This article is available in Spanish.

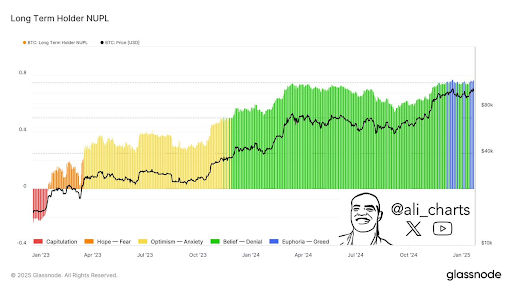

In a recent development, crypto analyst has Ali Martínez revealed that the long -term holders of Bitcoin have officially entered the greed area. This could be the price in the short term, although the long -term consequences can be serious. The greed phase suggests that Bitcoin holders are now overly optimistic about the future process of BTC.

Bitcoin-Langetery holders officially enter the greed area

In one XMartinez stated that Bitcoin holders in the long term, after they market cycleLet greed now prevail. With regard to market sentiment, these holders of capitulation have been transferred to hope, optimism and then faith, and are now in the phase of greed.

Related reading

This excessive optimism usually means that these investors accumulate more BTC without taking into account rational analyzes. In the short term This greed phase Is Bullish for the Bitcoin price, because this market sentiment could lead to more purchasing pressure and the flagship crypto could float higher.

This buying pressure for Bitcoin already seems to be clear, since the on-chain analysis platform Santiment revealed that the number of wallets with 100 to 1,000 BTC has broken a record high (ATH), rising to 15,777 wallets. The platform also mentioned that Bitcoin-Walvissen Peaked on steam this week with the inauguration of the US and a new BTC ATH, while transactions from more than $ 100.00 to their highest level rose in six weeks.

This greed phase is good for the BTC price, because it could continue to send the flagship crypto to new highlights. In the long term, however, this excessive optimism could put BTC in trouble boughtWhich would ultimately lead to a huge wave of sale that would make the Bitcoin prize plummet.

This greed phase among Bitcoin’s long-term holders seems to have been fueled by optimism around Donald Trump’s pro-Crypto administration and the strategic BTC reserve special. This is still a risk for the Bitcoin price, since the flagship Crypto could act well above its actual value if the BTC reserve is ultimately not created.

What should happen before BTC Bullish remains?

In another X-message, Ali Martínez Warned that the Bitcoin price should remain above $ 97,530 to stay bullish. According to him, this price level is the most important level of support that BTC should pay attention to, because it is crucial to stay above to maintain the current bullish momentum. Bitcoin is currently consolidating around this reach, after it had reached a new $ 109,000 ATH earlier this week.

Related reading

Meanwhile, crypto analyst Crypto Rover emphasized the $ 102,000 support area as the most important thing for the BTC price at the moment. His accompanying graph showed that the flagship Crypto could fall to $ 98,000 if it drops below this level of support.

At the time of writing, the Bitcoin price acts around $ 104,900, an increase of more than 2% in the last 24 hours, according to data from Coinmarketcap.

Featured image of Unsplash, graph of TradingView.com