- Bitcoin LTHs are spreading more slowly, signaling a possible shift in market sentiment

- Historical trends show that reduced LTH selling pressure often leads to upward price momentum

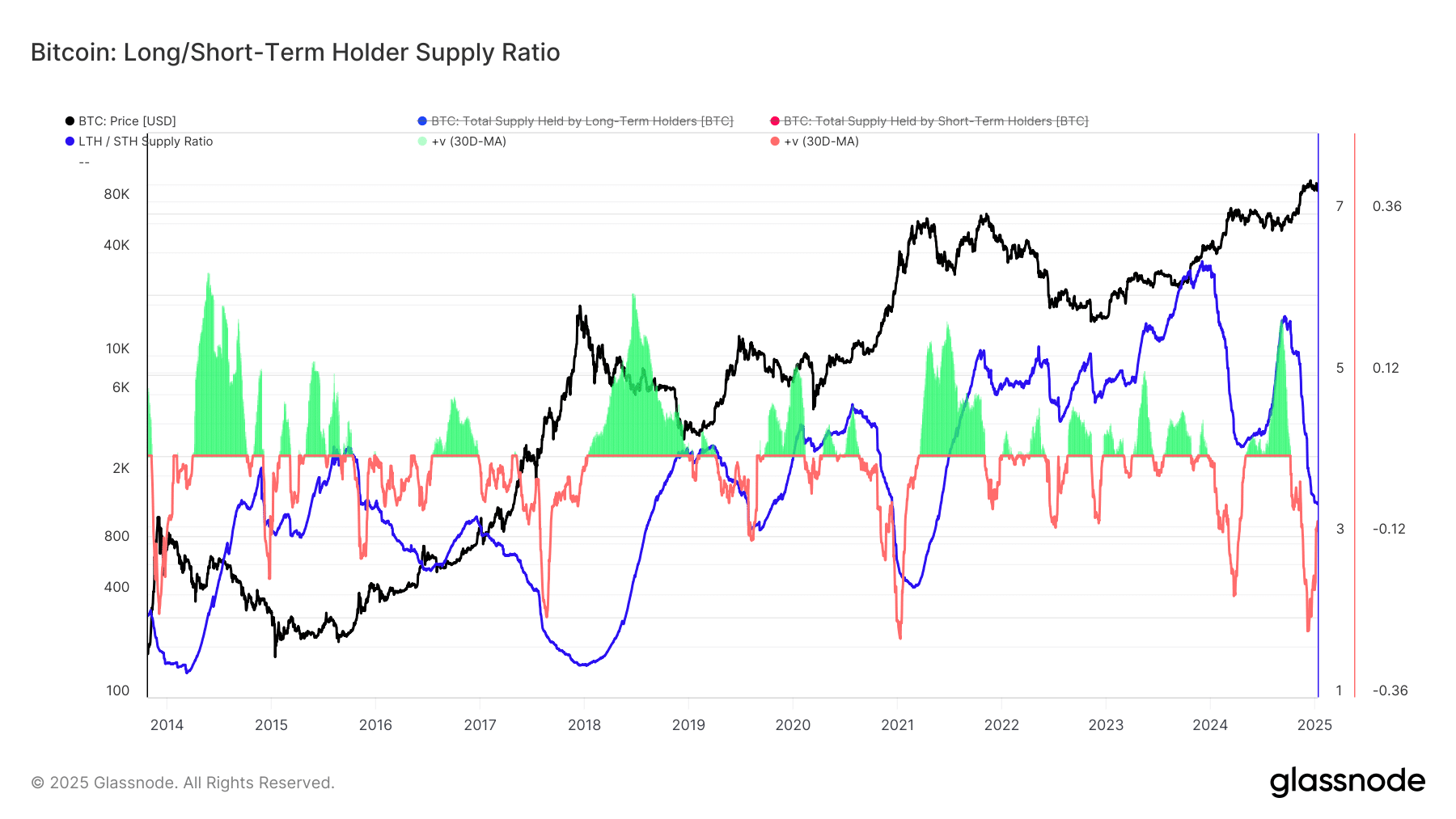

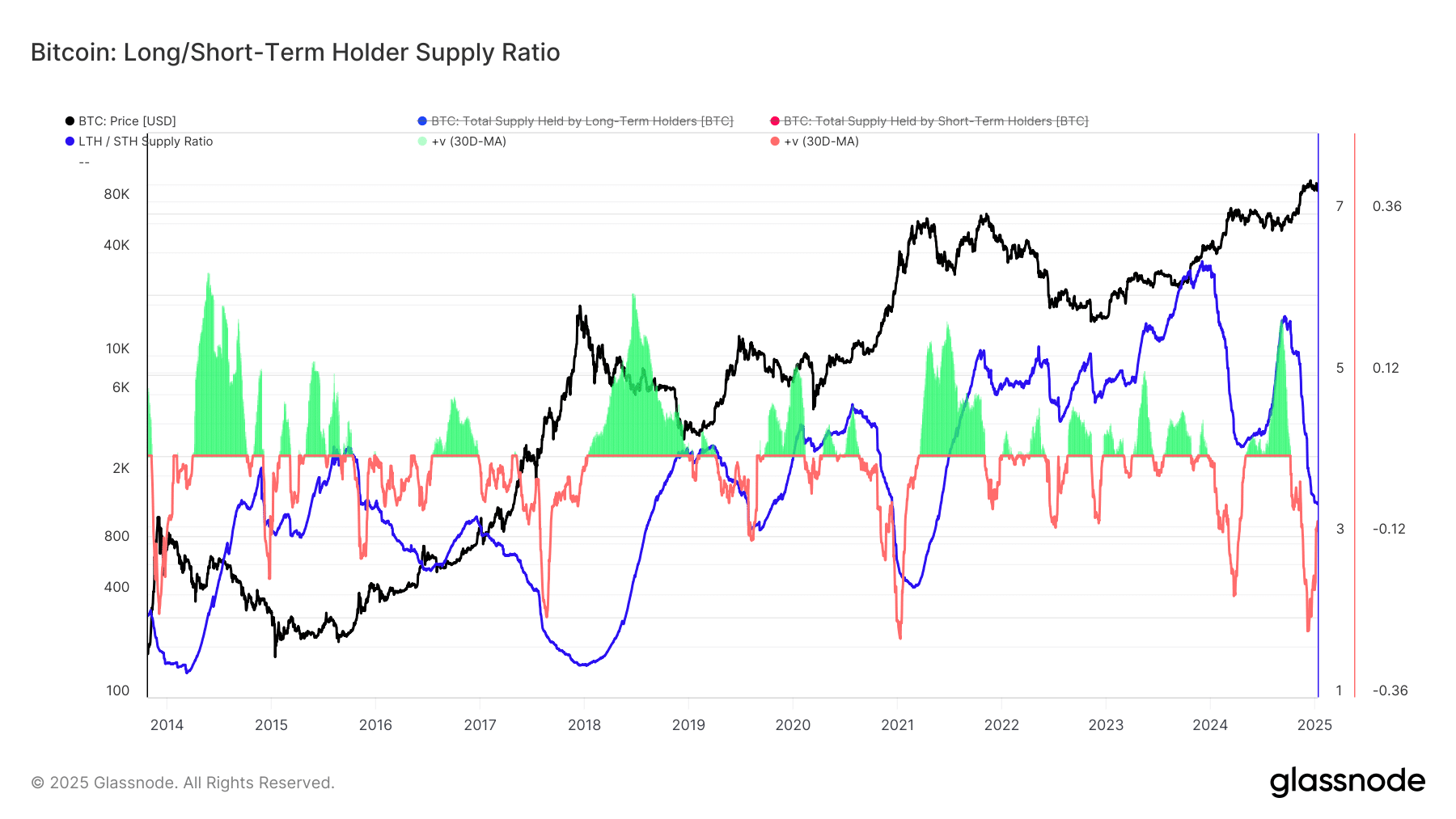

Bitcoins [BTC] the price appeared to be hovering about 12% below its all-time high at the time of writing, leaving many wondering about the future direction of the market. Despite this dip, LTHs continue to distribute their Bitcoin holdings, albeit at a slower pace.

In fact, on-chain data showed a significant shift: While LTHs are still selling, the rate of distribution is starting to slow. More importantly, the 30-day percentage change in LTH supply suggested that this distribution cycle may have peaked, indicating that selling pressure could soon ease.

LTH Distribution Trends

Source: Glassnode

Recent data shows that LTHs have continued to distribute their Bitcoin even with the price only 12% below its all-time high. This persistent selling behavior means these long-term holders are cautious, possibly driven by macroeconomic factors or a profit-taking strategy during uncertain market conditions. Despite this continued distribution, the pace of sales has begun to slow.

There is a declining change in 30-day LTH supply, indicating that the peak of LTH selling pressure may be over. This shift can be attributed to improving market sentiment and the stabilization of external pressures, which may have alleviated some of the concerns that led to earlier selling.

30-day percentage change in LTH supply

