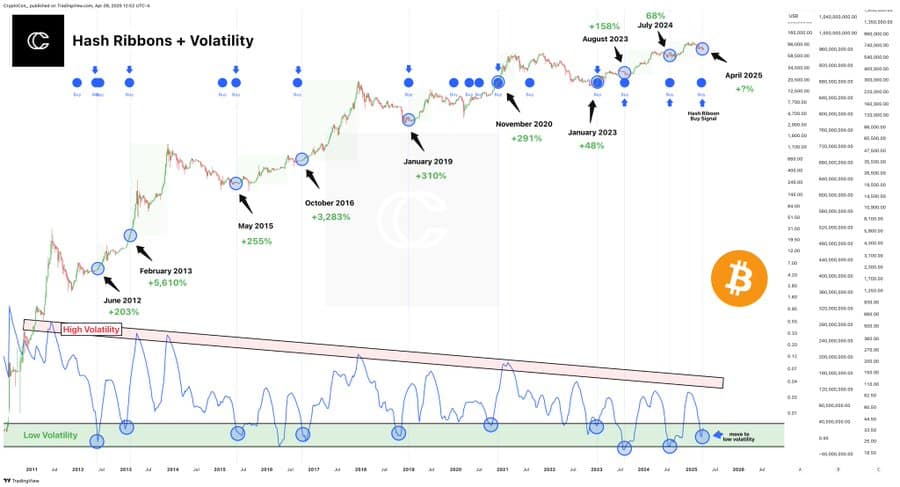

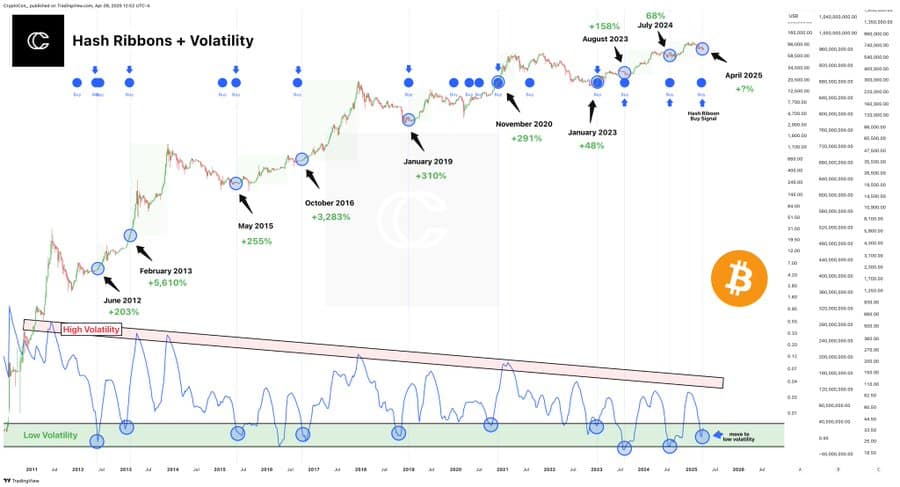

- The volatility of Bitcoin approached historical lows – usually a launch platform for large bullish movements.

- Hash ribbons buy signal and low volatility never have prior to a BTC rally prior to.

Bitcoin [BTC] has entered into an unusually silent phase, whereby volatility drops to exceptionally low levels. Historically, such periods of calmness have often preceded considerable price increases.

Adding this anticipation is the Hash ribbons buying signal, which green flashes – a reliable indicator that suggests a potential market shift.

Could this be the calmness for the storm for Bitcoin? It’s often.

Why low volatility is not boring – it’s bullish!

When Bitcoin volatility falls in the “low” zone, this usually indicates a period of creepy calm. But don’t wrong with weakness!

Historically, these periods of low volatility have often indicated the structure of Momentum for considerable price increases. Previous cycles in 2012, 2015, 2019 and 2023 show that calm markets often precede large upward movements.

The long -term fall in volatility also reflects the growing maturity of Bitcoin as an activa class. However, every moment of calmness is consistently followed by dramatic prize peaks.

Bitcoin is currently in this “green zone” with low volatility, which suggests a potentially rolled up spring moment if history is an indicator.

Bitcoin has increasingly moved with traditional assets such as shares and gold. This reduced volatility can also be seen as a sign of the continuous maturation of the market.

The signal with a 100% bullish hit rate

The Hash ribbons buy signal – Marked by those blue circles in the graph – was never activated during a bear market. Not once.

Source: X

This signal usually fires when the mining difficulty of Bitcoin is reset after a period of miner’s capitulation, which indicates the renewed strength in the network.

What is even more convincing? Every time this hash ribbon buys, there is a low volatility, as it does now, it precedes a huge rally.

Consider the rises in 2013, 2016 and 2020. The most recent purchase in August 2023 already brought a step of +158%. And yet, according to the graph, we have not even touched the “cycle top” zone with high volatility. The main event can still be ahead.

Skepticism is healthy – but the data does not lie

Can Bitcoin fake our fake? It is always a possibility.

However, the evidence suggests differently. The volatility is at unusually low levels, a new hash ribbon box signal has appeared and there are no indications for a macro-top bitcoin, the high volatility zone still has to come in that is typically seen with bullmarkt peaks.

Historically, any case of low volatility has accompanied a hash ribbon purchase signal without exception resulted in considerable returns.

Of course, performance from the past is not a guarantee, but rejecting a 100% historical success rate is perhaps more Wishful Thinking than a sound strategy.

At the time of writing, all indicators pointed up. This may not mark the peak, but rather the start of a significant climb.