- Bitcoin was steady above $60,000 but struggled to break the $70,000 resistance level.

- One analyst highlighted unrealized profits and whale activity as indicators of a potential buying opportunity.

Bitcoin [BTC] continues to show resilience by holding above the USD 60,000 mark, although it still needs to make significant progress towards breaking the USD 70,000 resistance.

After a brief rise to $64,000, the cryptocurrency faced a correction and fell to $62,340, down 1.8% in the past 24 hours.

Despite the price fluctuations, many analysts remained optimistic about Bitcoin current statushighlighting potential buying opportunities amid ongoing consolidation.

Bitcoin: Buying Opportunity Ahead?

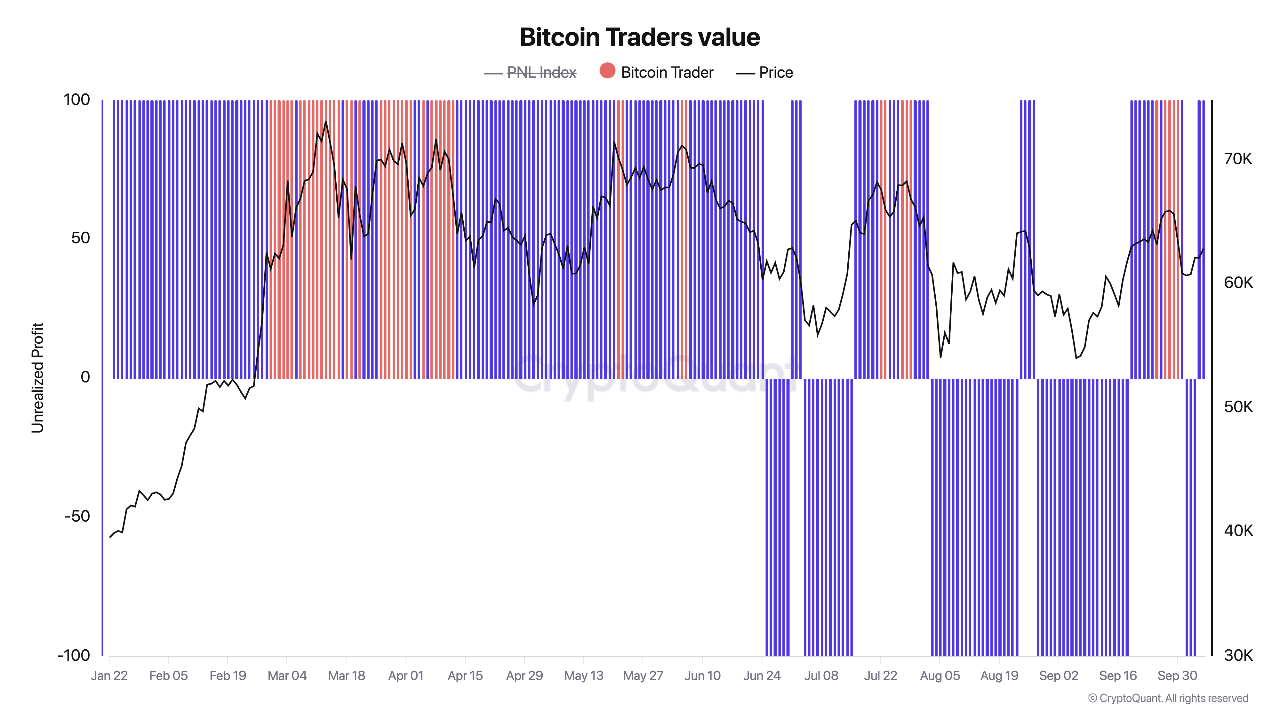

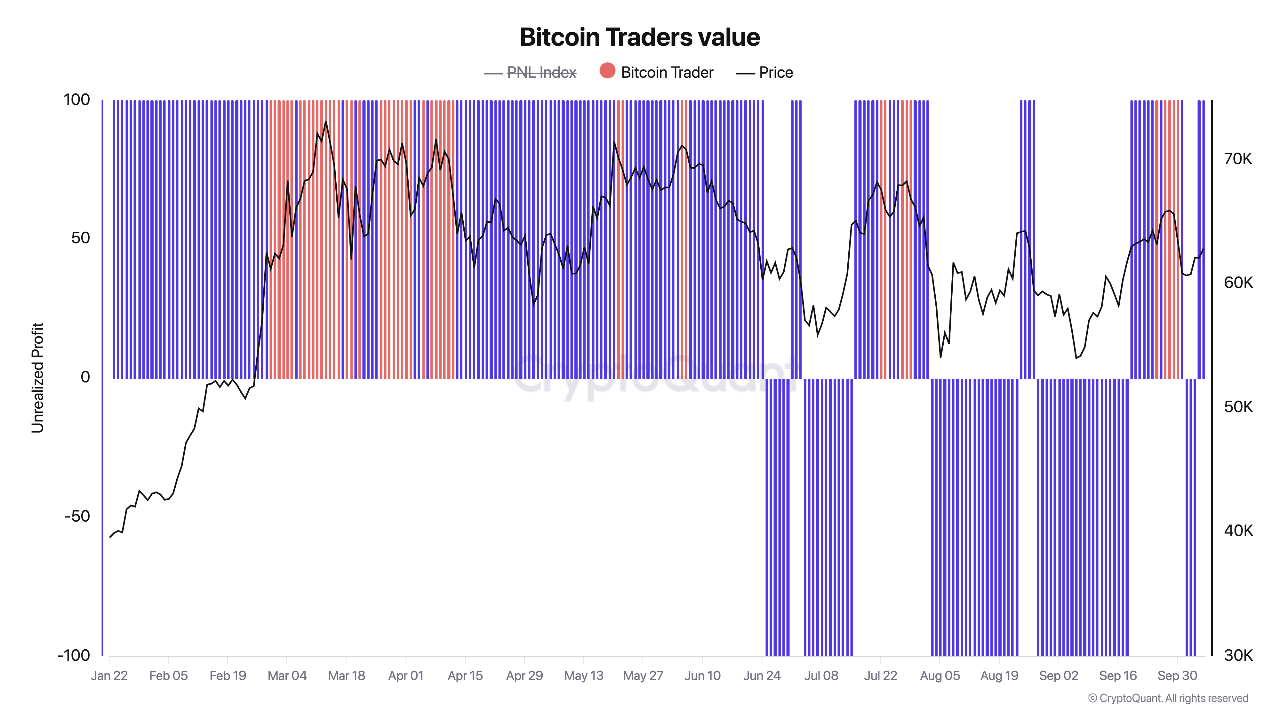

CryptoQuant analyst “Darkfost” provided insights in Bitcoin’s current market position, emphasizing the unrealized profit metric.

The analyst explained that high levels of unrealized profits often indicate potential selling pressure, as traders may be tempted to take profits when sitting on significant profits.

Conversely, negative unrealized gains indicate that traders are holding positions at or below their entry prices, which may indicate that the market is approaching a bottom and presents an ideal buying opportunity.

Darkfost pointed out that Bitcoin’s current negative unrealized profit zone indicates that many traders are taking positions with little to no profit, indicating that a market bottom may be forming.

The analyst noted:

“Currently we are mostly in the negative zone, which could indicate potential opportunities.”

Source: CryptoQuant

Additionally, Darkfost highlighted that unrealized gains have reached unprecedented levels, unlike previous market cycles, suggesting that the ongoing cycle could pose unique risks and opportunities for investors.

