Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

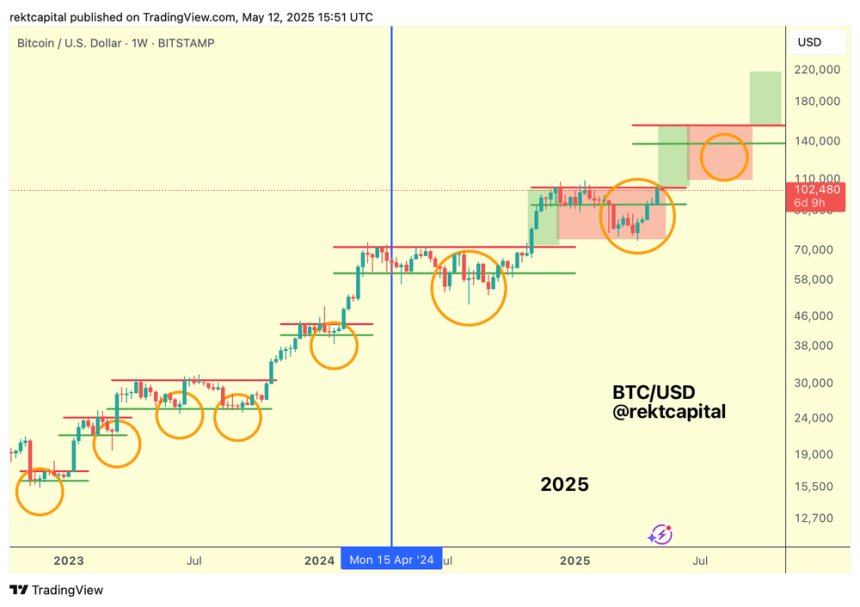

After jumping with 10% last week, Bitcoin (BTC) has reached a crucial resistance level that the flagship Cryptos Rally could stop or stop for a new all time.

Related lecture

Bitcoin affects key level

Bitcoin recently jumped above the $ 100,000 barrier for the first time since February. During its important weekly performance, BTC has risen more than 10% to reach a highest point in three months of $ 105,500 on Monday, so that the sentiment of investors with regard to a new ATH rally is fueled.

On Monday, Analyst stretches Capital marked That the Crypto flagship collected over the entire re-accumulation grade and closed its disadvantage and the first prize discovery correction. After he has risen high from $ 104,500, Bitcoin confronted with rejection of this key level, as well as his rally.

He pointed out that Bitcoin already had his first price discovery and price discount correction. The Cryptocurrency is now trying to confirm its second price discovery, but must recover the level of $ 104,500 as support to confirm this phase.

As the analyst has explained, this level currently acts as a resistance after the week was closed at $ 104.118, just below the reach. He added that “technically BTC can try to confirm an upward trend beyond this point by closing above $ 104.5K daily and then keeping it as support, so it will be worth looking at this lower period of time.”

However, until that confirmation is, this resistance will continue to act as one. And as resistances do, they tend to reject the price. “

According to Rekt Capital, Bitcoin has repeated some important elements from his mailing range in its current reach, which suggests that if BTC continues to reject this level, it could have to do with a retest after the outbreak of its lower high resistance.

One dip left for ATHS?

Earlier, the analyst described that BTC could repeat the performance of Q4 2024, whereby the cryptocurrency recovered from his downward deviation to hit a new ATH.

BTC was initially rejected at the lower high resistance and fell at the lows of the range before he broke above the lower high, re -testing as support and rose to a new Ath.

To repeat history, BTC must be rejected at $ 99,000, $ 93,500 as support and the range of $ 97,000- $ 99,000 breaks before it is rejected on the resistance of $ 104,500, which is the level to be supported for Bitcoin to break into his second price manure discovery. “

In particular, BTC followed this path closely last week, was rejected near $ 99,000 and re -testing the support of $ 93,500 before jumping above $ 100,000. To continue this version, the Cryptocurrency must fall until the range of $ 97,000 $ 99,000 and to keep it as support for a similar outbreak as new ATHS.

Related lecture

In his Monday analysis, Capital stretches that the lower high high resistance of BTC is at the level of $ 98,500, indicating that a 5% decrease could be for us. However, he noted that the retest “does not have to happen at all”, because Bitcoin could close above the key resistance daily, keep this level and visit new Aths.

“But in the case of a dip, converting the lower high resistance into a new support could fully confirm the interruption of this lower high, can make it in new support and BTC’s positioning in the $ 98.5k- $ 104.5k part of the travel carpet,” he concluded.

Featured image of unsplash.com, graph of TradingView.com