Recent data shows that the Difficulty level for mining Bitcoin is declining and has reached the lowest level since May. This is important considering what this could mean specifically for the Bitcoin ecosystem Bitcoin’s price.

Bitcoin mining difficulty drops to 79.5T

Facts from CoinWarz shows this Difficulty level for mining Bitcoin has dropped to 79.5 T at block 851.204 and has not changed in the last 24 hours. These mining issues have continued to decline for some time now, with further data from CoinWarz showing that they are down 5% over the past thirty-seven days.

Bitcoin mining difficulty refers to how difficult it is miners to mine a new block on the Bitcoin network. The difficulty usually decreases when there is less computing power on the stream and increases when miners mine faster than the block average time of ten minutes. The recent decline in mining problems suggests that more miners are leaving the Bitcoin network.

This is most likely due to the effects of Bitcoin’s halving, which caused its price to drop rewards for miners by half. This has reduced income from their mining operations, with many miners struggling to stay afloat, mainly due to increased competition. Bitcoin’s price action since the halve hasn’t helped either as the drop in the price of the flagship crypto has also affected their income.

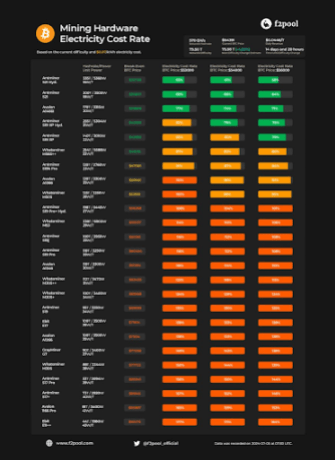

Bitcoin miner f2pool recently highlighted the profitability of several categories of miners at the current price of Bitcoin. The mining company noted that only ASICs with unit power of 26 W/T or less can make a profit in Bitcoin’s current price range.

Crypto analyst James Van Straten too recently highlighted how “weak and inefficient miners” continue to be removed from the Bitcoin network. He claimed that the recent decline in mining problems shows that the capitulation of miners is nearing an end. Due to the low profitability that miners have faced since the halving, some have had to offload a significant portion of their Bitcoin reserves to cover operational costs, and others have had to leave the Bitcoin ecosystem entirely.

What this means for the price of Bitcoin

The decline in mining problems suggests that miners’ capitulation could end soon, which is positive for Bitcoin’s price given the sales pressure these miners set it up. Bitcoinist reported that Bitcoin miners sold more than 30,000 BTC ($2 billion) last month, ultimately causing the flagship crypto to experience significant price crashes.

Crypto expert Willy Woo too attributed Bitcoin’s lukewarm price action against these miners and mentioned that the flagship crypto will only recover if the “weak miners die and the hash rate recovers.” He argued that this would require Bitcoin to shed weak hands, with inefficient miners going bankrupt while other mines are forced to buy more efficient hardware.