Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The bond market, often considered the foundation of global financial stability, shows signs of serious tension, whereby market participants on X sound the alarm about what many call a “broken” system. Jim Bianco from Bianco Research, a prominent voice in financial analysis, published a Stark warning On X: “Tonight something has been broken in the bond market. We see a disorderly liquidation. If I had to guess, the basic trade is completely settled.”

Bianco emphasized the seriousness of the situation and noted that the 30-year-old US Treasury yield 56 base points nailed in just three trading days since Friday, a movement that he described as historically: “Tonight something has been broken in the bond market. We see a disorderly liquidation. If I had to guess, the basic dealer was in full deal in full. […] The last time this yield rose so much in 3 days (close by) was January 7, 1982, when the proceeds were 14%. This kind of historical move is caused by a forced liquidation, no human managers make decisions about the prospects for rates at Midnight et.

This sentiment was reflected about the platform, in which Cathie Wood of Ark Invest said: “This Swap spread suggests serious liquidity problems in the American banking system. This crisis calls for a sort of Mar-a-Lago Accord on free trade, in combination with the Fed? No time more time.”

Evenzo waarschuwde Daniel Yan, de oprichter en CIO van Kryptanium Capital, een managing partner bij Matrixport Ventures: “Eerst hebben we een tarief aangedreven aandelenmeltdown. Dan begon de obligatie -basis te ontspannen en ziet er nu lelijk uit. De laatste stro is de kredietmarkt de kredietmarkt – de kredietmarkt is de kredietmarkt – de kredietmarkt is de kredietmarkt – de Kredietmarkt is the credit market – the credit market is the credit market – the credit market is the credit market – the credit market is the credit market – the credit market is the credit market – The credit market is the credit market.

Related lecture

Financial journalist Charlie Gasparino added The chorus notes: “Now things are becoming interesting and scary, so; bad peak in long dated bond rings forces a settlement of a huge trade, possibly a hedge fund that loses money and implements or a large foreigner dump to dump for the trade in trade war.

Financial commentator Peter Schiff added“As I have warned earlier, the treasury market crashes. The return on the 10-year-old reached only 4.5%and the return on the 30-year-old just reached 5%. Without reducing an emergency speed tomorrow morning and the announcement of a huge QE program, a stock market crash could be in 1987 tomorrow.”

Macro analyst Alex Krueger agrees: “The long bond crashes. The long interest rates of the US are now considerably above Trump’s inauguration day. Trump & Bessent shoot themselves in the foot. With a shotgun.”

What happens?

The core of this unrest is supposedly basic trade, a lever strategy used by hedge funds to use price differences between Treasury -Futures and the underlying bonds. Bianco states that this trade, which can now be in a complete settlement in popularity in the years of Ultra-Lage Rentet rates and quantitative relaxation.

Related lecture

The rapid Deleveraging has ensured that bond prices fell as the nail produced, so that the safe harbor status of American treasury is eroded. As the yields rise to 5.00%, the implications for the broader financial ecosystem, including the Bitcoin and Crypto markets, are in -depth.

This development is particularly alarming at a time when the financial markets are already faltering of the newly announced global tariff regime of President Donald Trump. Trump’s rates have worsened the fears for inflation and a recession.

It is remarkable that the dysfunction of the bond market does not take place on its own. The prices of crude oil have collapsed by 21% because Bianco calls ‘Liberation Day’ to $ 57 per barrel, the lowest level since April 2021. This simultaneous crash in bond prices and crude oil is unprecedented, which signals a wider systemic stress.

Implications for Bitcoin and Crypto

For the bitcoin and crypto markets, this unrest offers both risks and opportunities. Bitcoin and other digital assets are often praised as coverings against traditional financial instability, but their performance in recent months has shown a growing correlation with risk activa such as shares.

