- Miners are facing one of the steepest revenue declines in years.

- Reports suggested that the energy generated could be better used for increased revenue.

Bitcoin Miners have experienced a significant drop in revenue in recent months, with revenues at some of the lowest levels in years.

However, recent reports suggest that Bitcoin miners could have a promising opportunity to offset these losses by turning to artificial intelligence (AI).

Bitcoin Miners Could Generate Additional Income, Says VanEck Report

Bitcoin miners have experienced a decline in revenue due to several factors, including lower Bitcoin prices, increasing mining difficulties, and rising operational costs.

However, a recent one report by VanEck suggests that miners could offset these losses by partially switching to the artificial intelligence (AI) industry.

According to the report, Bitcoin miners have the energy infrastructure that the AI and high-performance computing (HPC) sectors desperately need.

By redirecting some of their resources to support these industries, miners could generate an additional $13.9 billion in annual revenue by 2027.

The VanEck report highlights that this shift could be crucial for miners, many of whom are struggling with weak balance sheets. These financial challenges often arise from excessive debt, excessive equity issuance, high executive compensation, or a combination of these factors.

Diversification in the AI sector could give miners a much-needed boost to their long-term profitability and sustainability.

Bitcoin miner sees turnover drop

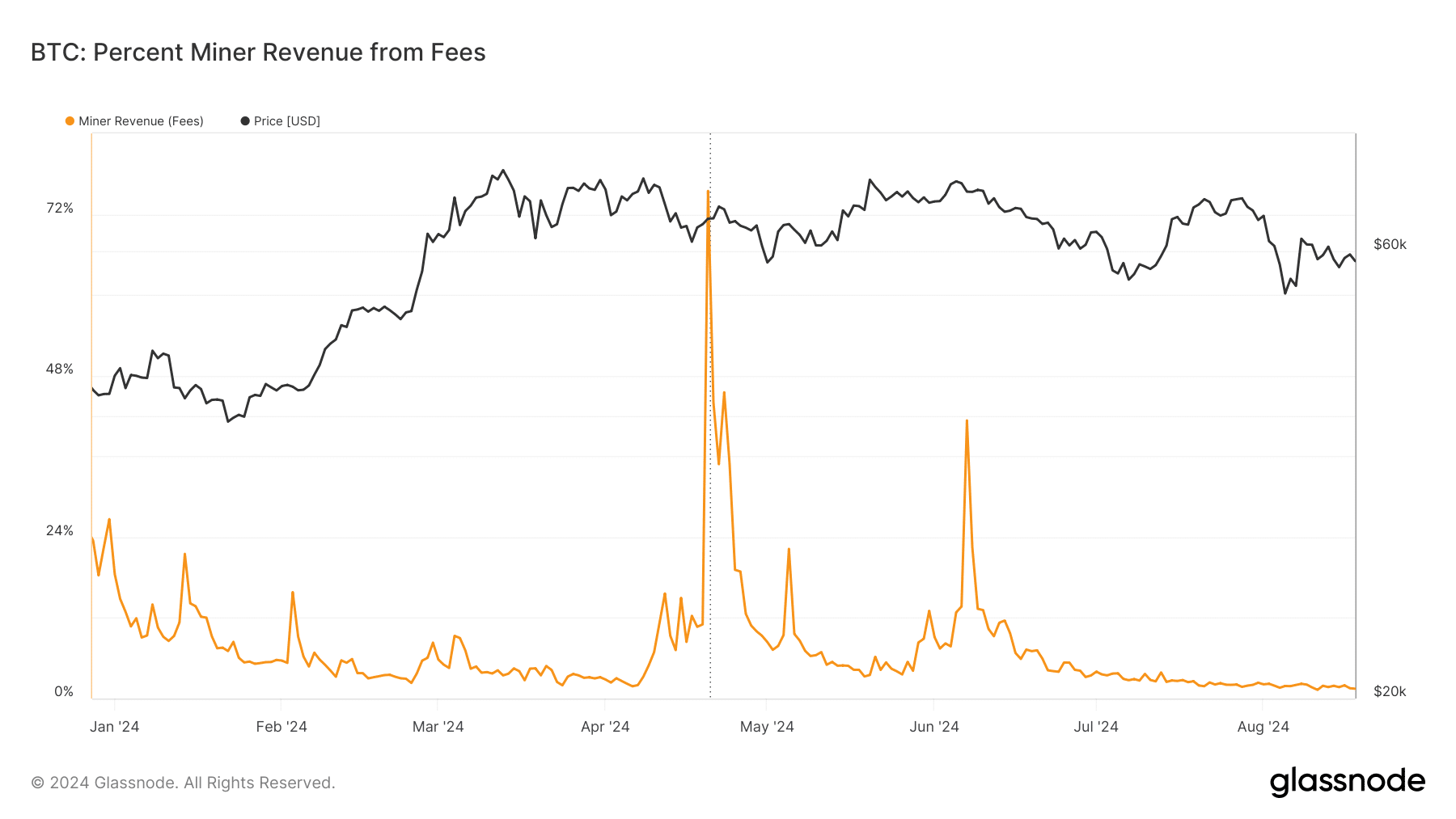

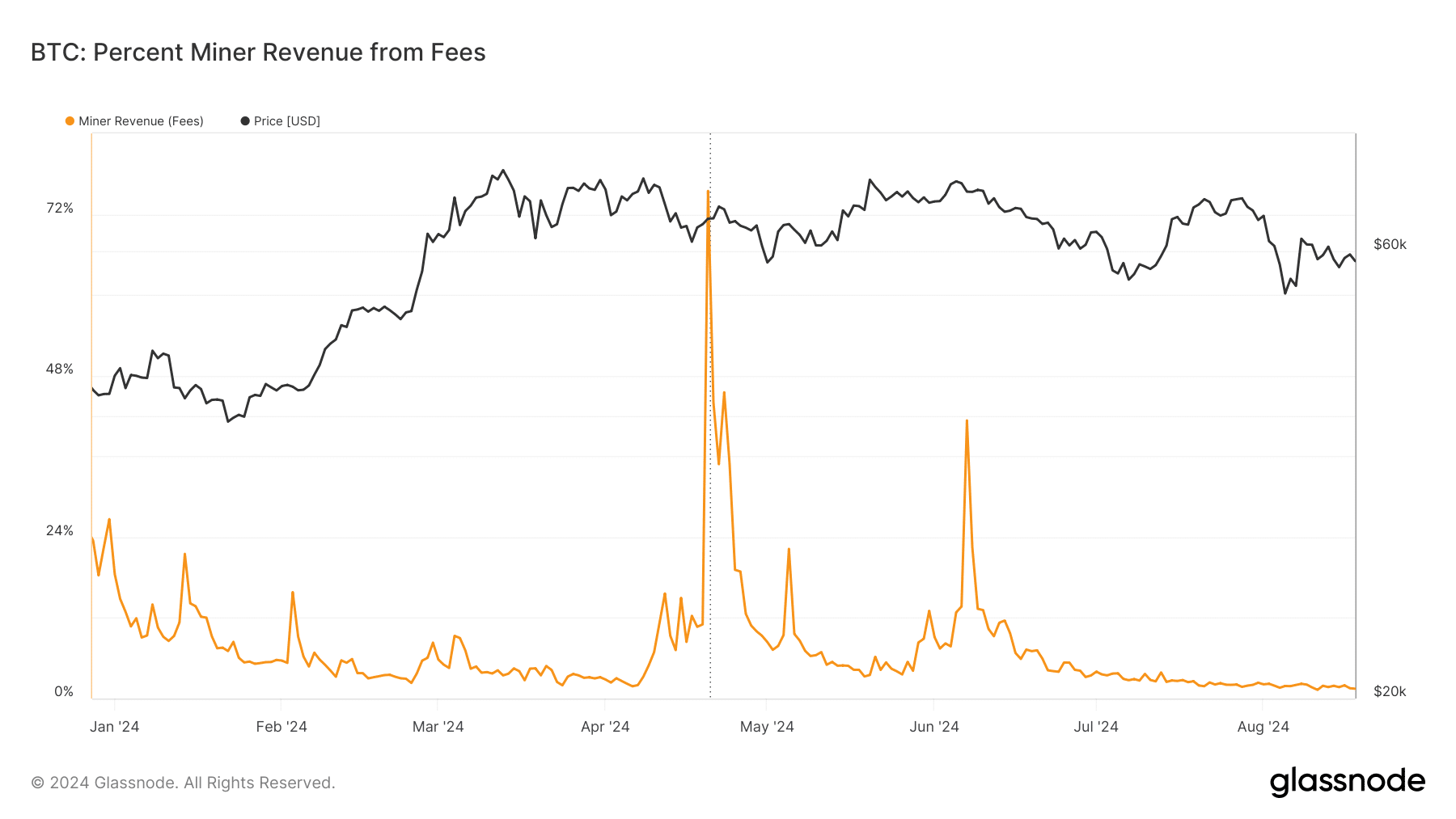

