- Bitcoin miners were confronted with pressed profit, because transaction costs reached historical lows.

- Network difficulties and rising costs are the survival of smaller miners.

Bitcoin [BTC] Miners will be confronted with a challenging landscape in 2025 Most important factors press profitability. Transaction costs have hit their lowest levels since 2012, while the network difficulty continues to climb.

The Halving from 2024 has increased competition and the turnover per unit of computing power drops rapidly.

Moreover, USD-nominated mining income remains volatile, creating uncertainty, even for large players.

As the profit margins tighten, miners are forced to optimize the activities, to close outdated equipment or to consider mergers.

With smaller players who run the risk of leaving the consolidation of the industry, so that only the most efficient and well -capitalized operations are left behind to survive.

Bitcoin -Mybouw is confronted with profitability tribe

Source: Alfractaal

The Bitcoin mining ecosystem stands for considerable challenges, because various important statistics indicate falling profitability.

The Bitcoin mempool, which follows unconfirmed transactions, has fallen to the lowest level in years, which indicates a reduced network demand.

This decrease has a direct influence on the turnover of miners from transaction costs, which are vital in addition to block reward.

Historically, similar decreases of transaction activity are followed by bear markets, and this decline – despite the high price of Bitcoin – can indicate a structural shift in the network.

Source: Alfractaal

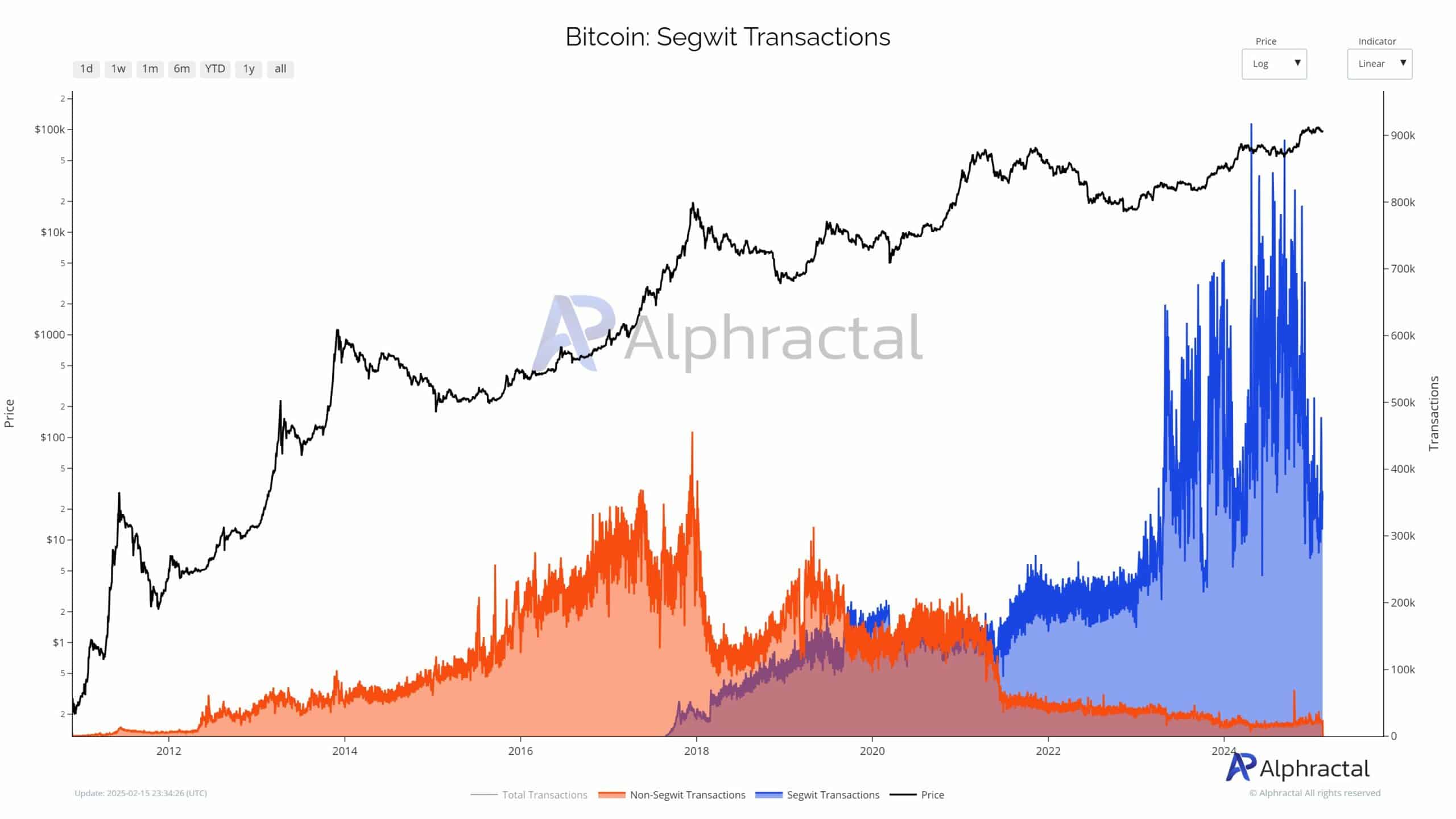

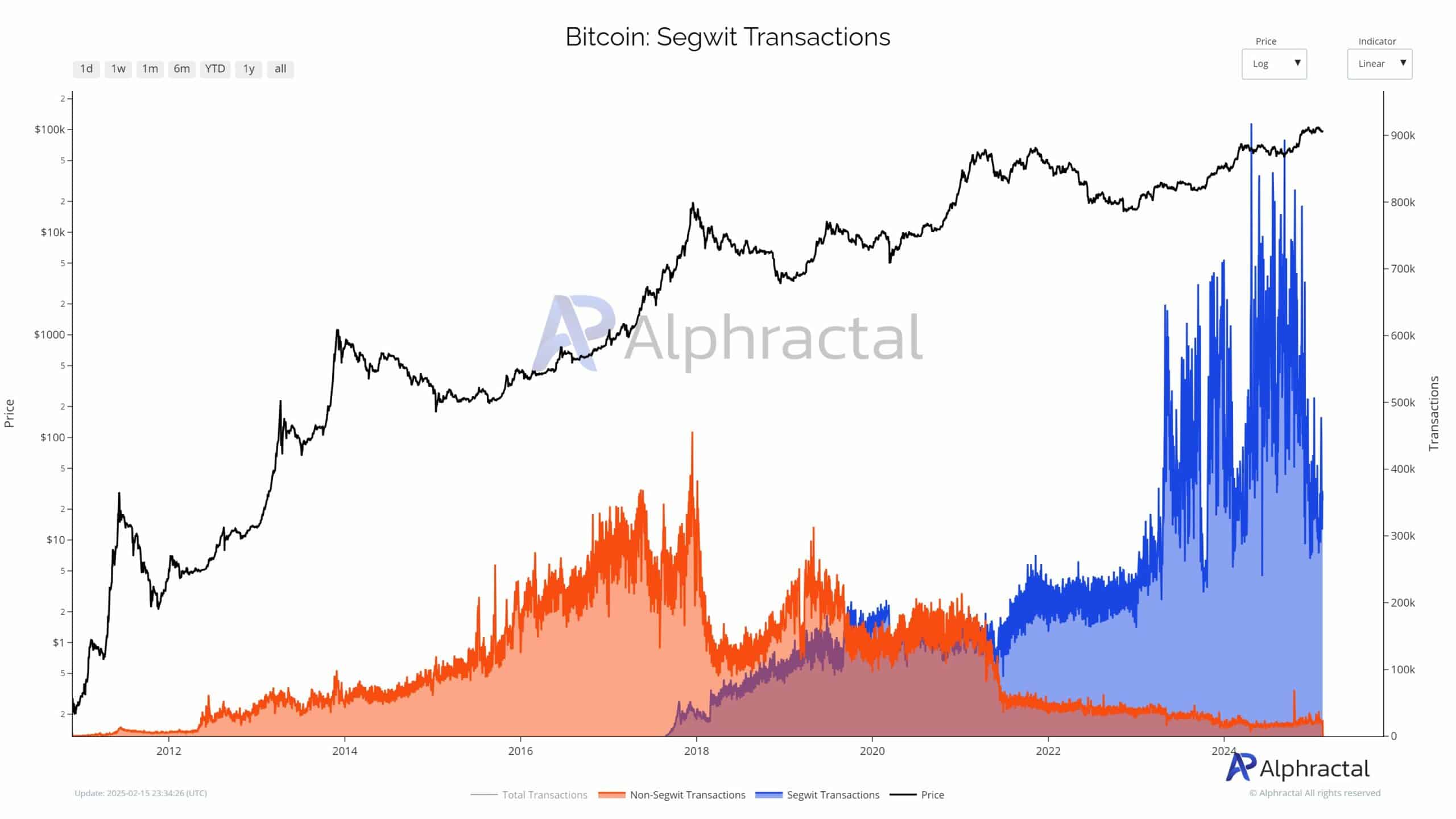

Moreover, Segwit transactions, which were once the dominant and efficient transaction type, are now in decline.

This reduces overall network efficiency, increasing the demand for block space and exerting further pressure on the income of miners.