Back up the data

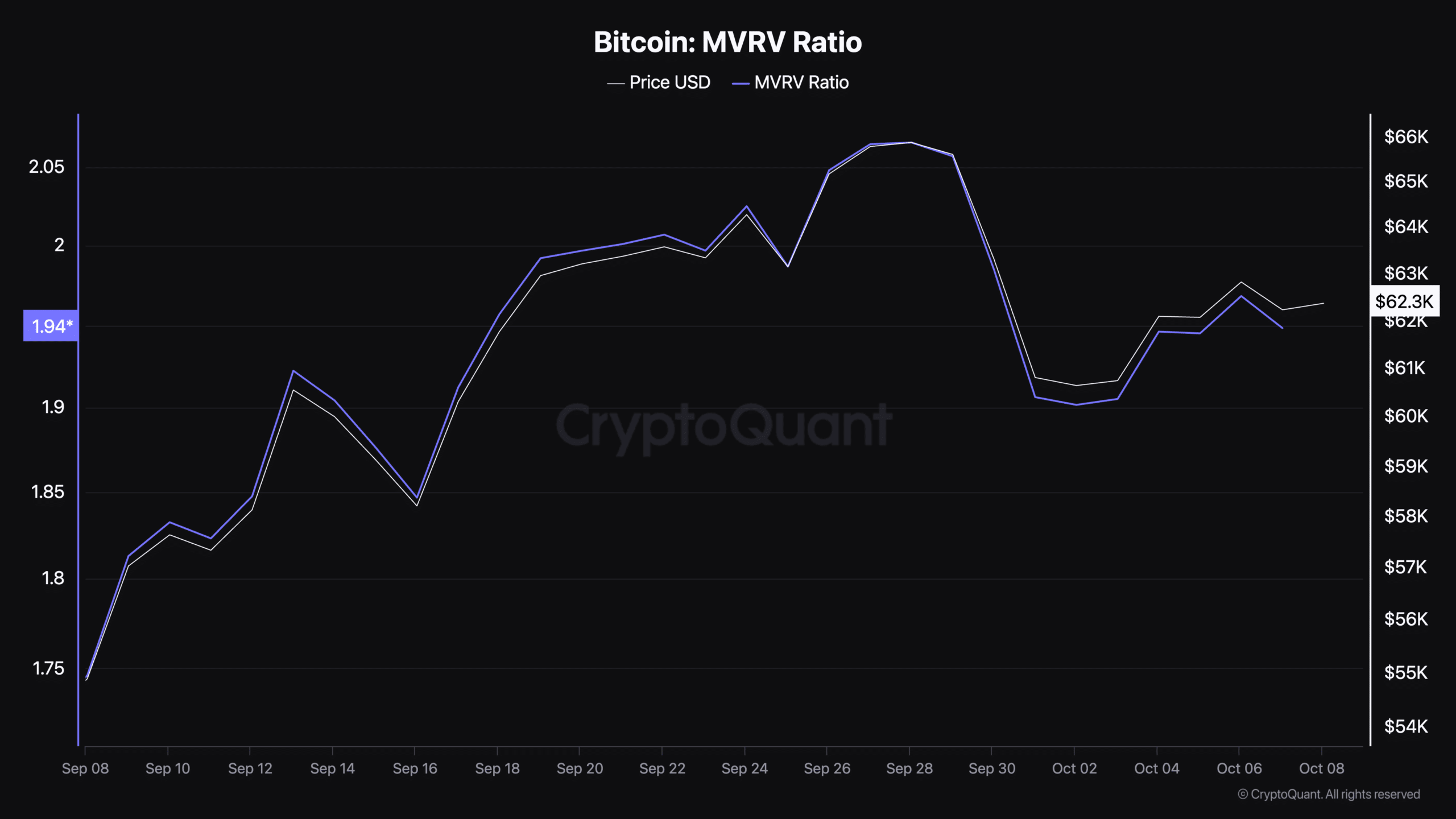

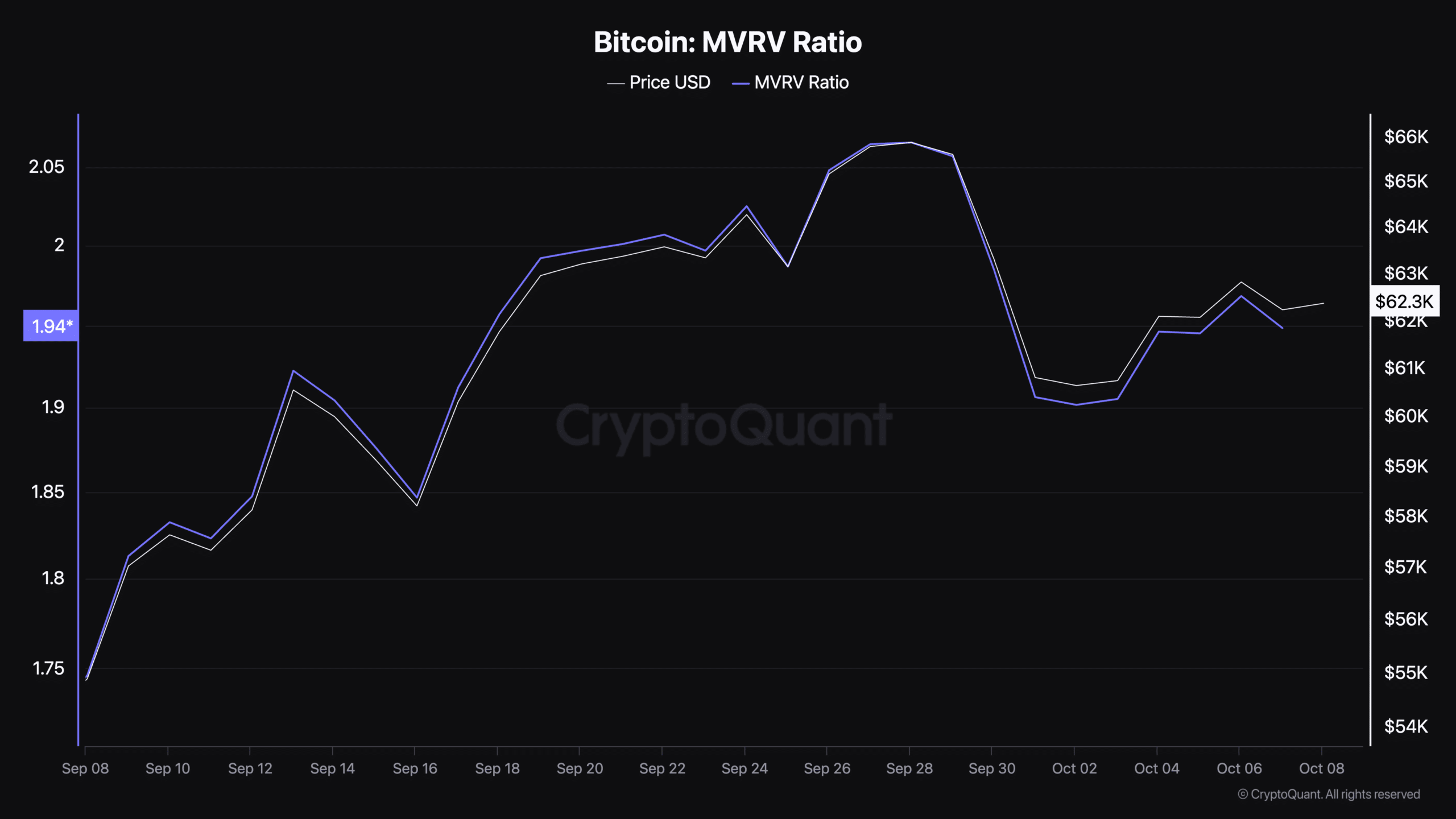

To further assess Bitcoin’s market position, it is worth considering other key indicators such as the market value to realized value ratio (MVRV).

The MVRV ratio compares Bitcoin’s current market value to its realized value (the price at which all coins last traded).

When this ratio is high, it can indicate overvaluation and potential market corrections, while a low ratio indicates undervaluation and buying opportunities.

As of today, Bitcoin’s MVRV ratio is the same increased from 1.74 last month to 1.94, indicating that the market is approaching a more balanced level but still has room for growth.

A rising MVRV ratio suggests that Bitcoin is gaining value compared to its historical performance, which could indicate positive sentiment in the market.

