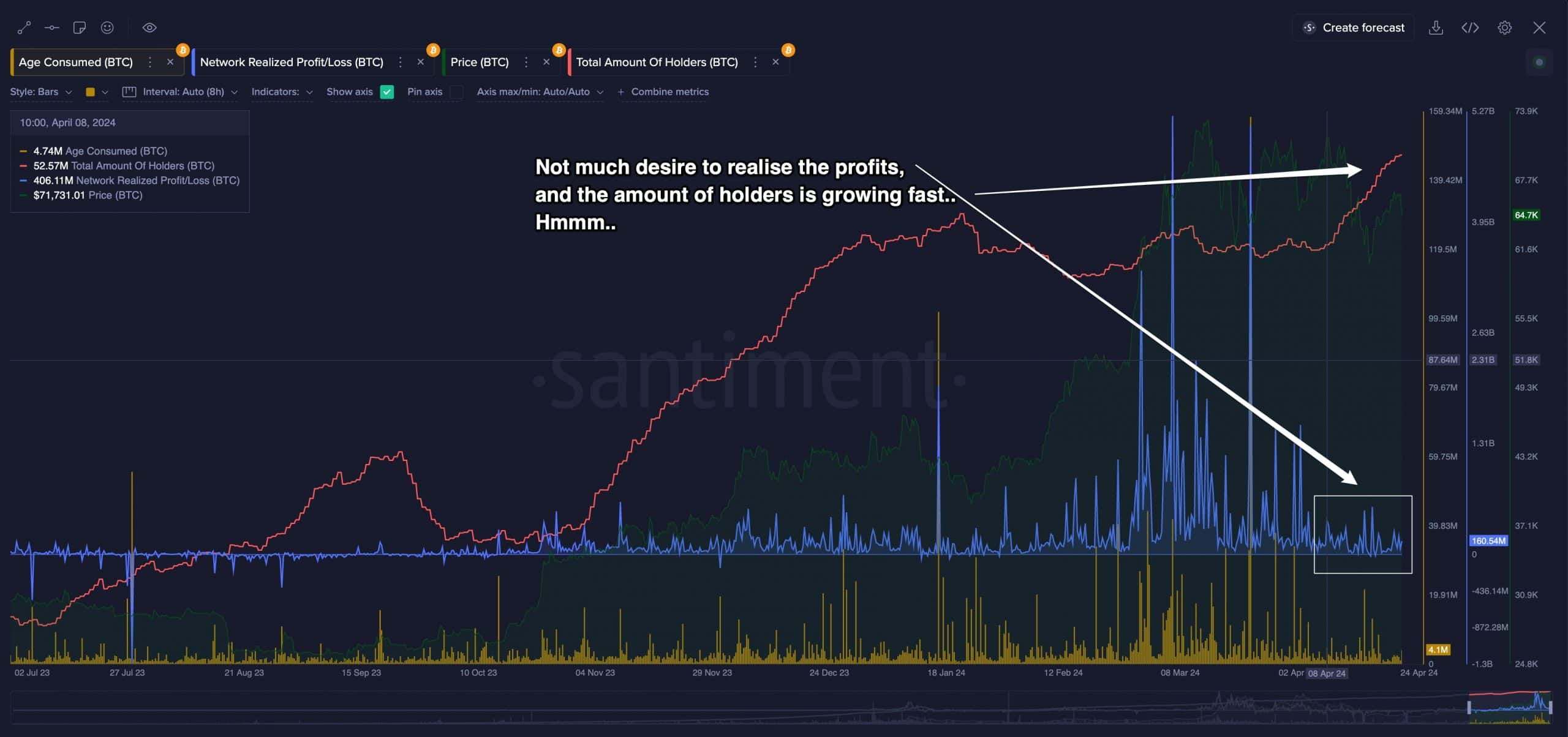

- There appeared to be a reluctance among BTC traders to cash in their profits.

