Mike McGlone, senior macro strategist at Bloomberg Intelligence, warns that Bitcoin’s (BTC) parabolic rise over the past decade is eerily similar to the stock market bubble of 1929.

McGlone says the high interest rate environment reminds him of the conditions that led to the stock market crash in 1930.

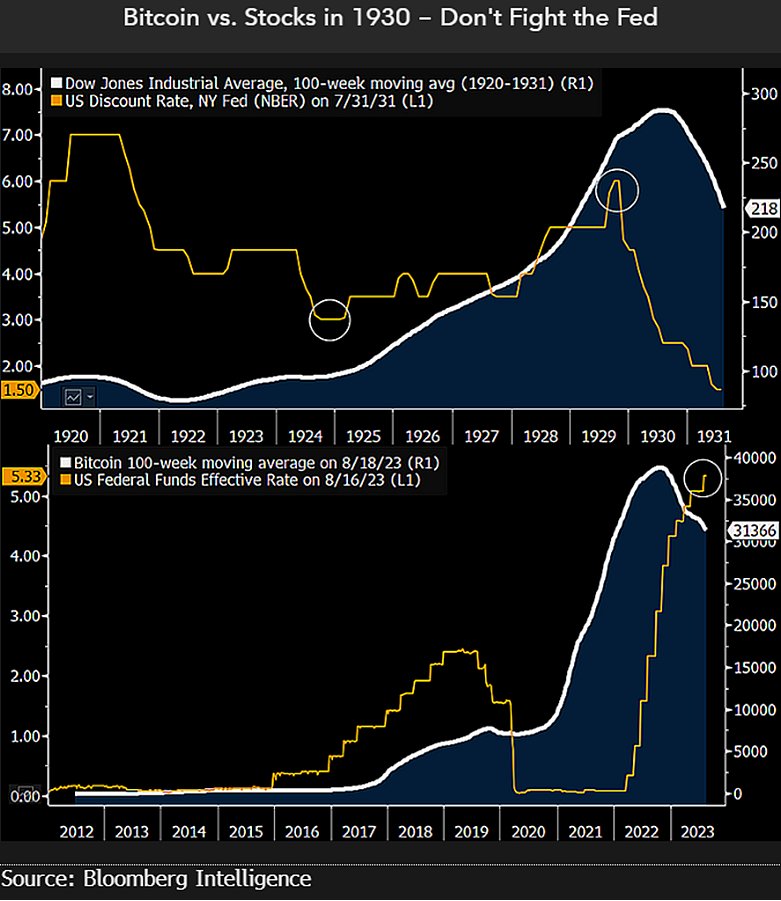

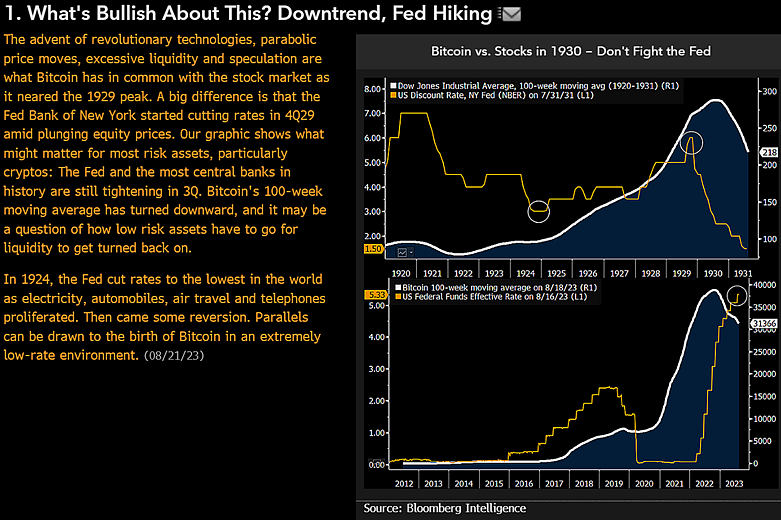

The analyst shares a chart showing how the US discount rate peaked in 1929, just before the 100-week moving average of the Dow Jones Industrial Average (DJIA) flipped.

The US discount rate is the interest rate charged to banks on loans from the Federal Reserve.

The chart also shows the Fed’s sharp rise in interest rates over the past year, with Bitcoin’s 100-week moving average witnessing a downward trend.

“One of the best performing assets in history and a leading indicator – Bitcoin – resembles the stock market in 1930. Statistician and entrepreneur Roger Babson began warning of high stock prices long before economist Irving Fisher declared a “permanent high plateau” in the market . 1929. The Fed shifts our preference to a position similar to Babson’s.”

McGlone also emphasizes that Bitcoin’s birth is reminiscent of technological advances some 100 years ago, when electricity, cars, air travel, and telephones spread rapidly. According to the Bloomberg analyst, Bitcoin’s parabolic rise and the rise of revolutionary technologies in the 1920s both came at a time when the Federal Reserve kept interest rates low.

“What’s bullish about this? Downtrend, Fed hike…

The advent of revolutionary technologies, parabolic price movements, excessive liquidity and speculation are what Bitcoin has in common with the stock market as it approaches its 1929 peak. A big difference is that the Fed Bank of New York started cutting interest rates in the fourth quarter of 2029, while stock prices plummeted.”

At the time of writing, Bitcoin is trading at USD 26,020.

Don’t miss a single beat – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney