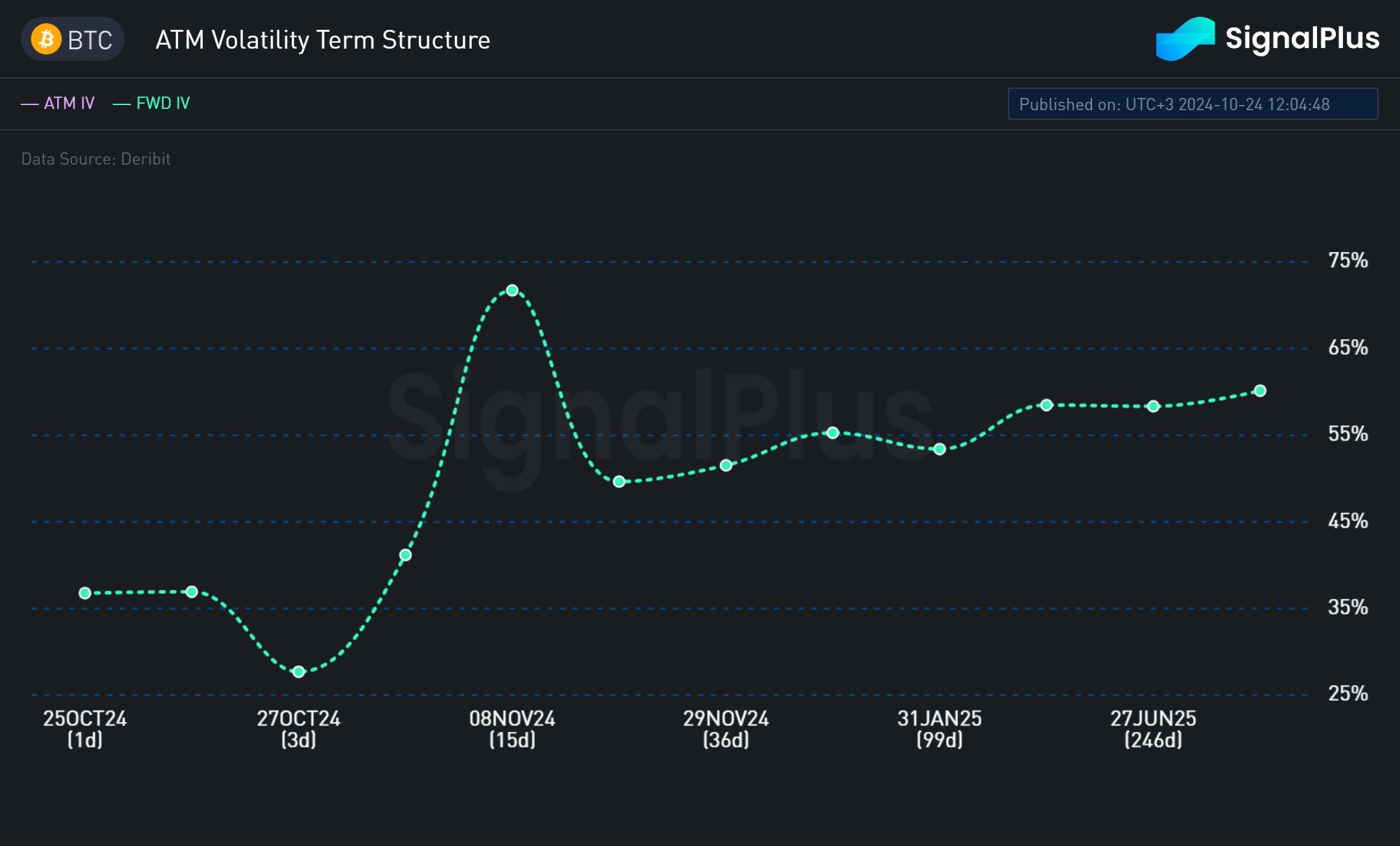

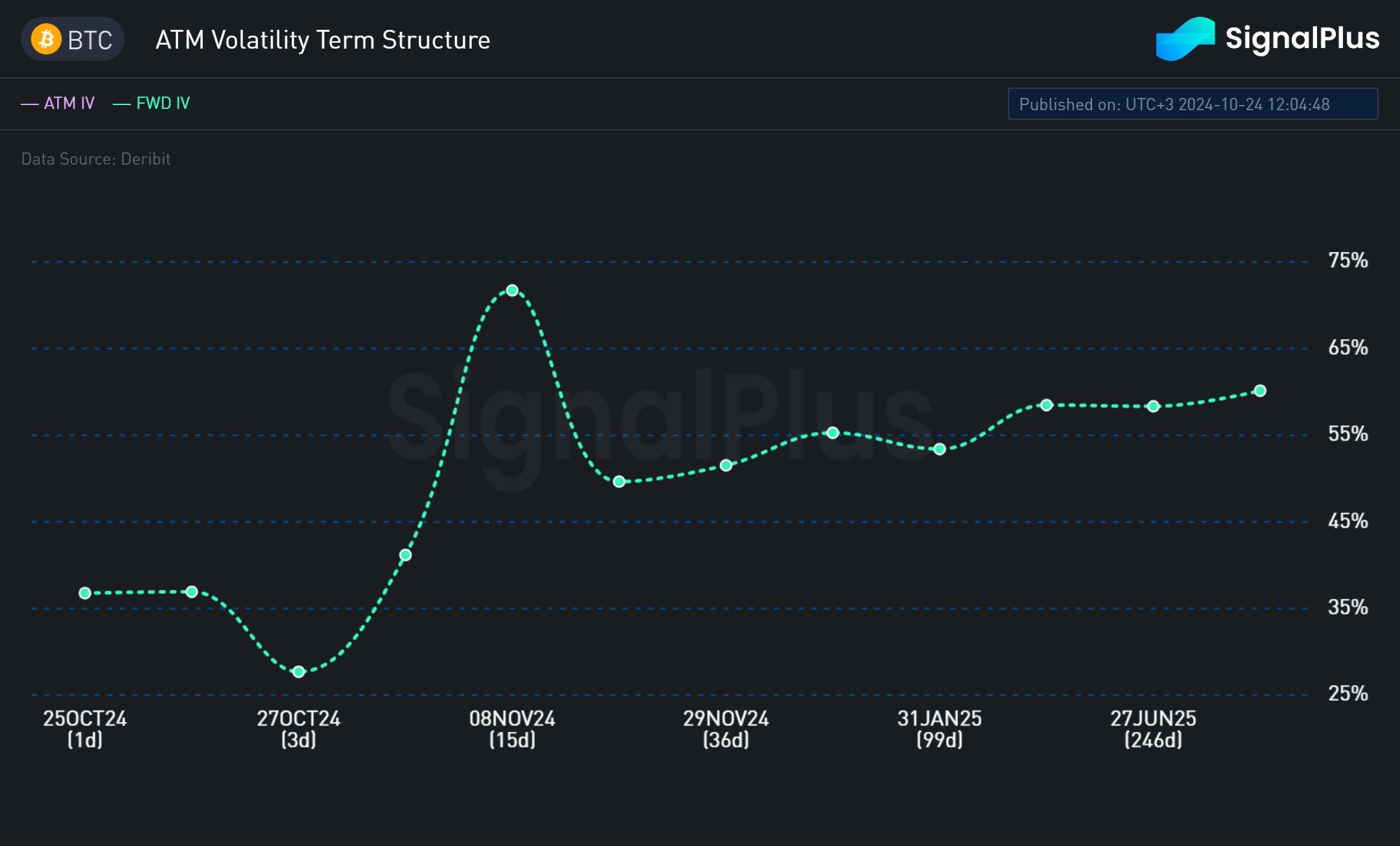

