- Despite corrections, Bitcoin’s price has remained firmly around the $90,000 zone

- The price of Crypto could soon rise well above this level

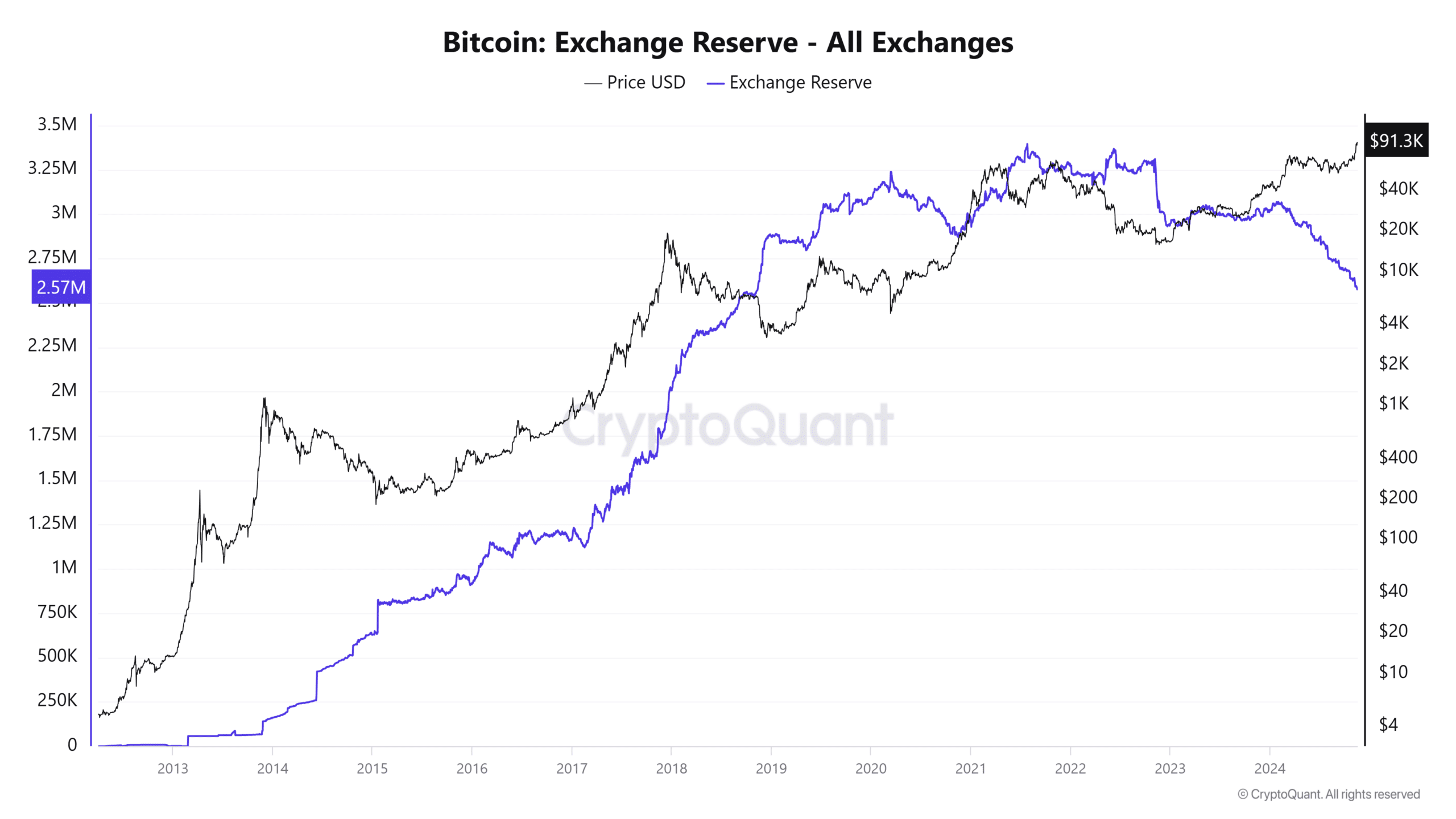

Bitcoin (BTC) foreign exchange reserves have fallen to their lowest level since November 2018, reflecting a significant shift in market dynamics. This milestone was recorded shortly after the crypto’s price rose above $91,000, supported by surging demand.

Needless to say, the confluence of these factors raises critical questions about the liquidity of the market and what this trend means for the future of Bitcoin.

Bitcoin exchange reserves and liquidity dynamics

Total Bitcoin reserves on exchanges dropped to 2.57 million BTC, as highlighted by CryptoQuant’s graphic. This level was last seen during the accumulation phase before the 2020-2021 bull run.

Historically, declining foreign exchange reserves indicate a decline in selling pressure as more BTC moves into private wallets. This can be interpreted as an allusion to a strong accumulation trend among long-term holders.

