- Bitcoin’s hashrate has been growing steadily for over a year.

- Hash ribbons signaled a good buying opportunity, while BTC’s RSI remained oversold.

About the last year, Bitcoin [BTC] has witnessed steady growth in its mining ecosystem as its hashrate continued to increase. In fact, the blockchain mining problem has recently hit an all-time high. While concerns remain about energy consumption, BlackRock, a leading investment management firm, expressed confidence in the BTC mining sector.

Read Bitcoins [BTC] Price Prediction 2023-24

The Bitcoin mining sector has potential

Recently, BlackRock became the second largest shareholder of the four largest Bitcoin mining companies. This clearly meant that the investment management company saw potential in the BTC mining sector and had high expectations. The company has recently increased its focus in the crypto space and the recent developments reflect its confidence in BTC’s future.

BREAK:

BlackRock is now the second largest shareholder of the four largest Bitcoin mining companies

— Whale (@WhaleChart) August 27, 2023

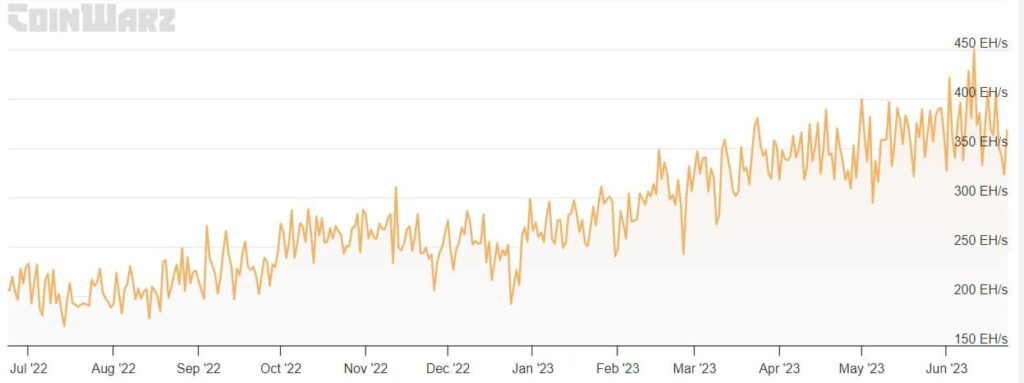

Actually, BTC‘s hashrate had been on the rise for years. Coinwarz’s chart revealed that the hashrate chart has risen significantly over the past year. At the time of writing, Bitcoin’s hash rate stood at 354.43 EH/s.

Source: Coinwarz

Higher hash rates suggested that more processing power was devoted to ensuring network security and validating transactions. If reported Previously, this also caused blockchain mining problems to peak and even reach an all-time high.

At the time of writing, Bitcoin is mining difficulty was 55.62 T. However, it should be noted that while the blockchain hashrate grew, miner revenues fell over the past seven days. One possible reason for this could be BTC’s sluggish price action.

Source: Glassnode

As miners’ earnings fell, they may have had to sell their assets to meet needs operational costs. This was evident from Glassnode’s factswhich showed that the balance of miners on August 26, 2023 also showed a decrease.

In addition, BTC’s Miners’ Position Index (MPI) indicated that miners sold their holdings in a moderate range compared to the annual average.

Something in store for Bitcoin investors?

Interestingly, Bitcoin mining statistics not only reveal the position of the industry, but also point to patterns and opportunities that can help investors make informed decisions. For example, the Hash Ribbon is a market indicator that assumes that Bitcoin tends to bottom out when miners capitulate.

At press hour, the 30-day moving average (MA) of hashrate was above the 60-day MA, generally suggesting a good buying opportunity for investors.

Source: Glassnode

Is your wallet green? Check the Bitcoin Profit Calculator

According to CurrencyMarketCapBTC’s price had only moved marginally over the past week. At the time of writing, it was trading at $25,913.27 with a market cap of over $504 billion.

However, things can change quickly, as with CryptoQuant facts be aware that BTCThe Relative Strength Index (RSI) was in an oversold zone. This could increase buying pressure and in turn raise Bitcoin’s price in the coming days.