- BTC was still in a bull market, according to the CEO of Ark Invest.

- US Spot BTC ETFs saw a 3-day intake streak, but can the BTC recovery increase?

Despite recently Bitcoin [BTC] Losses and Berenmarkt calls, Cathie Wood from Ark Invest was positive about the prospects of the cryptocurrency. In a Bloomberg interview, Wood repeatedly That the market was still in a bull market.

“Bitcoin is a bit halfway through the 4-year cycle.

The Exec held its BTC race target of $ 1.5 million by 2030.

Mixed view of Bitcoin

Cio Matt Hougan from Bitwise too reflect The Bullish Sentiment from Wood, which states that either the current macro uncertainty was canceled, could surpass the actively at the end of the year $ 200k.

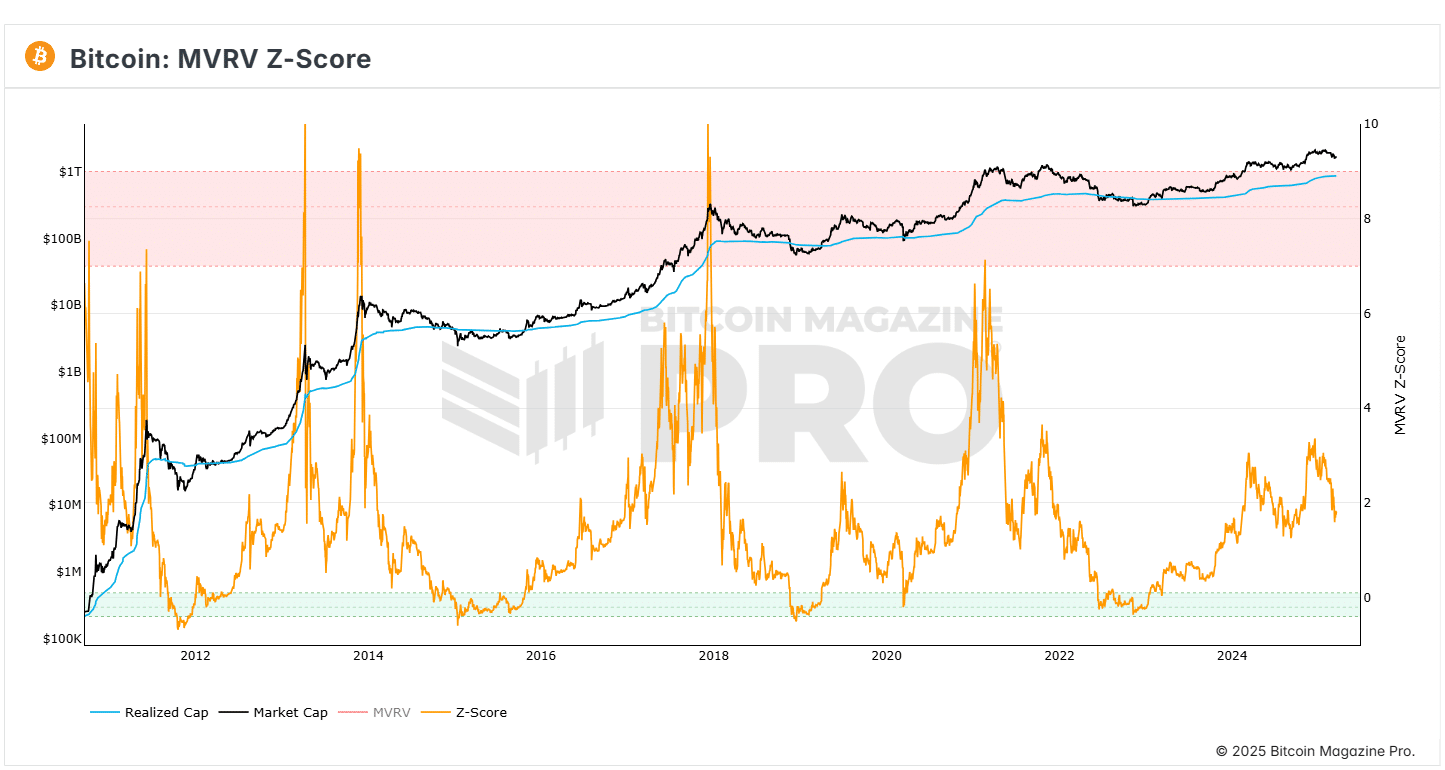

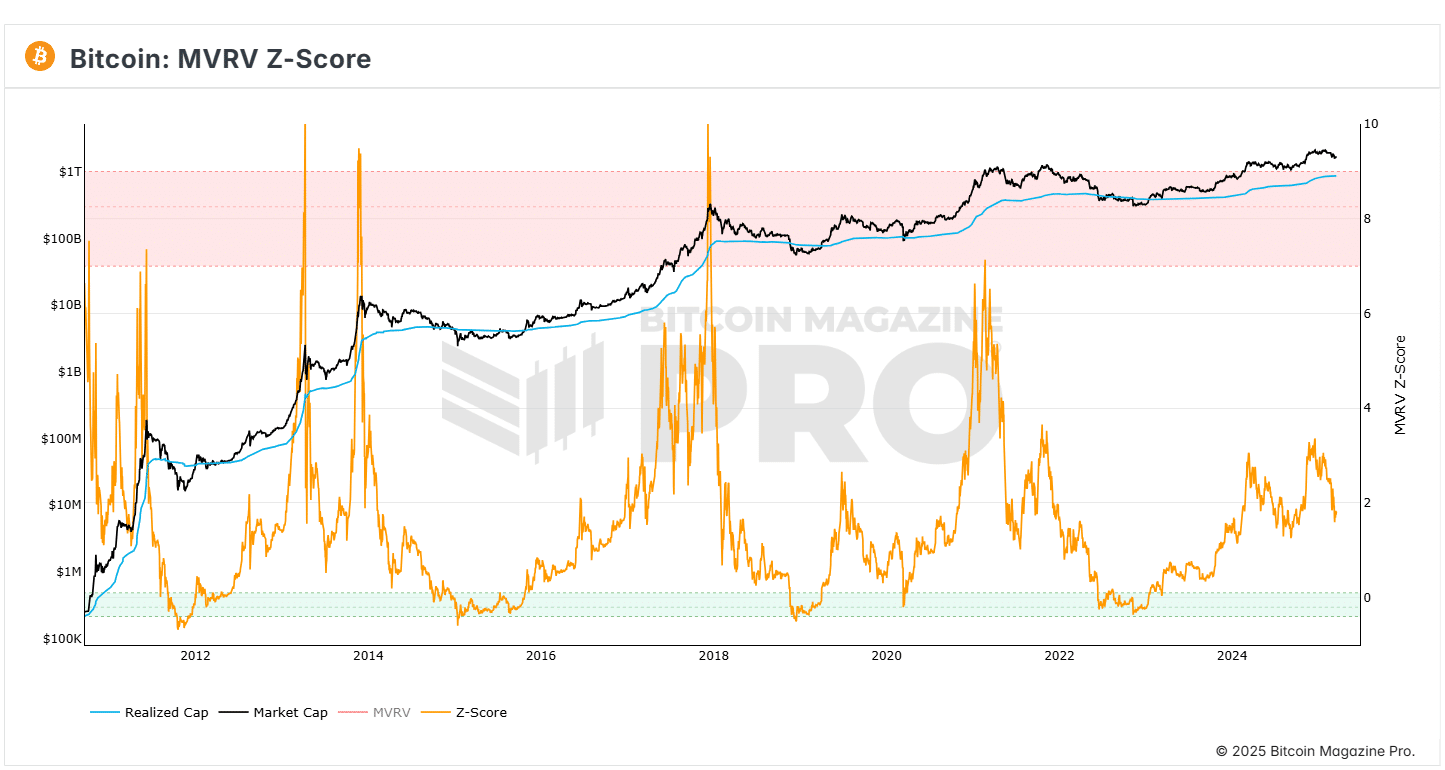

The Bullish projections were aligned with the MVRV-Z-score, a common valuation model and Cycle Top indicator. It was 1.5 and close to last year’s local soil. Interesting is that the indicator was almost at the same level in December, it did in Q1 2024.

