- BTC has remained bullish despite recent fluctuations.

- More long positions have been liquidated during the current trading session.

Bitcoin [BTC] started the new month with notable price swings, leading to varied market reactions.

Despite ending the previous trading session on a profitable note, the company experienced significant liquidation volumes due to price volatility.

Long liquidations dominate

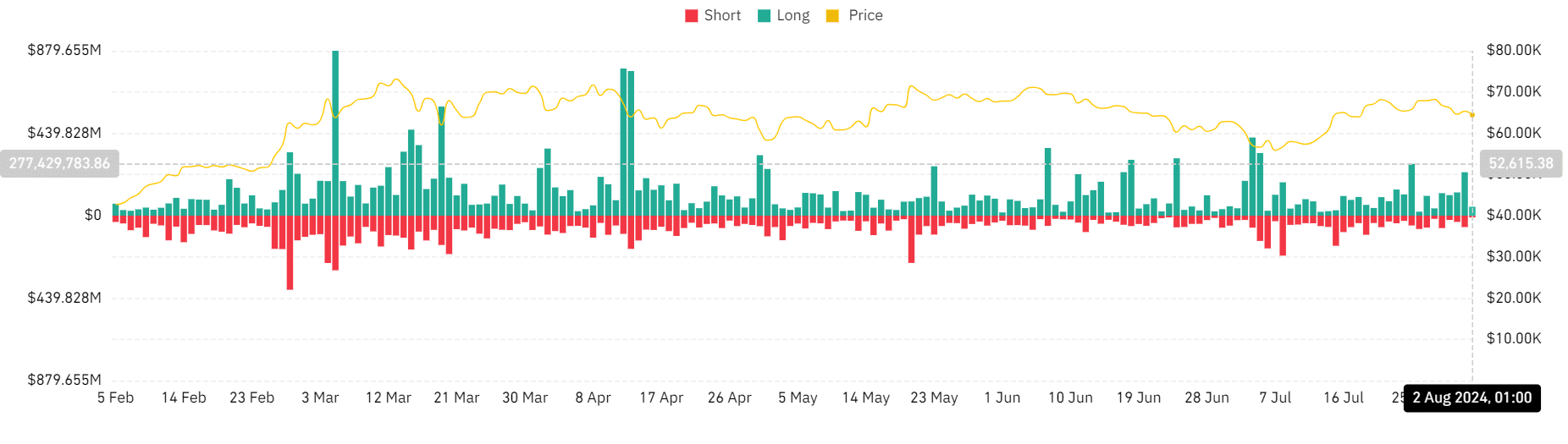

Analysis of the Bitcoin Liquidation Chart on Mint glass revealed that liquidations of more than $280 million took place on the first day of the month.

A deeper look at the data showed that long-term liquidations accounted for the majority of this volume, worth over $231.6 million. In contrast, short liquidations were significantly lower, at around $60.8 million.

Further analysis revealed that this spike in long-term liquidations on August 1 was not an isolated incident; BTC had been experiencing a dominance of long-term liquidations in the days leading up to this event.

This trend suggests that many traders were overly optimistic about BTC’s price movements. This led to a larger number of long positions being liquidated as the market turned against them.

Source: Coinglass

The prevalence of long liquidations highlighted a period of bullish sentiment that was abruptly undermined, causing significant financial consequences for those holding long leveraged positions.

The difference between long and short liquidation volumes underlines the volatility BTC has witnessed in recent days.

