- The power of Bitcoin was clear because ERC-20 Altcoins saw Sharp drops, with the sector in just 14 days $ 234 billion waste.

- Altcoin markets were confronted with a rare historical devaluation.

Bitcoin [BTC] his resilience remained in the midst of a broader market, which last week performed considerably better than the ERC-20 Altcoin sectors.

The latest data revealed a pronounced decline in several subsectors, with an emphasis on a grim divergence in market performance.

With Altcoin evaluation that experienced one of their greatest devaluations in years, the wider cryptomarkt is confronted with increased volatility.

Bitcoin holds while Altcoins dive

Despite market-wide weakness, Bitcoin has retained a stable position, which performs better than all ERC-20 Altcoin sectors.

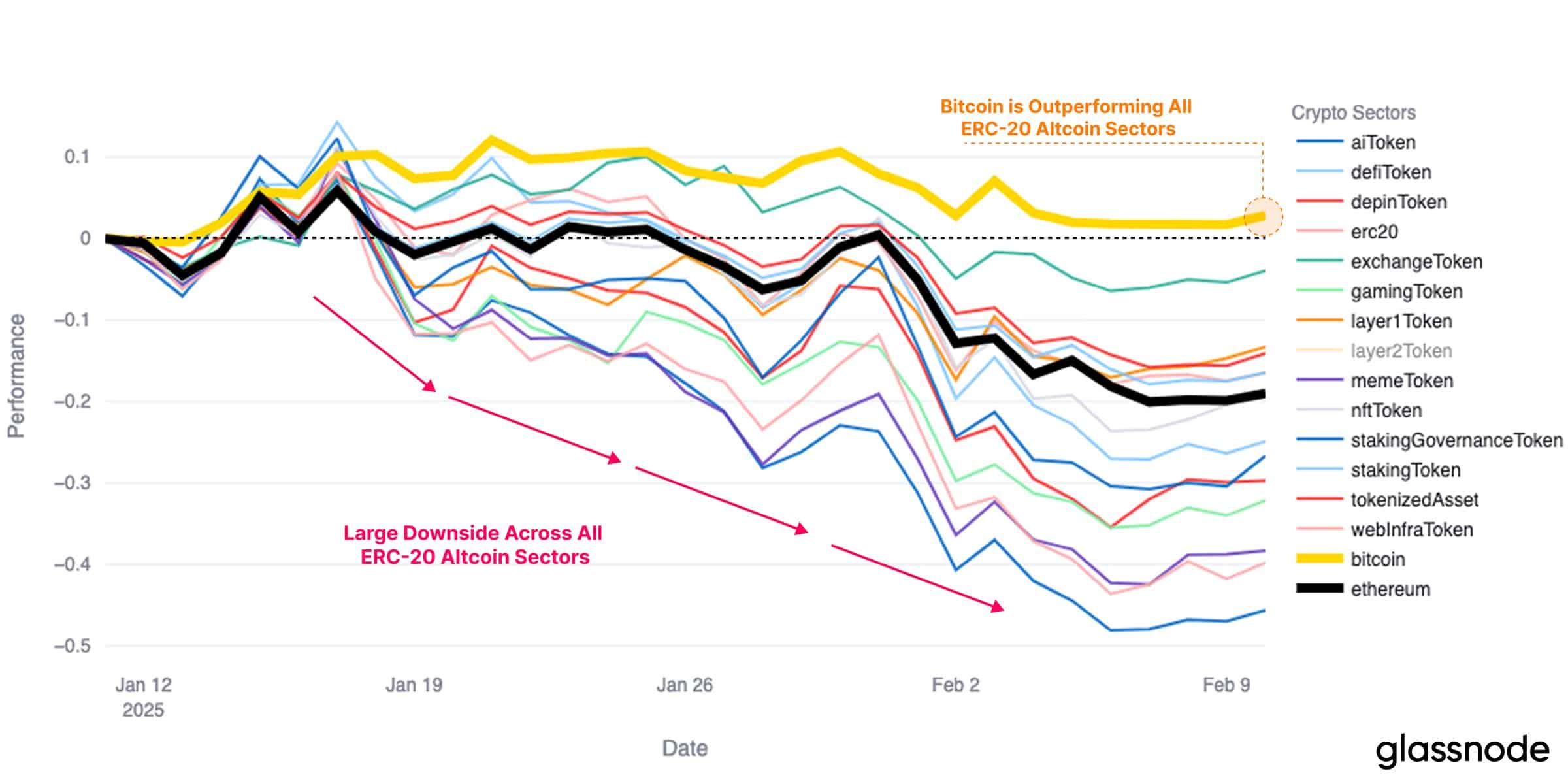

According to Glassnode’s Performance card, Bitcoin [yellow line] has kept above the neutral threshold, while retaining relative stability compared to Ethereum [ETH] [black line] And various Altcoin categories that have suffered significant falls.

Source: Glassnode

An important pick-up meal of this trend is the extensive disadvantage of ERC-20 sub-sectors, including Defi-Tokens, Gaming tokens and Meme tokens, all of which have been trived down since mid-January.

The sharp drop suggests decreasing investor confidence in Altcoins, with capital rotation that prefer Bitcoin. This shift emphasizes the role of BTC as a safer active during uncertain market conditions.

