Este Artículo También Está Disponible and Español.

In one after Published on X yesterday, Jeff Park, head of Alpha Strategies in Bitwise, that Bitcoin (BTC) currently offers a “generation chance” in the midst of intensifying global macro -economic unrest.

Park pointed to factors such as the proposed trade rates of US President Donald Trump, concern about the US debt ceiling and the growing sentiment of deglobalization as an important contribution to current economic uncertainty.

Bitcoin reigns supreme in the midst of global political and economic unrest

The year 2025 started with an unstable foot, characterized by the rising global economic and political instability due to trading rates, American debt ceiling issues and the wider push to deglobalization. These factors can significantly influence the financial markets and geopolitical stability.

Related lecture

Adding the uncertainty is the approaching expiry date of the American tax reductions and Jobs Act (TCJA) later this year, which could lead to unprecedented tax policy shifts and increased economic unpredictability.

Park also underlined the “Gold Run Tail Risk”, referring to Gold’s extreme price volatility during periods of financial need. At the time of writing is gold trade For $ 2,900 per ounce, considerably an increase of approximately $ 2,585 in December 2024.

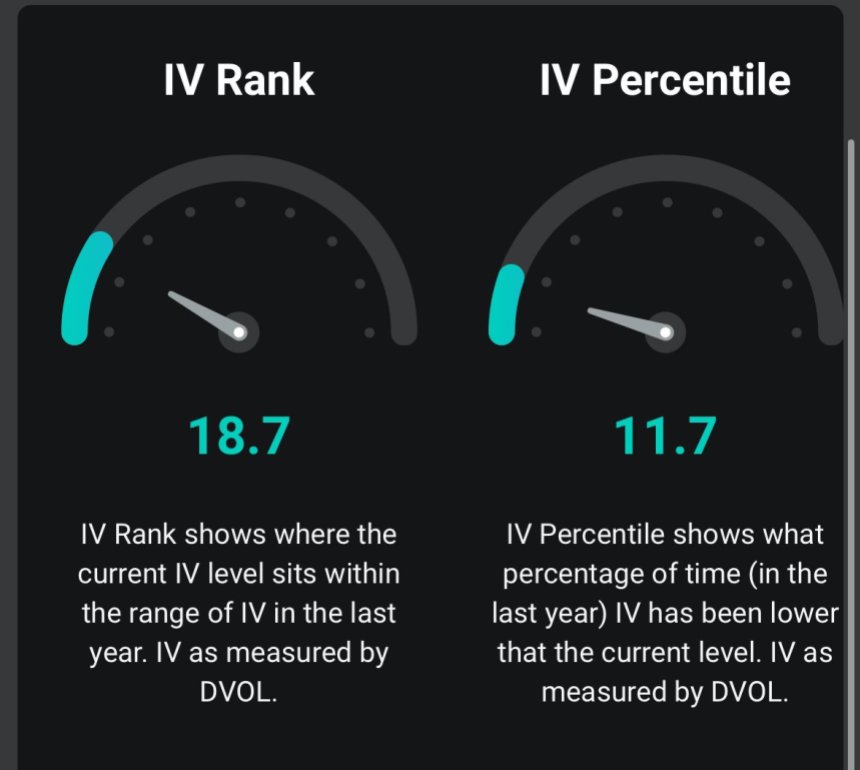

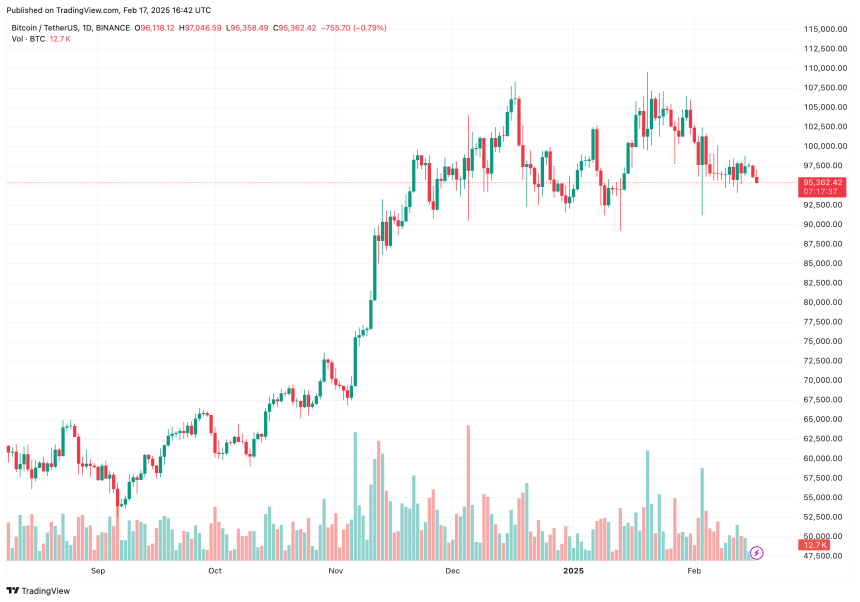

Despite these increasing risks, Bitcoin has remained resilient, with a price range between $ 90,000 and $ 100,000. Park emphasized BTC’s implicit volatility (IV) percentile – a measure that reflects how its current volatility relates to historical levels.

He noted that the IV percentile of BTC is at the lowest level of the year, which strengthens his opinion that Bitcoin offers a ‘generation option’. Following this sentiment, Bitwise CEO Hunter Horsley noted That many underestimate: “The massive jumps Bitcoin is going in the mainstream this year.”

Bitcoin does indeed continue to get mainstream traction and show resilience in the midst of increasing global economic uncertainty. For example, BTC remained largely unaffected Due to the release of the Release of the Chinese AI model Deepseek, due to the Tech Market sales.

No altitude season soon?

As Bitcoin strengthens its dominance, the Altcoin market has struggled, weighed by thin liquidity and decreasing retail interests. An important indicator supportive This trend is Bitcoin Dominance (BTC.D), which measures the market capitalization of BTC compared to the total cryptocurrency market.

Related lecture

The weekly BTC.D graph shows a strong rebound of around 54% in December 2024. At the time of writing, BTC.D is 60.65%, a level that has not been seen since March 2021.

That said, some analysts remain optimistic about a potential led by Ethereum (ETH) Altealth season later in 2025. Recent analysis by Titan van Crypto suggests that Ethereum is ready For a large upward movement this year.

The analyst also pointed out agreements Between the current price promotion of ETH and the behavior of BTC during the third market cycle, which implies that Ethereum can soon introduce what he calls the “most hated rally”. At the time of the press, BTC acts at $ 95.362, a decrease of 0.4% in the last 24 hours.

Featured image of Unsplash, graphs of X.com and TradingView.com