Bitcoin liquidations have increased over the past day following the market crash that rocked the crypto space on Thursday. The result of this is a liquidation event, the likes of which have not been seen since the collapse of the FTX in 2022. And Bitcoin’s numbers have skyrocketed, as traders have been completely wiped out in the process.

Largest single crypto liquidation event in 2023

After Bitcoin’s price drop to the low $25,000, liquidations quickly ramped up, quickly closing over $1 billion dollars worth of crypto holdings. Bitcoin, in particular, suffered the most from these liquidations, as the number quickly climbed to 9 digits.

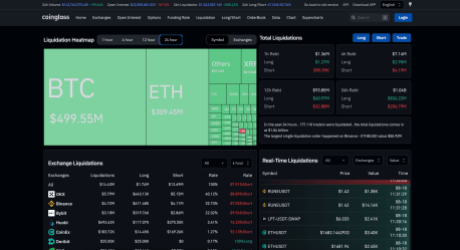

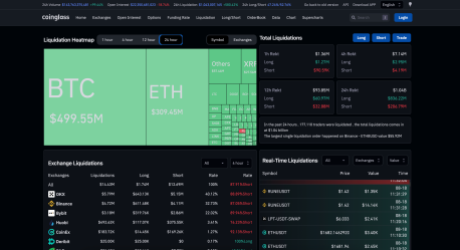

By the time Friday morning rolled around, the digital asset’s liquidation was around $500 million, with long traders taking the most losses. According to data from Mint glassBitcoin’s long liquidations have already exceeded $373 million, with shorts coming in at $125 million.

BTC liquidations almost at $500 million | Source: Coinglass

While Bitcoin led as expected, Ethereum was not that far behind. The second-largest cryptocurrency by market capitalization saw an even higher share of long liquidations compared to shorts. Of the $308 million in liquidations, long traders lost $254.59 million, while short traders took in $54.3 million.

Ethereum also saw the largest liquidation order. The order, worth $55.92 million at the time, took place on the Binance crypto exchange over the ETH/BUSD pair. However, the OKX exchange saw the largest Ethereum liquidations at $108.87 million, of which 92.8% are longs.

The tide is turning for Bitcoin

After the initial drop, Bitcoin started to show strength, pushing the price above $1,000. This recovery to $26,000 marked a potential turnaround for the digital asset and the shorts started to feel the heat at this point.

Over the past four hours, long traders have had a bit of a reprieve, as $8.53 million of the $10.96 million in liquidations to date have been short trades. However, long traders are still not left out with $2.46 million in liquidations.

As the Bitcoin price remains extremely volatile at this time, liquidation volumes are expected to increase. However, there is no indication so far where the price of the digital asset could head as bulls and bears continue a tug of war for control.

Bitcoin is currently trading at a price of 26,451, representing a price drop of 7.48% over the past day, according to data from Coinmarketcap. The asset has also seen a 110% increase in daily trading volume, which now stands at $34.47 billion.

BTC price falls from $29,000 to $25,000 | Source: BTCUSD on TradingView.com