Source: Alfractaal

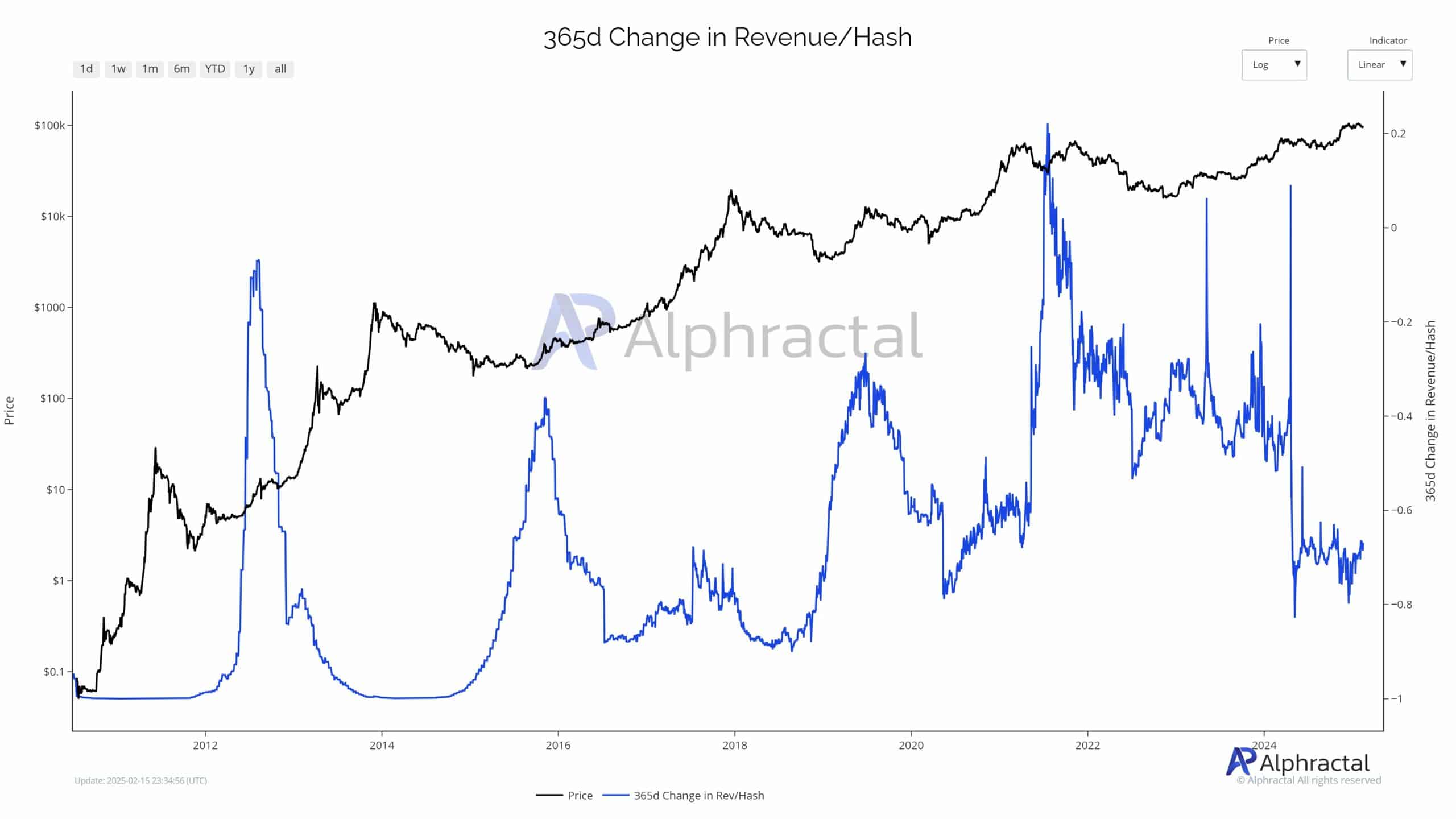

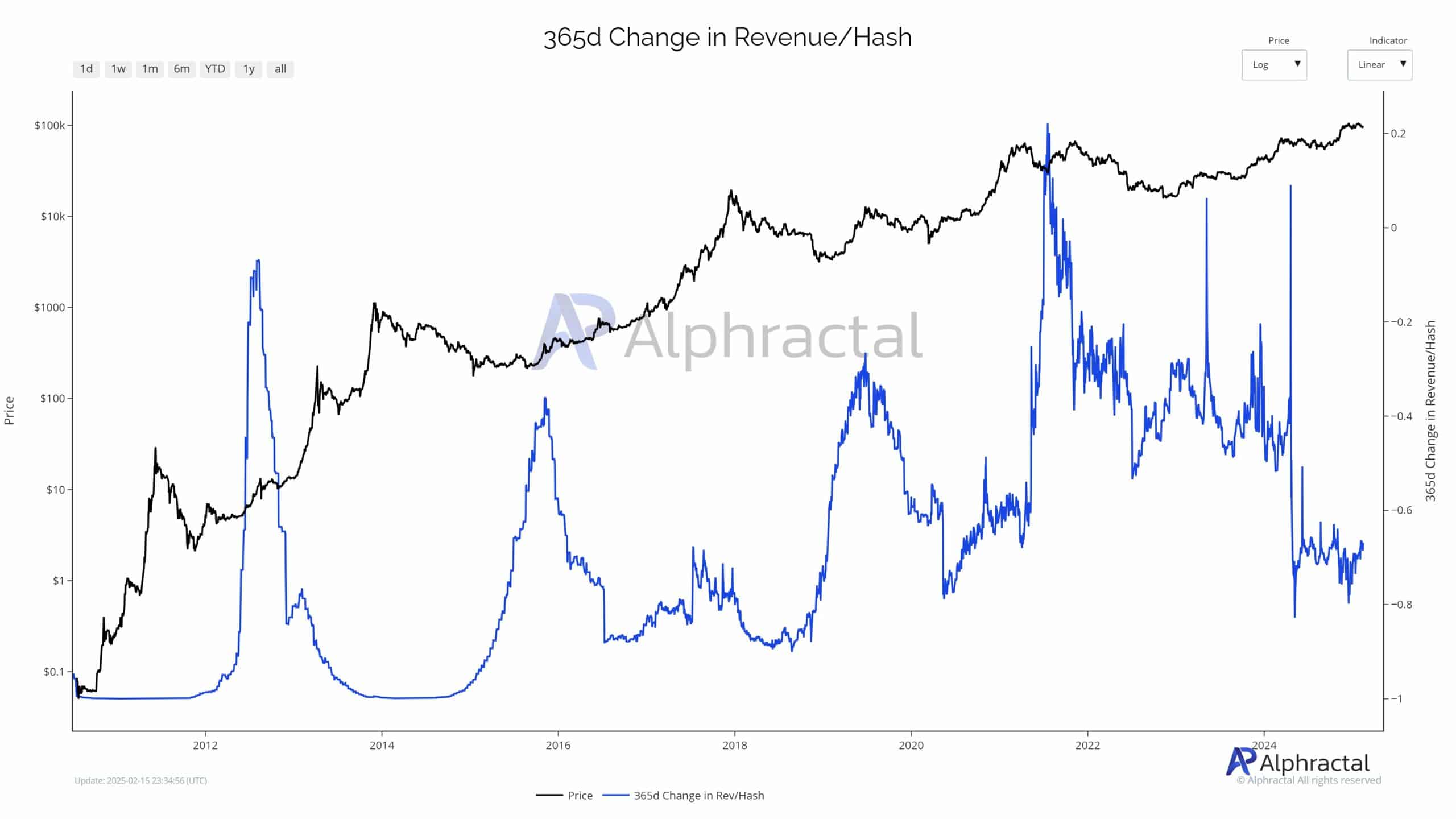

The income/hash ratio, an important statistics for miners, is at historic lows. Despite the rising price of Bitcoin, decreasing returns indicate that rising network problems and competition erode profitability.

With the approaching halving, reducing block reward, smaller operations may have difficulty staying profitable.

This dynamic can lead to increased centralization, where only large, technologically advanced miners will thrive, possibly force smaller players out of the market.

Increasing difficulty and rising costs

Bitcoin miners are confronted with increasing pressure on profitability, because network difficulties reaches record highs.

The falling income per hash makes it more difficult for smaller operators with outdated equipment to compete, especially because the energy and hardware costs continue to rise.

To survive, many miners migrate to regions with cheaper, more sustainable energy sources, such as hydro or geothermal strength.

Some also diversify income flows by branching to computer services, while others look for mergers and acquisitions.

These efforts can lead to further centralization in industry, with only the most capitalized and efficient mining companies that survive.

This could have a broader consequences for the decentralization of Bitcoin, in particular with regard to the geographical distribution of mining power.

A reform of Bitcoin’s security model can follow, which expresses concern about the long -term health of his decentralized nature.

Re -balance market

As operational costs rise and profitability decreases, Bitcoin’s Hashraat can see a natural decline, with inefficient miners who are closed.

This re -balancing will probably only leave the most capitalized and technologically advanced players, which strengthens mining as an industry with a high barrier.

However, this shift evokes concern about centralization. With a shrinking pool of dominant miners, the decentralized ethos of Bitcoin can be at risk, so that network security can be concentrated in less hands.

Although larger entities can guarantee stability, this consolidation can lead to questions about censorship resistance and trust in the long -term integrity of the network.

The Halving of 2024 has already tested the resilience of the Bitcoin -Mijnbouwecosystem.

The aftermath of this event is a crucial period to determine whether Bitcoin -Mybouw remains an open, competitive field, or whether the sector continues to consolidate in the hands of a few dominant players.