On-chain data shows that the Bitcoin Network Value to Transactions (NVT) Golden Cross has fallen into the lower region, which could be bullish for the asset’s price.

Bitcoin NVT Golden Cross has seen a sharp decline lately

As an analyst in a CryptoQuant Quicktake message explainedthe Bitcoin NVT Golden Cross will give a bottom signal for the third time in 2024. The “NVT ratio” is an on-chain metric that tracks the relationship between Bitcoin market capitalization and transaction volume.

When the value of this metric is high, it means that the value of the asset (i.e. its market capitalization) is high compared to the network’s ability to trade coins (its transaction volume). Such a trend could imply that the BTC price is overvalued.

On the other hand, the low indicator suggests that the market capitalization is low compared to the transfer volume, which could give the cryptocurrency’s price room to grow.

In the context of the current topic, a modified version of the NVT ratio is the actual indicator of relevance: the NVT Golden Cross. This statistic compares the short-term trend of the statistic with the long-term trend to determine the appearance of local tops and bottoms in the NVT ratio.

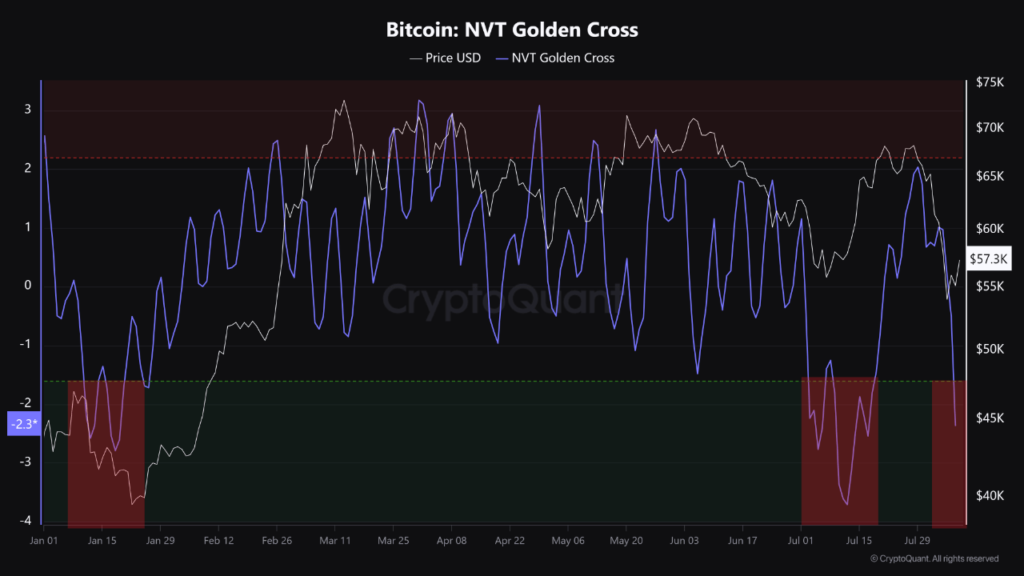

More specifically, the 10-day moving average (MA) represents the short-term trend and the 30-day MA represents the long-term trend. Here is a chart showing the trend in the Bitcoin NVT Golden Cross over the past few months:

In the chart, the quant has highlighted the two regions of the NVT Golden Cross that have been historically relevant to cryptocurrency. At values above 2.2, it can be assumed that the asset is close to the top, because here the short-term trend of the NVT ratio has significantly exceeded the long-term trend. Likewise, the zone below -1.6 is where bottoms are likely to form.

The chart shows that the indicator has recently observed a decline as the Bitcoin price itself has collapsed. The metric has entered the latter region, indicating that the coin may have become too expensive.

This is the third time this year that NVT Golden Cross has breached this territory, with the first occurring in January during the stock market plunge that followed the approval of the spot exchange-traded fund (ETF). This period of undervalued assets was followed by a rally towards the new all-time high (ATH).

The second time the indicator bottomed was last month, with the bottom paving the way for a rally towards $70,000. Considering that both events turned out to be bullish for Bitcoin, it remains to be seen where this third one leads.

BTC price

Bitcoin has furthered its recovery over the past day as the price has now broken back above the $58,200 mark.