- Whales’ Bitcoin transfers fuel sell-off speculation.

- The institutional commitment to BTC remains strong and is overtaking retail.

Bitcoin [BTC] is about to make history again in 2024. AMBCrypto recently reported that this week would be crucial in dictating BTC’s prospects, determining whether the company would join the cyclical trend and climb higher or lean toward the monetary outlook and a decline.

It seems that the king coin has followed the old path. On October 29, the leading cryptocurrency rose past the crucial $70,000 mark for the first time since June.

It peaked at $73,620 Binance– just shy of a hundred dollars highest ever of $73,777. At the time of writing, BTC was exchanging hands at $72,350, up about 2% in the past day.

This impressive rally reignited bullish sentiment among investors. Yet it also raised a pressing question: will this breakthrough trigger a wave of profit-taking?

Are BTC sales coming?

Recent activity indicates that a sell-off may be underway. According to Look at chainFollowing Bitcoin’s rise above $71,000, a whale wallet containing 749 BTC (worth $53.23 million) became active after remaining inactive for twelve years.

This whale originally collected BTC in 2012, when Bitcoin cost just $11, making a total investment of $8,151 at the time. Now it has transferred 159 BTC ($11.32 million).

Another major player that may be preparing for a payout is the government of Bhutan. Blockchain intelligence platform Arkham Intelligence revealed that crypto wallets tied to the Royal Government of Bhutan moved $66.55 million worth of BTC to Binance.

It is striking that their last deposit was four months ago, at the beginning of July. At the time of writing, Bhutan owned 12,47,000 BTC, worth $904.34 million.

Source: Arkham Intelligence

BlackRock is doubling its Bitcoin holdings

While a sell-off looms, BlackRock has remained firmly committed to Bitcoin. If noted Through Look at chainthe asset management giant bought another 4,528 BTC worth more than $322 million on October 28.

Furthermore, BlackRock has significantly increased its Bitcoin holdings over the past two weeks. add Added 34,085 BTC to his wallet. This addition was valued at approximately $2.3 billion.

The latest purchase brought his holdings to 408,253 BTC, valued at a staggering $29.09 billion, indicating strong institutional interest in the asset.

Where are the private investors?