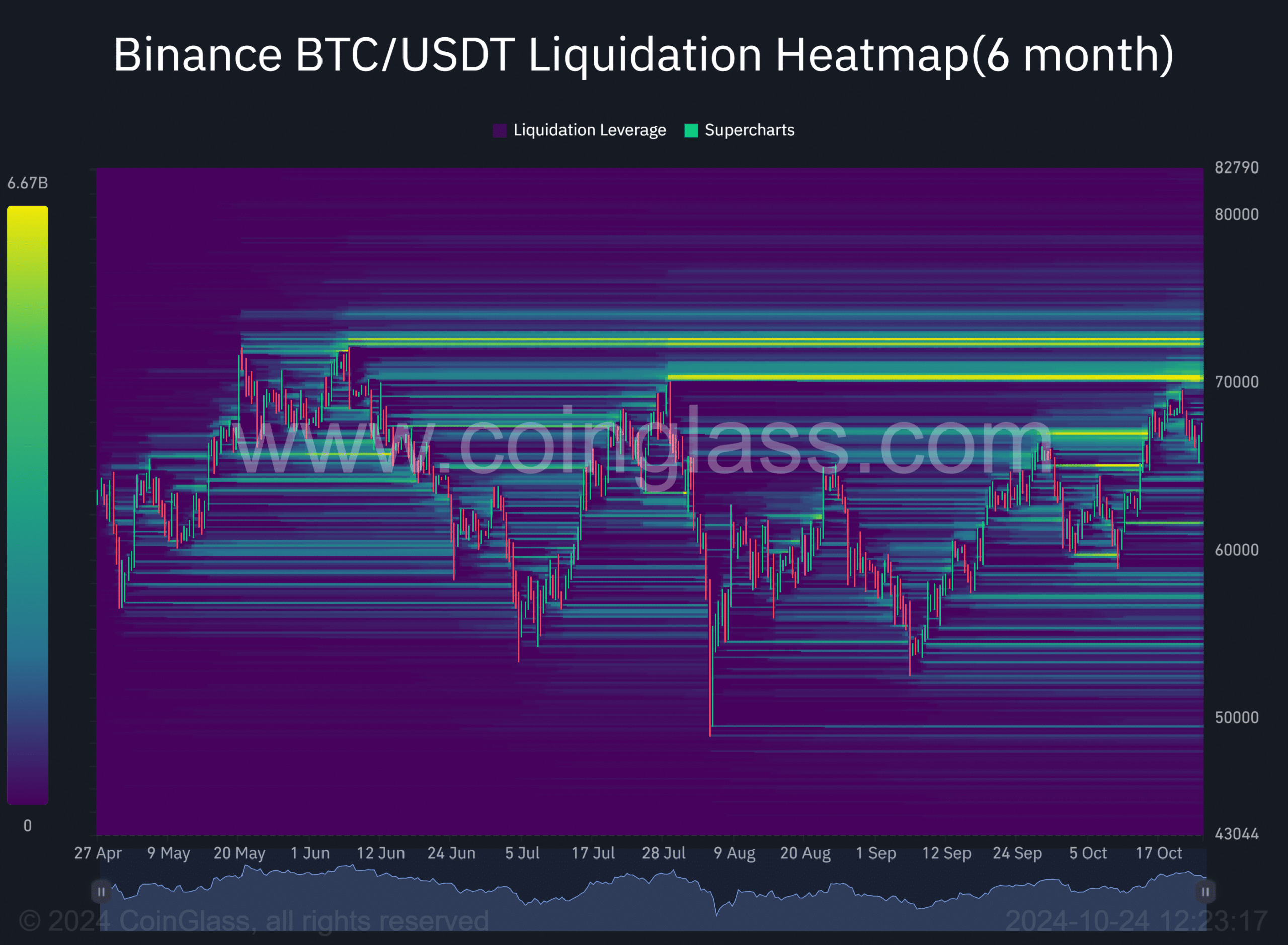

- Implied volatility for Bitcoin options around the US elections has increased by almost 50%.