Source: CryptoQuant

With the price of Bitcoin rising to $91,000, this drop in foreign exchange reserves underlines the limited supply against a backdrop of growing demand.

If reserves continue to decline, liquidity could tighten further, potentially increasing price volatility in the short term. However, this could also pave the way for a continued rally, especially as the BTC available for trading decreases.

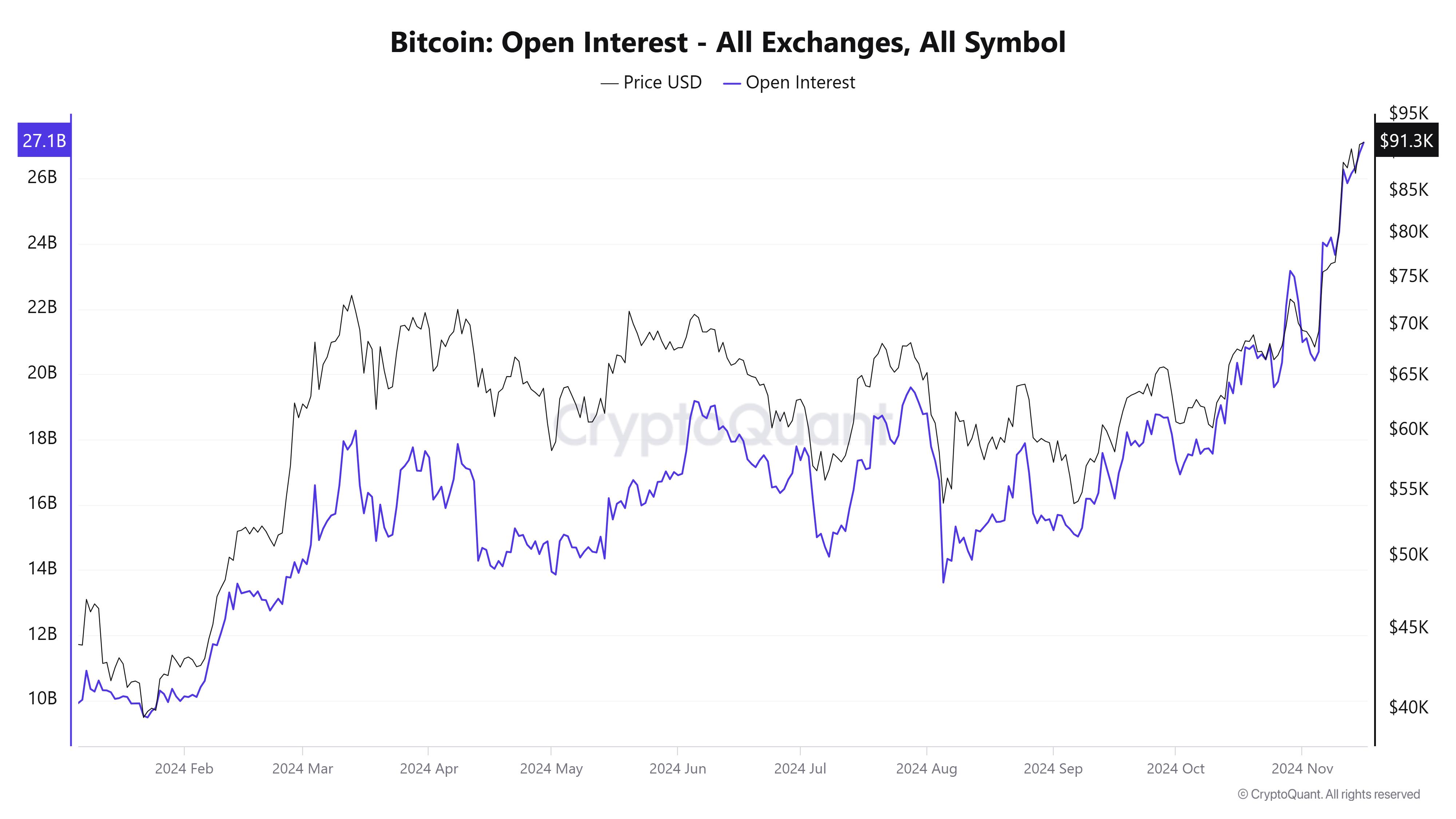

Derivatives Data – Bitcoin Open Interest Reaches New Highs

Open Interest across all exchanges rose to $26.8 billion, according to CryptoQuant data. Such a sharp increase reflected increased speculative activity, especially as Bitcoin’s price appears to be approaching uncharted territory.

Open interest rising along with a rising price is usually a bullish indicator: a sign of growing market participation and optimism.

Source: CryptoQuant

However, such high Open Interest levels warrant caution. Historically, sharp price movements often lead to liquidations, especially when debt levels increase.

