- Reduced risk hedging and increased on-chain activity suggested growing confidence in Bitcoin’s price potential.

- Bitcoin may be in a position for a breakout due to rising open interest and a lower NVT ratio.

Bitcoin [BTC] The options market showed a shift, with traders pulling back on their risk hedging. This development suggested that an outbreak could be on the horizon.

With on-chain metrics improving, Bitcoin’s current momentum begs the question: are new price highs within reach?

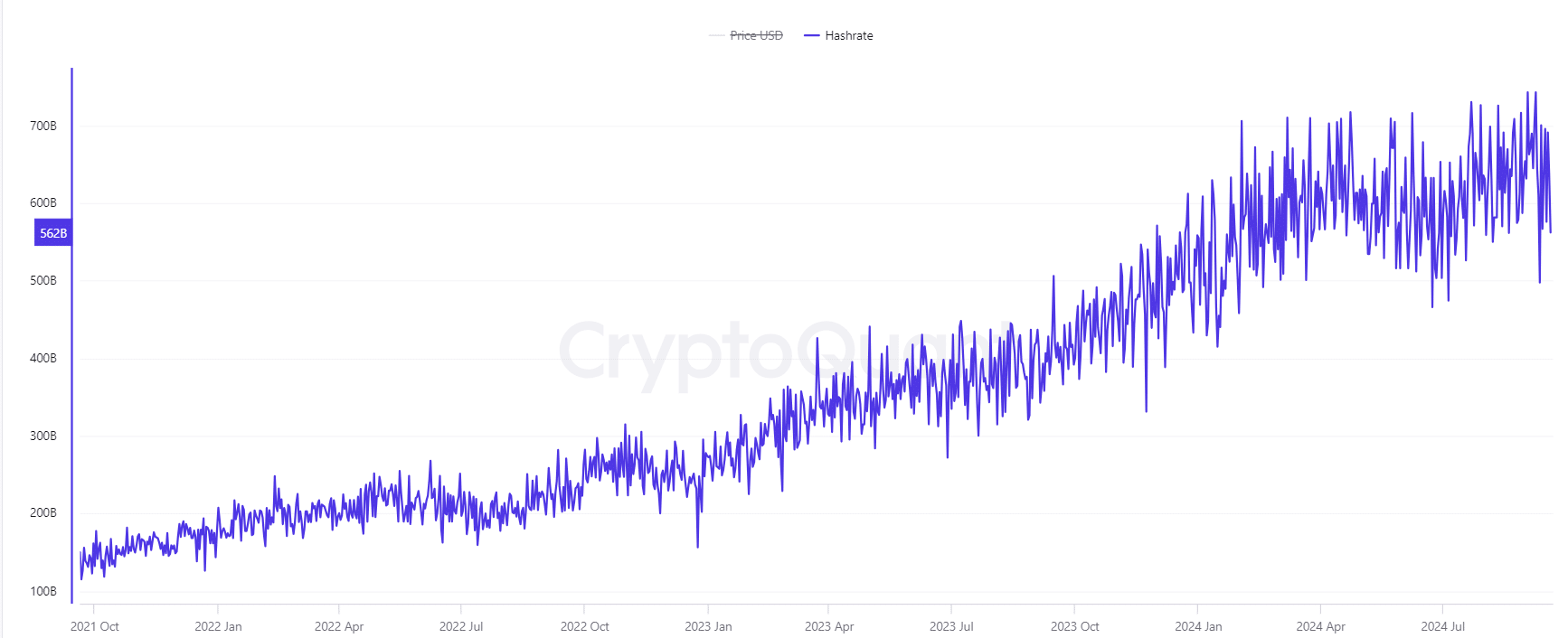

Does Bitcoin’s Hash Rate Reflect Growing Confidence?

At the time of writing, the hash rate has risen to 562 billion, representing an increase of 0.61% in the last 24 hours. This metric is critical because a higher hash rate often indicates that miners are confident in Bitcoin’s long-term prospects.

When miners invest more resources in securing the network, it is usually related to stability or expectations of an upward price movement.

Source: CryptoQuant

Do these numbers suggest rising demand?

Activity in the chain remained strong. According to CryptoQuant data, the number of active addresses stands at 8.685 million, an increase of 0.91% from the last day.

Similarly, the number of daily transactions increased by 1.29% to 584,631,000.

Both metrics highlight increased network activity, which often precedes notable price movements. Rising transaction volume indicates growing interest and engagement, potentially laying the foundation for a price increase.