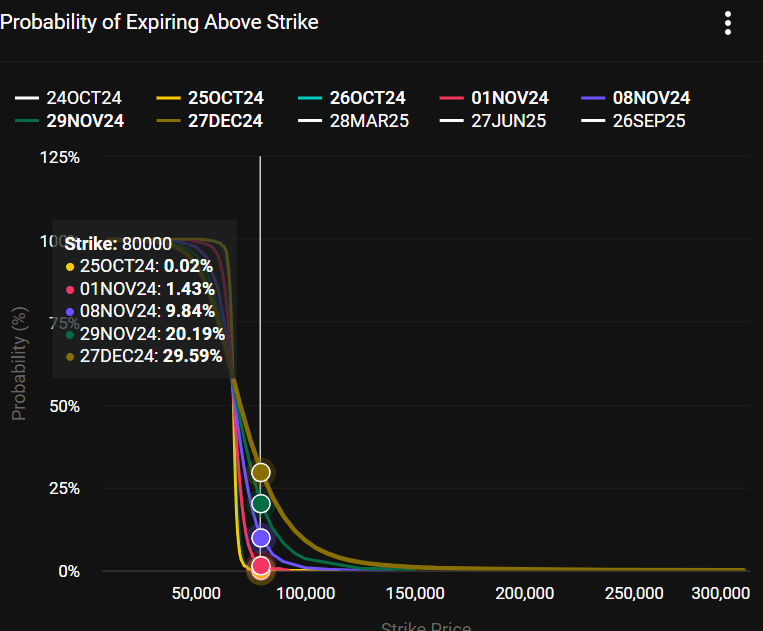

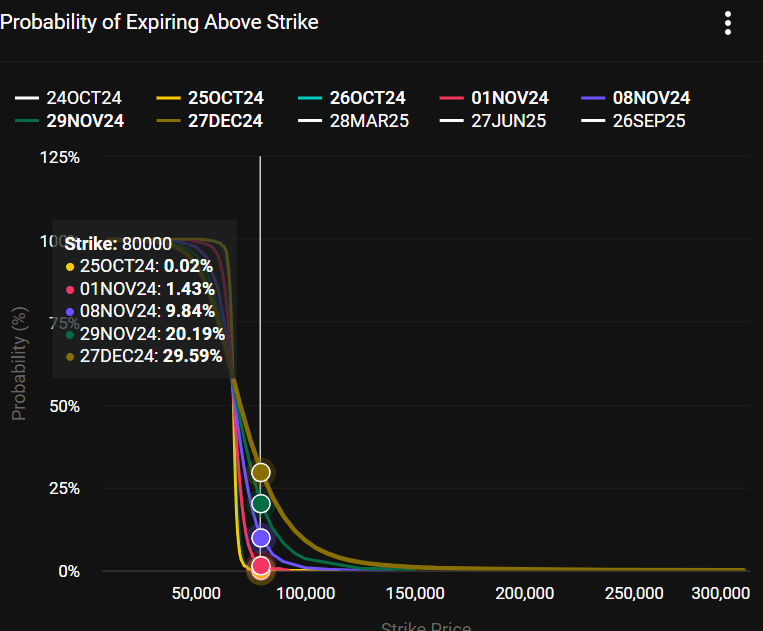

- Options traders estimate a 20% chance that BTC will reach $80,000 by the end of November.

With just two weeks until the US presidential election, Bitcoin [BTC] options traders remained optimistic and had a target of $80,000 in mind by November.

The election was a major market uncertainty, as noted by nearly 71% peak in FWD IV (forward implied volatility) by November 8.

This meant that the market was expecting wild price swings around the US elections. Therefore, the swings can be up or down as institutional investors hedge their positions against the risk.

Source: SignalPlus

Market volatility was expected to decrease after two major events: the election (November 5) and the Fed’s interest rate decision (November 8). The FWD IV movement southwards after November 8 illustrated this.

Bullish betting on options

However, despite election concerns, the BTC options market has maintained a bullish outlook, as recently noted by crypto trading firm QCP Capital. It declared,

“Short-term implied volatility peaks at the close of Election Day, with a spread of 10 full over the previous expiration and skews favoring calls over puts, despite BTC being about 8% below its all-time high stands.”

At the time of writing, Deribit facts outlined a similar outlook, with call options (bullish bets on BTC’s future price appreciation) dominating put options (bearish bets) for contracts expiring on November 29.

The options traders estimate a 20% chance that BTC will reach $80,000 by the end of November.

Source: Deribit

Commenting on the positioning, André Dragosch, head of Bitwise’s European research, called it an expectation of a “bullish outcome.”

“This supports the hypothesis that bitcoin options traders generally position for a bullish outcome.”

Well, Donald Trump has perhaps been the most pro-crypto candidate. He has maintained a 20-point lead over Kamala Harris in polls and prediction site Polymarket.

