- Bitcoin ETF inflows and increased miner profitability suggest that BTC’s upward price momentum could continue.

- Active addresses and rising open interest volume indicate strong market activity, despite mixed derivatives data.

Bitcoin [BTC] has seen a steady price increase in recent weeks, generating interest in the underlying factors driving this momentum.

According to a CryptoQuant analyst, Amr Taha, there is a notable relationship between Bitcoin ETF net flows and the sustainability of miners’ profits/losses, which could influence Bitcoin’s price movements.

The analysisshared on the CryptoQuant QuickTake platform, sheds light on how these two indicators interact and their potential impact on the market.

Bitcoin ETFs, Miners Work Together!

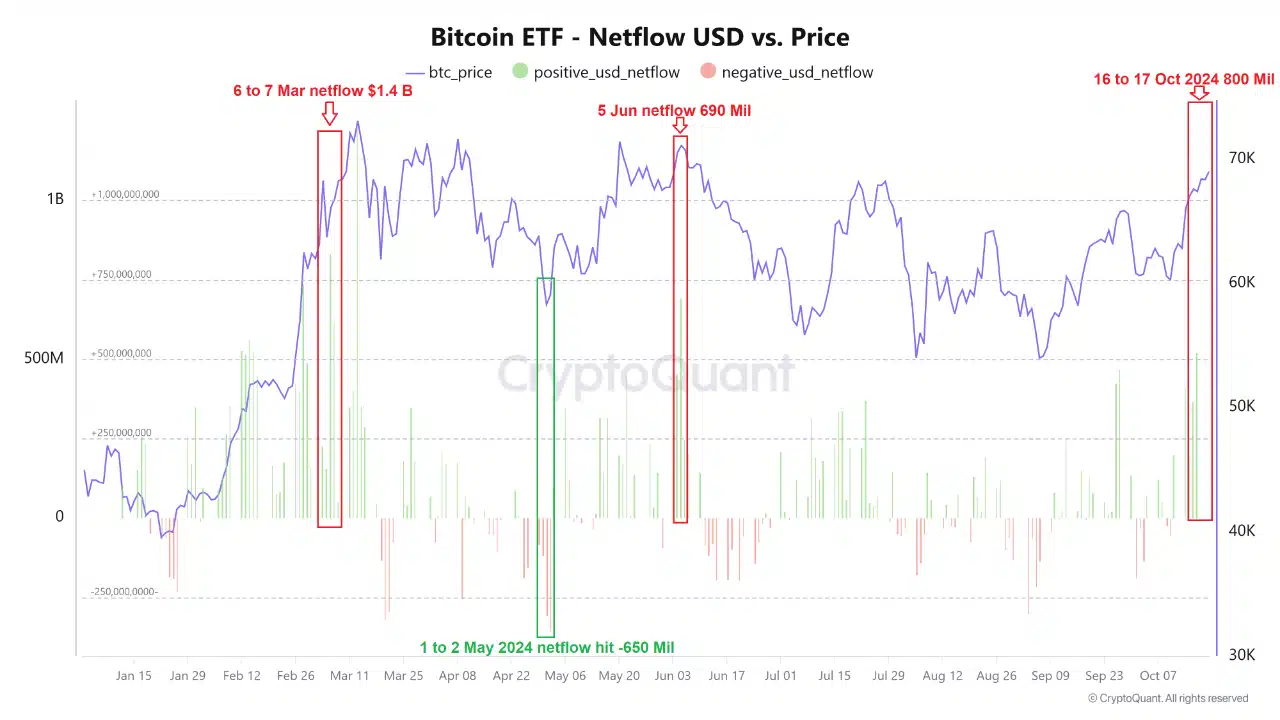

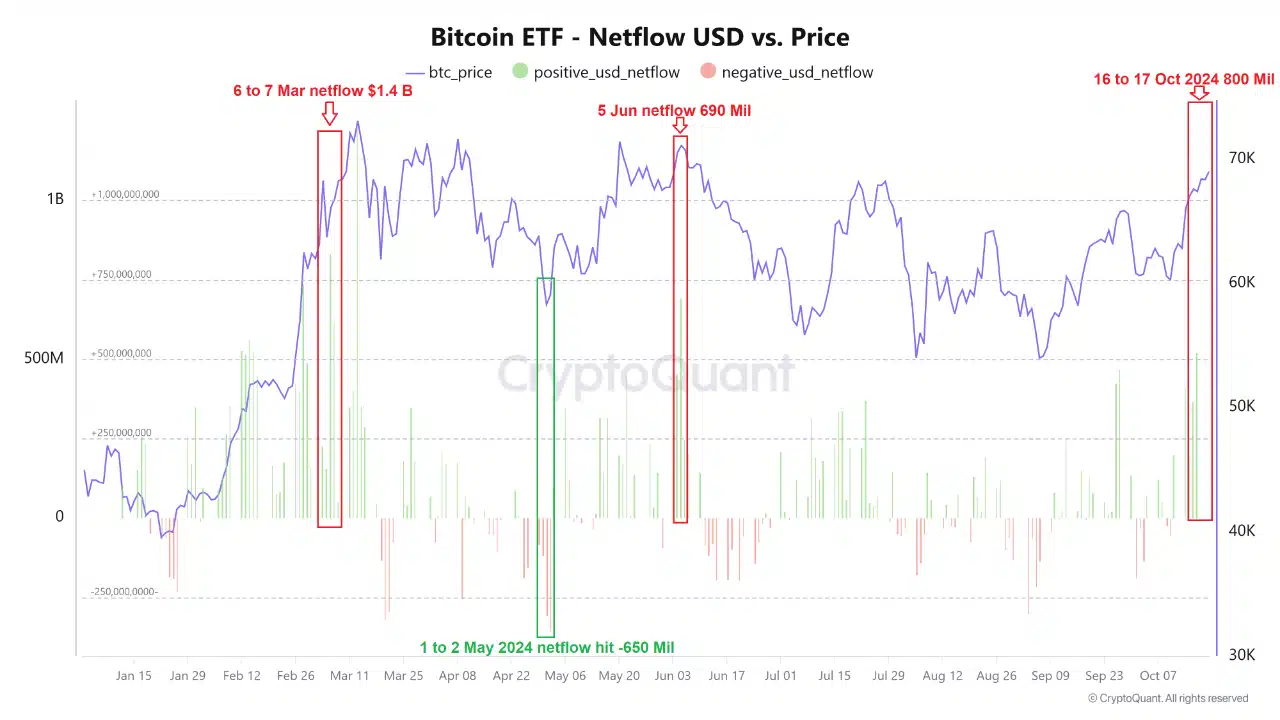

Taha’s analysis focuses on net capital flows into Bitcoin ETFs, highlighting that large positive net capital flows often occur near market peaks, while negative net capital flows tend to coincide with market bottoms.

This trend suggests that when capital flows into Bitcoin ETFs, it could lead to upward price pressurewhile capital outflows can create downward pressure.

