- One expert points to historical trends as a strong indicator of an impending BTC rally.

- Several key metrics support the potential for Bitcoin to climb higher, supported by multiple confluences of data.

Bitcoin last week [BTC] experienced significant downward pressure, resulting in a price decline of 1.67%. However, the market has since shown signs of recovery, with BTC posting a gain of 1.30% in the past 24 hours.

Analysts expect these gains to continue, with historical data and multiple metrics suggesting Bitcoin could surpass its recent 15.27% gain and rise further in the coming weeks.

Historical data shows a 7% decline followed by a huge price increase

According to crypto analyst Carl Runefelt in a recent post on X (formerly Twitter), Bitcoin is currently at a historical crossroads similar to October 2023.

He noted:

“Bitco fell 7% in early October 2023, and now it’s down about the same!”

Source:

Based on the chart he shared, if this historical pattern repeats, BTC could rise approximately 66.76% and possibly reach $100,000. However, it is worth noting that the pre-consolidation rally in 2023 was only 35.43%.

Whether BTC will experience a similar upward surge remains uncertain. AMBCrypto has analyzed various metrics to gauge the activities of market participants and provide insight into what could unfold in the coming trading sessions.

Traders are leaving the exchanges, increasing demand for Bitcoin

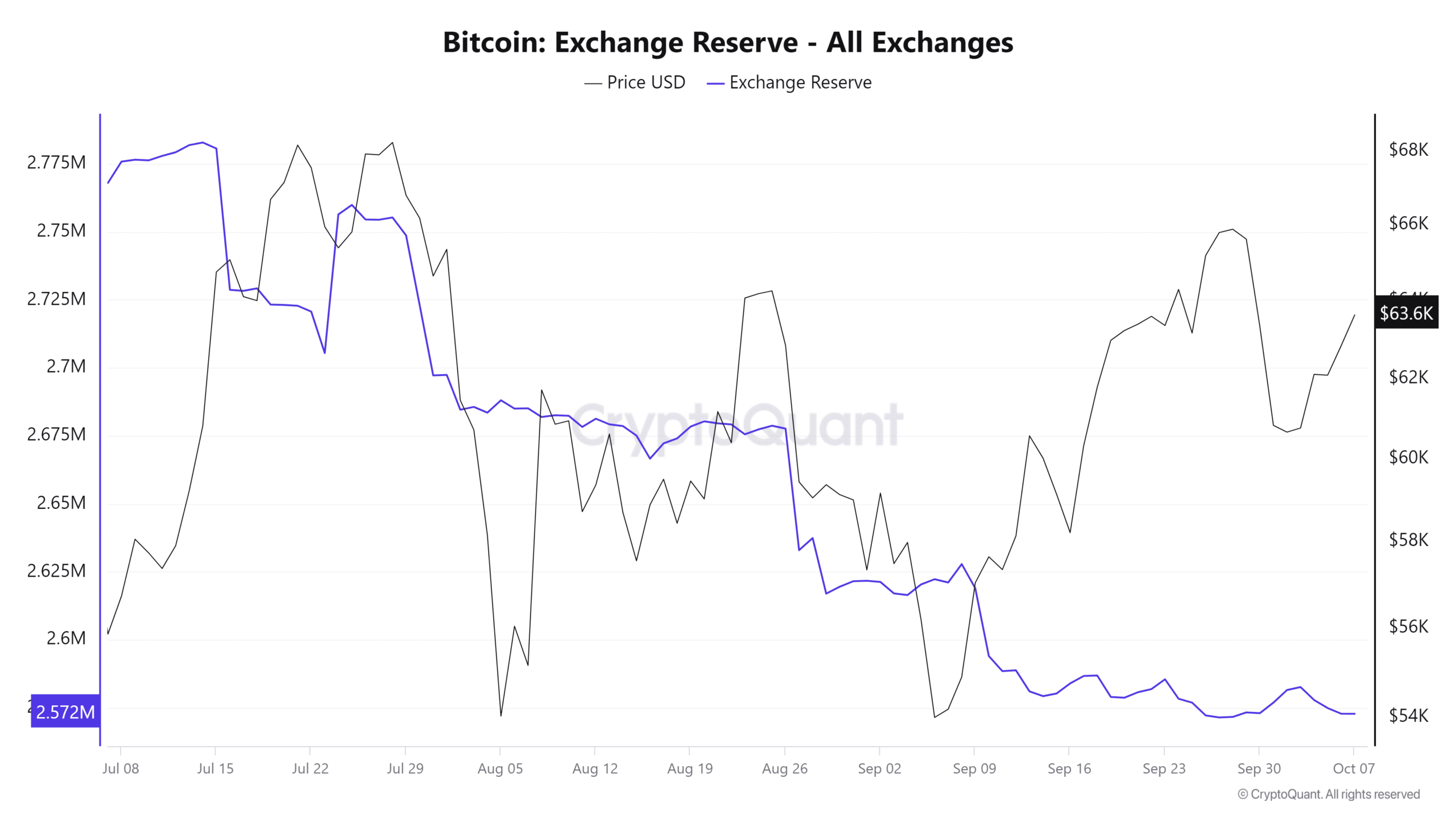

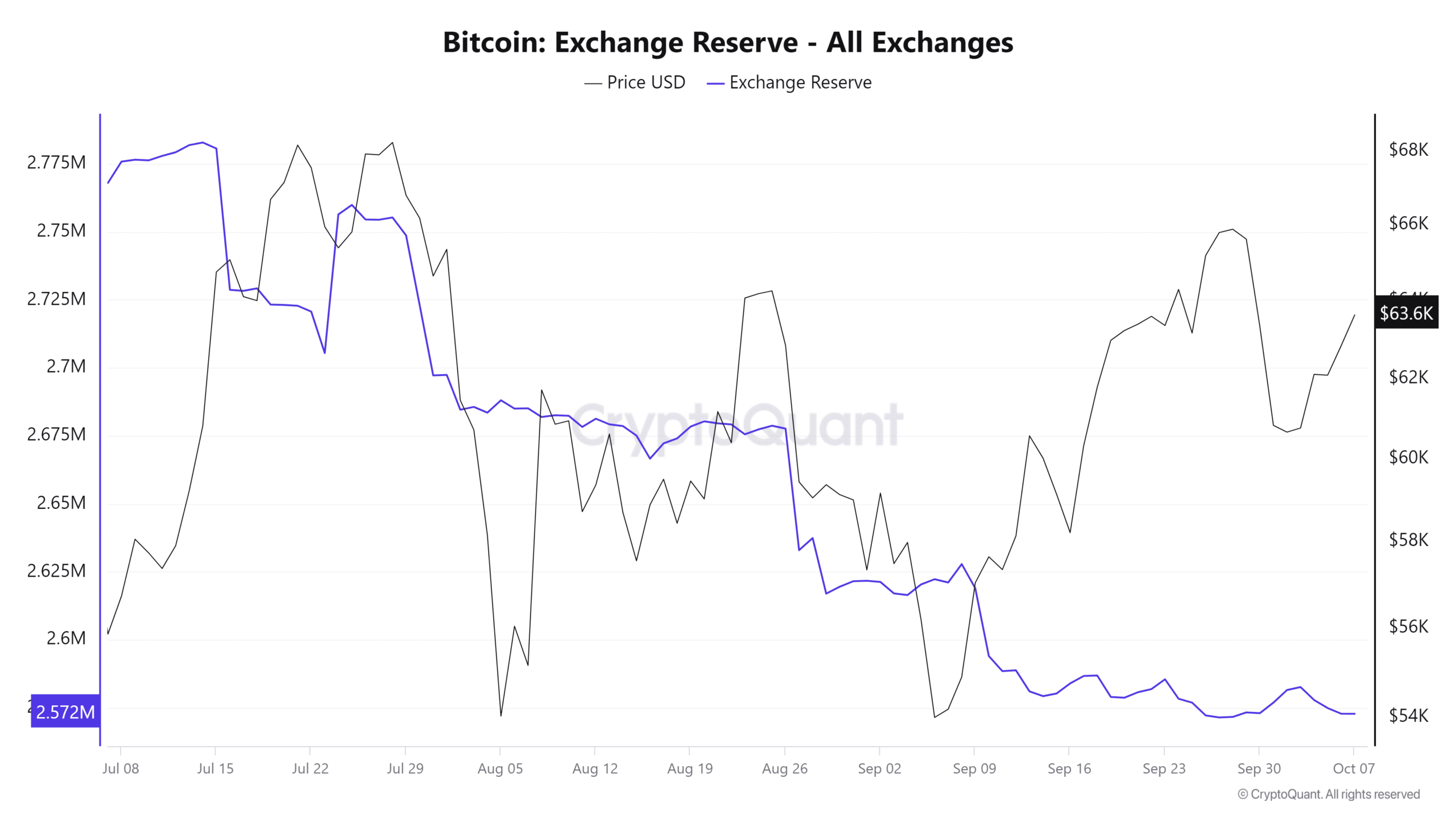

At the time of writing, the total supply of BTC across multiple crypto exchanges, as measured by the Exchange Reserve, has steadily declined since October 3.

Currently, there are only 2.57 million BTC left on exchanges, down from 2.58 million, indicating that traders are increasingly choosing to store their Bitcoin off-exchange, signaling growing confidence in the assets. This shift also creates greater demand for BTC.