A recent analysis of Bitcoin miners’ earnings on Glass junction shows significant fluctuations throughout 2024, with notable peaks in late April/early May and June.

In late April and early May 2024, miner revenues increased by more than 70%, followed by another significant spike in June 2024, reaching around 40%.

However, after these peaks, the graph shows a dramatic decline in miner revenue, down to around 0%.

Source: Glassnode

This sharp decline underlines a crucial challenge for Bitcoin miners: their heavy reliance on block rewards for the majority of their income.

Since the percentage of revenue from transaction fees typically remains low, often below 10%, miners rely primarily on block rewards to continue their operations.

The reliance on block rewards poses a significant long-term risk, as these rewards halve approximately every four years as part of Bitcoin’s programmed monetary policy.

Bitcoin price struggles below $60,000

At the time of writing, Bitcoin (BTC) is trading at around $58,600, reflecting a modest increase of less than 1%. Over the years, there has been a strong correlation between the price of Bitcoin and the revenue generated by Bitcoin miners.

Currently, Bitcoin faces significant challenges in regaining its psychological level of $60,000, which it has struggled to break in recent weeks.

Read Bitcoin (BTC) price prediction 2024-25

The continued difficulty in surpassing this key level is compounded by bearish market sentiment.

An analysis of Bitcoin’s Relative Strength Index (RSI) indicates that it is below the neutral line, indicating that the market is still in a bearish trend.