- TeraWulf is pursuing mergers to increase profitability and not just expand for the sake of expansion.

- TeraWulf prioritizes efficient Bitcoin mining operations over monopolistic goals.

In a strategic move towards improving profitability, Bitcoin [BTC] miner TeraWulf has expressed openness to possible mergers.

However, they only qualify if companies contribute to increasing profit margins, rather than simply pursuing expansion for their own good.

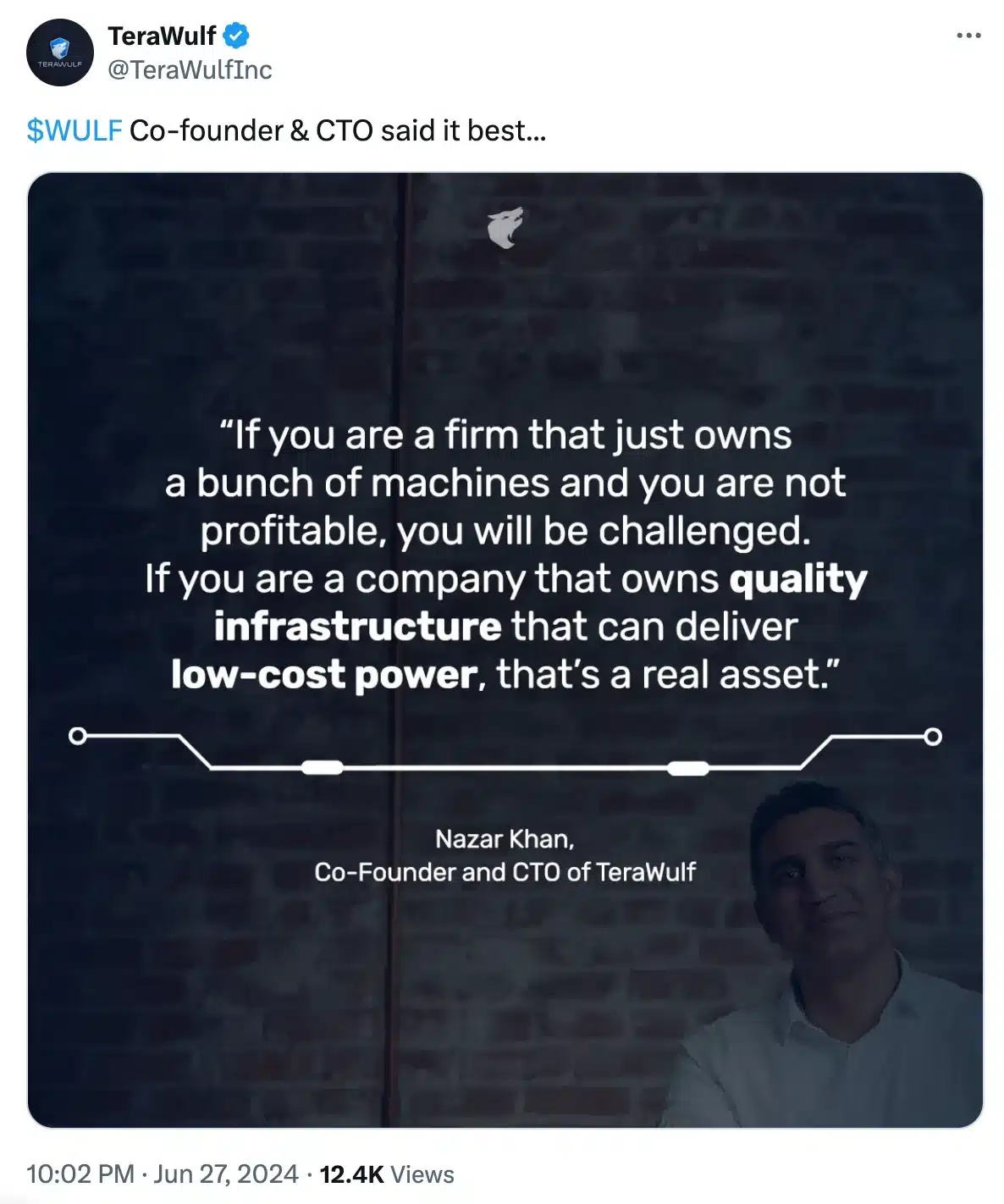

On the way to X TeraWulf noted,

Source: TeraWulf/X

A breath of fresh air

However, it is important to note that unlike many large Bitcoin mining companies that often seek to establish monopolies in the market, TeraWulf has adopted a different strategy.

The company emphasizes profitability and strategic partnerships over monopolistic ambitions.

Furthermore, this initiative is unlikely to directly impact Bitcoin price dynamics given TeraWulf’s prioritization of operational efficiency over market manipulation.

About the same Kerri Langlais, TeraWulf’s Chief Strategy Officer said in a publication:

“We will certainly consider inorganic growth opportunities through mergers and acquisitions [but] Expanding just for the sake of growth, or building an empire without considering profitability, makes no sense.”

The community praises TeraWulf’s move

Therefore, TeraWulf’s view on avoiding empire building is quite refreshing, as highlighted by an X user: James Roland who said,

“$WULF is a real asset.”

Building on the same, Langlais exclaimed:

“This distinction is crucial; it allows investors to distinguish between companies that are growing profitably and companies that are just growing.”

This merger is consistent with the predictions of Hash Rate Index Bitcoin Analysts Jaran Mellerud and Colin Harper, as early as January 2023. According to their analysis:

“This year (2023), miners will prioritize improving the health of their operations by strengthening their balance sheets and minimizing costs. Efforts to minimize costs will lead to some public mining companies merging or going private.”

Fast forward to 2024, after the recent fourth halving, the analysis appears to have been validated.

What lies ahead?

In conclusion, amid discussions about profitability after the fourth halving on April 20, which saw the block grant halved to 3,125 BTC ($174,100), TeraWulf’s strategy stands out.

The company is primarily powered by nuclear energy and focuses on profitability, keeping the price of Bitcoin above $40,000.