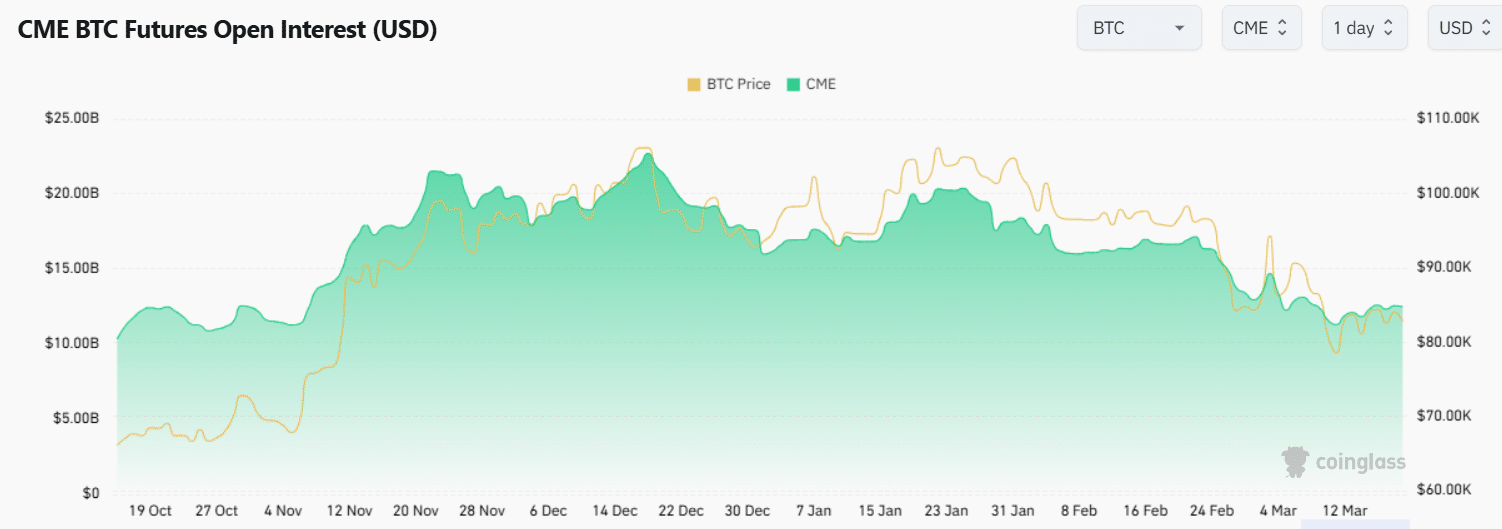

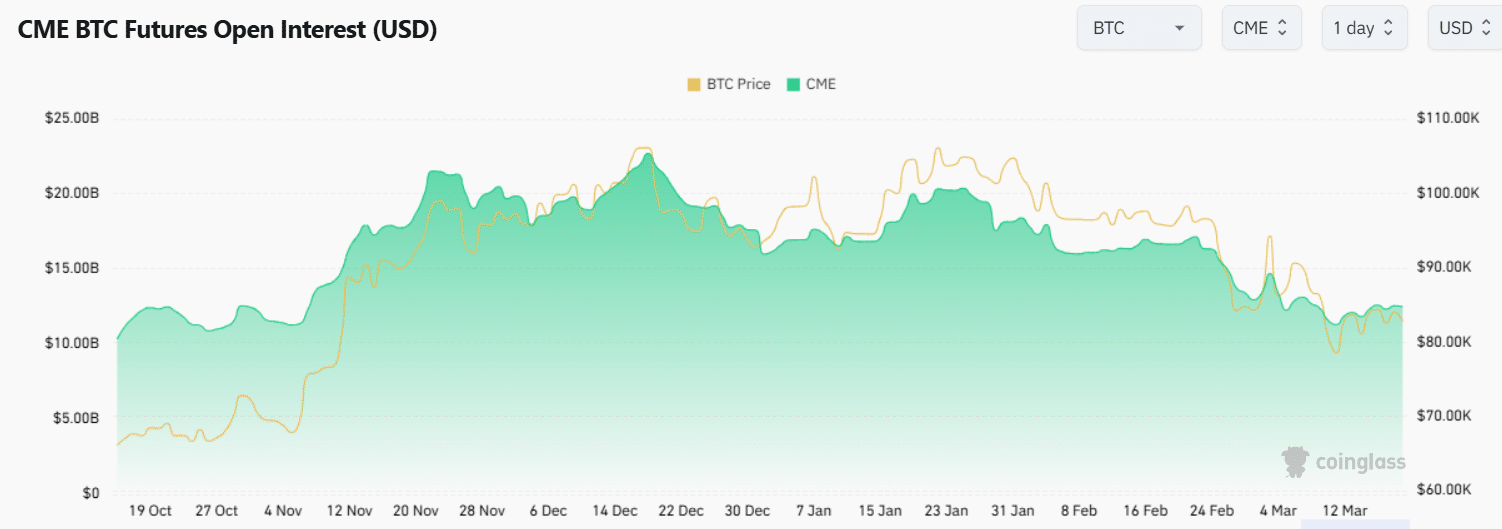

- The Futures market of Bitcoin saw more than $ 10 billion in open interest swept away.

- CME Open interest rate fell by 45% from December 18 to March 18.

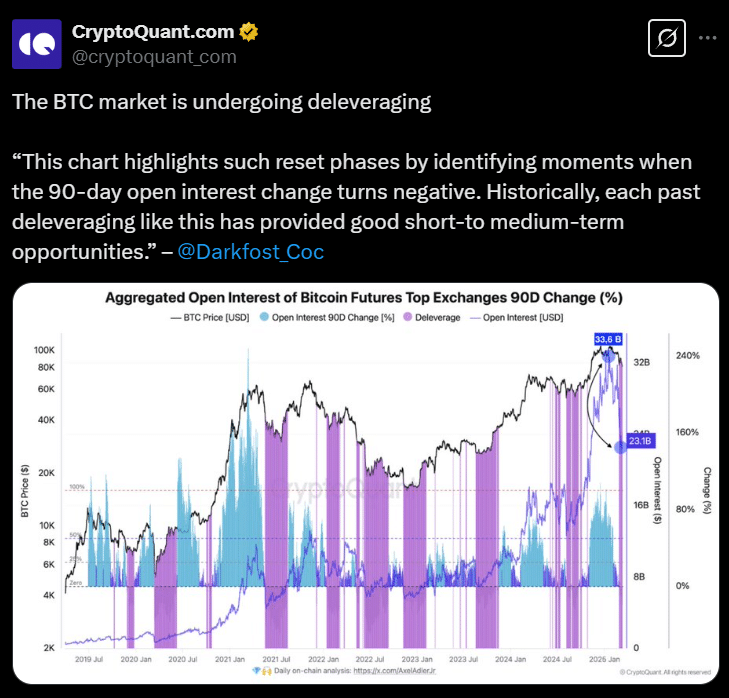

Bitcoin’s [BTC] Futures Market is undergoing one of the largest Deleveraaging events, with more than $ 10 billion in open interest since January 2025. The peak, on January 17, amounted to $ 33 billion.

It was a record high of market lever, according to one Cryptuquant Analyst.

Source: X

Between February 20 and March 4, the open interest rate fell by $ 10 billion.

The decline was apparently accelerated by setting up the uncertainty of both domestic and international political developments and market -wide liquidations.

Cryptoquant analysts describe this phase as a natural market set, a pattern that has been historically preceded in advance of bullish trends in short to medium term.

This decline is not the first time that excessive leverage has activated a market set.

History repeats itself: Echos from March 2024

A similar event took place in March 2024, when Bitcoin returned sharply from $ 69,000 to $ 59,700. That specific event forced a wave of compulsory outputs of lifting tree positions, a total of $ 1 billion.