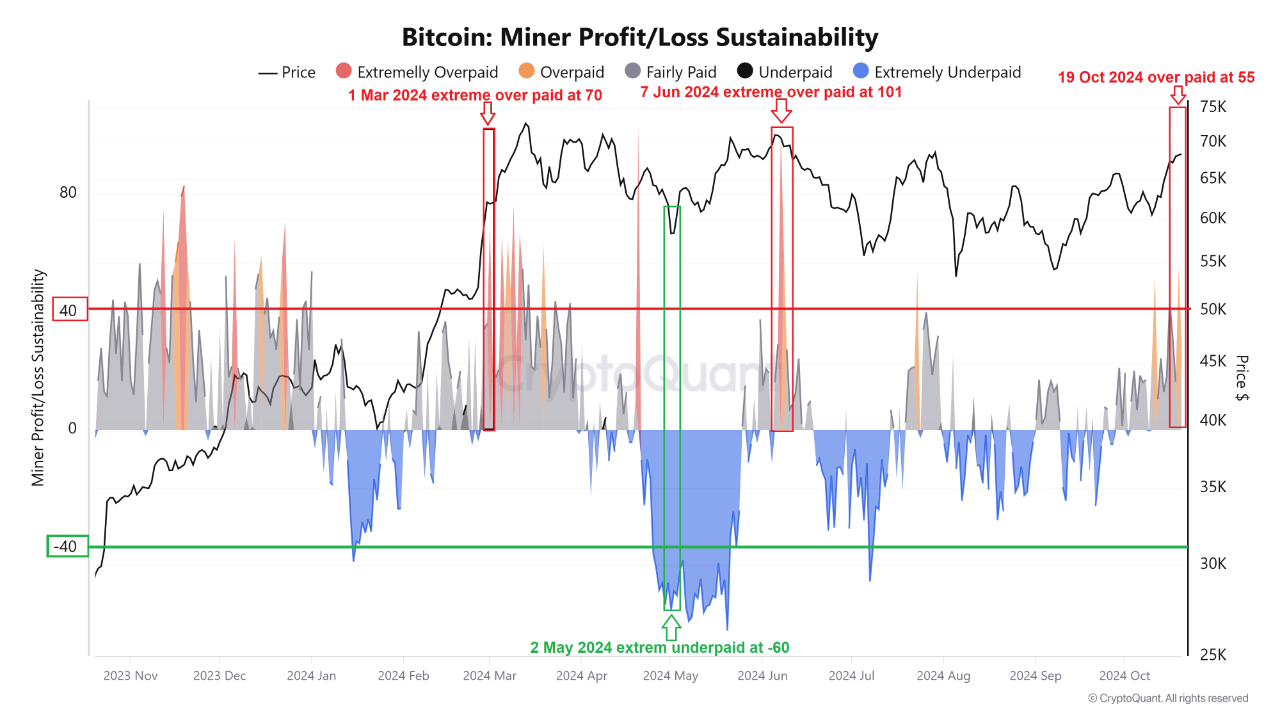

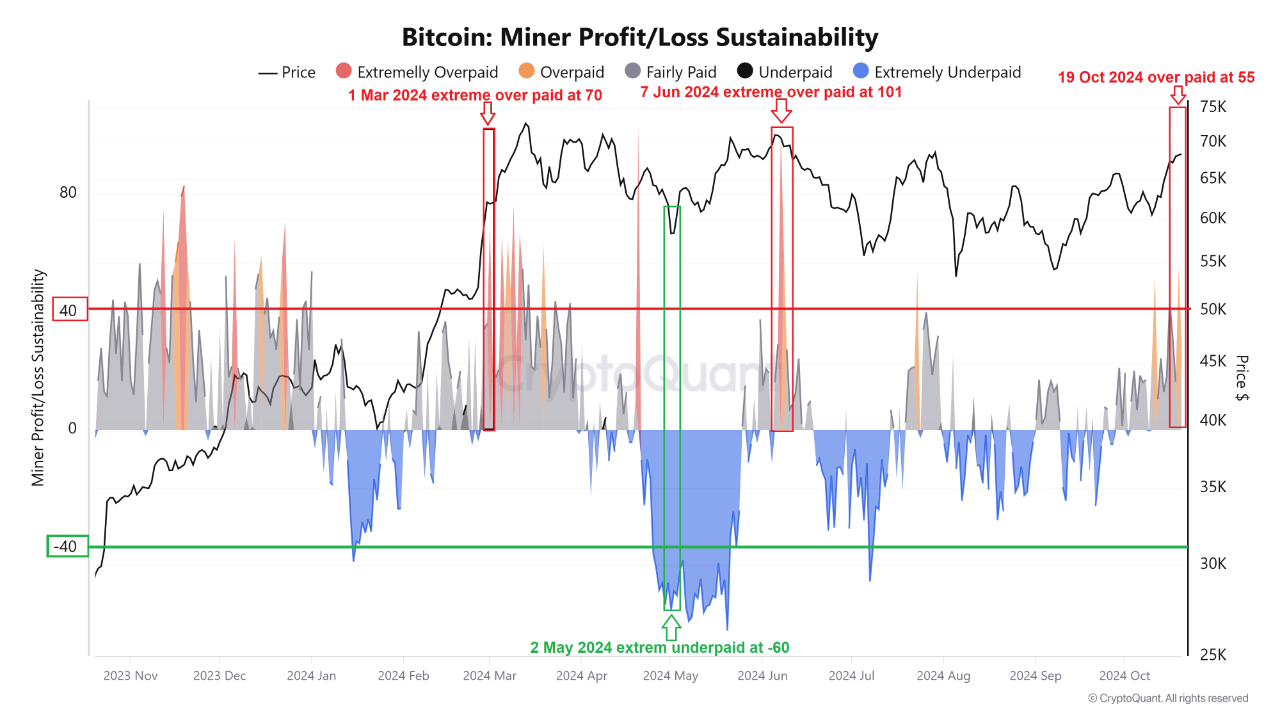

Additionally, the Miner Profit/Loss Sustainability chart helps track whether Bitcoin miners are operating profitably, based on the difference between Bitcoin prices and miners’ operating costs.

The chart identifies ‘overpaid’ zones, when miners generate significant profits, and ‘underpaid’ zones, when miners face losses.

Source: CryptoQuant

Taha’s analysis provides key insights into how BTC prices relate to miner profitability. As Bitcoin prices rise, miners typically find themselves in more profitable positions, as seen in March, June and October 2024.

During these periods, miners generated significant profits, with miners’ sustainability metrics rising above 40.

However, when capital leaves Bitcoin ETFs, miners’ revenues may decline due to selling pressure, leaving them in a less profitable or loss-making position.

A notable example of this occurred in May 2024, when Bitcoin prices fell sharply, leading to a miner sustainability level of -60, indicating that miners were extremely underpaid.

Source: CryptoQuant

It is worth noting that BTC ETFs have experienced positive momentum thus far. facts from Sosovalue shows that BTC ETFs have recorded continuous inflows of over $200 million over the past seven days.

This marked a seven-day consecutive streak of inflows, which reflected increased demand for BTC-related financial products and could support further price increases.

Meanwhile, CryptoQuant data showed that miner inflows have also increased, peaking at 11,810 BTC on October 14 and another significant inflow of 9,302 BTC on October 21.

The correlation between ETF inflows and miner reserves suggests that both institutional interest and miner activity are contributing to Bitcoin’s current price momentum.

