This article is available in Spanish.

Bitcoin shows resilience and remains firmly above the $69,000 mark after a slight decline from recent local highs of $73,600. After weeks of bullish momentum and near its all-time high, BTC has settled just below the critical resistance at $73,794, a key level that if exceeded would push the cryptocurrency into price discovery mode.

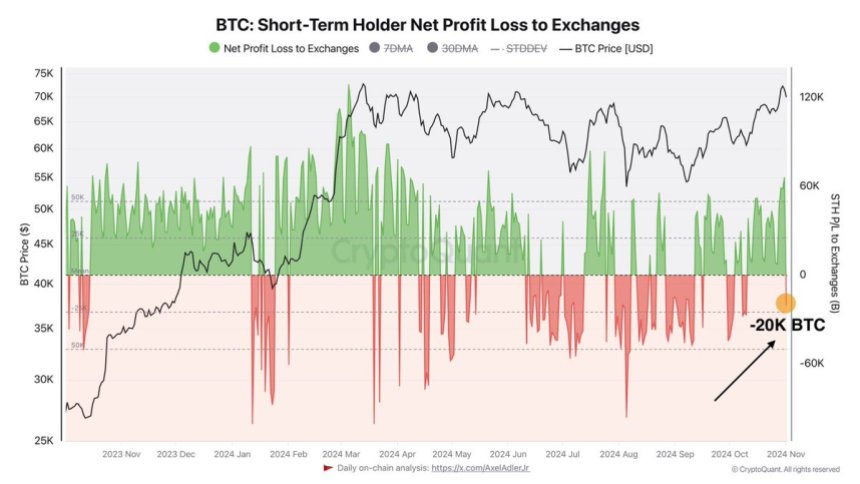

According to data from CryptoQuant, short-term holders are experiencing a net profit-loss ratio of negative 20 BTC, indicating a wave of panic selling among retail investors. This type of behavior, often driven by fear, uncertainty, and doubt (FUD), can precede a significant price increase as stronger hands accumulate BTC at lower prices.

Related reading

Historically, similar sales by retail investors have been followed by renewed upward momentum as long-term investors seize the opportunity to enter or strengthen their positions. If Bitcoin can maintain support above $69,000, the chances of a break above all-time highs increase significantly.

Market watchers are now keeping a close eye on the resistance level as crossing it could trigger a wave of buying interest and push BTC to new highs. The coming days could prove crucial and pave the way for Bitcoin’s next big move.

Bitcoin weak hands sell

Bitcoin recently attempted a breakout to new highs but failed to break its all-time high of $73,794. This entered a consolidation phase as the market focuses on important events: next week’s American elections and the Federal Reserve’s expected interest rate decision.

CryptoQuant’s recent data, shared by analyst Axel Adler on Xpoints to a notable trend among BTC holders in the short term. The net profit-loss ratio for these holders shows a negative balance of -20 BTC, indicating a wave of panic selling following Bitcoin’s struggle to reach new highs. This sell-off among short-term investors, who tend to react more quickly to market volatility, signals some caution amid the uncertainty.

Adler emphasizes that in such turbulent times, a long-term “HODL” (hang on for dear life) approach may be the most beneficial strategy. Staying strong despite market noise has historically rewarded BTC investors who kept their positions intact during periods of retracement and increased volatility.

With Bitcoin’s all-time high in sight, a successful breakout would likely mark the start of a broad bull run in the market. The coming days are critical as Bitcoin is at a crucial point in its cycle, teetering between strong consolidation and the possibility of explosive growth.

Related reading

The influence of the Federal Reserve’s decision on interest rates, combined with possible election outcomes, could create the market conditions necessary for BTC to push past its all-time high. If this level is breached, it would not only confirm a bullish outlook for BTC but also likely trigger a rally in the entire cryptocurrency market.

BTC remains above key support

Bitcoin is currently trading at $69,620, after a comeback from its recent high of almost $73,600. Despite this pullback, bulls remain in control as BTC remains firmly above the crucial $69,000 support level – a price point that has acted as resistance since late July. This level has now turned into strong support, reinforcing the bullish sentiment in the market.

If Bitcoin holds above $69,000, a renewed surge above record highs seems likely. Breaking through this resistance would propel BTC into uncharted territory, potentially leading to a new wave of bullish momentum and price discovery. However, if the price falls below this level, it could indicate the need for a larger correction to gather enough purchasing power for the next move higher.

Related reading

The $69,000 level serves as a key indicator of market confidence as losing it would imply that BTC could temporarily look for lower support levels to attract new buyers and stabilize before attempting new highs again. For now, Bitcoin’s price structure remains strong, and as long as this support holds, the market expects further upward momentum in the coming days. Bulls are closely watching this level as it could determine the next phase of Bitcoin’s bull run.

Featured image of Dall-E, chart from TradingView