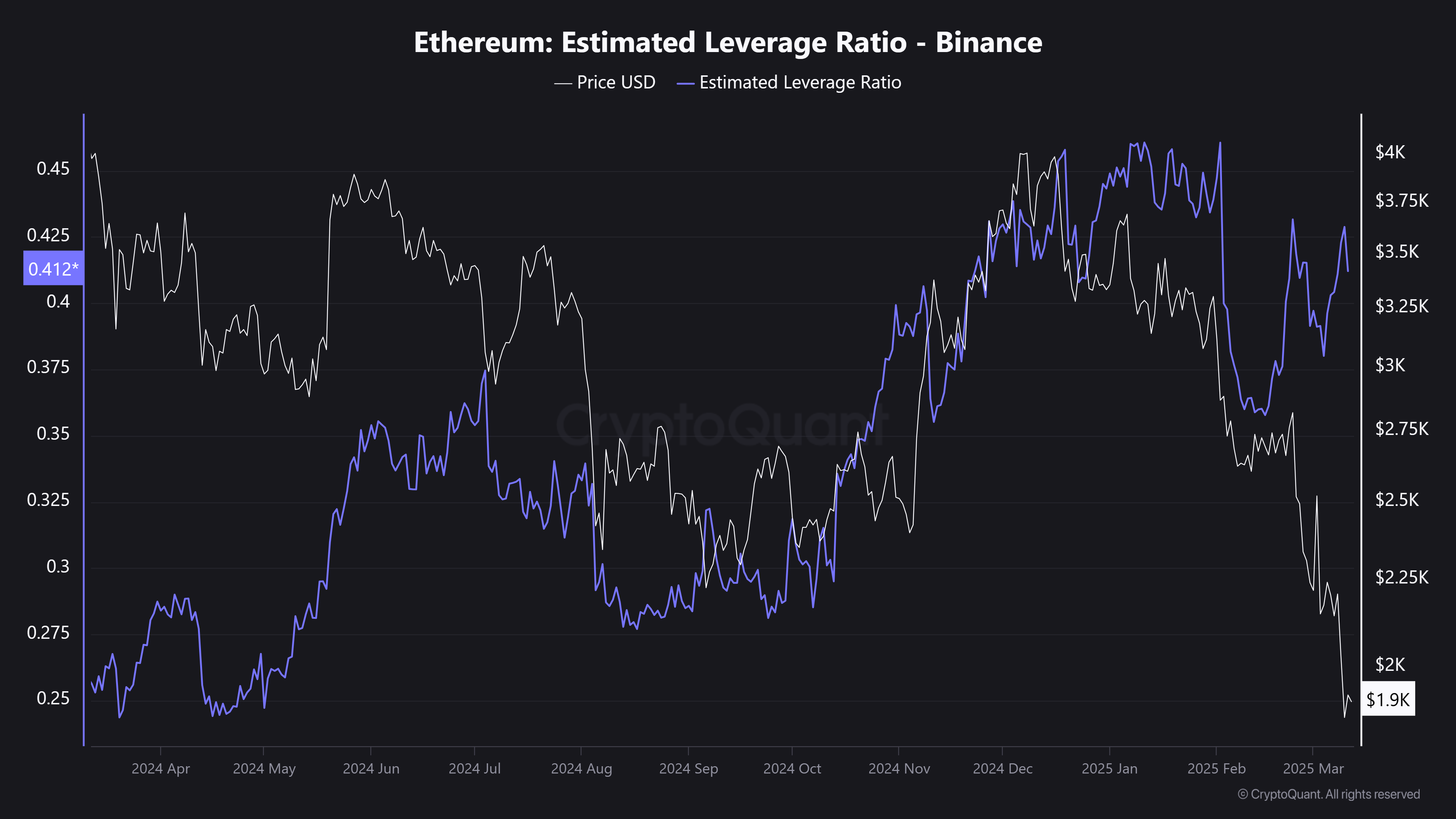

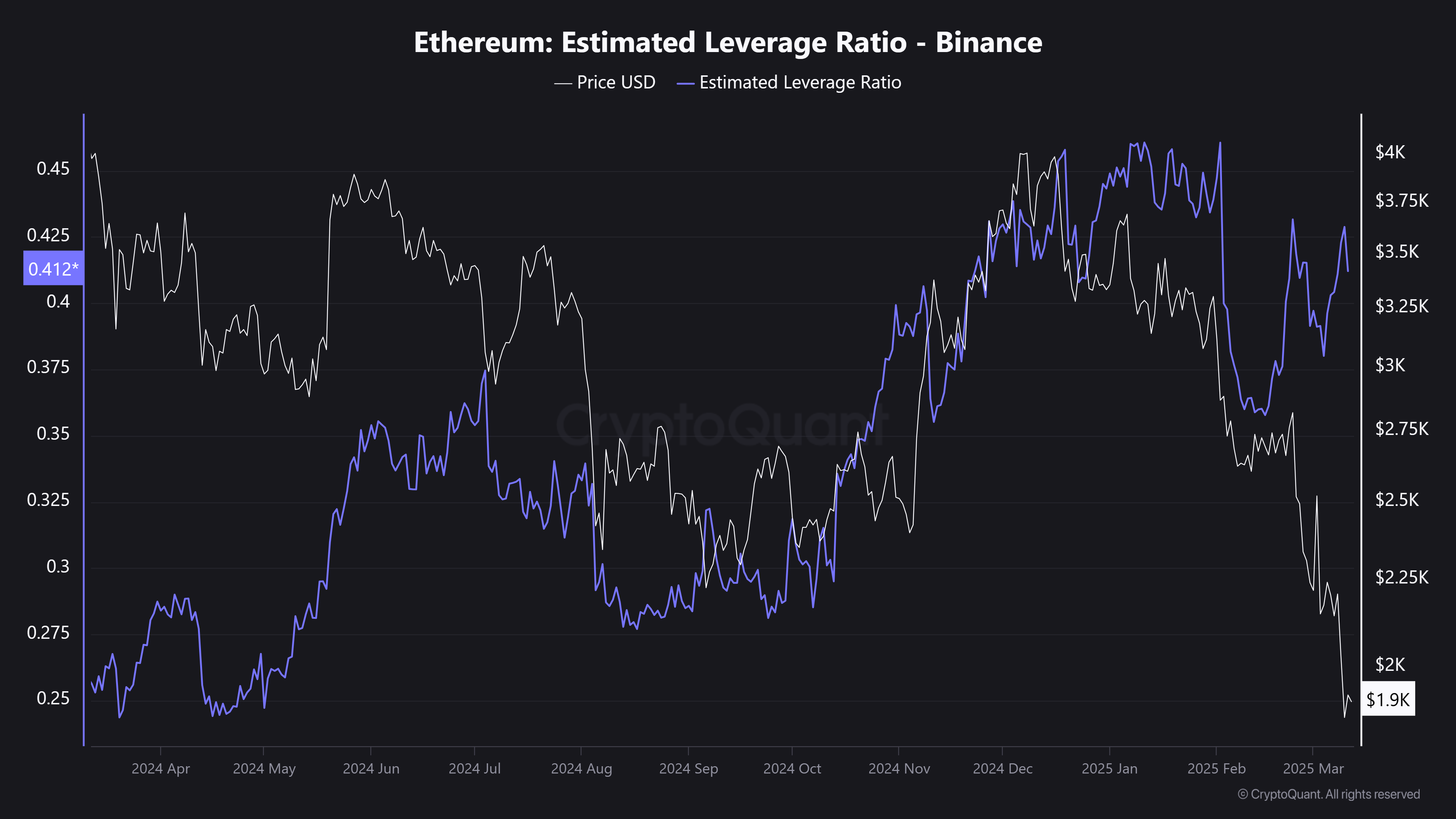

Ethereum (ETH) is an example of this trend. Despite the loss of support of $ 2,000 for the first time since 2023 and the exchange reserves are rising, the estimated lever ratio (ELR) has risen to a monthly high. This is an indication of increased risk exposure in derivatives markets.

Source: Cryptuquant

In other words, traders raise aggressive use of positions on both sides, reinforce volatility – a traditional “high risk, high reward” setup that could feed competitive price fluctuations.

This Altcoin diversion is also clear in price action, with ADA, SOL and XRP that break under the most important support zones and are stuck in consolidation.

Increasing volatility is to turn from Altcoin trade into a speculative game with a high risk.

However, Bitcoin, however, positions itself as the more stable asset in the midst of the growing uncertainty?

Bitcoin as a stable store of value

Historically, BTC has seen Volatility Pikes above 100%, but The details of March 2025 seemed to point out a more stable price structure.

Although Bitcoin offers a safer port with lower volatility, it also limits the profit potential in the short term. This, in contrast to Altcoins, where reinforced risk results in the temptation of higher rewards.

Does this strengthen the role of Bitcoin as a long -term company? Well, volatility trends suggest that it could just be.

