- Prices recovered to $26,301 at the time of writing, but the gains from the mid-June rally were reversed.

- Analysts equated the selling pressure with the aftermath of the FTX collapse and the US banking crisis.

After being frozen for weeks, Bitcoin [BTC] finally came to life during trading hours on Thursday. However, instead of flying into the air, the king coin crashed to the ground.

How much are 1,10,100 BTC worth today?

BTC falls off a cliff

The most popular cryptocurrency witnessed one of the sharpest price drops of 2023, dropping to $25,000 on August 17. Although prices recovered to $26,301 at the time of writing, the gains from the mid-June rally had effectively been erased.

Bitcoin’s implosion led to a bloodbath in the broader crypto market. The global market capitalization fell 7.42% in the past 24 hours, per CoinMarketCap facts. The total crypto volume exploded by 81% in the past 24 hours to $67 billion, an indication of the intense selling wave.

In fact, one popular on-chain analyst equated the ongoing situation with the aftermath of the FTX collapse and the US banking crisis — two of the crypto market’s most bearish events in the past 12 months.

Wow.

The selling pressure is similar to the #FTX collapse and the Silicon Valley Bank Crisis.

This is crazy 🥴 https://t.co/hDbNFuaDEX pic.twitter.com/M1vvsTuRxm

— Maartunn (@JA_Maartun) August 17, 2023

The analyst’s observation was based on the Net Taker Volume indicator, which dipped deeper into negative territory. It is calculated by finding the difference between the Taker Buy Volume and the Taker Sell Volume. Negative readings reflected that the market was dominated by sellers.