Understanding the cause

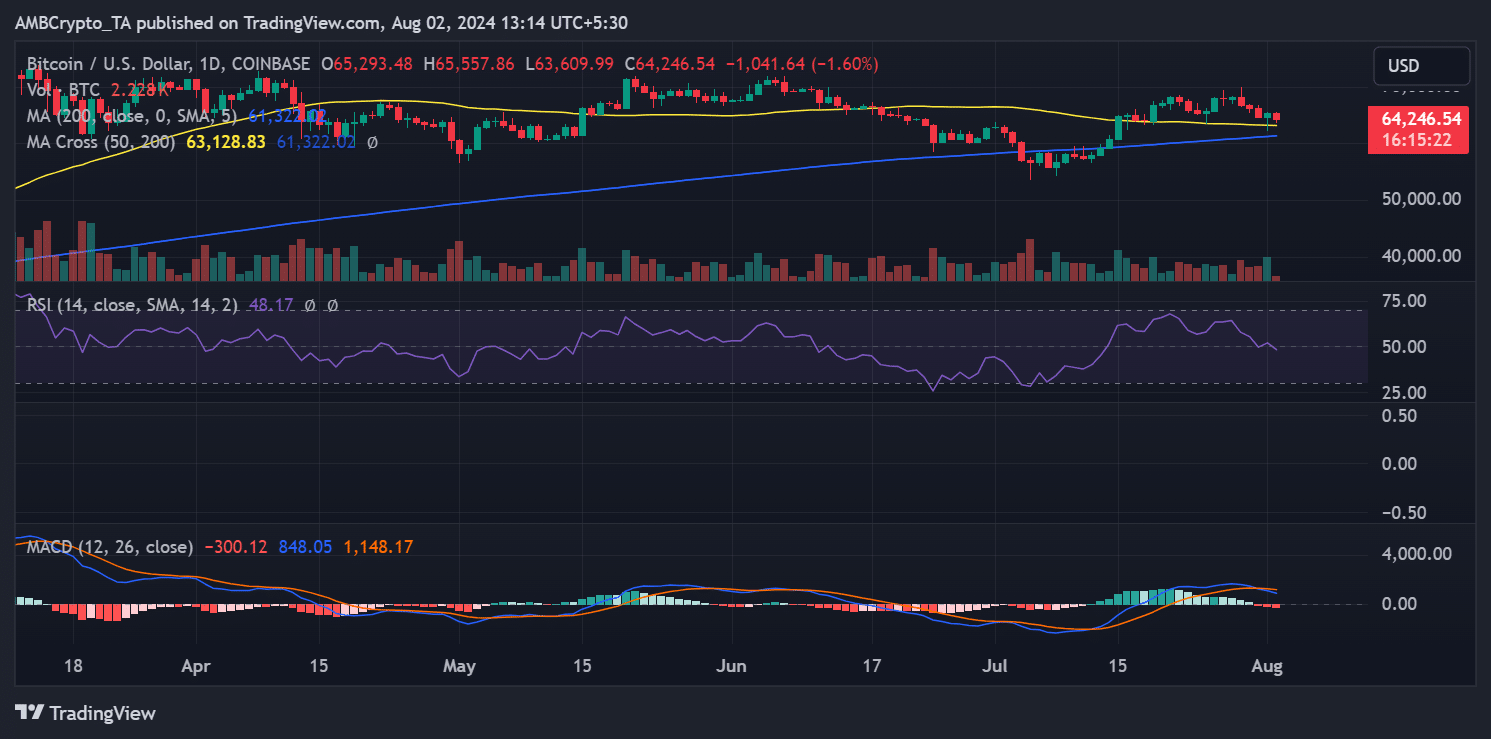

AMBCrypto’s analysis of Bitcoin on a daily time chart showed that it ended the previous trading session up more than 1%.

However, long liquidations dominated due to significant intraday volatility despite these gains rather than the session closing price.

According to AMBCrypto’s analysis, Bitcoin started trading at around $64,609 but then fell to around $62,212. This sharp decline caused the significant long liquidation volume observed.

By the end of the day, Bitcoin had recovered and was trading at around $65,288.

Source: TradingView

At the time of writing, Bitcoin was down over 1% and trading at around $64,254. If this trend continues, another day of long liquidation dominance is likely.

Bitcoin is seeing great activity

Bitcoin’s volume trend continues Santiment indicated decent trading volume. The chart showed that the highest volume during the previous trading session was approximately $41 billion.

aAs of this writing, volume has already exceeded $38 billion.

Read Bitcoin’s [BTC] Price forecast 2024-25

Although the current price trend favors sellers, there is potential for a shift if buyers can take control of the market.

Such a shift could change the ongoing liquidation trend, potentially reducing the dominance of long-term liquidations and stabilizing price movement.