On-chain data shows that Bitcoin has recently made a breakthrough that has led to rallies of at least 99% the last three times this has happened.

Bitcoin has now exceeded the cost basis of ‘Single Cycle HODLers’

In a new after On X, analyst Ali talked about a level that BTC recently broke. The level in question is the cost basis of long-term holders of Bitcoin with one cycle. The terms may be unfamiliar, so here’s what they mean, one by one.

First, the ‘long-term holders’ (LTHs) here refer to the investors who have been holding their coins since at least 155 days ago. The LTHs consist of the determined diamond hands or HODLers, who rarely sell even when market volatility occurs.

Next, ‘single cycle HODLers’ specifically refer to those LTHs who purchased BTC within a single cycle. Their range is typically estimated at 6 months to 3 years. This means that the oldest among these investors (with three-year-old coins) would have seen all the chaos of the current cycle, from the highs of the 2021 bull to the lows of the 2022 bear.

Finally, “cost basis” refers to the average purchase price of a group of Bitcoin investors. If the spot price of the cryptocurrency trades below this value, it means that the cohort in question is in a state of net loss. Likewise, the fact that the asset is at the top implies the dominance of profits.

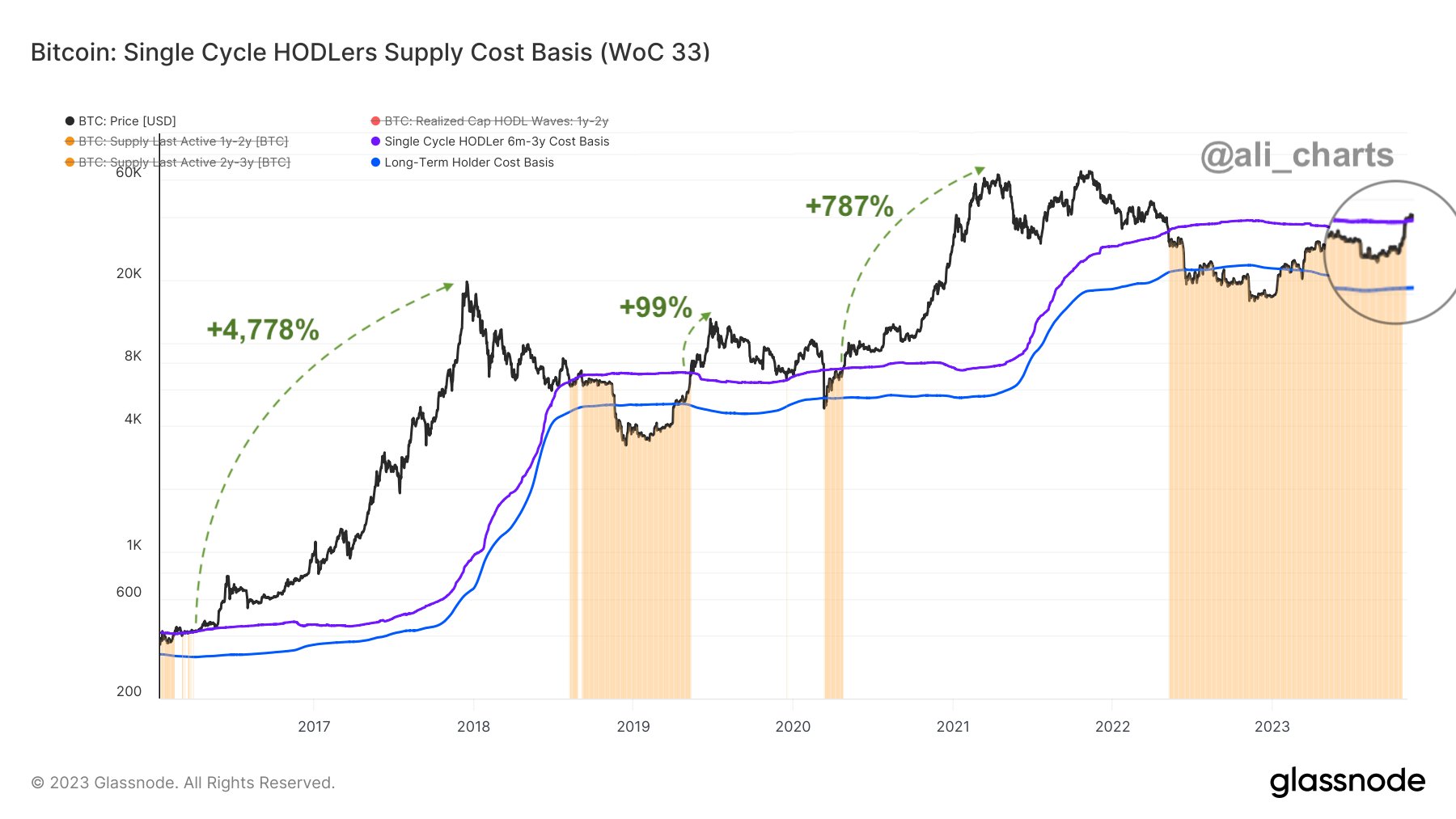

Here is a chart showing the trend in the cost basis of single-cycle LTHs over the past few years:

Looks like the price of the asset has interacted with this level in recent days | Source: Glassnode on X

Currently, this benchmark has a value of $34,150, meaning Bitcoin has already risen above it in the last rally. This means that the average single-cycle HODLer, who has been making losses since the first half of 2022, is now finally making a profit again.

In the chart, Ali has also highlighted the trajectory that BTC took during the last three times it broke above this level. It appears that each of the last two major bull rallies occurred after the breaks that occurred in 2016 and 2020 respectively.

From the time of this breach, the cryptocurrency enjoyed returns of 4,778% and 787% over the course of the respective rallies. The recovery rally that started in April 2019 also caused a break in this cost base, after which BTC posted a 99% gain.

If this pattern of the HODLer one-cycle cost basis paving the way for a Bitcoin rally is something that can be followed, then the asset could potentially see a rise now that it has broken above again.

Since Bitcoin’s current rally most closely resembles the April 2019 recovery rally, it is possible that if a surge does occur, it would be more in line with this rally, rather than the outright bull runs.

BTC price

Bitcoin has been stagnant lately as it has only registered a 2% gain over the past week while the price is now hovering above $35,200.

BTC has been stuck in consolidation recently | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Glassnode.com