- Bitcoin has fallen below the $60,000 price range.

- More long positions have been liquidated in the past 48 hours.

Bitcoin’s Recent Downturn [BTC] price has left traders in long positions vulnerable. As the price of BTC continues to decline and cross critical thresholds, many holders are liquidating their positions.

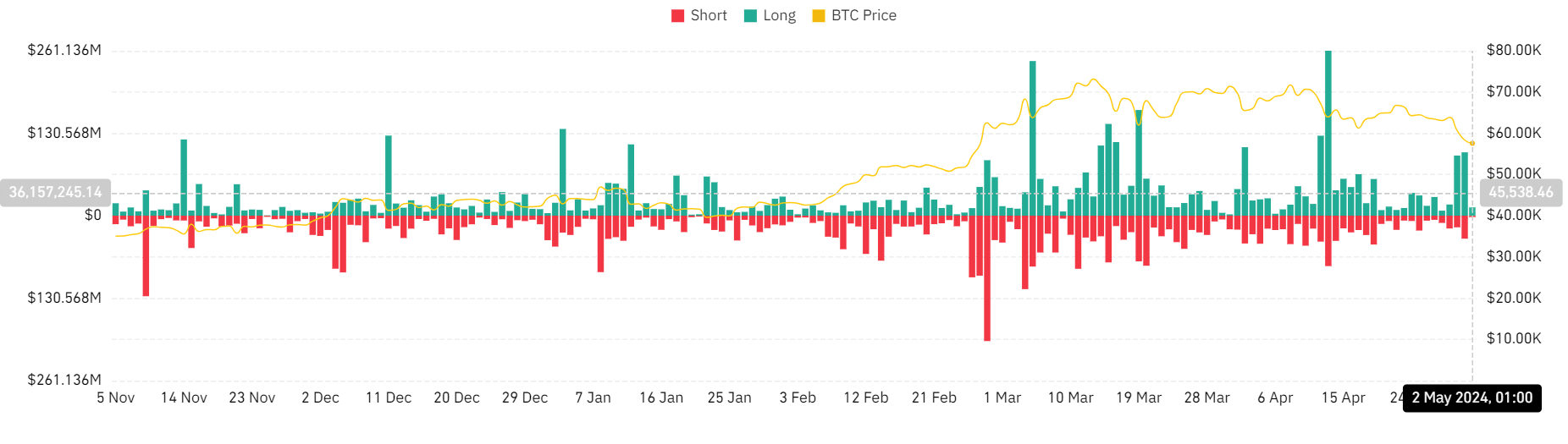

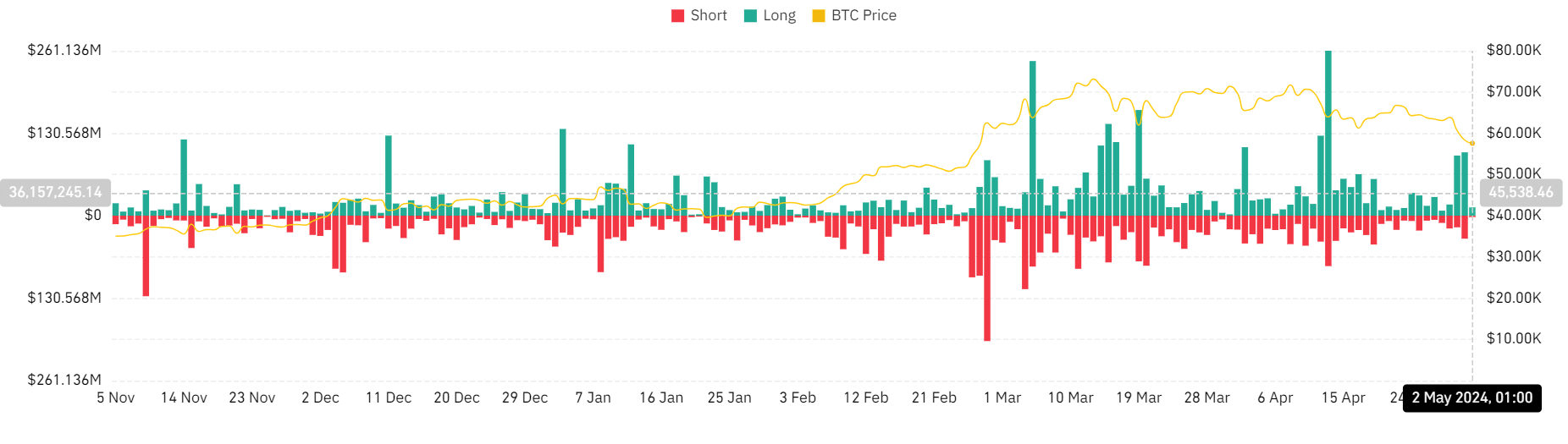

Bitcoin sees over $100 million in liquidations

According to data from Crypto Rank, the cryptocurrency market saw liquidations totaling more than $464 million on May 1, and Bitcoin was responsible for more than $136 million of these outflows.

AMBCrypto’s analysis of the Bitcoin liquidation chart on Coinglass indicated that long positions bore the brunt of the liquidations, with approximately $100.3 million liquidated on May 1.

Conversely, short liquidations amounted to approximately $36.4 million.

Source: Coinglass

On April 30, long positions also saw more liquidations, with more than $95 million liquidated, compared to approximately $18.4 million in short liquidations.

According to Crypto Rank data, long-term liquidations represented more than 80% of the total number of liquidations recorded on May 1.

At the time of writing, nearly $13 million had been liquidated in long positions, while short liquidations amounted to approximately $2 million.

