- Bitcoin’s bullish price trajectory ensures profitability amid challenges

- Halving could cause a supply shock, causing volatility and price appreciation

The year 2024 has proven to be an exceptional year for Bitcoin [BTC], boosted by ETFs and capped by the fourth halving. But that’s not so interesting: there has also been a significant change in the behavior of miners.

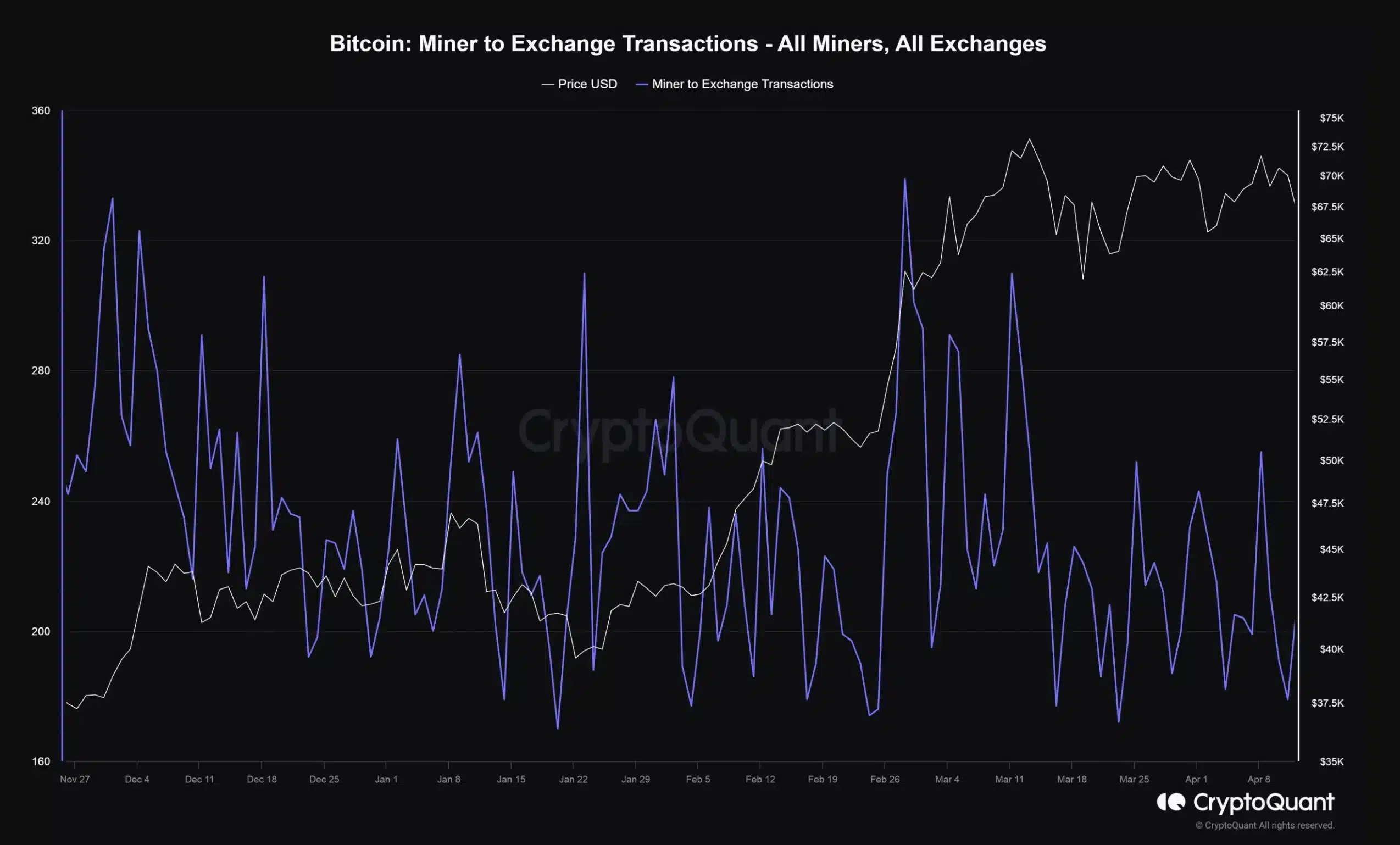

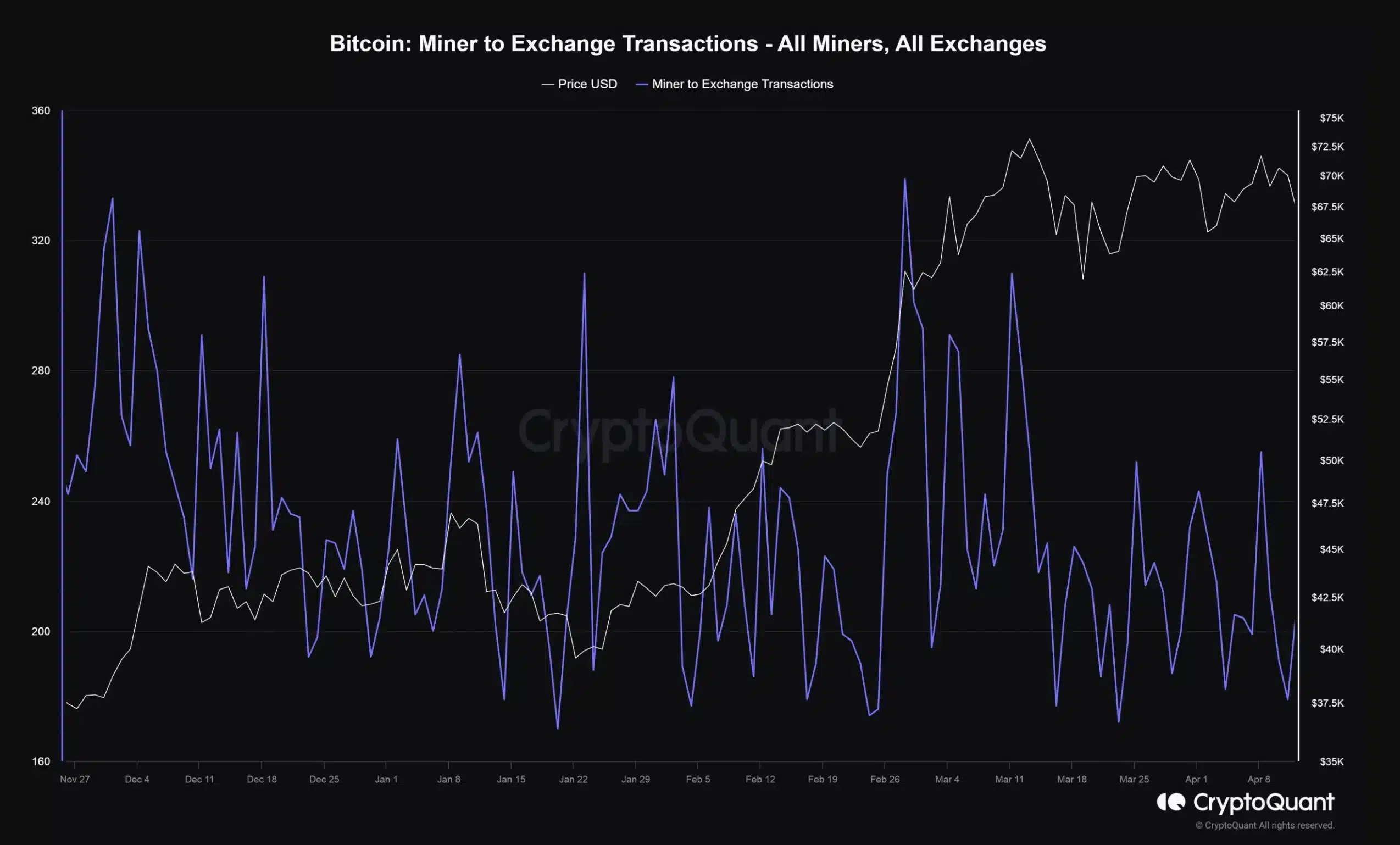

Recently even facts from CryptoQuant researcher revealed that miners have been sending around 374 BTC to spot exchanges every day for the past month. This amount was less than a third of the daily average observed in February.

Source: CryptoQuant

What impact will the Bitcoin halving have on miners?

Contrary to what some might say, Bitcoin’s halving isn’t necessarily a doomsday scenario for miners. This according to Adam Sullivan, CEO of Core Scientific. In a recent one interviewhe said,

“The halving of Bitcoin is not the Armageddon moment for us.”

He added,

“Today, with Bitcoin above $60,000, profitability means that almost no machine will actually shut down. During the halving, many of them will maintain profitability.”

What this means is that countless mining companies are financially robust and ready to weather short-term profitability challenges. Perhaps smaller, less efficient miners could experience problems after the halving. However, this would likely result in a consolidation of the sector.

Is there a chance of a supply shock?

Mark Yusko, founder of Morgan Creek Capital Management, however, thinks differently. He believes Bitcoin’s halving may be underestimated, with the potential for a significant supply shock. Throwing light on the same he said:

“I actually think the halving will have a bigger impact and I don’t think it’s priced in. I think people are distracted by the demand shift that has happened and caused this ATH.”

He added,

“So they forget that when this happens there will still be miners who are in trouble because their costs are fixed and the number of rewards goes down and so there will be a supply shock.”

Moreover, he has in a separate interview Then DolevManaging Director at Mizuho Securities, believed the halving would lead to a “sell-the-news” reaction.

@BobLoukas However, was quick to refute this, saying:

“The halving is not priced in. Totally untrue.”

Future Prospects of Bitcoin

Despite the prevailing skepticism before the halving, Bitcoin predicted strong buying pressure after the event, as evidenced by the 3.26% price increase. According to David Aldermana Digital Asset Research Analyst at Franklin Templeton,

“As the price goes up, I think the noise will go up a lot more.”

Therefore, it is intriguing to see that despite the ongoing geopolitical tensions, Bitcoin has held to its historical patterns and soared post-halving.

Source: LayahHeilpern/Twitter