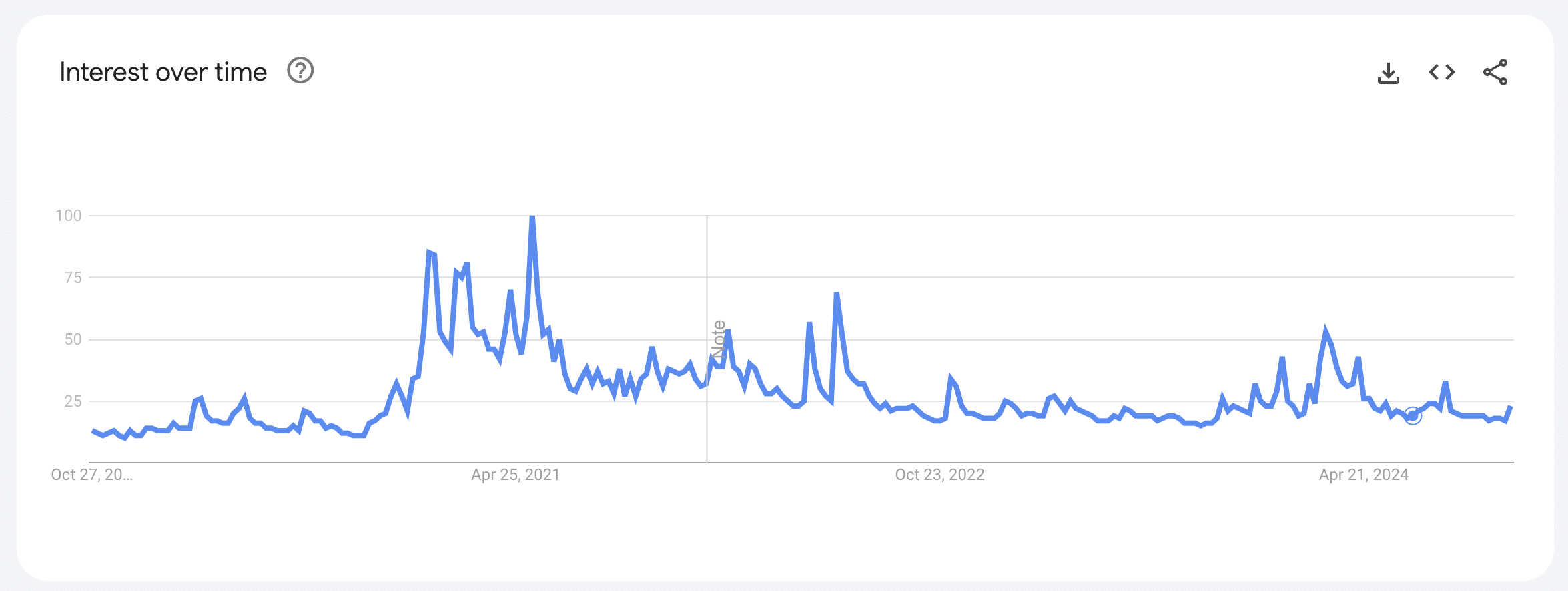

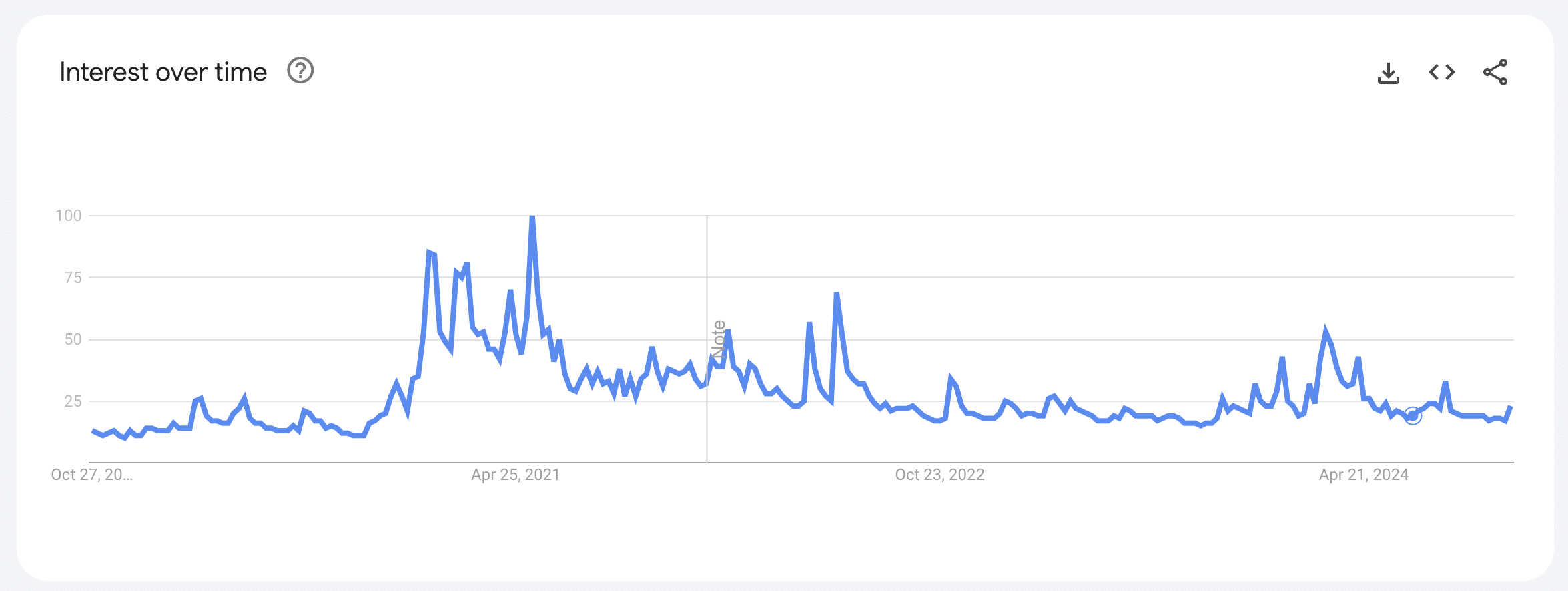

Despite Bitcoin’s remarkable price performance, the retail industry seemed to be sleeping on this asset. GoogleTrends facts revealed that search interest for “Bitcoin” scored just 17 out of 100 last week. At the time of writing, the value had risen slightly to 23.

Source: Google Trends

Meanwhile, the latest from CryptoQuant report indicated that private participation was overshadowed by larger investors.

However, as retail investors gradually reentered the market, their investments grew at an unusually slow pace.

Furthermore, Bitcoin transfer activity among retail investors remained relatively low. Daily transfers totaled just $326 million on September 21, the lowest level since at least 2020.

Historically, low transfer activity by retail investors often precedes Bitcoin price increases, a trend that appears to be playing out now.

Read Bitcoin’s [BTC] Price forecast 2024–2025

As Bitcoin approaches record highs, the interplay between whales, institutions and retail could determine its short-term trajectory – one that could pave the way for all-time highs or a profit-making lull.