Moreover, that correction led to a standardization of financing percentages in large cryptocurrencies, which made the road clear for a continuing meeting later in the year.

As history suggests, Deleveraging -Cycli often coincides with external economic and geopolitical developments, which further reinforces market reactions.

The newest Deleveraging Wave was reportedly influenced by external geopolitical tensions and continuous macro -economic shifts, adding complexity to market dynamics.

A series of market reactions followed Donald Trump’s recent statements about Crypto, including claims of ending “Joe Biden’s War on Bitcoin and Crypto.”

Market -wide delevering is not isolated. Financing percentage Movements provide further insight into how traders have adjusted their risk exposure during this period.

From $ 104k to $ 82k – what really happened?

By the end of February, the open interest on Bitcoin -Futures contracts had fallen under $ 60 billion, a decrease of $ 70 billion in January, according to data from Coinglass.

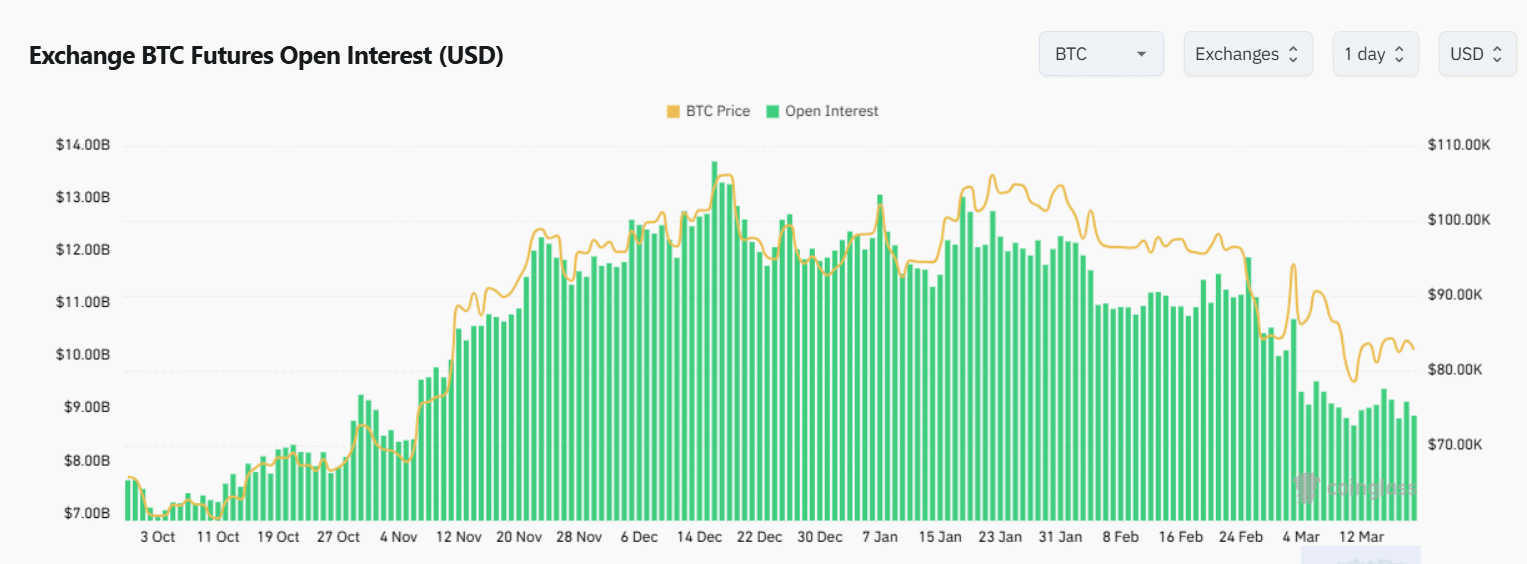

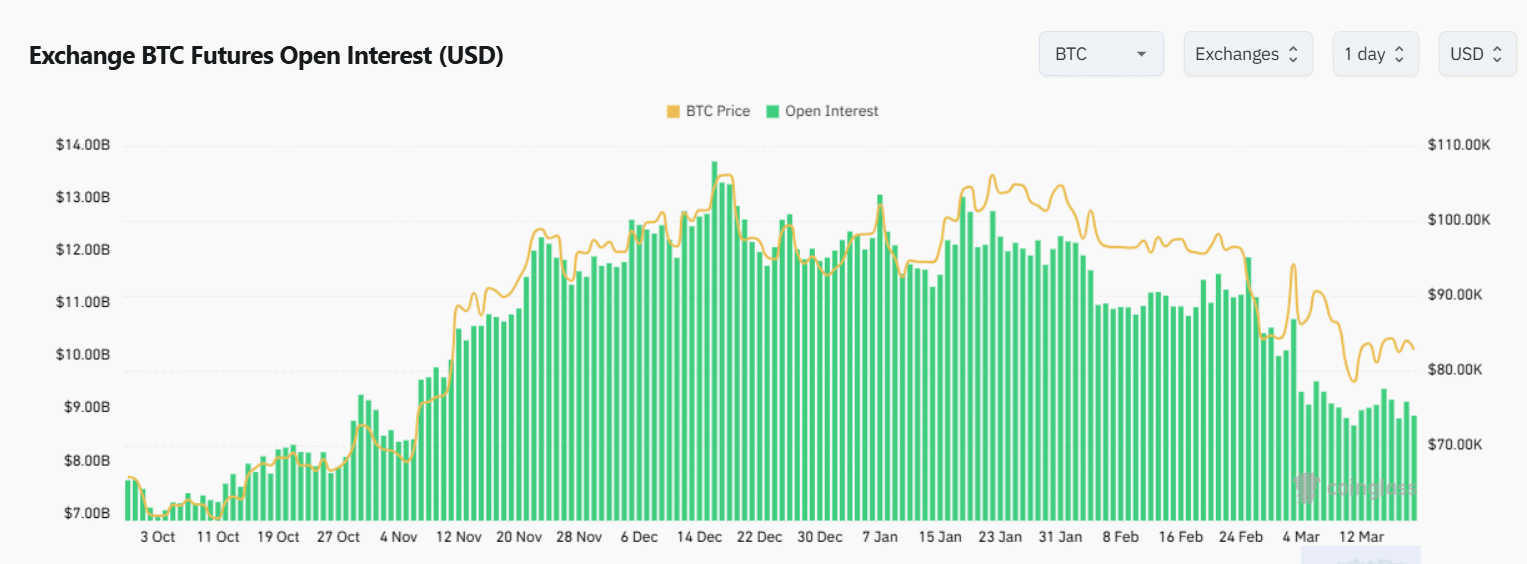

Source: Coinglass

Bitcoin’s Futures Open interest on Coinglass emphasized the connection between leverage reduction and price movements.

Between December 2024 and March 2025, Bitcoin’s open interest rate fell from $ 13.70 billion to $ 8.86 billion. The data confirm a decrease of 35% in OI during this period, in addition to a 20% decrease in the Bitcoin price.

This suggests that the December rally was fed by excessive leverage, which was later settled as sentiment shifted.