Source: CryptoQuant

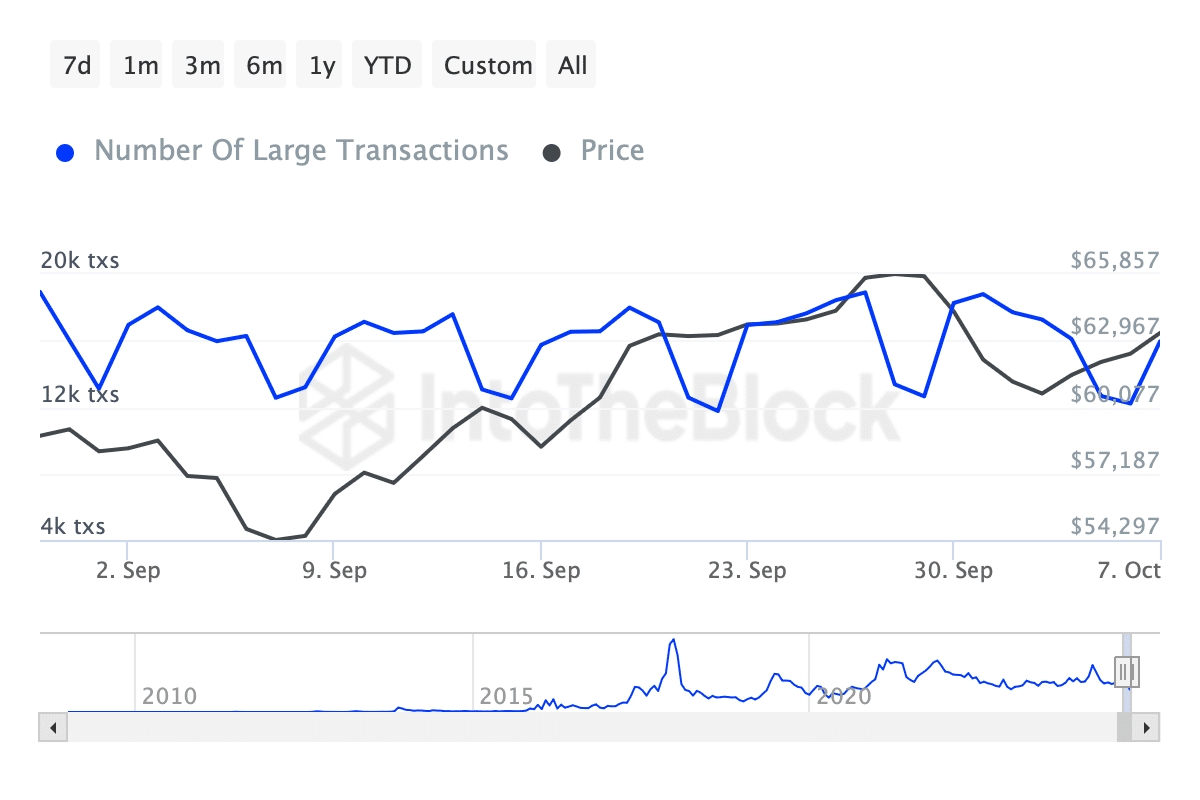

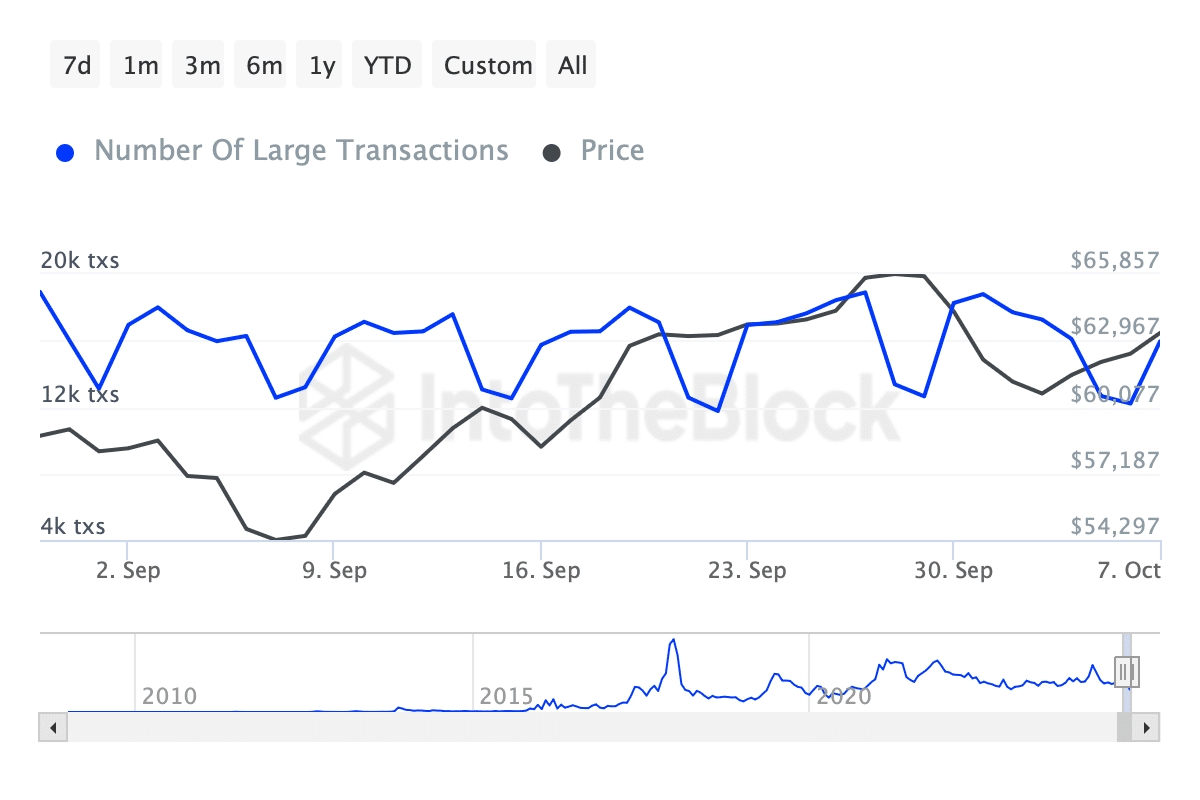

While price action and profitability metrics provide valuable insights, Bitcoin’s whale activity is another important factor worth monitoring.

Facts from IntoTheBlock revealed that transactions over $100,000 have increased significantly in recent days.

The number of such large transactions has risen from less than 13,000 to more than 15,000, indicating growing interest from institutional investors and high-net-worth individuals.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024–2025

This increase in whale transactions generally suggested that large investors were accumulating Bitcoin, which could further support the price and indicate confidence in the future growth of the King Coin.

The involvement of whales often precedes significant market movements, as their trade can strongly influence the overall dynamics of supply and demand.