Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

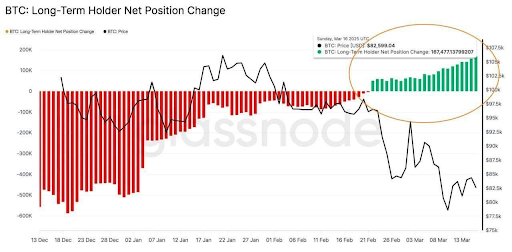

The long -term holders of Bitcoin have resumed the accumulation in what a remarkable shift in investor sentiment is Despite the turbulence The market has seized this in recent weeks. In particular, data from On-Chain Analytics Platform Glassnode that the metric “BTC: Long-Term Holder Net Position” has been reversed positively for the first time this year. This suggests that long-term Bitcoin investors benefit from market conditions to add significant amounts of BTC to their participations.

Long -term holders add 167,000 BTC in the midst of March crash

Earlier this month, the Bitcoin price fell from more than $ 90,000 to around $ 80,000 during a rapid sale. This prize surprised many traders and led to a continuous wave of liquidations in short -term investors. Despite this steep correction, long-term holders treated the levels of sub $ 90,000 As a buying option Instead of a reason to capitulate.

Related lecture

In other words, coins go to portfolios that their BTC haven’t spent a long time, which is a remarkable reversal At the beginning of 2025 with a negative Net position change. This marks the first net accumulation by these “hodlers” in 2025. Glassnode’s long-term holder Net Position Change Metric, who had been in red, turned around “Green” as long-term investors collected by the decline.

Published in chains it appears that this flip has seen to green Long -term holders are increasing Their net bitcoin interests with more than 167,000 BTC in the past month. This remarkable inflow is appreciated at almost $ 14 billion. In short, the cohort of seasoned holders started to pick up cheap BTC while the sentiment in the short term Was on his gloomy.

Is a Bitcoin -Prize Referstel brewing?

The timing of this flip from red sale to green accumulation at long-term holders is striking, given what the Bitcoin price has undergone in the past two weeks. This data suggests that a large part of the Bitcoin -Crash was caused by Panic sales at holders in the short term. This behavior corresponds to earlier market cycles between August and September 2024, where holders in the long term collected aggressively during a price dip.

Related lecture

Interesting is that the long-term holder of Glassnode is not the only one that points to a positive Bitcoin sentiment at large holders. After weeks of uncertainty, Bitcoin exchange-related funds (ETFs) started to see Net intake again. On March 17, Spot Bitcoin ETFs together drew around $ 274.6 million, the biggest inflow with one day in 28 days and a clear signal from renewed investor’s interests.

The next day brought another wave of fresh capital, with around $ 209 million that flowed in Bitcoin funds on March 18. In fact, this three-day line represents the first continuing series of positive inflow since 18 February, a period in which Bitcoin funds have experienced consecutive days of outsourcing.

At the time of writing, Bitcoin acts at $ 83,500.

Featured image of Unsplash, graph of TradingView.com