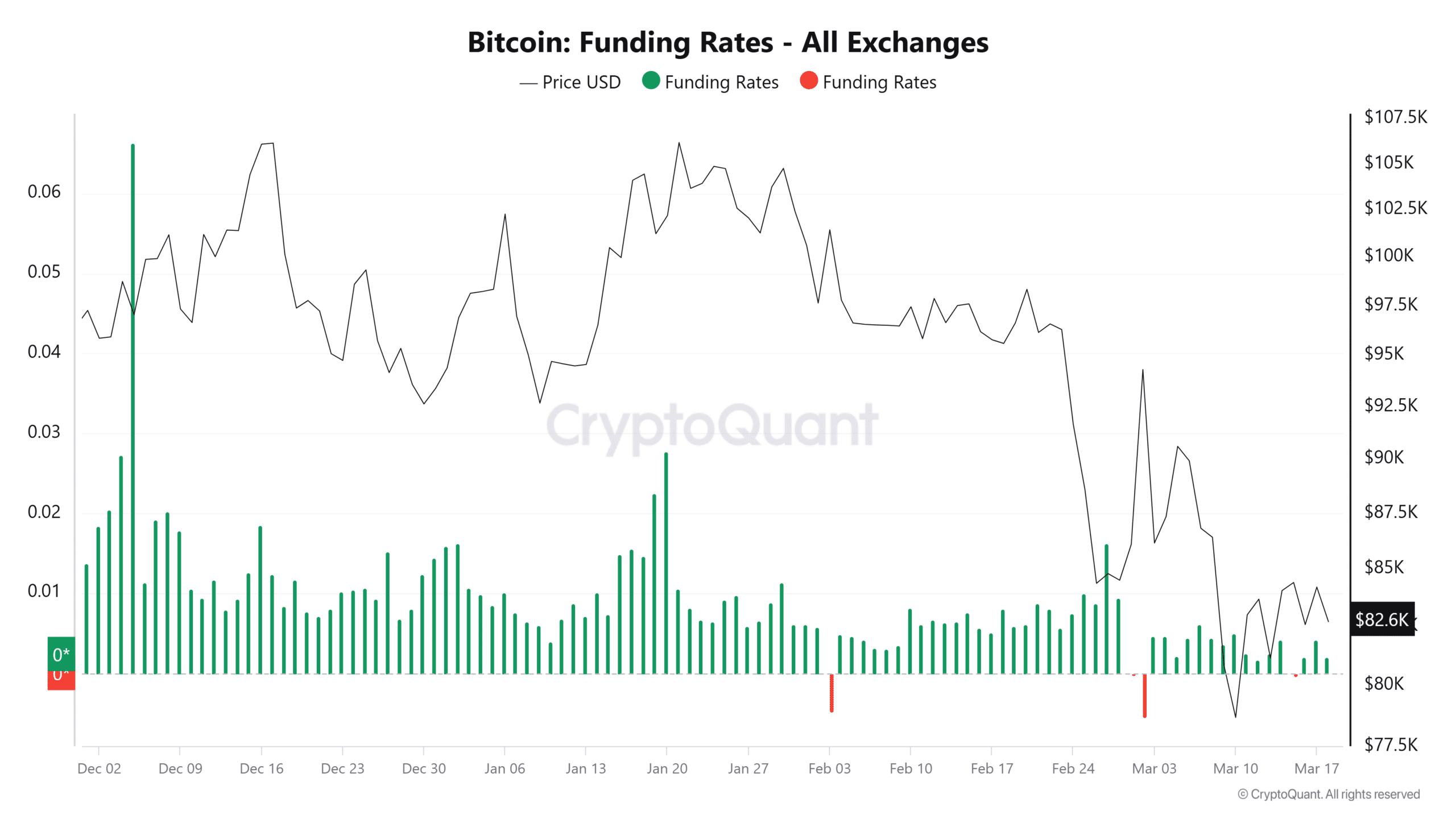

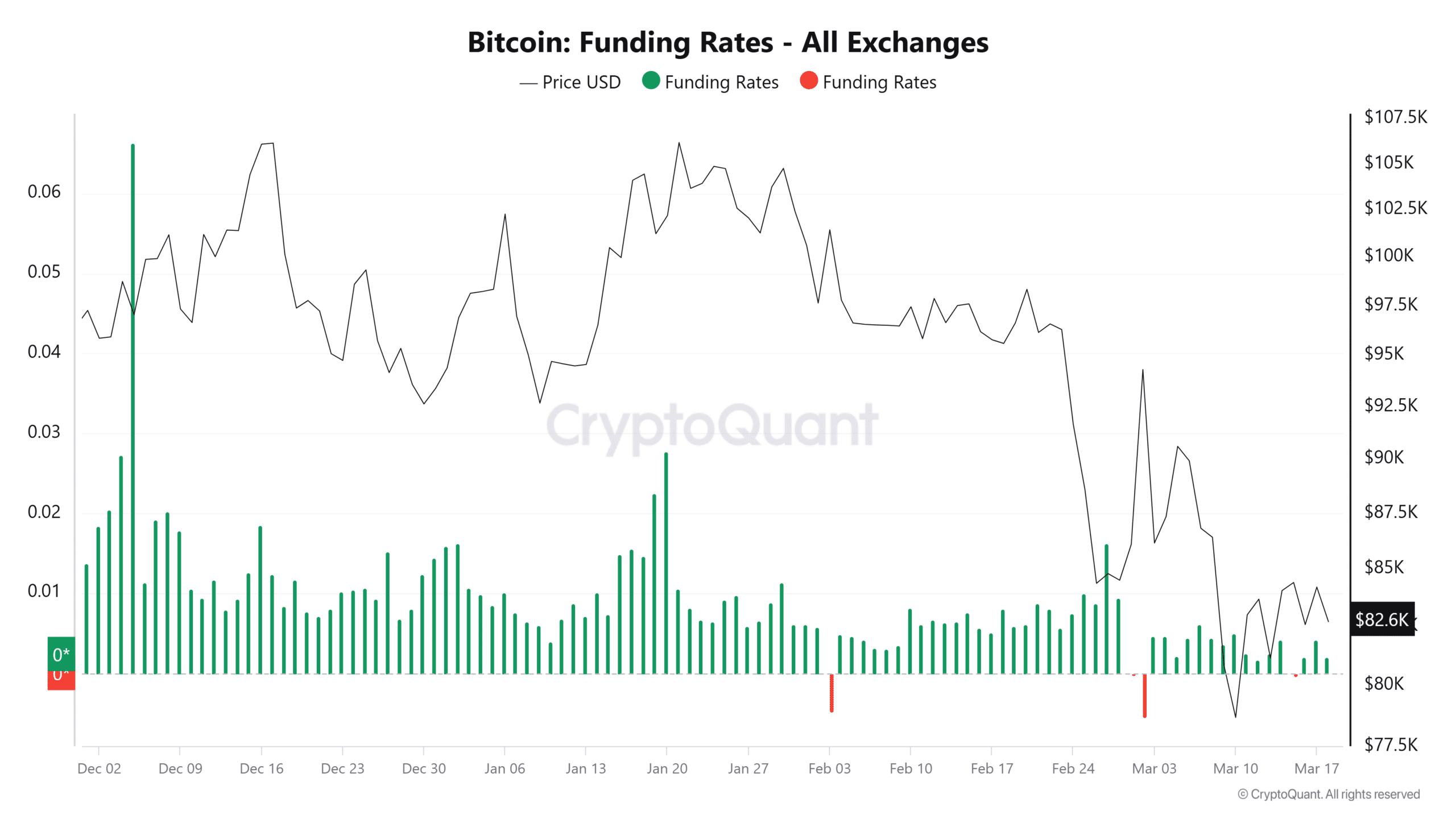

Source: Cryptuquant

Financing percentages Turn

Trends for financing percentage provided Additional confirmation of the current delevering of Bitcoin.

Between December 2024 and March 2025, the financing percentages shifted from highly positive to negative. That was a transition from bullish to bearish sentiment.

During December and the beginning of January, the financing percentages were consistently positive, which reflects a high demand for livered long positions.

On 3 February, the financing percentages became negative for the first time in months (-0.00479), together with Bitcoin’s prize peak of $ 101,440.

By March 2, the financing percentages had fallen further to -0,00554. This confirmed that traders conclude lifting tree positions or were confronted with forced liquidations.

This decrease reflects the reset from March 2024, when the rates have collapsed from triple figures to less than 20%, indicating the end of an overheated futures market.