In comparison with cycle tops above 6 (upper band), BTC had room for growth if historical trends were repeated.

Source: BM Pro

But the CEO of Cryptoquant, Ki Young Ju, made one bear call And noticed that the bullmarkt was over for the next 6-12 months. The analyst called weak ETF streams and volume to push BTC above $ 100k.

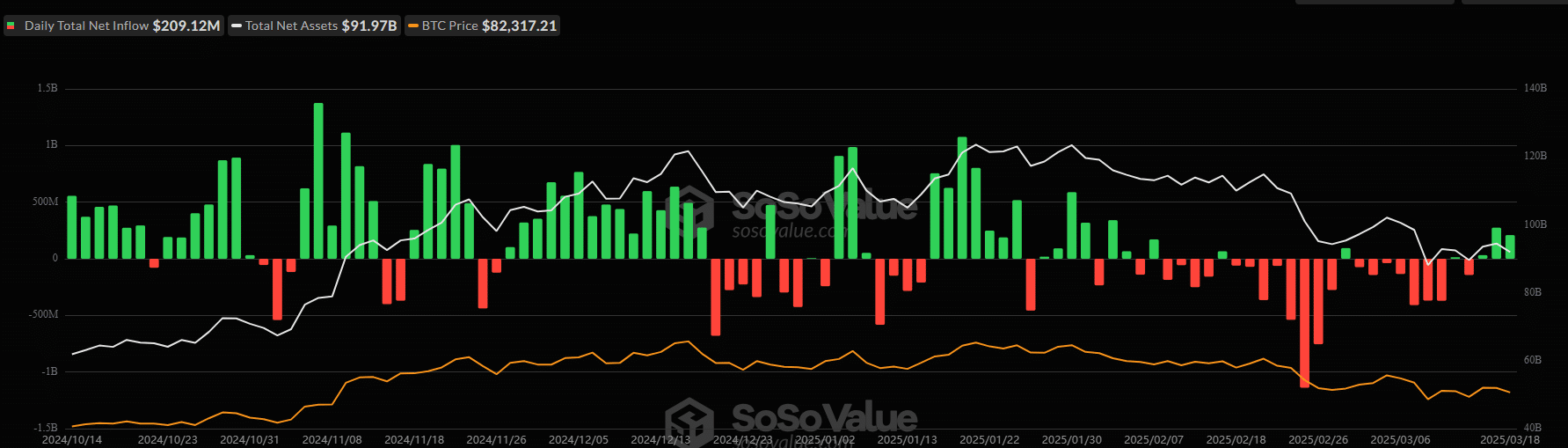

Here it is worth noting that the ETF products have recorded three consecutive days of inflow, which reverses the caring outflow trend in the past three weeks.

On March 17 they saw $ 274.5 million inflow, followed by another $ 209 million question on March 18, per SOSO value data.

It can still be seen whether the renewed question will expand and stimulate the BTC recovery in the short term. BTC was currently appreciated at $ 83k for the announcement of the Fed Rate.