- Bitcoin mining difficulty reaches ATH.

- Bitcoin whales bought over 84,000 BTC in July.

Bitcoin [BTC] has failed to reach new highs, but crypto investors are still optimistic about BTC in the long term.

CEO of VanEck has done that predicted Bitcoin will reach half the market cap of gold, surpassing the $350,000 price point. Separately, Morgan Stanley advisors will pitch BTC ETFs from BlackRock and Fidelity starting August 7.

These, combined with Trump’s Bitcoin debt idea, indicate a strong future for crypto. However, the asset could be on the verge of a potential downtrend.

The difficulty of Bitcoin mining is reaching a new high

It was reported that problems with Bitcoin mining and the US money supply have reached new all-time highs, requiring more computing power, potentially affecting profitability.

This may be due to increased activity on the Bitcoin blockchain. With global wealth at $900 trillion and a BTC market cap of $1.25 trillion, this is a significant allocation.

Source: BitcoinMagazine PRO

A recent $3 trillion stock loss due to recession fears underlines Bitcoin’s resilience. While traditional assets plummet, BTC remains a focus.

Many investors underestimate the potential of cryptocurrency, making this a good time to consider BTC in a diversified portfolio for long-term gains.

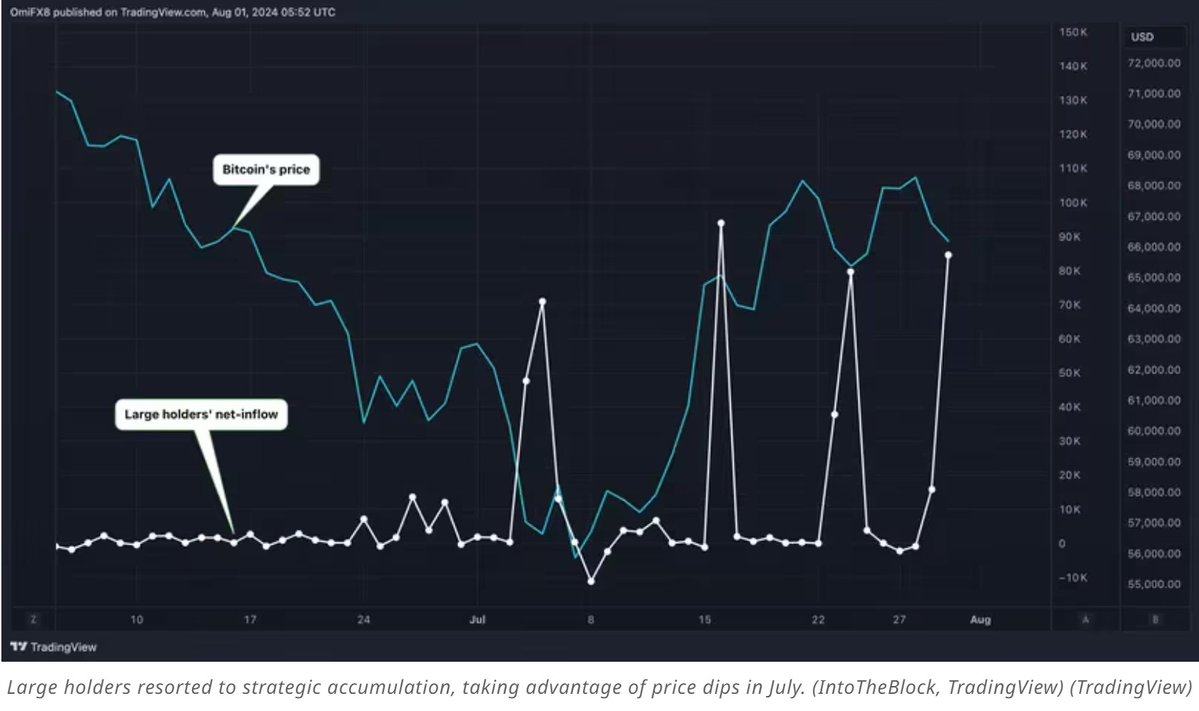

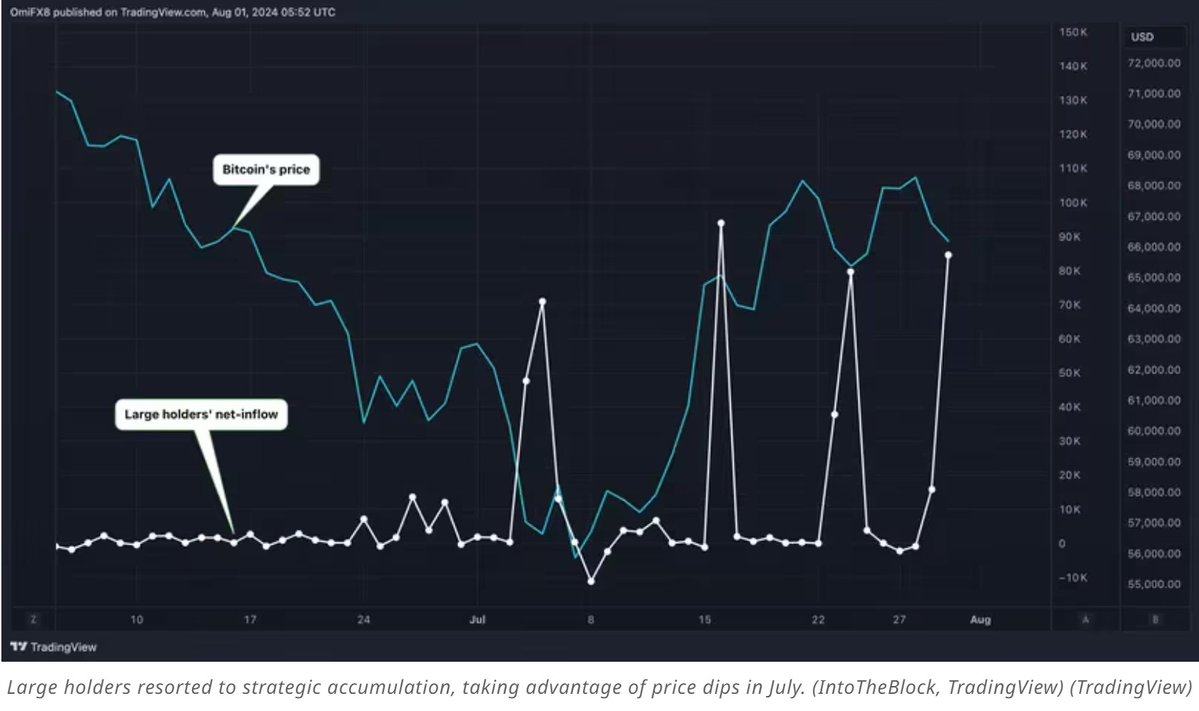

Bitcoin whales expect a rally as BTC investments increase

In July, Bitcoin whales bought over 84,000 BTC, the largest purchase since October 2014, worth $5.4 billion.

While many investors lost their holdings, these large holders, who controlled at least 0.1% of the total Bitcoin supply, piled in, according to IntoTheBlock.

This significant increase highlights whales’ strategic moves during market swings, strengthening their influence and confidence in Bitcoin’s long-term potential.

Source: TradingView

BTC potential downtrend

A look at Bitcoin’s MACD shows a lower high in 2024 compared to 2021, with the trend lower and rapidly moving downward, while the price is trading higher but in a potential reversal zone.

This divergence suggests that a potential bearish trend is about to begin with confirmation of price action hitting consecutive equal highs.

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin’s new ATH in 2024 could be the result of monetary inflation rather than real value growth.

The bearish trend of the MACD is a signal to the short-term traders that BTC may soon change direction and target the critical support range of $28,000 – $37,000.

Source: TradingView