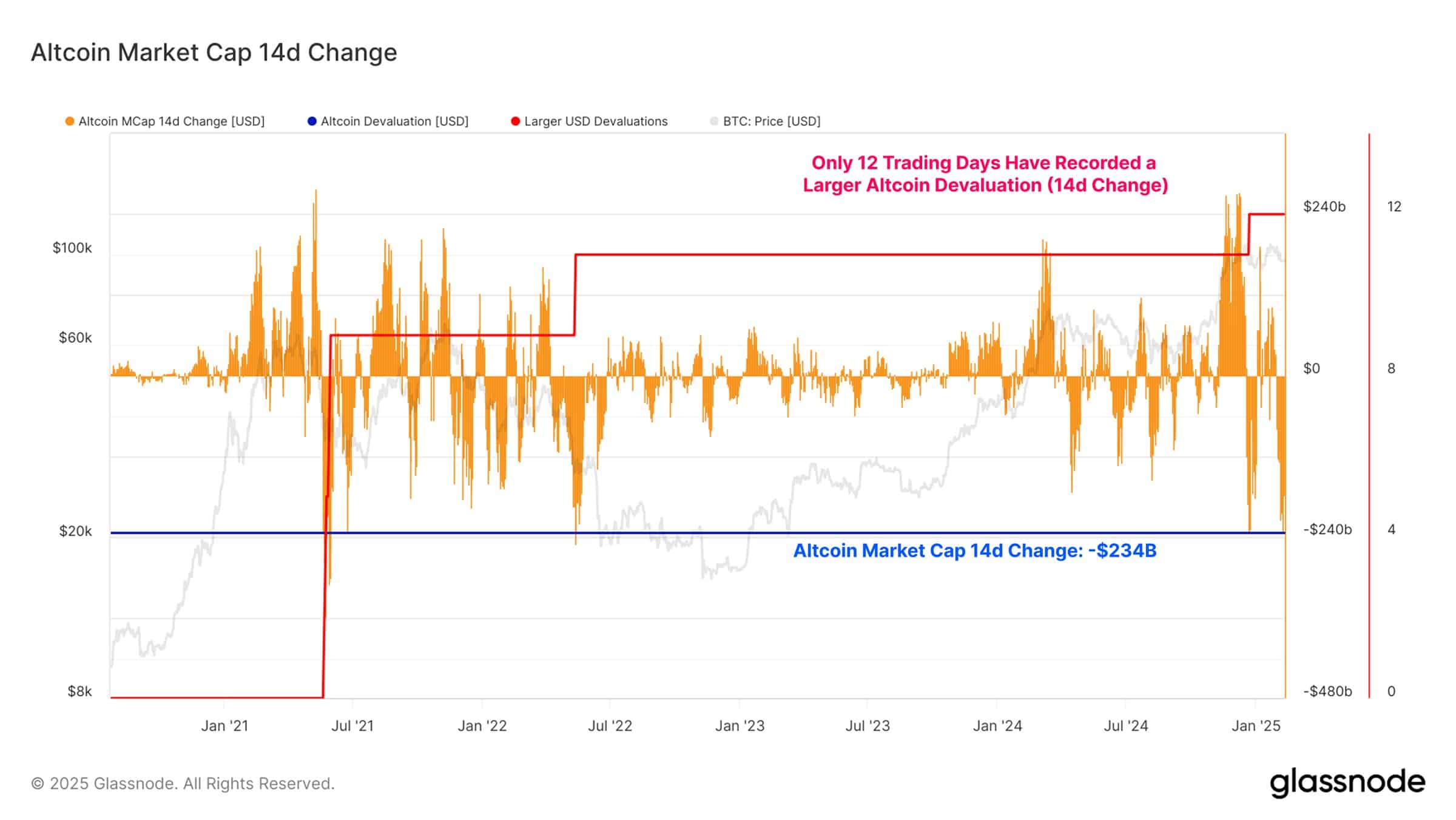

Altcoin Market sees one of the largest 14-day devaluations

Look at Glassnode’s Altcoin Market Cap 14-day change diagram strengthened this bearish trend, with a stunning decrease of $ 234 billion in Altcoin market capitalization in the past two weeks.

Historically, such significant falls were rare, with only 12 previous trading days witnessing a larger Altcoin devaluation.

This level of deduction suggests that the appetite in the Altcoin space has fallen sharply, with traders aggressively discharging positions.

Source: Glassnode

In particular, these types of sharp corrections often coincide with large structural shifts in market sentiment.

If Altcoins keep finding out while Bitcoin is stable, further capital flight to BTC could strengthen its dominance, which means that every broad recovery in the Altcoin market may be postponed.

What this means for the market

The constant divergence between Bitcoin and Altcoins suggests that investors position themselves defensively, and prefer BTC as a more stable active one.

Historically, comparable periods of Altcoin UnderPerformance preceded Bitcoin-conducted market trally, where capital consolidates in BTC for the first time before they rotate later in riskier assets.

However, a crucial factor to look at is whether Bitcoin can preserve its strength in the midst of growing macro -economic uncertainty. If BTC starts to weaken, the wider crypto market can be confronted with further downward pressure.

As an alternative, when Bitcoin stabilizes and starts up another leg, this can cause a renewed speculative interest in altcoins.