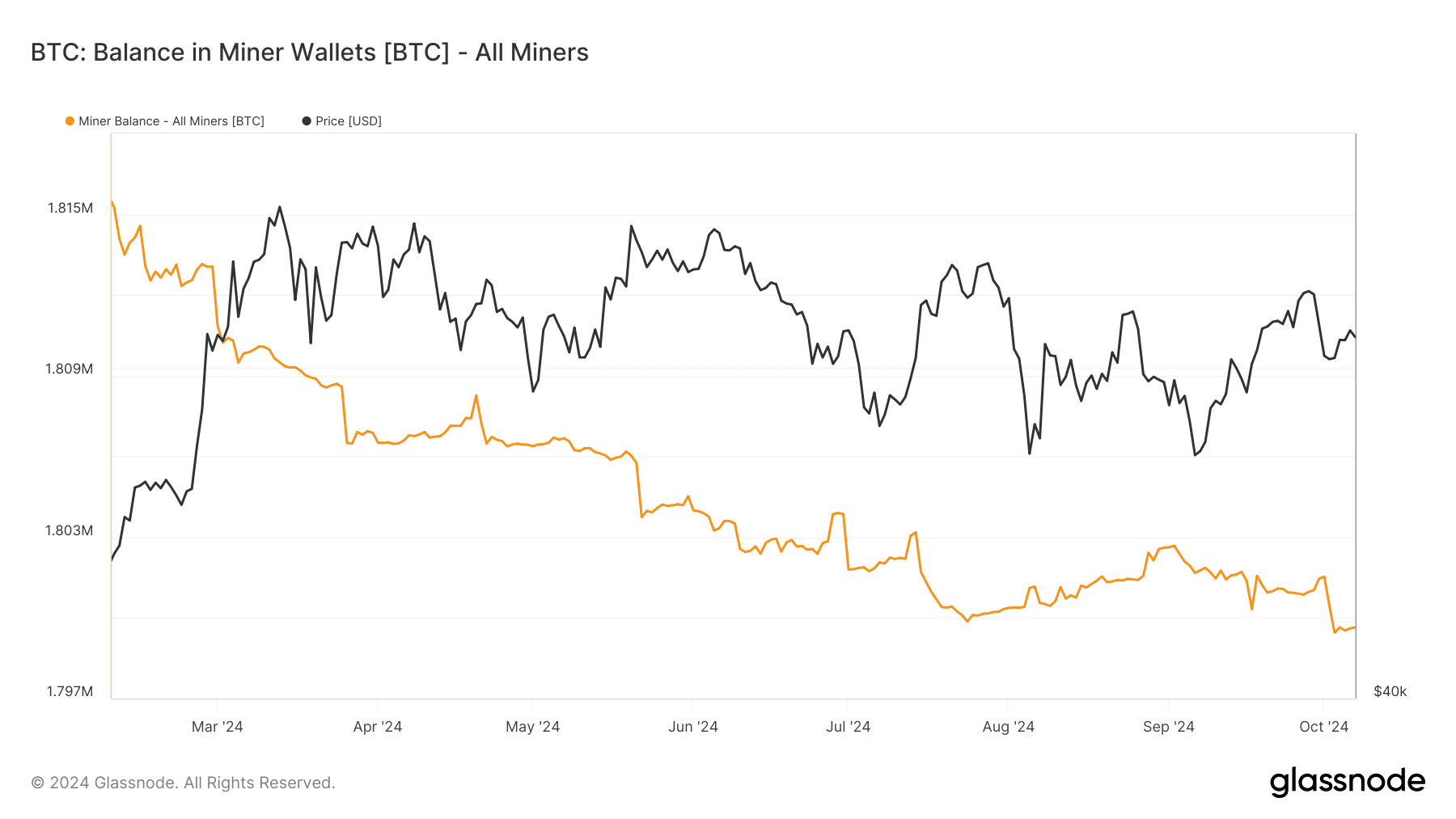

- Bitcoin miners saw their balances drop, dropping to around 1.799 million BTC in September.

- Despite the volatility, Bitcoin miners’ revenues remained stable, increasing slightly to around 2.5%.

Bitcoin [BTC] Miners experienced mixed performance in September as Bitcoin’s price showed significant volatility. Despite holding on to their BTC, miners saw a drop in revenue compared to August.

Bitcoin miners’ balances are falling

In September, Bitcoin Miners’ balances gradually decreased. At the beginning of the month, the total balance was around 1.802 million BTC, but by the end of the month it had dropped to 1.801 million BTC.

This slight increase from the mid-month low of 1,800 million BTC reflected a brief uptrend.