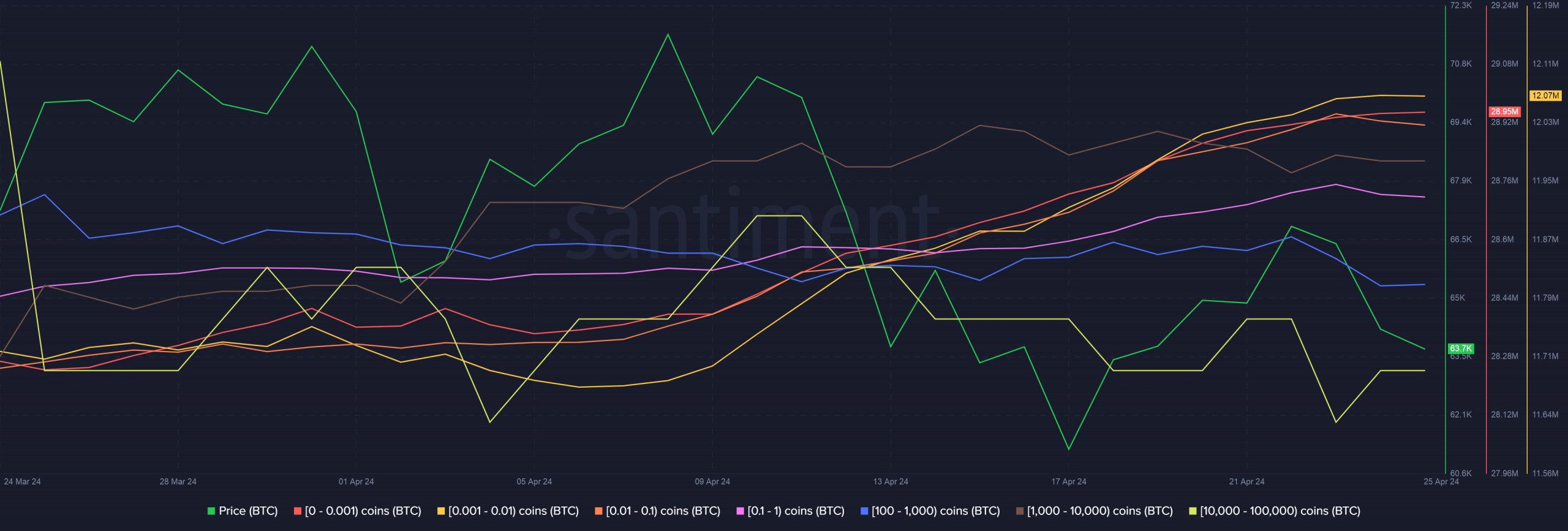

- Early HODLers distributed to newer participants.

It has been a rollercoaster ride for Bitcoin [BTC] after the most recent halving.

The initial reaction was positive, with the king’s coin skyrocketing to $67,000 three days after the pivotal event, according to CoinMarketCap. However, the gains have been wiped out as BTC has fallen 4% to pre-halving levels over the past 24 hours.

So it will be crucial to understand where the world’s largest digital asset stands after the halving, as well as insights on the next steps in the short to medium term.

Profit taking still on the low side

According to on-chain analytics firm Santiment, there seemed to be a reluctance among BTC traders to cash in their profits. The Network Realized Profit/Loss (NRPL) indicator remained low and the pattern was consistent with previous peak periods of 2017 and 2021.

The number of BTC holders was also seen to increase.

Santiment called this phase “irrational divergence,” in which the market refused to sell despite rising prices.

While this phase is rooted in BTC’s long-term growth potential, it historically precedes “significant market tops,” making it sound more like a bearish signal.

Source: Santiment

HODLers were redistributing

In contrast, the Mean Dollar Invested Age (MDIA) measure has fallen sharply in recent months, indicating an active redistribution phase.

During redistribution, wealth is transferred from early HODLers to newer market participants. After a twelve-month rebalancing cycle, the market has historically returned to an accumulation phase, lending support to the belief that the bull market will continue.

Source: Santiment

Is your portfolio green? Check out the BTC profit calculator

The above deductions were reflected in the supply distribution across the most important cohorts. Small holders in particular, or those who held a maximum of 1 whole Bitcoin, appeared to buy after the halving.

On the contrary, Sharks and Whales, who had between 100 and 100,000 coins in stock, distributed their coins.

Source: Santiment