More Bitcoin hits stock markets

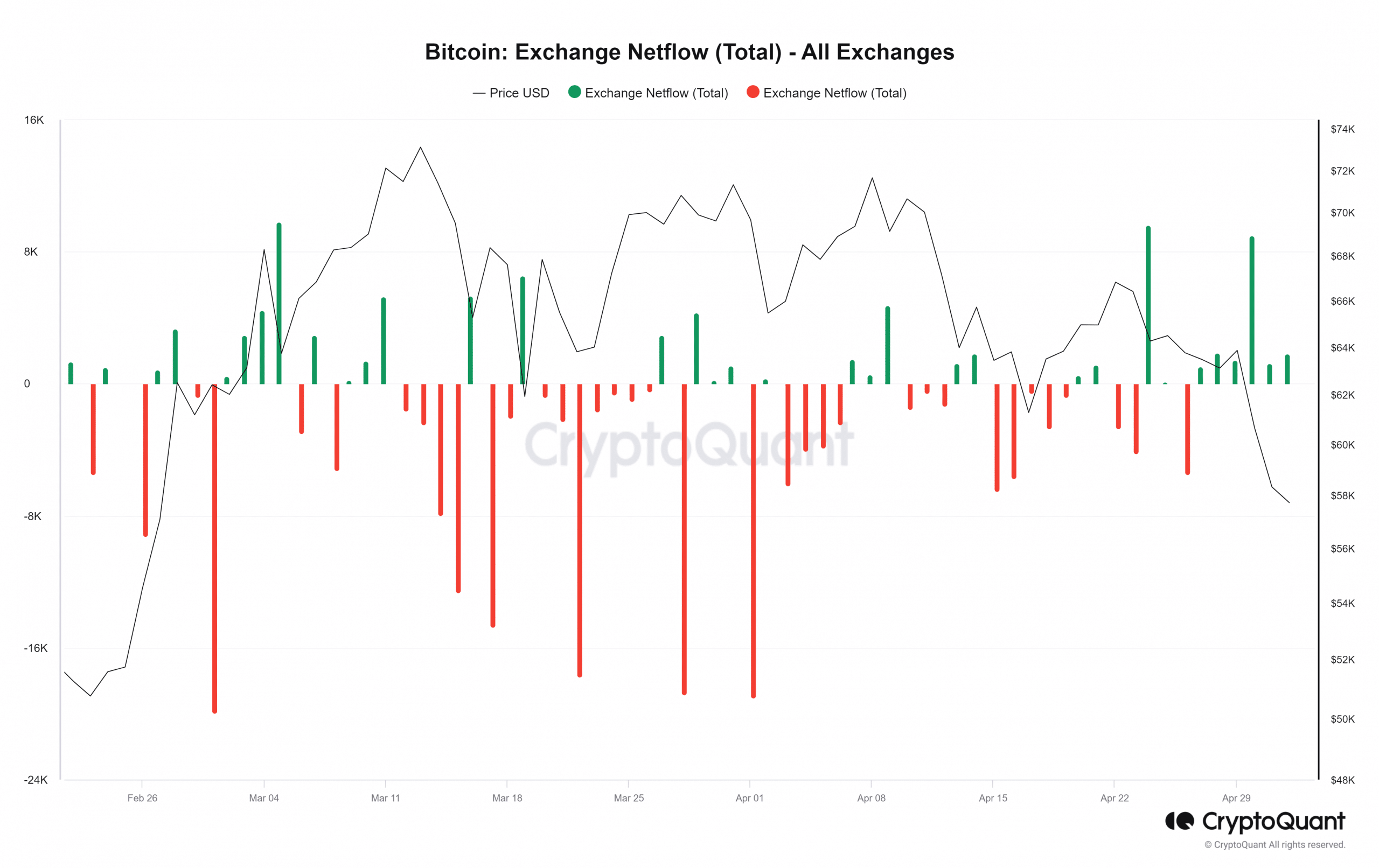

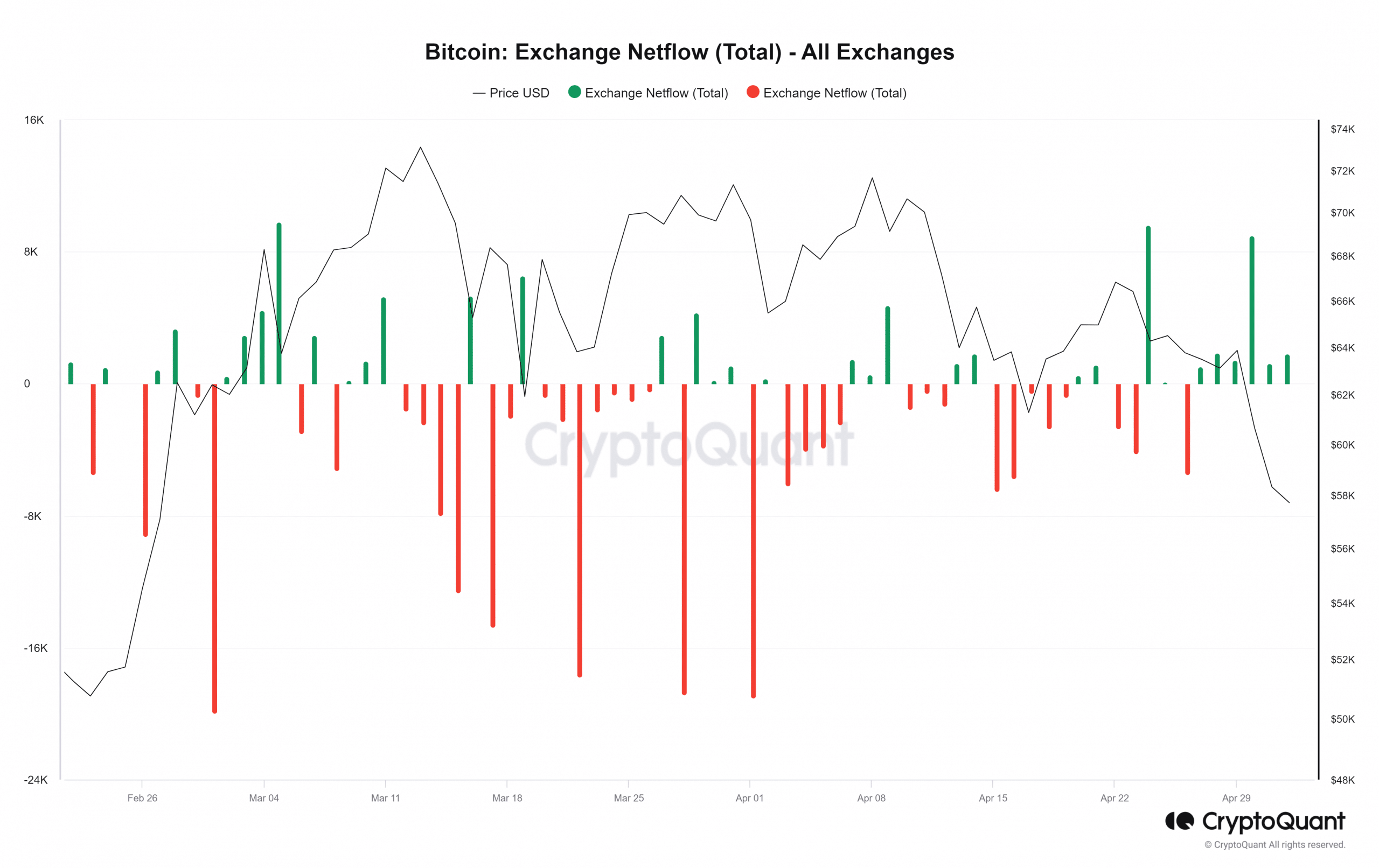

AMBCrypto’s look at the Bitcoin Exchange Netflow indicated a notable increase in the number of assets sent to exchanges, indicating increased selling activity. On May 1, the number stood at 1,200.

Source: CryptoQuant

Further analysis of the BTC flow revealed an inflow of over 32,300. These numbers suggested a continued trend of more BTC being sent to exchanges.