As the financing percentages reset, open interest data offer a different insight into insight into how capital left lifting tree positions.

How institutional traders responded

Institutional traders followed a similar pattern, with CME Bitcoin -Futures that showed a similar reduction in exposure to livered.

A strong decrease in the open interest of CME Bitcoin Futures confirms that institutional traders have also reduced exposure to leverage.

Source: Coinglass

CME Bitcoin Futures Open interest rate fell by 45% of $ 22.71 billion on December 18 to $ 12.50 billion by March 18, when Bitcoin dropped to $ 82,785.

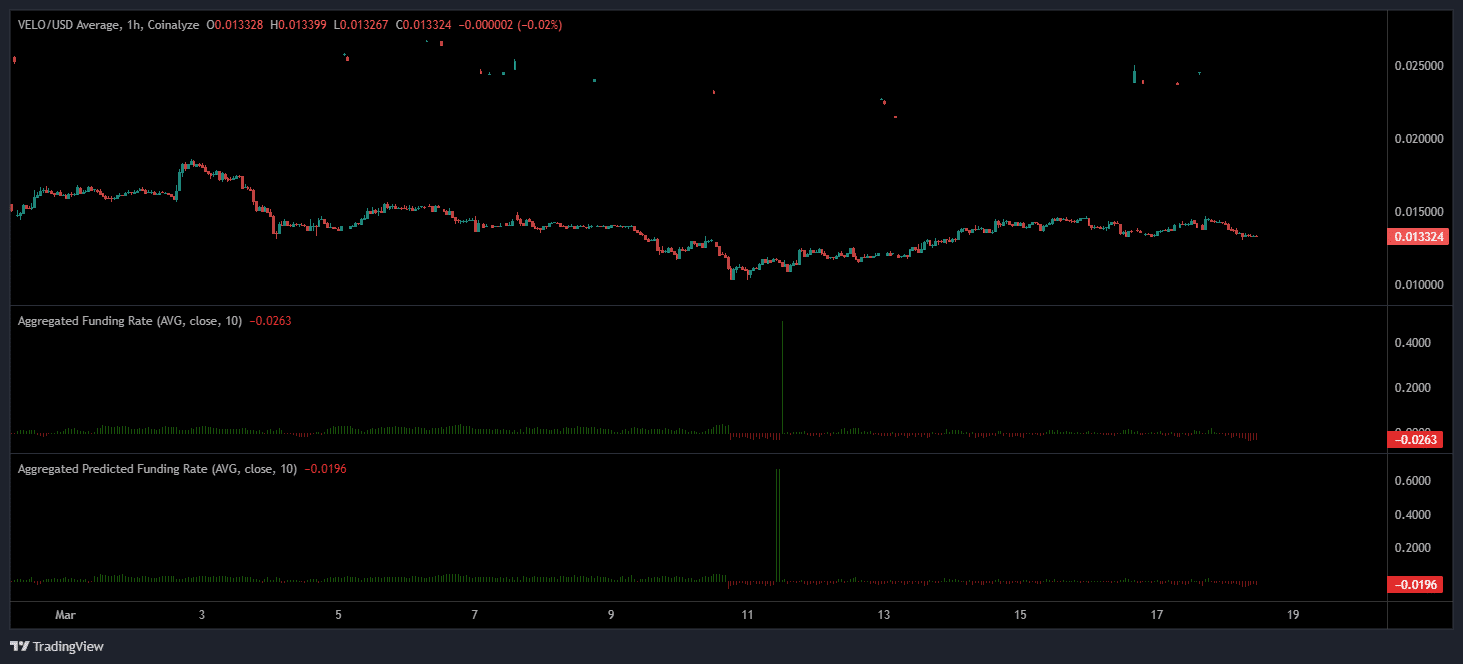

To further validate the degree of market set, financing speed on a broader scale offer an extra perspective.

