- Bitcoin mining revenues reach $45 million daily, showing signs of healthy network growth

- Spikes in mining revenues could signal a shift toward sustainable growth or emerging price increases

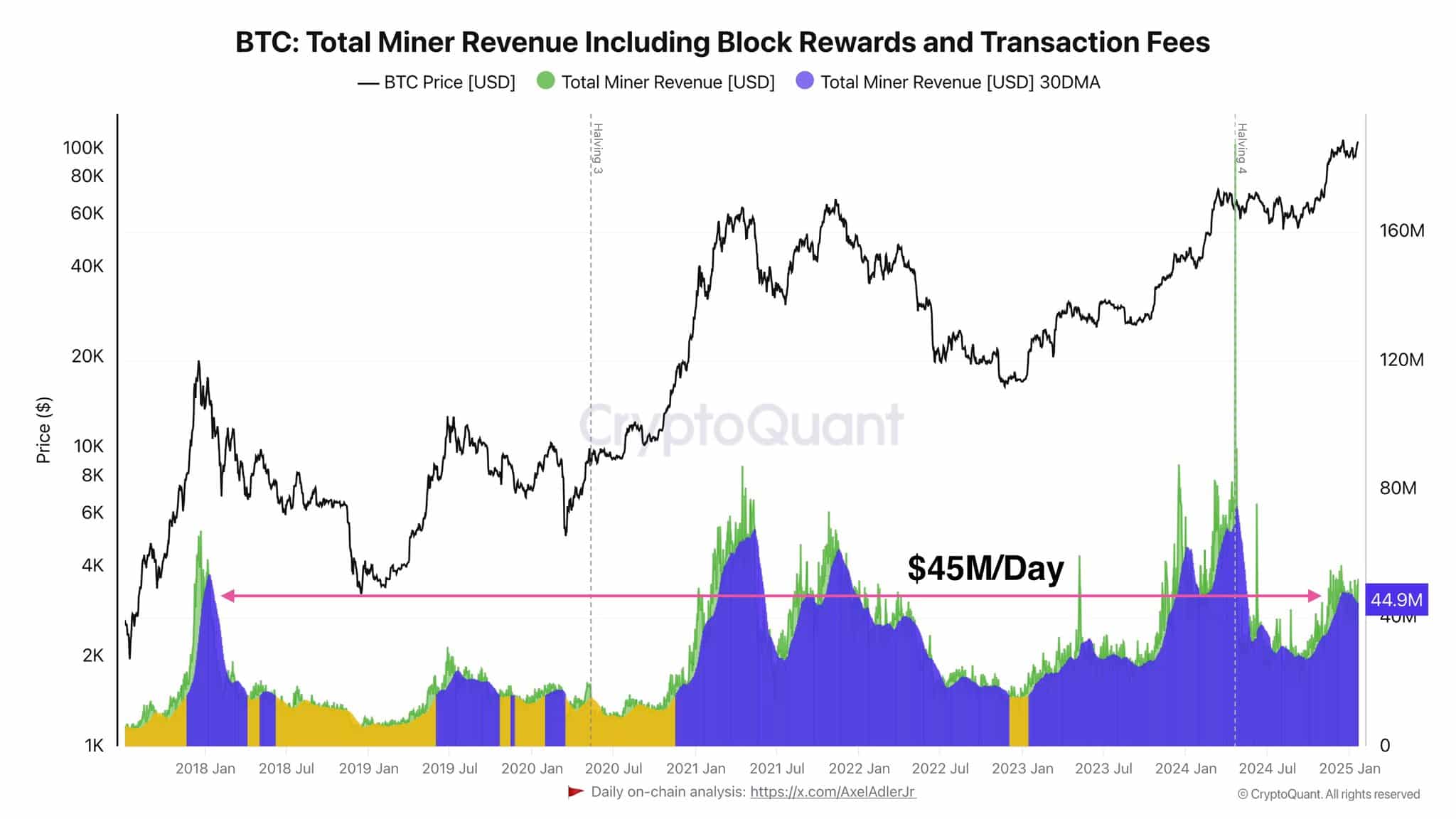

Bitcoin [BTC] Mining has long been a key indicator of market health. Recent spikes in mining revenue and network activity seemed to indicate that the Bitcoin network could be entering a new phase. With daily mining revenues reaching approximately $45 million, current conditions closely mirror the high network activity seen during Bitcoin’s previous bull cycles.

However, the big question remains: is this rise in mining revenues the start of another explosive bull run, or is it an indication of continued growth that is less tied to immediate price fluctuations?

The role of Bitcoin mining in the network

The recent increase in Bitcoin mining revenues, which reached approximately $45 million daily, highlights a significant increase in network activity. This increase not only indicates a healthy ecosystem, but also greater confidence among miners. As miners continue to secure the Bitcoin network, metrics such as hash rate and block difficulty provide valuable insights into its overall strength.

Rising hash rate means greater participation and computing power, while climbing block difficulty indicates a more challenging environment for miners. Together, these indicators point to a thriving Bitcoin network that could be preparing for a new phase of growth.

Historical comparison and patterns

Source: Cryptoquant

Daily mining revenues of $45 million appeared to closely match these historical thresholds, suggesting a possible bullish signal. However, the impact of this figure could extend beyond direct price speculation. It highlighted strong network activity, miner confidence and growing adoption, indicating that Bitcoin’s ecosystem is strengthening.

If historical patterns hold, current mining returns could foreshadow a significant price increase or signal continued, steady growth powered by a thriving, secure network. Either scenario would reaffirm Bitcoin’s position as a resilient, maturing asset class.

Bitcoin is showing bullish momentum

At the time of writing, Bitcoin was trading at $104,551, with a steady uptrend in recent sessions. The RSI showed bullish momentum but was not yet in overbought territory, indicating room for further upside.

On-balance volume of -89.25K reflected growing accumulation, supporting price action.

Source: TradingView

Historical resistance levels around $110,000 could act as a critical test for continued momentum. If this is broken, it could mark the start of a broader bull run.

However, sustained volume and momentum above the RSI threshold of 70 are needed to confirm a strong trend. Press time data supported the optimism but necessitated careful monitoring to confirm an ongoing outbreak.

Read Bitcoin’s [BTC] Price forecast 2025–2026

Beyond the bull cycles

Bitcoin mining appears to be entering a phase of sustainable growth, independent of traditional market cycles. Increasing institutional adoption by major players like BlackRock and Fidelity is stabilizing the market, while global demand for Bitcoin as a hedge against inflation and an alternative financial system continues to grow. Technological advances in mining hardware, such as low-power ASICs, further improve profitability and ensure miners remain competitive even as block rewards decline.

Long-term trends point to a transformation in the mining economy. As block rewards halve every four years, transaction fees are expected to become the main source of revenue, driving miners to adopt sustainable energy and cost-efficient practices. By adapting to sustainability and technological innovation, Bitcoin mining can be well-positioned for continued growth and relevance in the evolving digital economy.