Data from the chain shows that sales pressure is increasing Bitcoin miners has recently been delayed. This is important given the impact this can have Bitcoin’s price heading into the third quarter of the year.

Selling pressure from Bitcoin miners has subsided significantly

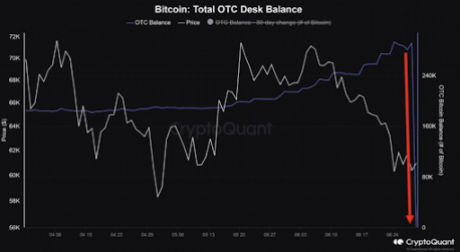

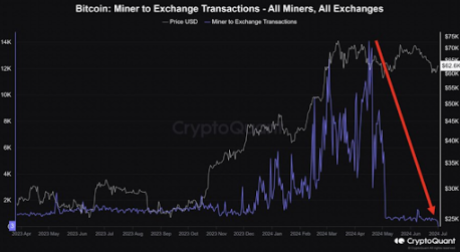

Reference data from the on-chain analytics platform CryptoQuantCrypto analyst Crypto Dan noted that selling pressure from miners has decreased significantly for two reasons. One is that the amount of Bitcoin these miners use sent to exchanges sales have dropped dramatically since May.

Related reading

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for sales has been consumed, indicating that someone recently available Bitcoin supply of these miners. The OTC Desk volume would have piled up until June 29th as there was no buyer willing to purchase these crypto tokens.

Bitcoin miners contributed enormously to the price crashes that the flagship crypto suffered in June. Data from the market information platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) during the month. This put significant selling pressure on Bitcoin, causing it to fall below $60,000 at one point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue running of the bulls for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” for Bitcoin to continue its upward rally in this third quarter of the year.

Crypto analyst Willy Woo had that too previously predicted that the price of Bitcoin would recover once the miners capitulated. With that out of the way, Bitcoin could enjoy an uptrend this month and make huge moves to the upside.

BTC’s uptrend has begun

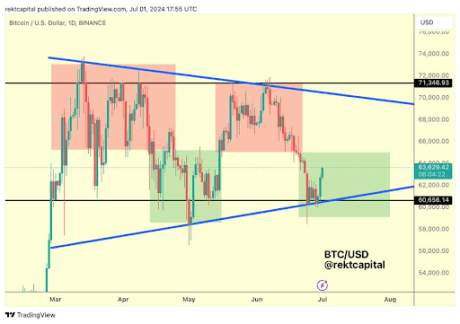

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) after that Bitcoin’s upward trend has begun. He claimed that the macro higher low has been confirmed and Bitcoin is now moving higher. He added that the flagship crypto is a macro bull flagwhich presents a bullish outlook for the crypto token.

Related reading

In another X afterthe crypto analyst noted that the goal for Bitcoin after its strong start in July is to build a “foundation from which it can jump to the Range High area of $71,500 over time.”

Crypto analyst Michaël van de Poppe Also suggested that Bitcoin’s downtrend is over and a bullish reversal is underway as the flagship crypto makes significant moves upward. He also said he believes Bitcoin has done that bottomed out and has found support at $60,000, meaning a near-term decline below that price level was unlikely.

At the time of writing, Bitcoin is trading around $62,900, down in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com