Source: Glassnode

However, at the time of writing, miners’ balances have fallen further to around 1.799 million BTC, according to data from Glass junction. This level is similar to the level in July, when miners experienced a notable decline.

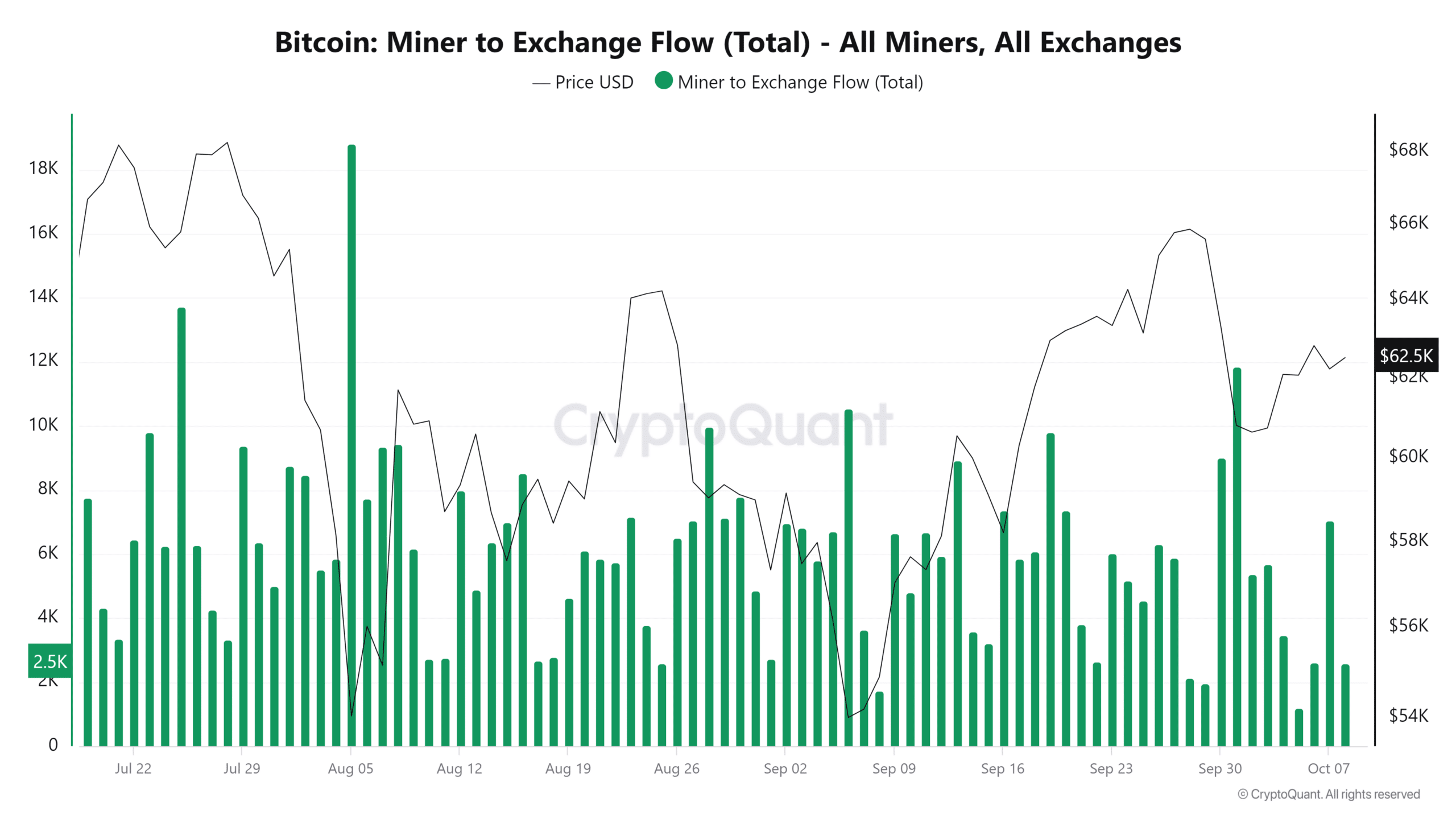

Fewer holdings were moved to stock exchanges

Despite Bitcoin’s price volatility in September, miners moved fewer assets to exchanges compared to August. Although there were transfers, they were significantly lower than the previous month.

The largest single transfer in September was 11,842 BTC, compared to over 18,000 BTC moved in August.

Source: CryptoQuant

Furthermore, Bitcoin Miners’ revenue statistics for the past month did not show any significant peaks or valleys.