Dumping whales, but others bought into the dip

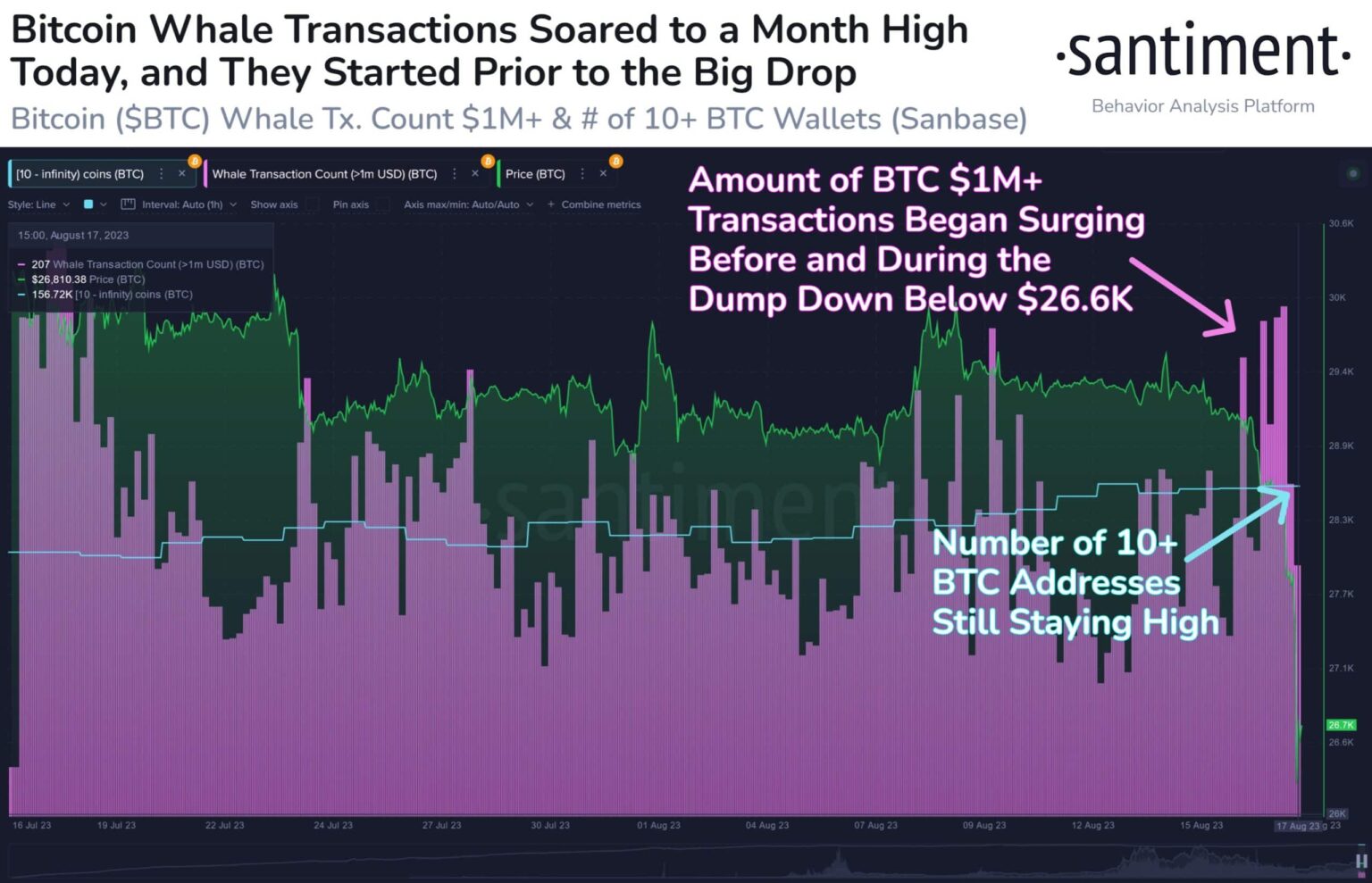

A significant portion of whale investors contributed to the selling pressure. According to data from on-chain research firm Sanitationtransactions involving more than $1 million BTC rose to levels not seen in the past month.

In reality, trades started piling up even before the meltdown, when BTC dropped below $29,000 on Aug. 16.

Source: Sentiment

Interestingly, the number of wallets holding more than 10 BTC did not see a major drop. This possibly explained that some holders used the landfill to fill their treasuries. Further research of user cohorts confirmed this claim.

The number of addresses holding between 10 and 100 BTC tokens has increased by 70 in the past 24 hours. In addition, at least four more wallets have been added to the cohort of 100-1,000 users.

Source: Sentiment

Much of the discussion on crypto-related social media has centered on “Buy the Dip” mentions. The phrase-cum-strategy is used by investors, where an existing long position is expanded with a fundamentally strong asset.

📉 After #altcoins spent the past week bleeding, #Bitcoin finally had its own implosion… and took everything #crypto away with it. Prices recover slightly, but this dip was enough for the public to evoke #buydip at the highest level since April. https://t.co/SwBU58tnqr pic.twitter.com/O65Hs0w8VM

— Santiment (@santimentfeed) August 17, 2023

Volatility is back

The latest turn of events created the coveted volatility in the market, which has been seen as both a USP and a curse, depending on how you look at the crypto landscape.

According to on-chain tracking company Glassnode, 1-week realized volatility for the king coin rose to a month high. Such a fight was last seen after XRP’s victory in the legal battle with the US Securities and Exchange Commission.

Source: Sentiment

The increase in volatility led to more interaction with centralized exchanges. Inflows to trading venues, which had hit an all-time low prior to the event, also hit a one-month high. In fact, transfers to exchange addresses have been on a steady upward trend since the start of the week.

Derivatives markets were also swept up in the tornado of extreme volatility. Long positions worth more than $843 million have been liquidated in the past 24 hours, according to a Coinglass report. However, as people bought into the dip and prices recovered, bearish leveraged traders suffered as shorts worth $196 million were wiped out.

In total, liquidations worth more than a billion were in the market at the time of writing.

174,892 traders were liquidated in the last 24 hours, total liquidations totaling $1.04 billion

Long

$843.83 million

Short

$196.13 millionhttps://t.co/C47AgBCcTk#BTC pic.twitter.com/TOL753FteD— CoinGlass (@coinglass_com) August 18, 2023

Is your wallet green? Check out the BTC Profit Calculator

As prices crashed, market sentiment shifted to fear, according to the latest reading of the Bitcoin Fear and Greed Index. This was a sign that investors were concerned and could dump more of their holdings in the coming days.

Market sentiment turned to fear after hovering in the neutral zone for two months.

Source: alternative.me