- Bitcoin’s network hash rate rose to its highest point in four months.

- Miners delayed selling their holdings because of their belief in BTC’s growth potential.

Bitcoins [BTC] Miner activity is closely monitored by experts in the crypto ecosystem as it provides vital clues about the health of the network and the level of profitability in the mining sector.

Is your wallet green? Check out the BTC Profit Calculator

According to a post from on-chain analytics company Glassnode, the network’s hash rate rose to its highest point in four months on Aug. 26. The previous four-month peak was recorded over a month ago on July 7.

📈 #Bitcoin $BTC Hash Rate Just Hit Four Month High of 1,016,562,908,660,169,965,568

The previous four-month high of 968,386,423,095,645,962,240 was observed on July 7, 2023

View statistics:https://t.co/idoCHWnGEn pic.twitter.com/ITJM5RwJD5

— Glassnode Alerts (@glassnodealerts) August 25, 2023

Miners turn on their machines

An increase in hash rate meant that more computing power was spent validating the transactions and securing the network. The arrival of more miners or the use of more efficient machines generally leads to a spike in this statistic. Overall, the increase is a healthy sign in terms of network security and decentralization.

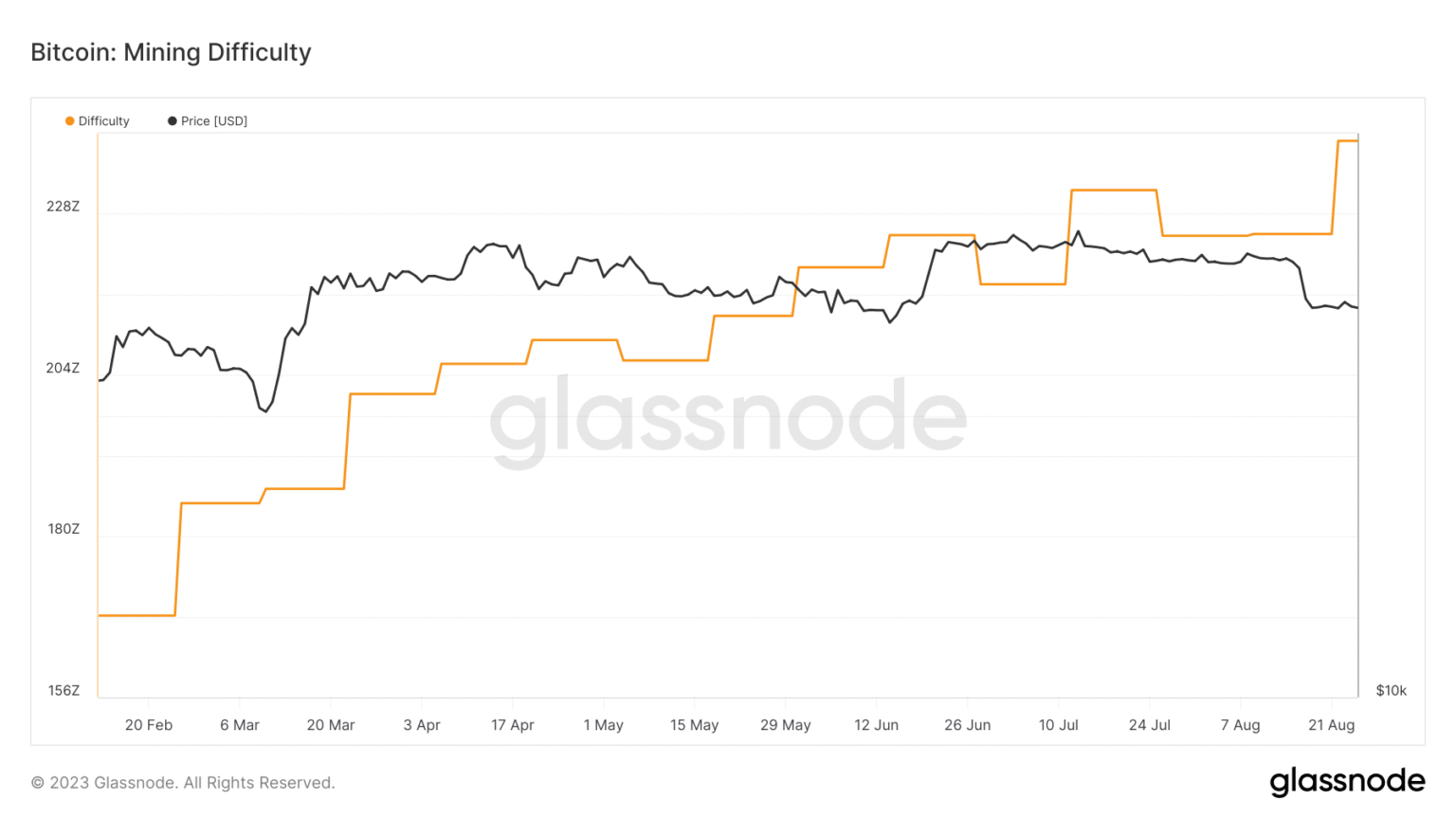

The jump in hash rate has pushed mining difficulty to unprecedented heights over the past week. The mining difficulty is automatically adjusted approximately every two weeks to keep the total block time at 10 minutes.

Source: Glassnode

In a statement Bitfinex analysts shared with AMB Crypto, they revealed that the increase in mining troubles was rooted in miners’ positive expectations towards Bitcoin.

“Miners can be confident that the price of Bitcoin will eventually recover as this can be seen as just a downward deviation from its true value. Therefore, it could be very profitable for them to invest more resources to mine Bitcoin at these prices.“

Are Miners Optimistic About BTC?

The analysts further stated that miners delayed selling their assets because of their belief in BTC’s growth potential.

Glassnode’s data supported the above insights. It showed that the total supply stored at miner addresses reached a monthly high of 1.83 million on August 26.

📈 #Bitcoin $BTC Miner balance just reached a one-month high of 1,831,069,286

The previous one-month high of 1,830,669,079 was observed on August 21, 2023

View statistics:https://t.co/cHhwgaCLee pic.twitter.com/fJj58NC498

— Glassnode Alerts (@glassnodealerts) August 26, 2023

Read Bitcoin’s [BTC] Price Forecast 2023-24

Remember that miners often pay out money to cover their mining and energy costs. A slowdown in liquidations generally means they are waiting for Bitcoin’s price to get stronger.

Miners’ earnings are falling

Miners’ optimism about Bitcoin has been a refreshing sign, especially at a stage where earnings have dried up significantly. Aside from the early May euphoria over BRC-2o, Bitcoin miner earnings have remained subdued throughout most of the ongoing crypto winter.

Source: Glassnode