- Hayes placed a buy call on BTC in anticipation of US dollar liquidity as the Japanese banking crisis worsens.

- However, another analyst suggests that BTC’s headwinds won’t end until the miner crisis ends.

Japan’s banking crisis is reportedly on the verge of exploding and could boost US ‘dollar liquidity’ and boost the economy. Bitcoin [BTC] and the overall crypto market.

In a new blog after on June 20, BitMEX founder Arthur Hayes viewed the potential impact of the Japanese banking crisis as a ‘pillar’ for the sector.

“This is just another pillar of the crypto bull market.”

According to Hayes, the fifth largest Japanese bank, Norinchukin is already under pressure and plans to sell $63 billion of US and European bonds.

The BitMEX founder added that the US may be forced to intervene to rescue the crisis, which could trigger a “stealth dollar liquidity injection.”

How will Bitcoin benefit from this?

According to Hayes, Norinchukin’s U.S. Treasury sell-off could prompt other megabanks to follow suit.

“All Japanese megabanks will follow in the footsteps of Nochu (Norinchukin) and dump their UST portfolio to make the pain go away. That means $450 billion worth of USTs will soon hit the market.

However, according to Hayes, the US might not allow the above scenario because “interest rates would rise higher,” making financing the federal government extremely expensive.

In response, the US could convince the Bank of Japan (BoJ) to use a repurchase facility program to ‘absorb the UST’s supply’. In return, the US will hand over “freshly printed US dollars” to the BoJ, increasing dollar liquidity.

The director also noted that a similar situation occurred in the fourth quarter of 2023, and “it was a race for all risk assets, including cryptocurrencies.” Furthermore, the US banking crisis in March 2023 caused BTC to rise +200% after a bailout was announced, Hayes explained.

For the founder of BitMEX, the US elections in November were yet another game that could force the US to intervene in the Japanese banking crisis.

“In an election year, the last thing the governing Democrats need is a huge increase in US interest rates that affects important issues that their average voter cares about financially.”

As a result, the next US liquidity injection would likely come from the Japanese crisis, which has been a boon for crypto investors. If so, Hayes urges investors to “buy the f**king dip.”

BTC dilemma

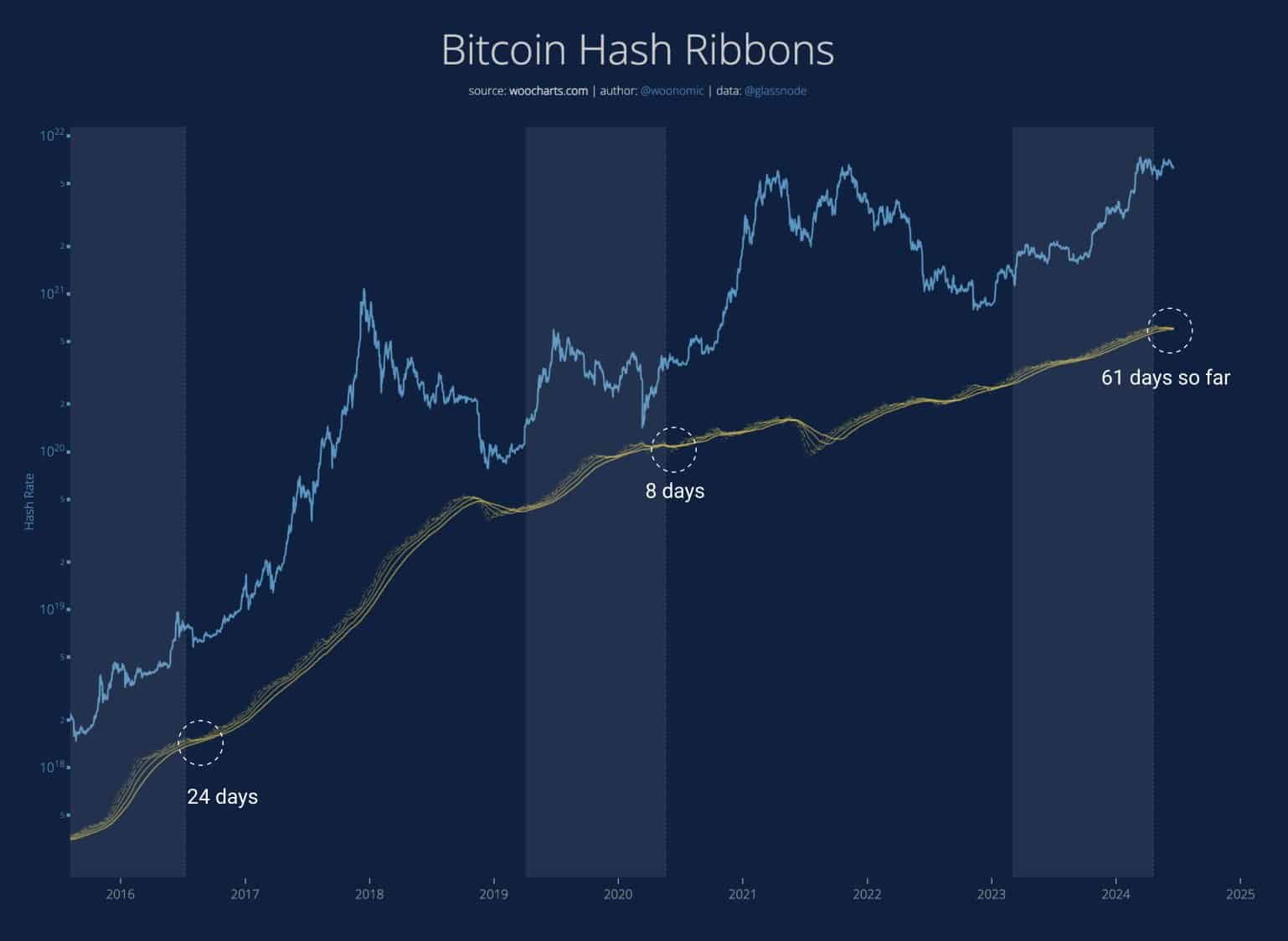

Despite the above macro buy signal for BTC from the troubles in Japan, the Bitcoin miner crisis was not over yet to confirm the buy call.

According to Willy Woo, a renowned BTC analyst, the BTC miner crisis lasted longer, and BTC will only improve.

When will #Bitcoin recover? It’s when weak miners die and the hash rate recovers.”

Source: Willy Woo