- According to this analysis, Bitcoin mining could help bulls start another big rally.

- Miner reserves rose to a six-week high despite recent market FUD.

Now that Bitcoin [BTC] trading below $60,000 again, many may be wondering if this is an ideal time to buy, especially now that the stock has shown some weakness above that key price point.

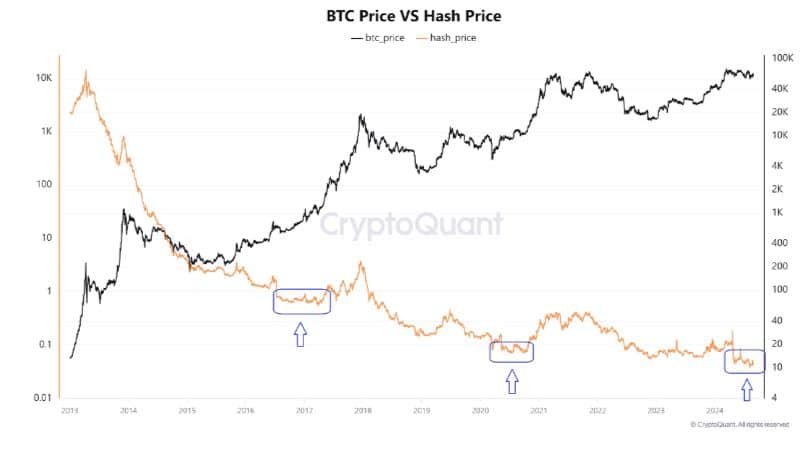

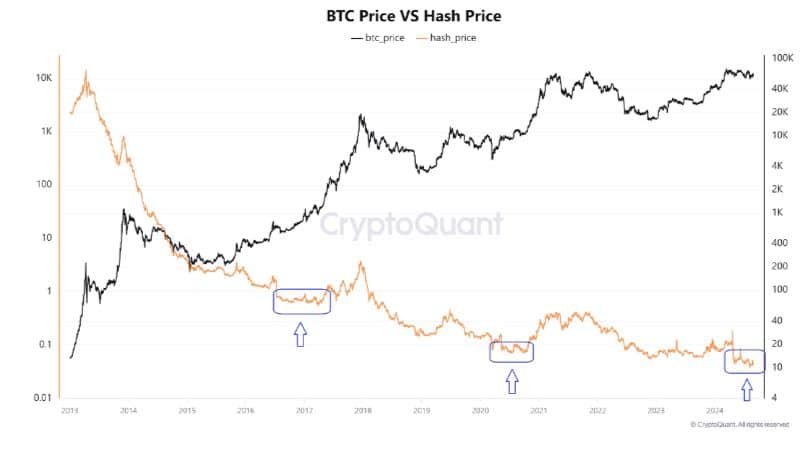

According to CryptoQuant analyst Woominkyu, Bitcoin is currently in a buying opportunity. The analyst made a bullish case for the cryptocurrency using the Bitcoin hash price, which showed the profitability of miners.

Woominkyu’s analysis suggested that the hash price can be used as a bullish signal. A comparison with Bitcoin’s lows suggested that the hash price, which is at the bottom of its trend, could indicate bullish opportunities ahead.

Source: CryptoQuant

The Bitcoin hash price recently fell to its lowest historical level. This coincided with BTC’s recent downtrend, especially in early August.

If this analysis is true, it suggests that Bitcoin may already be in the early stages of its next big rally. It also suggests that the recent pullback could represent the best accumulation opportunities at discounted levels.

Meanwhile, decentralized mining pool operator Loka Mining plans to introduce new measures that could prevent or facilitate the capitulation of miners.

According to its CEO Andy Fajar Handikathe company will finance its growth and short-term needs through forward mining contracts.

The aim is reportedly to offset some of the pressure miners face due to declining block rewards and high operating costs.

How Bitcoin Mining Affects Demand

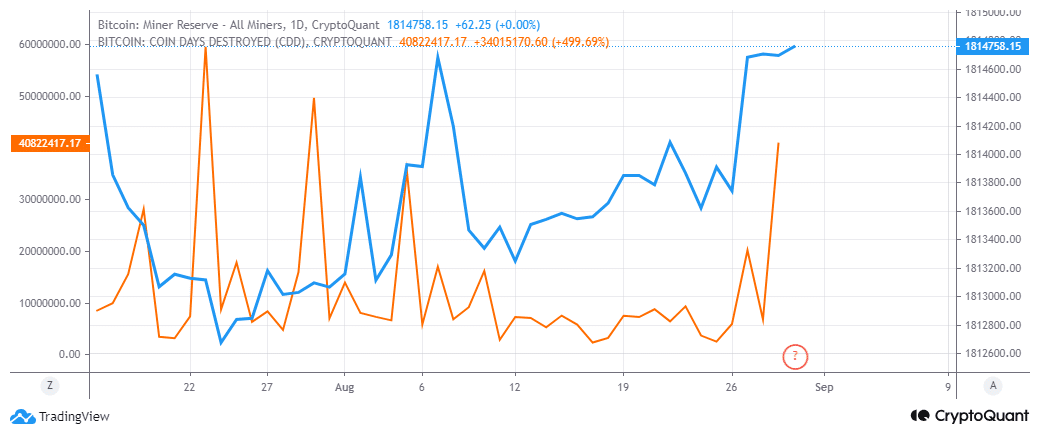

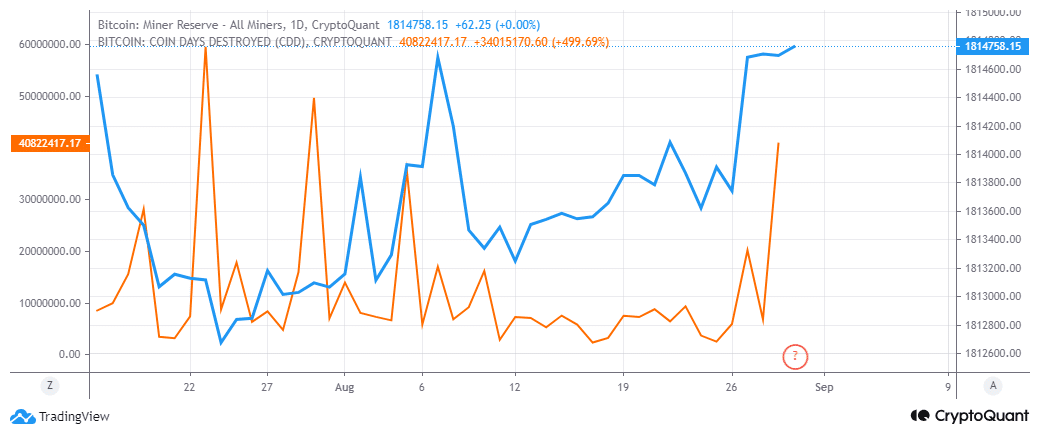

Bitcoin has shown healthy demand so far below the $60,000 price level. Other miner-related metrics also point to favorable sentiment for a potentially bullish outcome.

For example, miner reserves have been at their highest levels for the past six weeks.

Source: CryptoQuant

Rising miner reserves suggest miners are HODLing their coins in anticipation of higher prices. We also observed the highest spike in coin days destroyed in August.

The second highest peak during the month was at the height of the dip at the beginning of the month.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Previous spikes in the coin day destruction indicator were observed before a major price move. This suggests that Bitcoin could be on the verge of another highly volatile move, either up or down.

However, the above observations suggest that the likelihood of a bullish outcome is higher. Nevertheless, traders should proceed with caution as there is still a fair level of uncertainty in the market.