Actively address growth and market data

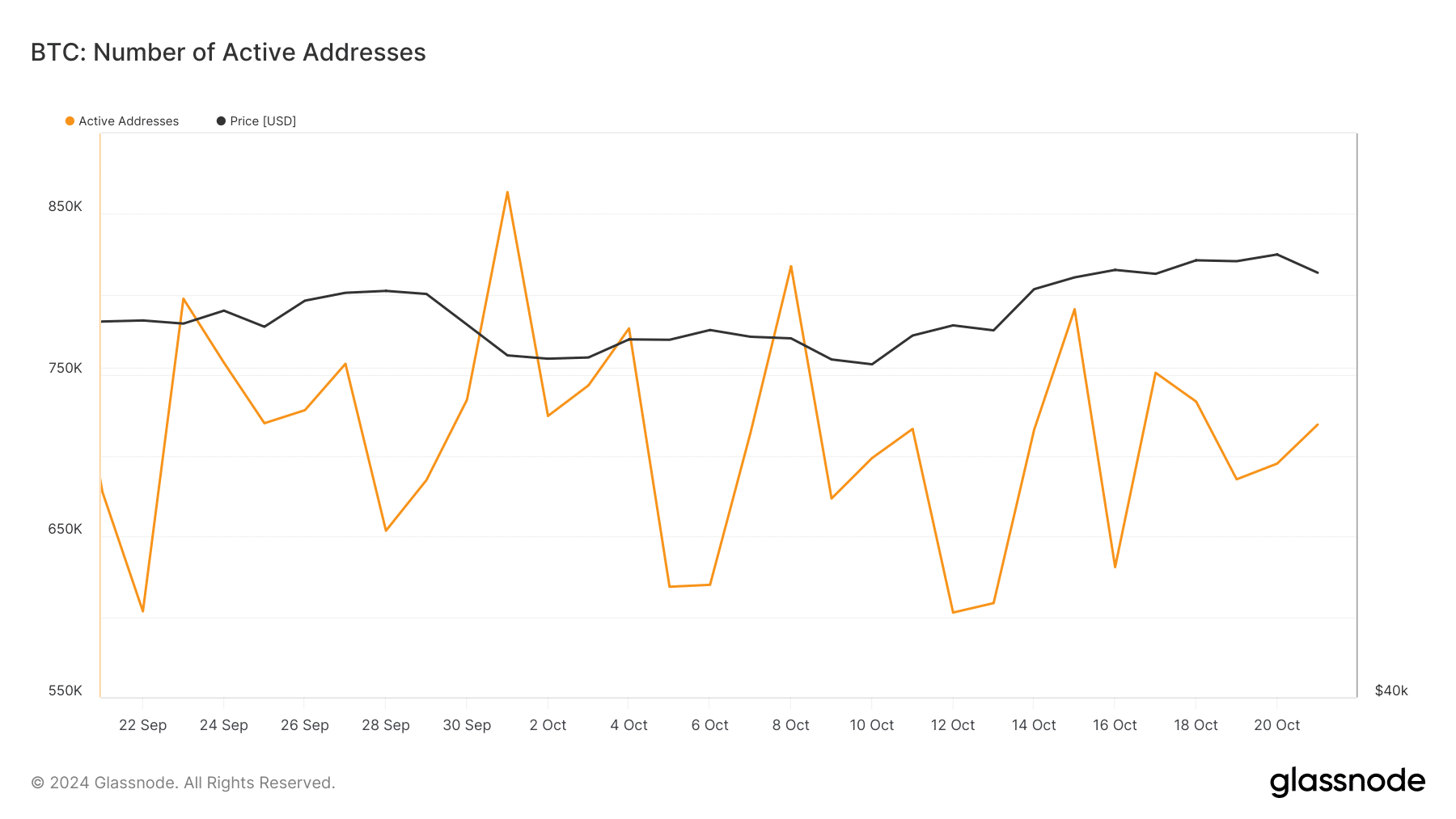

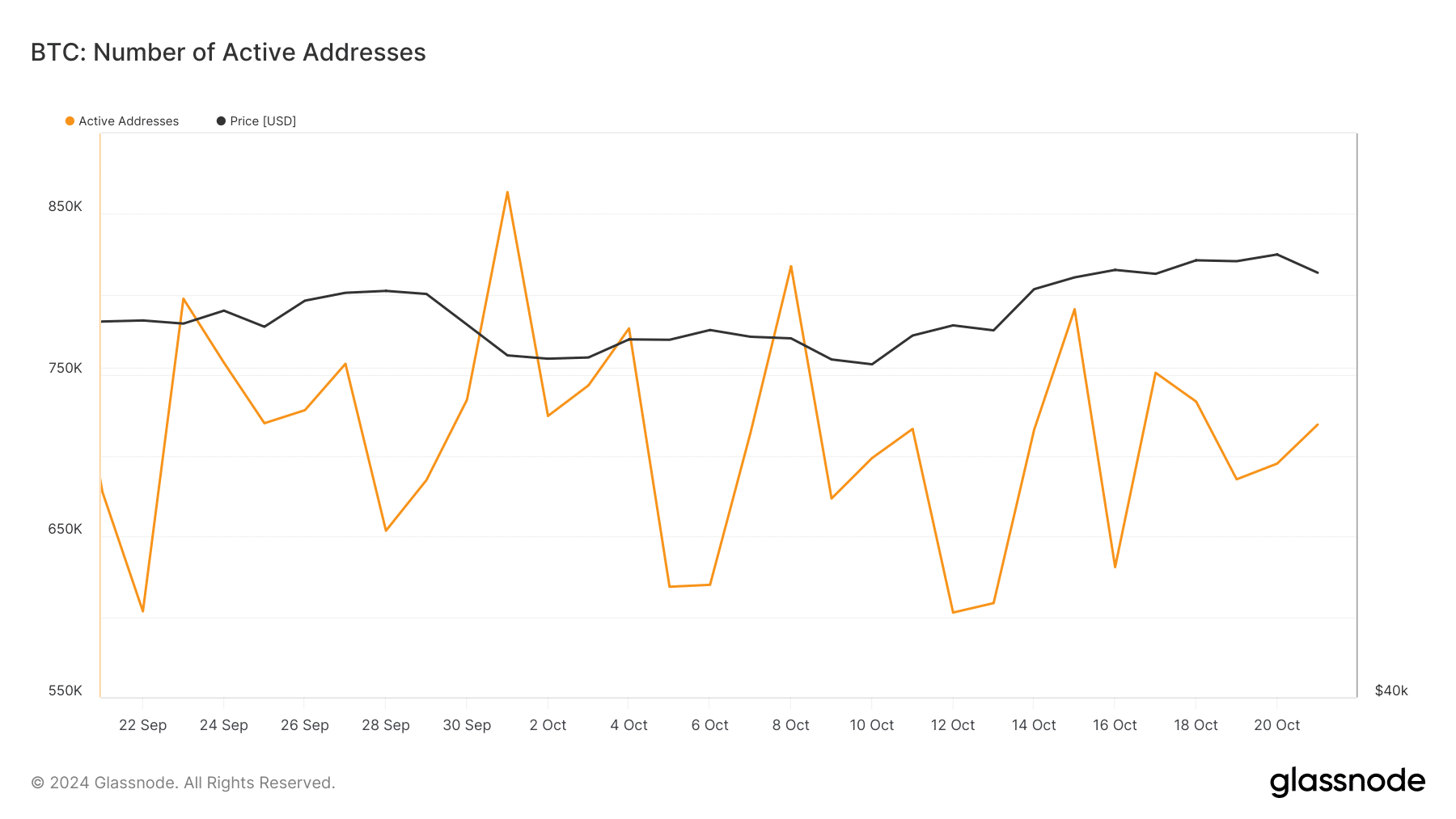

In addition to the ETF and miner related statistics, facts from Glassnode indicated that Bitcoin network activity has increased in recent days.

Active Bitcoin addresses have increased from 630,000 on October 16 to over 719,000 on October 22.

Source: Glassnode

This growth in active addresses indicates greater user engagement and transaction activity on the BTC network, which could potentially contribute to the asset’s bullish momentum.