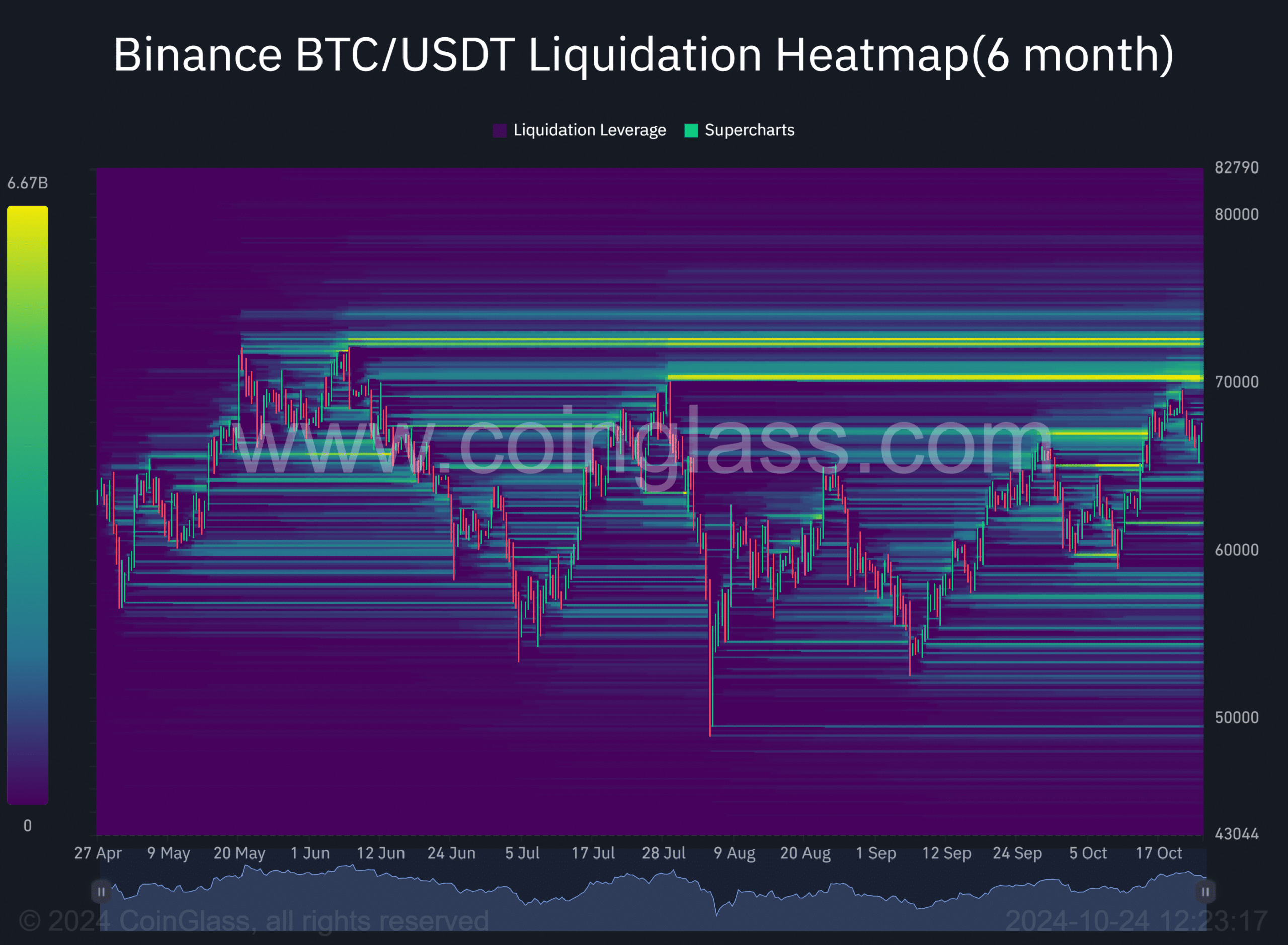

That said, if BTC were to rise to $80,000 and reach the psychological level of $70,000, almost $7 billion in short positions would come under pressure.

Source: Coinglass

However, BTC has seen a short-term weakening due to the ongoing US earnings season. At the time of writing, the value of BTC was $67,000, about 10% away from the all-time high (ATH) of $73.7,000.