On-chain data shows the Bitcoin Market Value to Realized Value (MVRV) ratio is retesting what has historically been important for BTC.

Bitcoin MVRV Ratio is now retesting its 365-day SMA

As explained by an analyst in a CryptoQuant Quicktake afterBitcoin MVRV ratio retests a level that has functioned as an important psychological level in the past.

The “MVRV ratio” here refers to a popular on-chain indicator that, in short, compares the value the investors hold (i.e. the market cap) to what they used to buy the cryptocurrency (the realized capitalization).

When the value of this measure is greater than 1, it means that it can be assumed that the investors are currently making a profit. Tops are more likely to form the higher the ratio is above this point, as holders are increasingly tempted to harvest their profits.

On the other hand, the fact that the indicator is below the level implies the dominance of losses on the market. Bottoms may be likely in this zone as sellers are becoming exhausted here.

Of course, the MVRV ratio is exactly equal to 1, which indicates that investors are holding profits and losses in equal shares, so it can be assumed that the average holder is just breaking even on their investment.

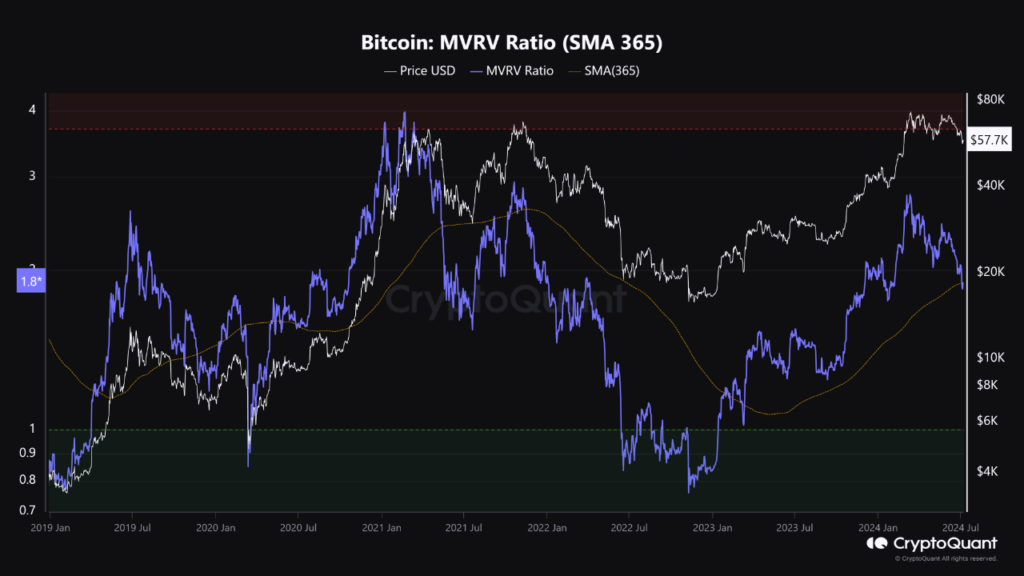

Here is a chart showing the trend in the Bitcoin MVRV ratio, as well as the 365-day simple moving average (SMA), over the past few years:

As shown in the chart above, the Bitcoin MVRV ratio has seen a decline since the price all-time high (ATH) in March. This trend is due to the fact that BTC has been on bearish momentum since then.

Investors’ profits, which once soared to relatively high levels following the rally, have taken a significant hit due to the price drop. However, holders are still making big profits as the measure’s value is currently around 1.8.

The chart shows that this is around the same level the indicator’s 365-day SMA was recently hovering around. Historically, this SMA has acted as an important level for the indicator, sometimes taking on the role of support during bullish trends.

The MVRV ratio crossing below this line often signaled a transition to a bearish trend for Bitcoin. As such, this current retest between the indicator and the line could be significant for the cryptocurrency.

It remains to be seen if this support level will hold or if the benchmark will fall below it, potentially leading to an extended bearish period for BTC.

BTC price

Bitcoin has only recovered slightly from its last crash so far, as the price trades around $56,900.