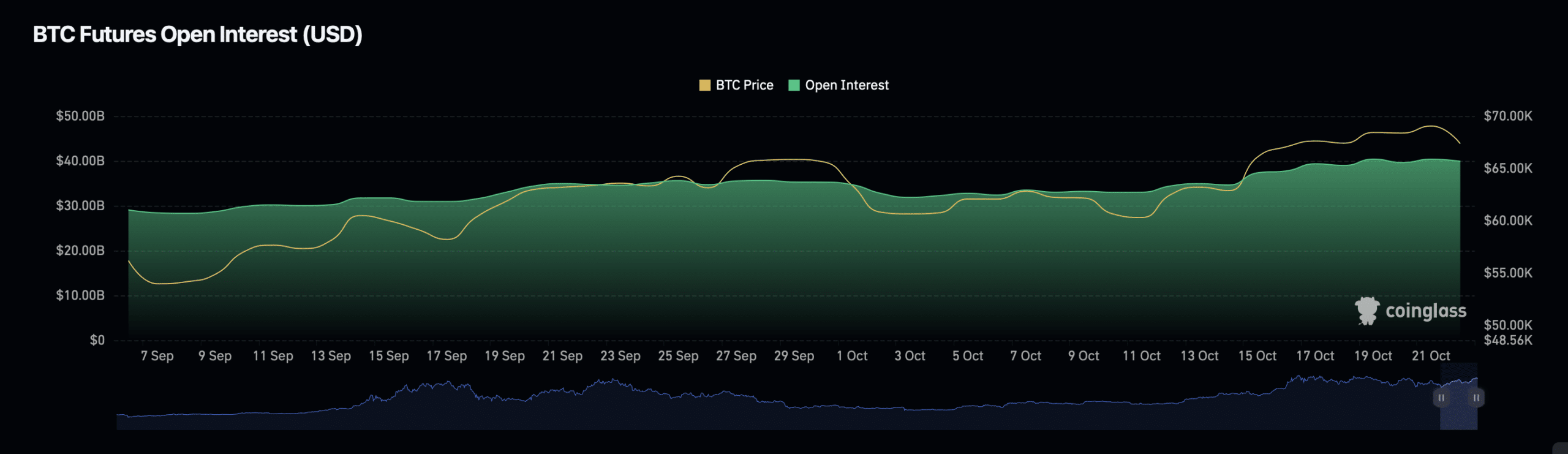

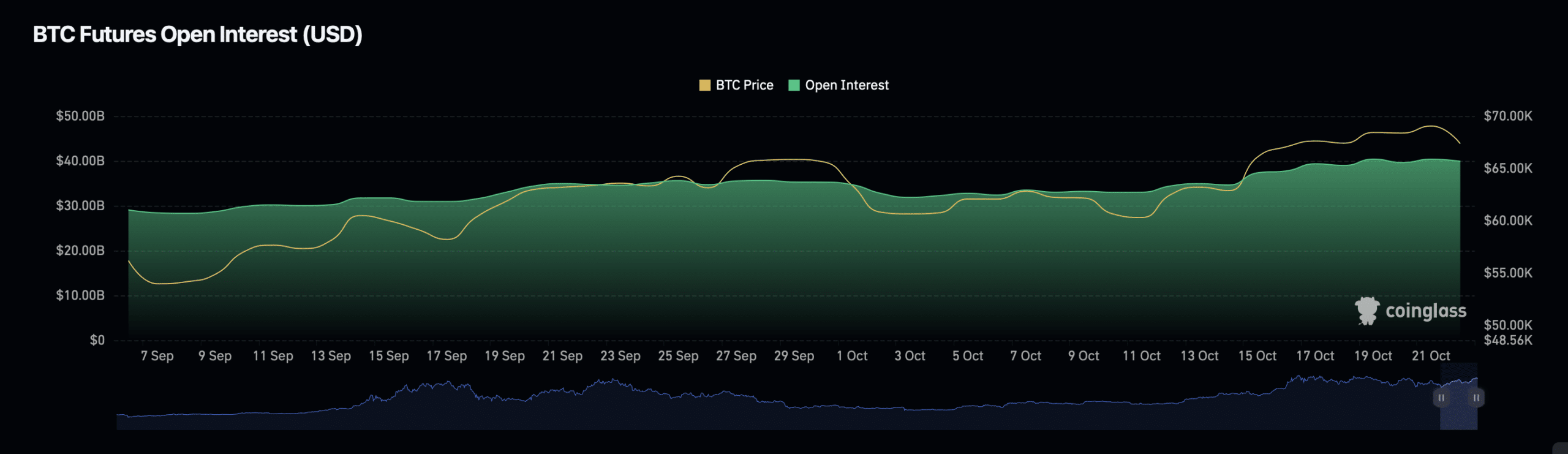

On the other hand facts from Coinglass highlighted some mixed signals in the Bitcoin derivatives market.

Bitcoin’s Open Interest, which measures the total value of outstanding derivatives contracts, fell 3.17% to a valuation at time of writing of $39.36 billion.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

However, Bitcoin Open Interest volume increased by 55.69% to $68.28 billion.

The increase in Open Interest volume indicates that while fewer positions are being held overall, position sizes are increasing, indicating a possible build-up of market activity in anticipation of significant price movements.