Bitcoin’s price fell below $51,000 to retest critical support levels on February 17, despite remaining strong following stronger-than-expected CPI data in recent days.

The flagship crypto was trading at $50,856 at the time of writing, after hitting a low of $50,625.

The decline marks a decline of 2.81% in the past 24 hours, with Bitcoin’s market capitalization now approaching $997.31 billion, just under the $1 trillion mark.

Mixed feelings

The recent price action comes against a backdrop of both bullish and bearish sentiments among investors.

An analysis by Changelly shows that market sentiment was largely bullish, with a bullish sentiment of 76% versus a bearish outlook of 24%, supported by a Fear and Greed Index score of 77, indicating a prevailing sense of greed in the market.

Despite this optimism, Bitcoin has experienced significant price volatility over the past month, with 19 of the past 30 days closing in the green.

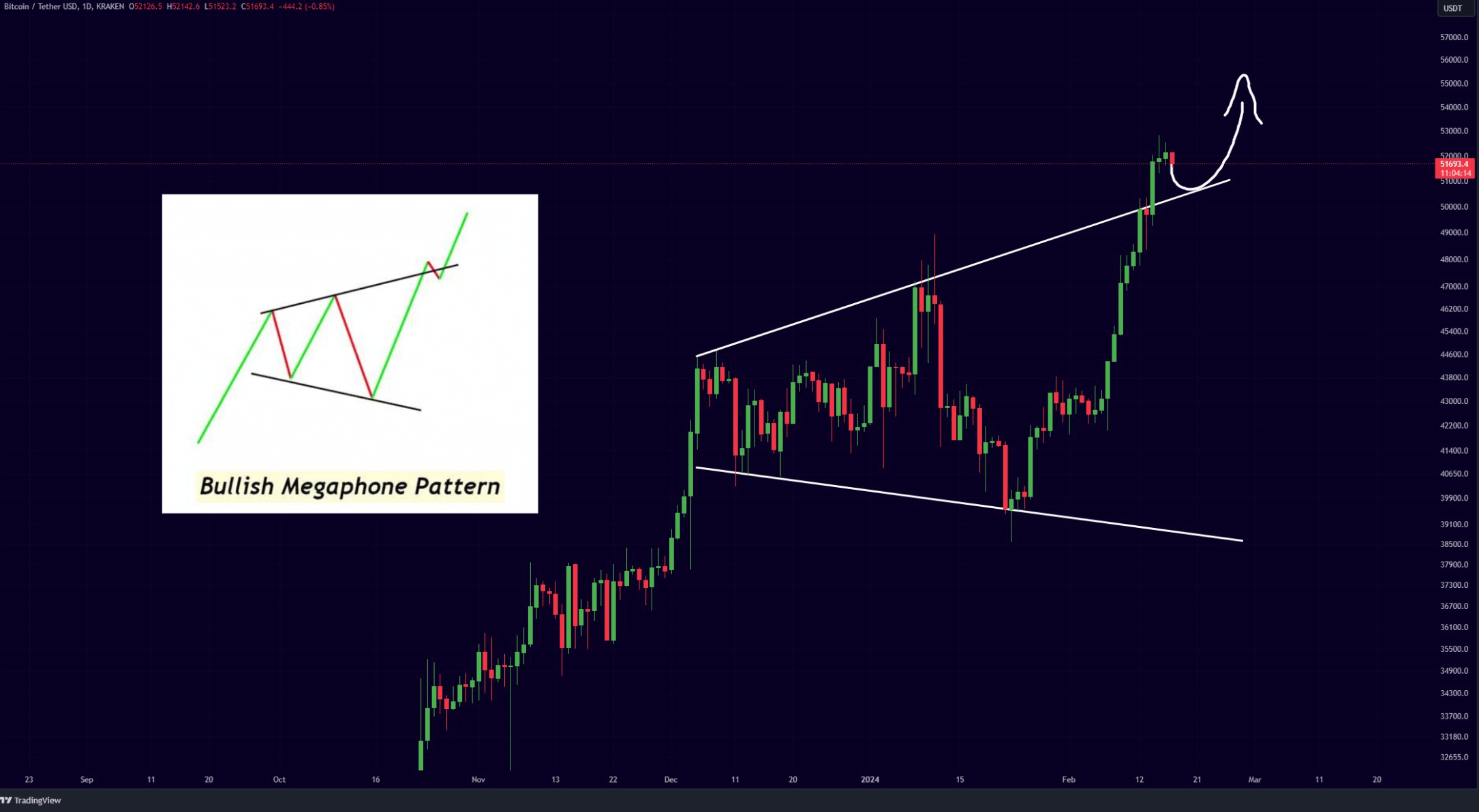

Bitcoin bulls suggest the price is testing support sooner rises to annual highsbecause it has already broken out of a critical price ceiling and formed a bullish megaphone pattern.

Central point of discussion

Bitcoin, the world’s first decentralized cryptocurrency, remains a central point of discussion among investors, policymakers, and the general public. Energy consumption, security features and potential for adoption as legal tender in different countries remain hot topics.

Crypto’s journey from a high-risk investment to a primary reserve for major companies like MicroStrategy and Bitcoin ETFs issued by major asset managers illustrates the growing acceptance and changing attitudes toward digital currencies.

Furthermore, the legal and political landscapes surrounding Bitcoin are evolving. Countries like El Salvador have adopted Bitcoin as legal tender, a move that has fueled discussions about other countries’ adoption of cryptocurrencies.

Meanwhile, environmental concerns associated with Bitcoin mining continue to fuel debates about the sustainability of cryptocurrencies and their impact on global energy consumption.

Bitcoin Market Data

At the time of printing 17:04 UTC on February 17, 2024Bitcoin is number 1 in terms of market capitalization and so is its price down 2.1% in the last 24 hours. Bitcoin has a market capitalization of $1 trillion with a 24-hour trading volume of $19.87 billion. Learn more about Bitcoin ›

Summary of the crypto market

At the time of printing 17:04 UTC on February 17, 2024the total crypto market is valued at € $1.92 trillion with a 24 hour volume of $59.22 billion. Bitcoin’s dominance currently stands at 52.24%. Learn more about the crypto market ›