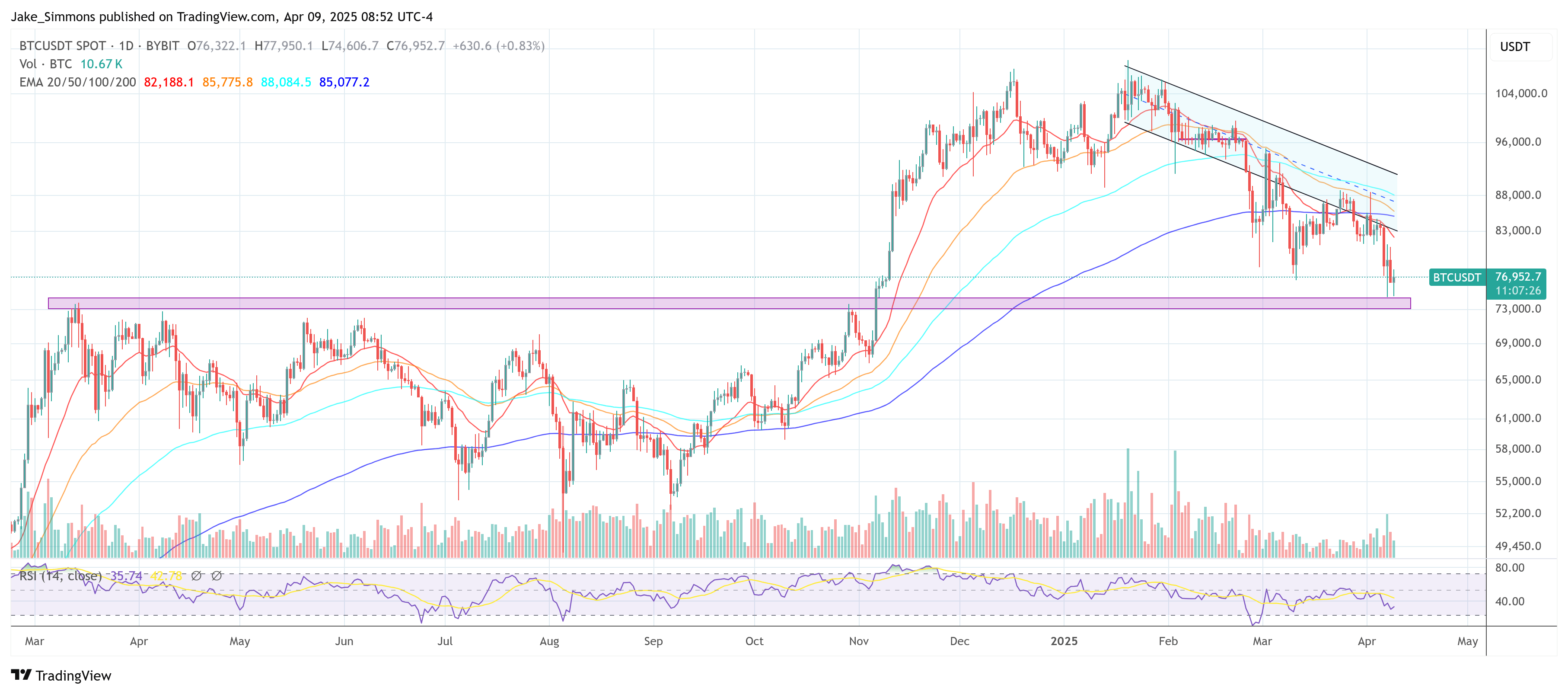

Since S&P Futures tumbled by -12% in the midst of the bond markertrout in the past 4 trade sessions, BTC -8% has fallen because it is confronted for an overflow effect. The US Dollar Index (DXY), which has risen since Thursday’s low point, indicates net foreign purchasing on American markets, which prevents speculation that China discharges treasure boxes to ‘punish’ the US due to rates.

Bianco argues that if China did indeed sell massive treasure chest, the dollar would probably decrease, not appreciate. This suggests that the primary motivation of the sale of the bond market is domestic, probably connected to the forced liquidation of lifting tree positions instead of foreign intervention.

In the midst of this unrest, calls for the intervention of the Federal Reserve have become louder. Some X market participants have speculated about the possibility of reducing the emergency speed to stop bleeding, something that can be extremely bullish for Bitcoin.

“Dumps foreigners? The basic trade that blows up? Inflation fears? Nobody knows for sure.

But look beyond the ‘why’ and it all leads to the same fork: fed intervention – or net interest costs shoot through $ 1 trillion, ”writes Bitcoin expert Sam Callahan via X.

When reported earlier today Bitcoinist, Bitwise Chief Investment Officer (CIO) Matt Hougan argues that Bitcoin could consider considerably from the push of the Trump government to a weaker dollar.

Bitcoin commentator Stack Hodler added Via X: “This is not 2008. It’s worse. The worldwide sovereign debt bubble is bursting for us. Two options: Total collapse … Or the Fed buys everything, Institutional credibility touches new lows, neutral reserve activa Gold & Bitcoin take the Treasury harbor bid and full.”

At the time of the press, Bitcoin traded at $ 76,952.

Featured image made with dall.e, graph of tradingview.com