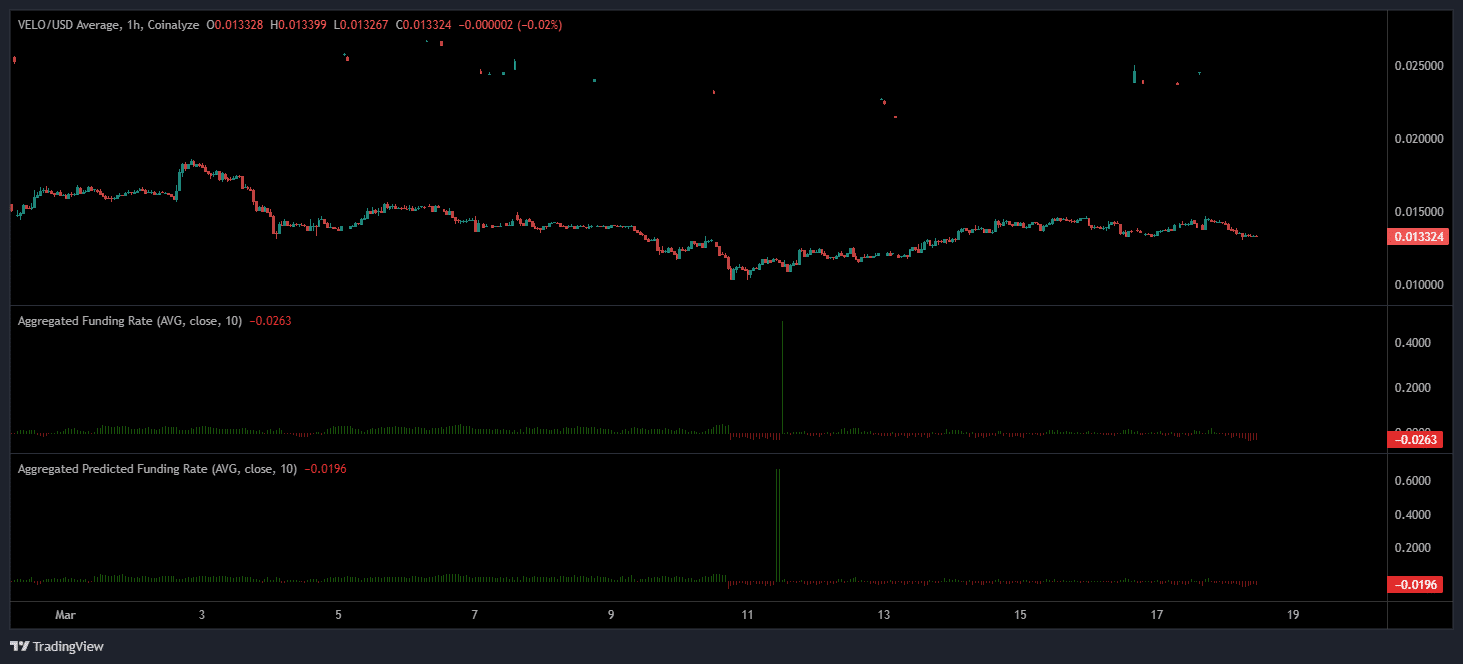

An analysis of aggregated financing percentages also supports the Deleveraging thesis.

On March 11, aggregated financing percentages streamed up to +0.4984, as a result of an overheated market. However, a rapid reversal followed, with the rates that become negative by March 18 (-0.0263).

Source: VELO/COINALYZE

The price decrease of Bitcoin from $ 101,440 in February to $ 82,800 in March suggests that traders are aggressively long positions settled, which enhances the downward pressure.

A reset or a reversal?

Despite the recent decline, analysts see potential for a bullish recovery.

Bitcoin’s Deleveraaging of $ 10 billion is one of the largest resets in more than a year.

With the normalization of financing and stabilizing open interest, traders watch accumulation signals that can cause a bullish trend in Q2 2025.

Although uncertainties persist, historical patterns indicate that such resets often free up the way for long -term recovery.