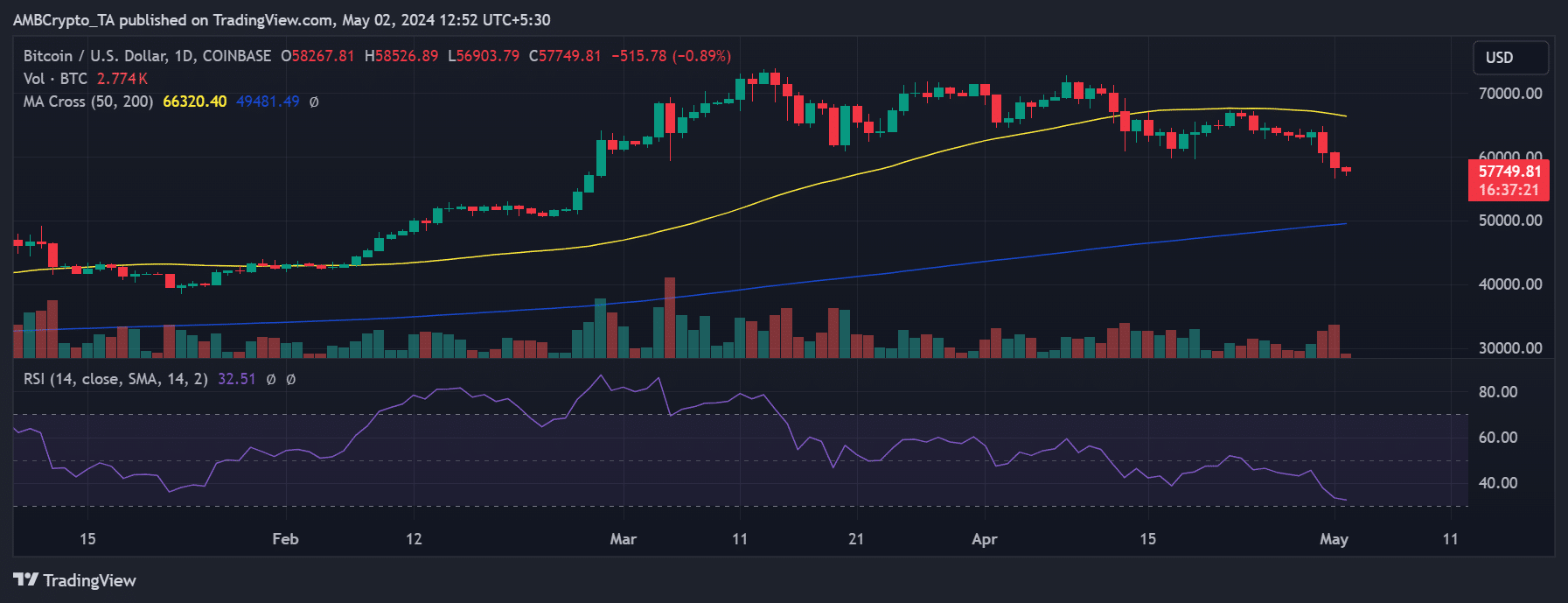

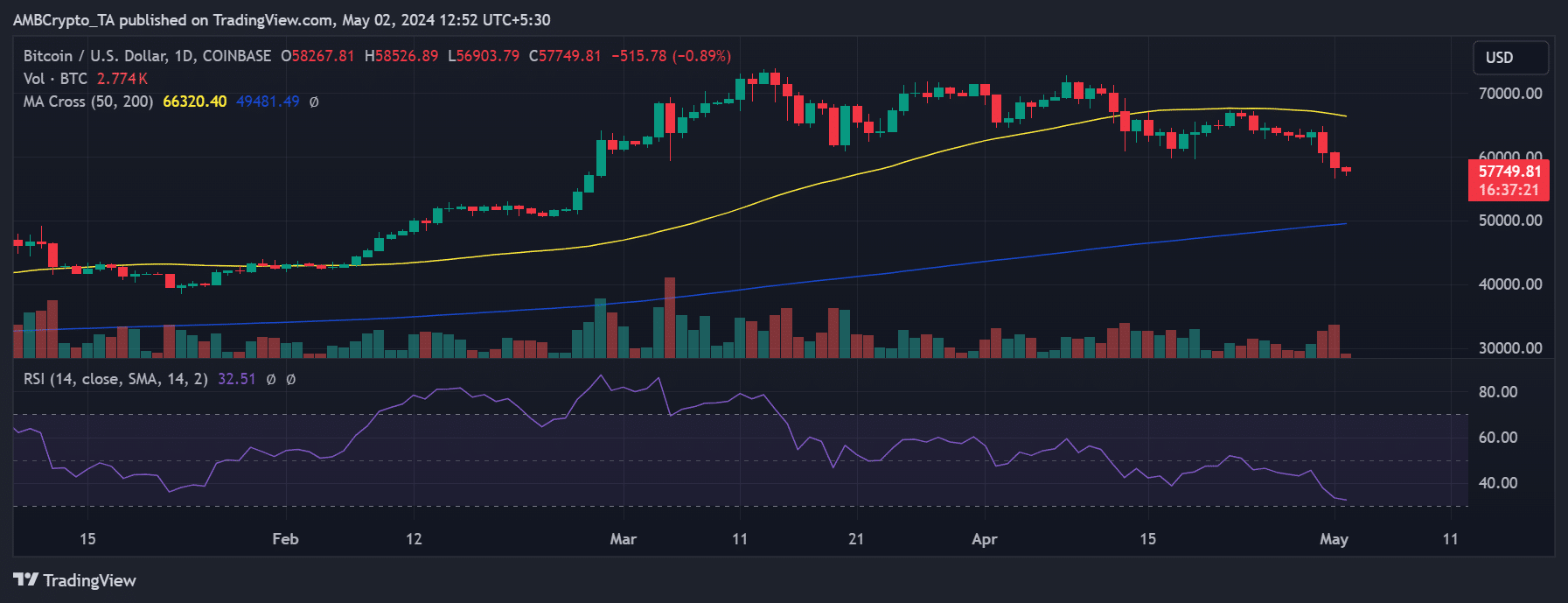

BTC in free fall

AMBCrypto’s look at Bitcoin’s daily chart analysis revealed a continued price decline over the past three days. On May 1, BTC experienced a loss of 3.89%, with the price falling to around $58,260.

This was the first time since the March surge fell below the $60,000 price range.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-25

At the time of writing, BTC was trading at around $57,740, showing a decline of less than 1%. This prolonged price decline has further entrenched a bearish trend, as evidenced by the Relative Strength Index (RSI).

The downward price trajectory also contributes to greater foreign exchange inflows and the liquidation of long positions.