Analytics firm Glassnode says an on-chain metric for Bitcoin (BTC), which has historically indicated the early stages of a bull market, is appearing on the radar.

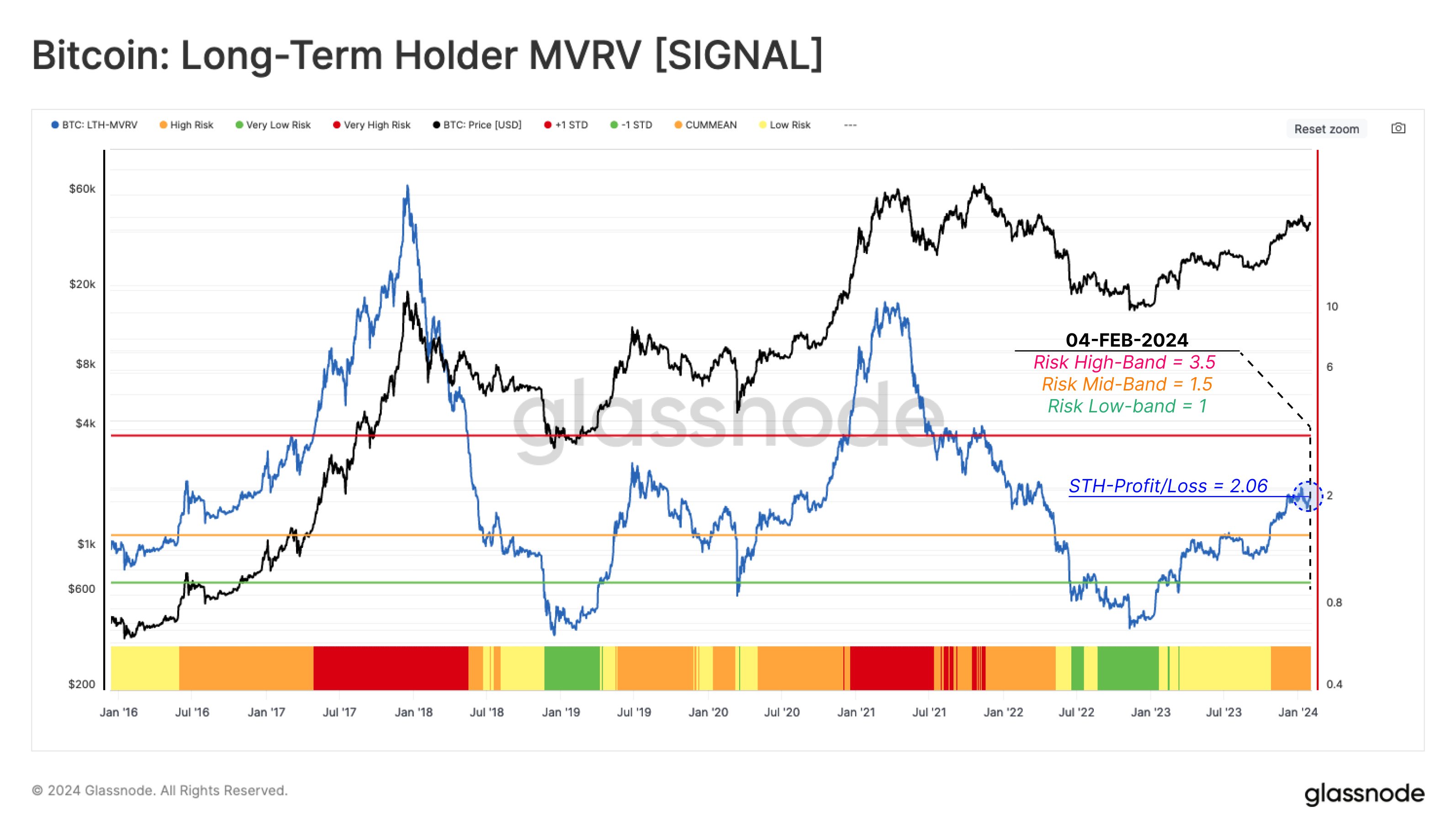

According to Glassnode, Bitcoin’s long-term holder, MVRV (LTH-MVRV), which tracks the behavior of long-term investors in BTC has entered the “high risk” territory.

The analytics firm shares a chart suggesting that BTC tends to witness significant market expansion when the LTH-MVRV signal hovers above the risky area.

“After the challenging recovery since the collapse of the FTX, this indicator has risen to 2.06, entering the risky regime.

These levels are typically seen during the early stages of bull markets, when long-term investors return to relatively meaningful levels of profitability.”

Glassnode also looks at the Percent of Supply in Profit (PSIP) metric, which measures the share of coins with a cost base lower than the current spot price. According to the company, the metric suggests that BTC may be a few thousand dollars away from taking Bitcoin into a “euphoric phase” of the bull market.

“When this indicator trades above the upper band, it is historically in line with the market entering the ‘euphoric phase’ of a bull market. During the recent market rally around the introduction of a spot ETF (exchange-traded fund), this metric reached very high risk, which was followed by a contraction to $38,000.”

At the time of writing, Bitcoin is trading at $48,302.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3