Monitoring funding rates alongside Open Interest will be key to assessing whether the market remains overheated or gearing up for further upward momentum.

Accumulation over distribution

Exchange net flow data highlighted the continued outflows, with -7.5K BTC leaving the exchanges, compared to an inflow of 4.2K BTC. Consistent net outflows align with the accumulation story, especially as investors move Bitcoin to cold wallets or custody solutions.

In previous market cycles, extended outflows have preceded major rallies, reflecting market dynamics in which supply on exchanges is becoming increasingly scarce. These trends suggested that market participants are holding onto Bitcoin in anticipation of higher prices – another bullish sign.

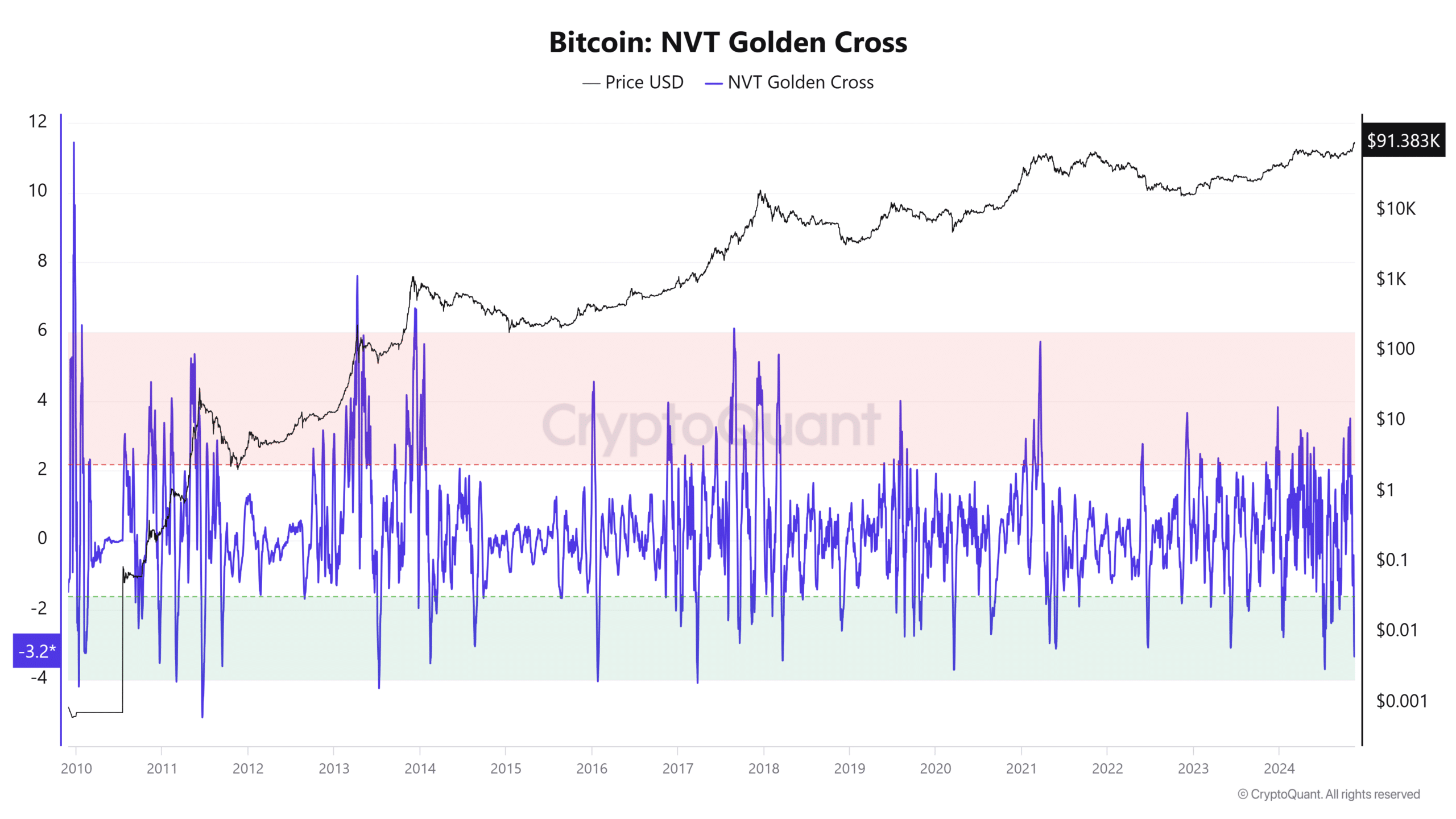

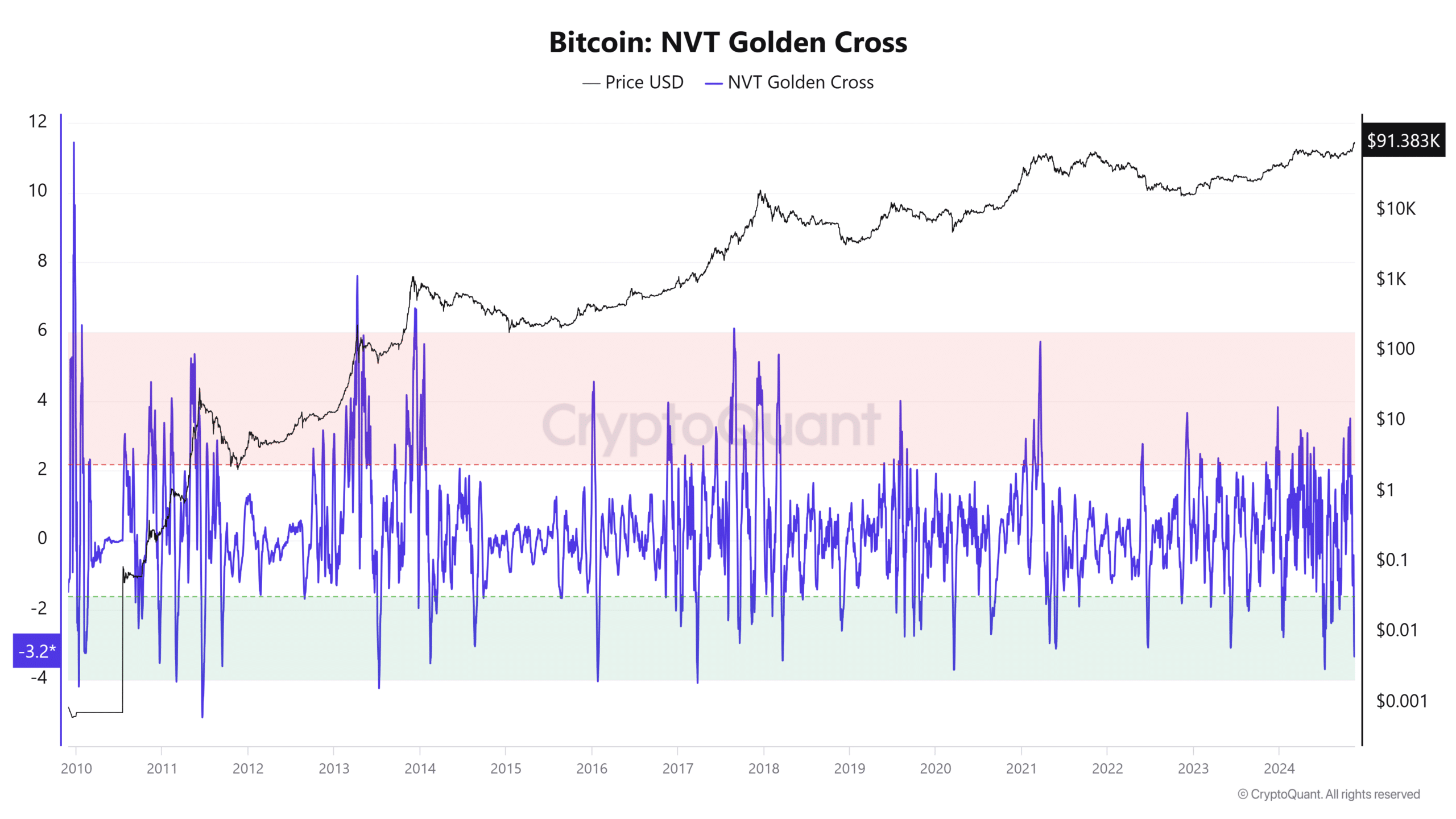

Bitcoin NVT Golden Cross – A signal of market strength

Bitcoin’s NVT (Network Value to Transactions) Golden Cross also recently entered bullish territory, with the same underlined by CryptoQuant’s charts.

Here it is worth noting that this metric compares Bitcoin’s market capitalization with transaction volume. It provides insight into whether the network’s valuation is supported by its activities.

Source: CryptoQuant

Historically, when the NVT Gouden Kruis falls into the green zone, it means that transaction activity is high relative to Bitcoin’s valuation – a sign of healthy network usage and bullish market conditions.

Conversely, a move into the red zone indicates overvaluation or reduced network activity. The positioning in the bullish zone reinforced the story of growing adoption and network trust. This seemed to be in line with declining foreign exchange reserves and rising Open Interest trends.

– Read Bitcoin (BTC) price prediction 2024-25

The drop in Bitcoin exchange reserves, coupled with rising Open Interest, consistent net outflows and a bullish NVT Golden Cross, underlined a strong market setup.

While reduced liquidity on the exchanges could lead to higher volatility, the data appeared to indicate that market participants may be positioning themselves for continued upside potential.