Este Artículo También Está Disponible and Español.

Bitcoin’s recent price crash took the Entire market surprisedAs a result, bullish investors lose losses. In particular, this crash Bitcoin saw its foot lost at the price level of $ 90,000 and expanded a crash Multiple cryptocurrencies.

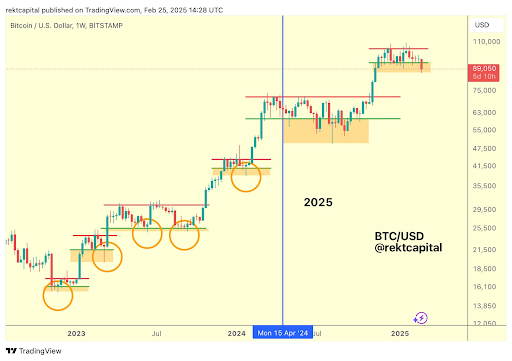

Technical analyst stretches Capital drawn this withdrawal as a downward deviation within a re-accumulationment, During potential market changes In the coming weeks.

Bitcoin’s falls below $ 90,000: a necessary reset?

Bitcoin’s break in recent days under $ 90,000 marks his first time Trade below this level since November 2024. After months of ongoing upward boost, Bitcoin began to consolidate under the price level of $ 100,000 and spent most weeks between $ 90,000 and $ 100,000.

Related lecture

This consolidation phase, although disturbing to some investors, was interpreted by some analysts As a natural part of Bitcoin’s wider market cycle. Crypto analyst stretches Capital has noticed That bitcoin often undergoes phases of re-accumulation during bull cycles, so that the market for the next leg can be reset. According to his assessment, the current price movement is in line with historical trends, with Bitcoin establishing an accumulation floor for another meeting.

Interesting that Bitcoin’s Recent break below $ 90,000 is part of this phenomenon of travel cargo. Capital describes this as a “disadvantage” within the reach of the range, which is a pattern that Bitcoin has exhibited several times in previous cycles.

What to expect from the next step from BTC

Phases for herncumulation are generally emphasized by buying pressure from a few whales and investors in the retail trade, while the larger market continues to sell. According to Data from On-Chain Analytics platform Glassnode, some long-term Bitcoin holders are not underfilled by the recent price crash. The newest sale has even offered them an important accumulation option, with these long-term addresses increasing their total Bitcoin interests with 20,400 BTC in the last 48 hours.

Related lecture

Bitcoin’s future process will depend on how it responds within this re-accumulation oak. If Bitcoin successfully recovers $ 90,000, this could confirm that the break below was only a shakeout before it wins further. A strong rebound of this level would probably restore the bullish sentiment, allowing the road to free the road for a substantial break above $ 100,000.

A longer decrease of less than $ 90,000 can, however, be very devastating for Bitcoin and its long -term holders who are currently gathering in the travel -off -off zone, because there is no Much of a support level To support every downward trend to the price level of $ 70,000.

At the time of writing, BTC acts at $ 88,628, which reflects a decrease of 7.5% in the last seven days. However, the cryptocurrency has demonstrated early signs of stabilization, after about 2% after reaching an intraday layer of $ 86,867.

Featured image of Adobe Stock, Chart van TradingView.com