The 30-day percentage change in LTH supply measures the net accumulation or distribution of Bitcoin by LTHs over a rolling monthly period. When this measure increases, it often indicates accumulation, while a decrease usually indicates active distribution.

The data showed that there was a plateau in LTH distribution, indicating that the sales phase may be coming to an end. Historically, such slowdowns precede periods of reduced selling pressure. As LTHs reduce distribution, downward pressure on Bitcoin could ease, allowing for consolidation or a potential bullish reversal.

Is your portfolio green? Check out the Bitcoin profit calculator

Comparison with previous cycles and possible implications

Comparing the current trend to previous cycles, it is clear that similar distribution delays have marked the end of bear markets or the beginning of bull markets. In 2015, 2019 and 2020, the slowdown in LTH distribution was followed by reduced market volatility, paving the way for upward trends. During these times, Bitcoin saw greater stability, greater confidence, and a new influx of new investors – all of which contributed to price increases.

If this trend follows previous cycles, Bitcoin could stabilize at its price at the time of writing before it goes up. The change in LTH behavior and reduced selling pressure could signal the start of a price increase. This could lead to bullish momentum or extended consolidation, depending on market conditions.

As history has shown, such moments of reduced selling pressure often set the stage for Bitcoin to reach new highs. However, whether the market will follow this pattern again remains to be seen.