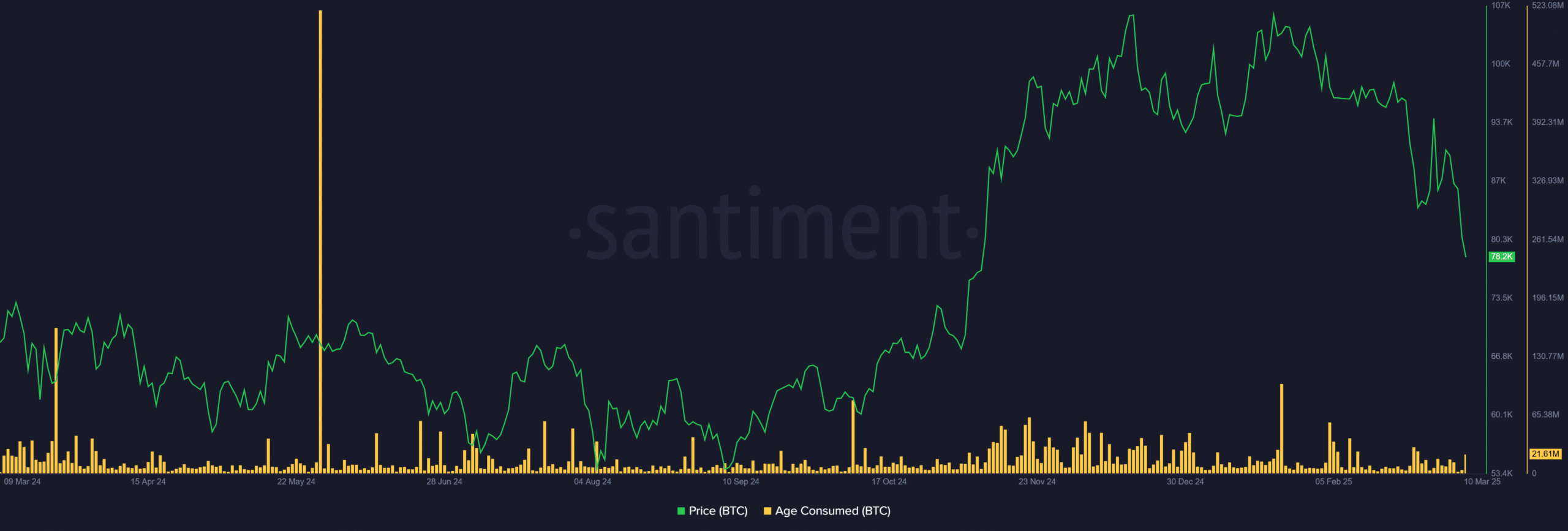

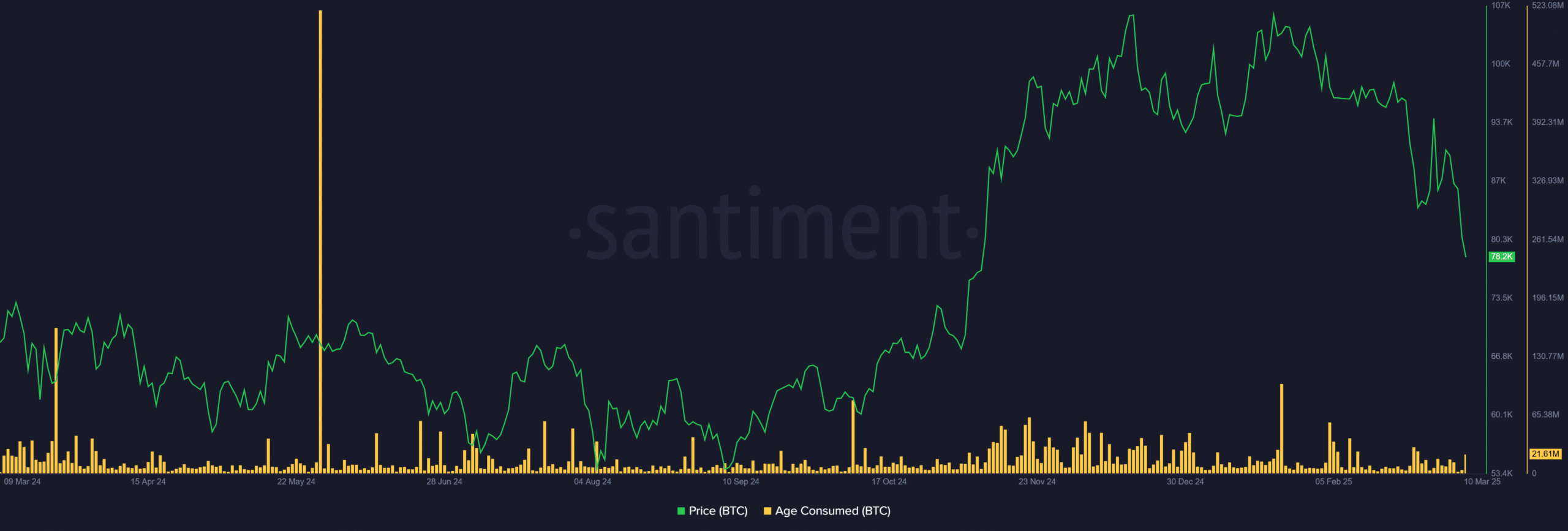

In the meantime, the metrics used by the age of long-term holders’ movements is not to nail, despite the fact that BTC fell below $ 80k and knew billions in market value.

Source: Santiment

This suggested that seasoned investors are not surprised, reinforcing confidence in Bitcoin’s long -term process.

It is clear that volatility trends now form trade strategies.

With altcoins that exhibit a higher risk-remuneration potential, they can dominate speculation in the short term. While Bitcoin continues to settle as the preferred storage of value in the long term.