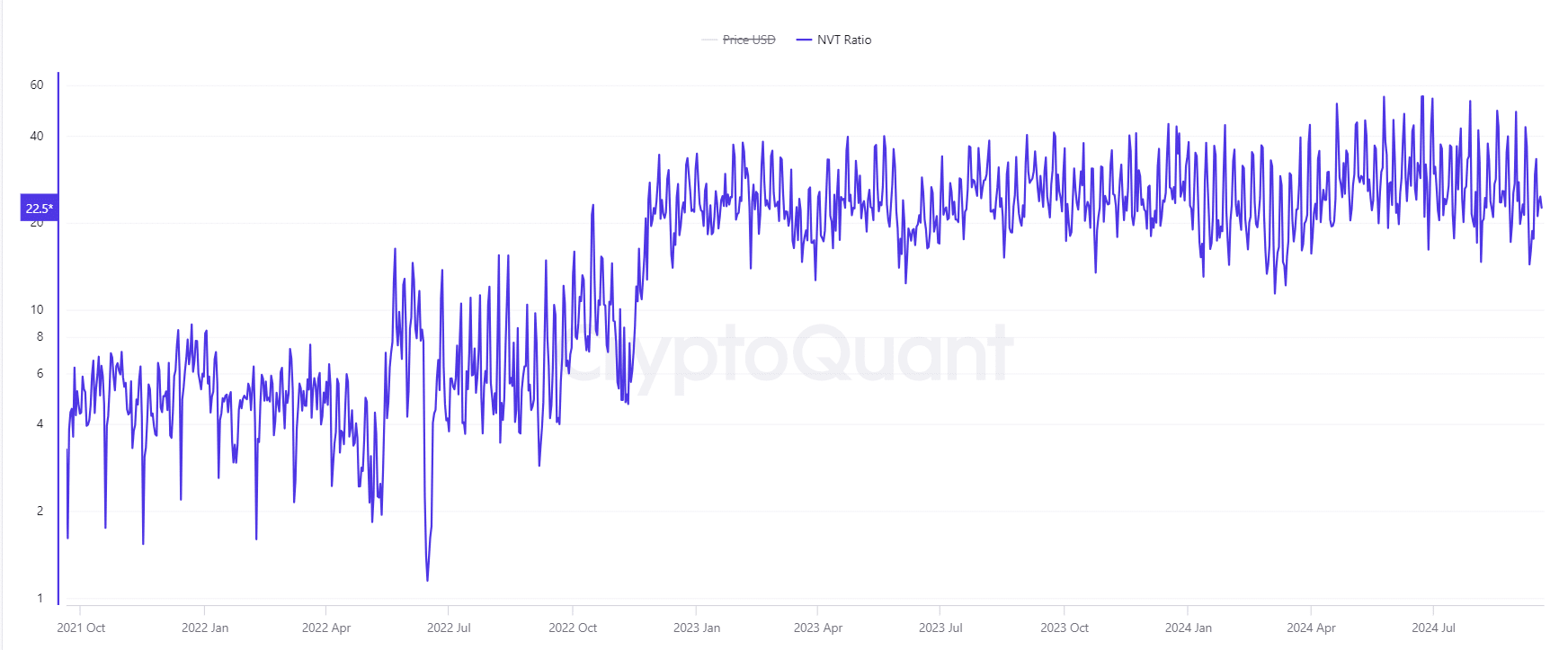

Is Bitcoin Undervalued Based on the NVT Ratio?

Looking at the NVT ratio, which currently stands at 22.549 (down 8.36%), Bitcoin could be undervalued.

The NVT ratio measures the relationship between market capitalization and transaction volume, and a lower ratio suggests the network is seeing more activity than the price reflects.

This imbalance could indicate strong potential for upward price movement, especially when combined with positive trends in the chain.

Source: CryptoQuant

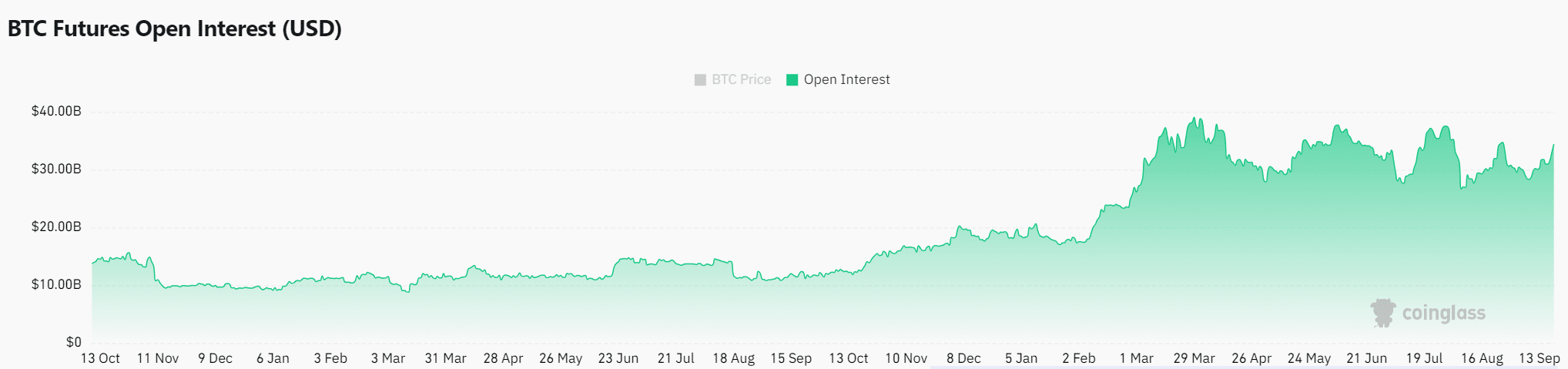

Could the rise in open interest trigger a price breakout?

Open interest in Bitcoin options increased 3.86% to $35.38 billion. Moreover, the reduction in risk hedging is notable considering Bitcoin is trading at $63,402.45, up 1.34% in the last 24 hours at the time of writing.

When traders lower their protective puts, they often expect less volatility and a potential price breakout. This market behavior suggests growing optimism about Bitcoin’s price action.

Source: Coinglass

Realistic or not, here is the market cap of ETH in terms of BTC

Are new range highs likely?

With a rising hash rate, increasing on-chain activity, and a reduced NVT ratio, BTC appears positioned for an upward move.

The increase in open interest, combined with reduced risk hedging, strongly indicates that new range highs may be around the corner.