Source: CryptoQuant

This buying pressure is further confirmed by CryptoQuant’s Exchange Stablecoin Ratio. When this metric is low, as is the case for BTC, it suggests that available stablecoins are likely to be used to purchase Bitcoin, causing its price to rise. The current value of the ratio is 0.00009506 and continues to trend downward.

If these numbers continue their downward trend, it is likely that BTC will continue its upward momentum as market sentiment increasingly favors the bulls.

While these are strong bullish indicators, AMBCrypto has also identified additional metrics that point to the same conclusion.

Short traders face losses as BTC rises

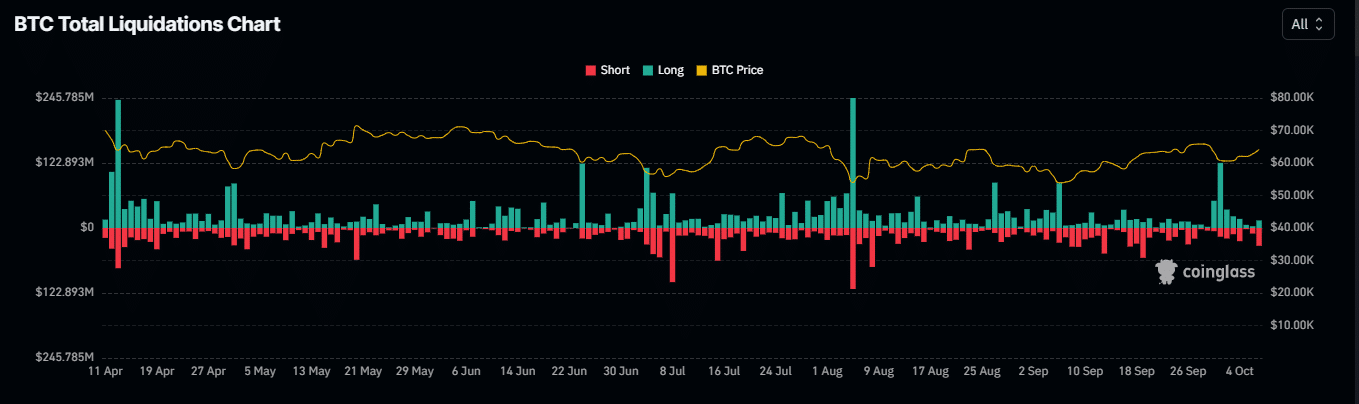

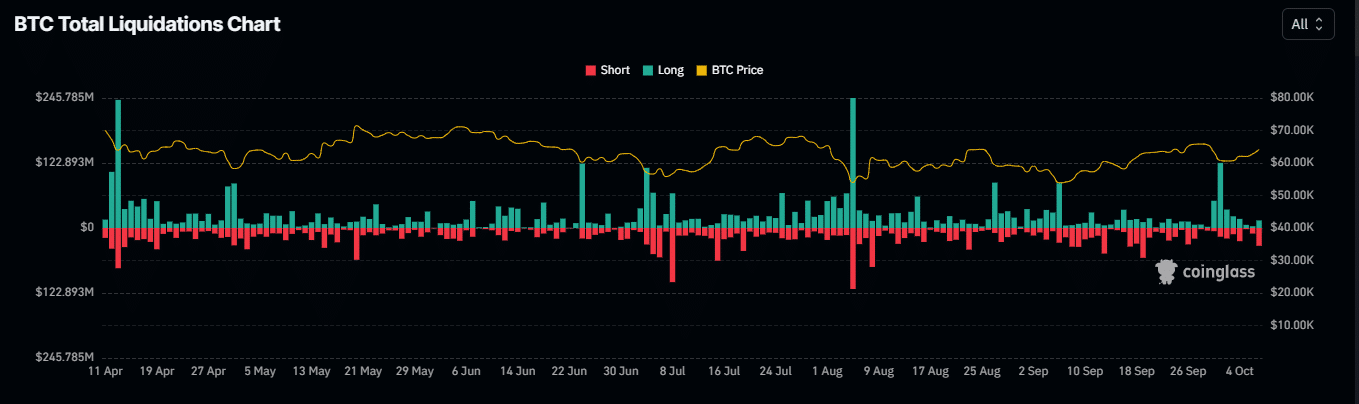

Over the past 24 hours, numerous short traders have been liquidated as the price of Bitcoin moved against their bearish predictions.

Data from Mint glass reveals that approximately $41.80 million worth of short contracts on BTC were wiped out, highlighting a strong bullish shift in the market.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

Furthermore, Open Interest, a key metric that measures trader activity, indicates a bullish trend, rising 3.66%, bringing the total to $34.08 billion.

If this trend continues, BTC’s upward momentum is likely to continue, confirming the bullish sentiment among traders.