- Bitcoin’s utility has increased amid recent losses, pointing to a potential increase in value.

- Liquidity decreased, but BTC won’t get close to $20,000 anytime soon.

As the flagship digital asset, Bitcoin [BTC] may show signs of a possible recovery after a period of consolidation and downward pressure. The recent dip, which took BTC below $28,000, has caused a change in market sentiment, leading some to question the presence of an early bull market.

Read Bitcoins [BTC] Price prediction 2023-2024

View of recovery

However, Santiment revealed that there is an increase in active addresses, so that as of August 3, the stat surpassed the highs of the past three and a half months. The increase in active addresses suggests an increase in the use of BTC in transactions.

📈 #Bitcoin‘s address activity rose to its highest level in 3.5 months in August. This increase in utilities, combined with large loss trades and negative sentiment, is a strong sign that a short-term (minimum) $BTC price increase is more likely. https://t.co/5PzjYROX5T pic.twitter.com/G2tevAWdSM

— Santiment (@santimentfeed) August 3, 2023

But that was not all. The increase coincided with negative sentiment and large loss trades. Historically, this is evidence that the period of consolidation could soon come to an end. In turn, BTC may bounce back in the upward trajectory.

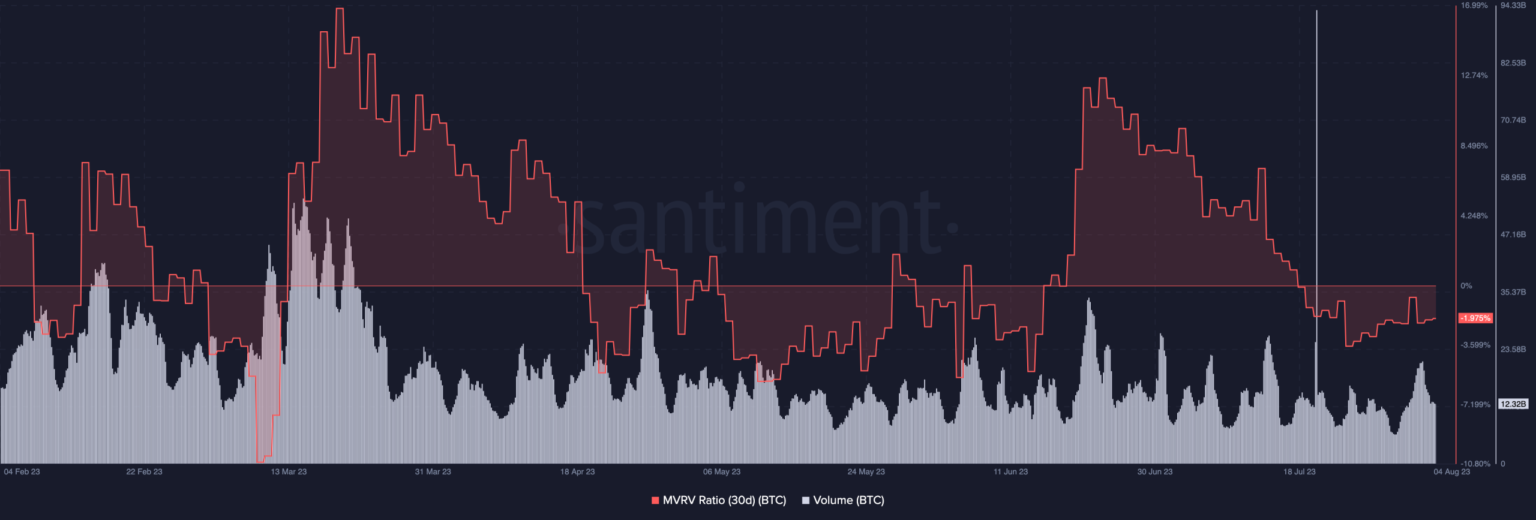

From the chart above shared by the on-chain analytics platform, on-chain volume in profit to loss was down to -0.155. As a key indicator of profitability in the market, this decline implies that the loss-making volume was an overwhelming gain.

In addition, the 30-day market value to realized value (MVRV) ratio was also negative. The MVRV ratio measures the relationship between the market and realized capitalizations. Values in the positive region indicate progress to the top of the market.

Conversely, when the metric is in negative territory, it means BTC could be near the bottom. So at press time, BTC tended to recover rather than slide again. Another metric to consider in this context is volume.

The pace is set

At the time of writing, the volume was 12.32 billion. Although this measure fell, it had previously risen to 20.05 billion on August 2, indicating increased liquidity. Therefore, if volume rises again, it could set the tone for BTC’s bounce.

Source: Sentiment

Meanwhile, Bitcoins realized cap was $396.98 billion, according to CryptoQuant. This metric attempts to measure the value of a coin by comparing its network value and on-chain volume-weighted price.

Is your wallet green? Check the Bitcoin Profit Calculator

Compared to the market cap, on-chain data showed that the market value was way ahead at $567.11 billion. If the market cap and the realized cap are similar in value or if the latter is slightly higher, this can generally indicate an approaching market floor.

Source: CryptoQuant

But in this case, BTC may have the potential to recover. However, considering the press time price as a bottom may not be valid. So if BTC drops again, it could still be around $25,000.