AWhile there were small fluctuations, sales increased as much as 2.5% on certain days, which was much less dramatic than the 18% highs in August.

TThe low point in miners’ earnings in September was about 1.2%; at the time of writing, sales have stabilized at approximately 2.5%.

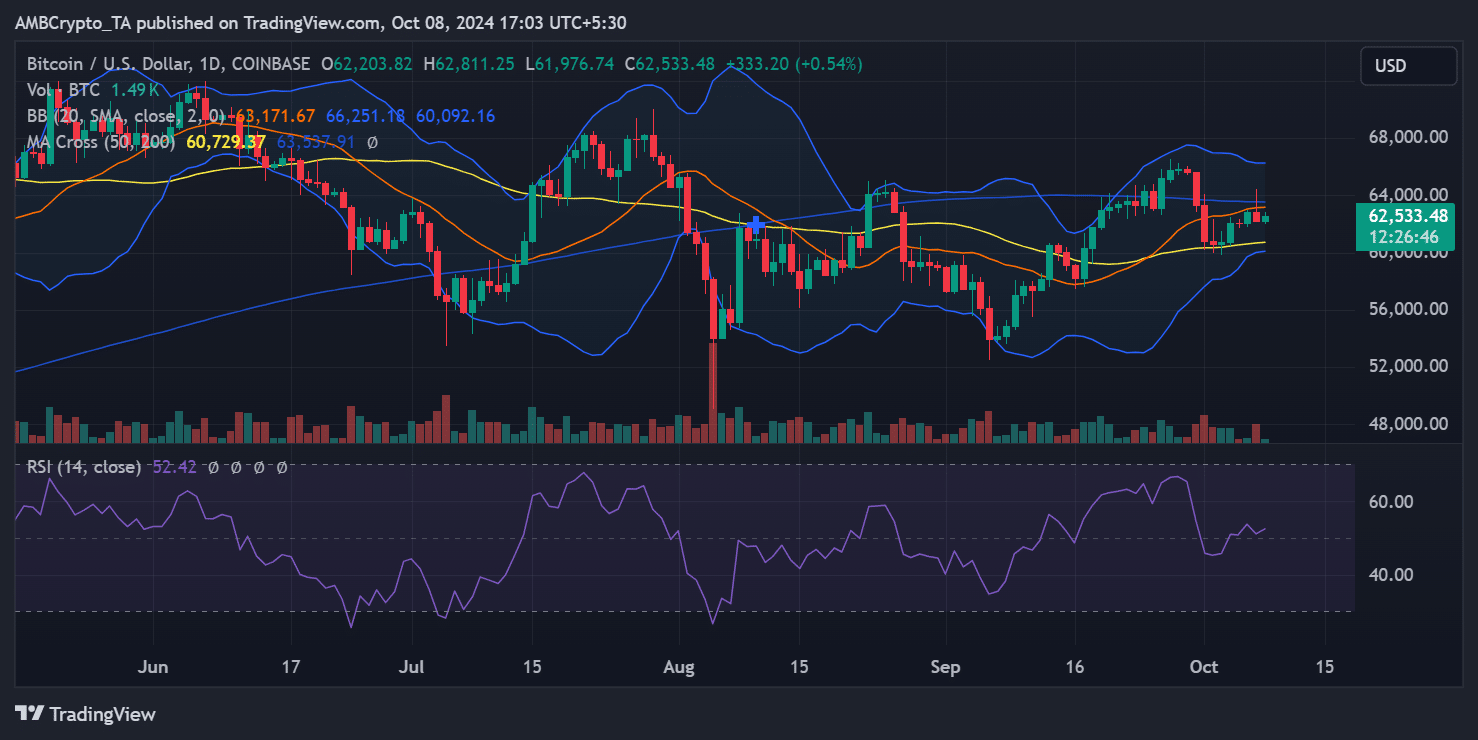

Bitcoin remains volatile

Bitcoin price volatility continued into October. The long-awaited ‘Uptober’ trend has yet to fully materialize as the daily price chart shows Bitcoin struggling to recover after early-month declines.

A Bollinger Bands analysis shows that price swings are still large, indicating continued volatility.

This continued volatility could mean that Bitcoin Miners will continue to experience mixed numbers in the coming weeks.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-25

Currently, Bitcoin is trading around $62,480, showing a slight increase of less than 1%. The 50-day moving average serves as a solid support level, while the 200-day moving average at $63,700 remains a resistance point.

Miners have faced a combination of declining balances and relatively stable revenues amid price volatility. Due to Bitcoin’s continued unpredictability, miners may see fluctuating performance in the short term.